To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Mostly sunny. Highs in the lower 80s. South winds around 5 mph. Tuesday Night: Mostly cloudy. A chance of showers after midnight. Lows in the mid 60s. Chance of rain 40 percent.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

The Palm Coast City Council meets at 9 a.m. at City Hall. Three new council members will be sworn in today: Mayor Mike Norris and council members Ray Stevens and Ty Miller. For agendas, minutes, and audio access to the meetings, go here. For meeting agendas, audio and video, go here.

County Commission Swearing-In: The Flagler County Commission holds a special meeting at 4 p.m. at the Government Services Building, 1769 East Moody Boulevard, Bunnell, to swear-in two members who won election in November, Pam Richardson and Kim Carney. They will take the places of Donald O’Brien and Dave Sullivan, both two-term commissioners who elected not to run for a third term. Richardson and Carney join Commission Chair Andy Dance and Commissioners Leann Pennington and Greg Hansen.

The Flagler County School Board meets at 6 p.m. in Board Chambers on the first floor of the Government Services Building, 1769 East Moody Boulevard, Bunnell. Board members Janie Ruddy, Lauren Ramirez and Derek Barrs will be sworn in, and the board will select a new chair for the coming year. Board meeting documents are available here. The meeting is open to the public and includes public speaking segments.

The Flagler Beach Library Writers’ Club meets at 5 p.m. at the library, 315 South Seventh Street, Flagler Beach.

Fall Horticultural Workshops at the Palm Coast Community Center, 305 Palm Coast Parkway NE., 6:30 p.m on Tuesdays, 10 a.m. on Fridays. Join master gardeners from the UF/IFAS Agricultural Extension Office for these workshops that cover a variety of horticultural topics. $10 a workshop.

Random Acts of Insanity Standup Comedy, 8 p.m. at Cinematique Theater, 242 South Beach Street, Daytona Beach. General admission is $8.50. Every Tuesday and on the first Saturday of every month the Random Acts of Insanity Comedy Improv Troupe specializes in performing fast-paced improvised comedy.

Notebook: I would rather be covering the murder trial on Judge Nichols’s docket: it’s her first trial as the county’s felony judge, it’s an interesting one–one of those first-degree murder trials of a drug dealer whose product led to the victim’s overdose–since most of these usually end up in pleas, and the only other one that went to trial here led to an acquittal. For good reason. The indictments are only following the law, but the law is a misapplication of justice, especially as first-degree murder: even the cigarette barons faced civil judgments after we learned that they had knowingly sold addictive poison to millions. The cause-and-effect in the case of fentanyl is reduced from years to minutes, sometimes seconds. The end result of the lethality is the same, and the agency of the user, in both cases, cannot be simply overlooked. But this isn’t where I was going with this. I just meant to say that I’d prefer camping out in Courtroom 401 all day than to be traipsing from the City Council to the County Commission to the School Board for all those swearings-in, some of them more momentous than they should have been. This is the end of David Alfin, Colleen Conklin, Cheryl Massaro, Don O’Brien, Dave Sullivan, and of course it’s also the end of Ed Danko (cue Annie). More good than bad is ending, and on the whole, I’m not so sure that more good than bad is picking up where they left off. Congratulations to all the winners: it’s no small feat. Let’s hope they (some of them) don’t feel so conflated with the national heave for boorish, no-holds-barred governance that we end up a Venezuelan province. We’ll have to see. Or endure. Or seek escape routes.

—P.T.

View this profile on Instagram

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

Free For All Fridays With Host David Ayres on WNZF

Scenic A1A Pride Meeting

Friday Blue Forum

Acoustic Jam Circle At The Community Center In The Hammock

Flagler Beach Farmers Market

Coffee With Flagler Beach Commission Chair Scott Spradley

Grace Community Food Pantry on Education Way

Gamble Jam at Gamble Rogers Memorial State Recreation Area

Stetson University Concert Choir in Concert with Orlando Philharmonic

For the full calendar, go here.

He clutched my shoulder. “Tiger in the road,” he said. Perhaps forty feet ahead of us a tiger sat in the middle of the track. It filled the track, in fact, and seemed somehow to fill the forest that stretched away on either side as well. Nothing had prepared me for its size or for the palpable sense of menace and power that emanated from it. “His name is Akbar,” Fateh whispered, beginning softly to hum with pleasure at the sight of him. “About five hundred pounds.” The tiger rose slowly to his feet. Everything about him seemed outsized: his big round ruffed face; his massive shoulders and blazing coat; his empty belly that hung in folds and had finally forced him into the open to hunt; his long twitching tail. It seemed inconceivable that such a big, vivid animal could have stayed hidden in this drab open forest for so long. We sat very still in the open Jeep as the tiger stared at us. “He’s a good boy,” Fateh said, still humming. I devoutly hoped so. The tiger turned and cocked his huge head to listen as a sambar called from a clearing off to our left; then, after fixing us with one more steady glance, he slipped silently into the grass. Neither his smiling protector nor his protector’s wary guest had been worth so much as a growl.

–From Geoffrey Ward’s “Tiger in the Road!,” Best American Essays 1987.

Pogo says

@A different tiger

“Look,” whispered Chuck, and George lifted his eyes to heaven. (There is always a last time for everything.)

Overhead, without any fuss, the stars were going out.

— Final lines, The Nine Billion Names of God, by Arthur C. Clarke

https://urbigenous.net/library/nine_billion_names_of_god.html

Ray W, says

The EIA’s Short-Term Energy Outlook (STEO) through the month of October came out on November 14th.

Here are a number of bullet points:

– Renewable electricity generation percentage of overall generation is projected to reach 25% in 2025. Renewables accounted for 21% of overall electricity generation in 2022.

From other EIA sources and from this source, I know that coal, already significantly down from its high of over 50% of total electricity generation some two decades ago, is projected to retain a 15% share of the nation’s electricity needs in 2025.

– “We expect U.S. electric power sector generation to increase by 3% in 2024. The increase in generation is mostly to supply increased air-conditioning demand compared with last year, driven by hotter summer temperatures this year. The increase in consumption in 2024 is being supplied primarily from growth in the use of natural gas (up 3% from 2023) and solar power (up 34%). We forecast that U.S. solar power generation will continue growing by another 31% in 2025 as solar power capacity expands, while higher natural gas prices reduce electricity demand from the natural gas sector.”

– Overall U.S. CO2 emissions are projected to slightly drop in 2025, over 2024 emissions, which slightly dropped compared to 2023 emissions, which slightly dropped from 2022 emissions.

– U.S. LNG exports, non-existent in January 2016 because the first dedicated U.S. export facility came online early in 2016, should rise to 14 billion cubic feet per day. (I have previously commented on the fact that one new LNG export terminals is coming online now, and two more export terminals should become operational next year). The average daily volume of export capacity in 2024 is 12 billion cubic feet. It was 11 billion cubic feet per day on average in 2022.

– “We expect the Henry Hub natural gas spot price to rise in the coming months to average $2.80 per million British thermal units (MMBtu) in 1Q25, following seasonal patterns during which prices typically rise during the winter. The monthly average Henry Hub daily spot price fell to $2.20/MMBtu in October and below $2.00/MMBtu in early November. Low prices reflected warm temperatures, which could delay the beginning of withdrawals of natural gas from storage until mid-November. We expect the Henry Hub price to average to average around $2.90/MMBtu in 2025, as global demand for U.S. liquefied natural gas exports, a component of U.S. natural gas demand, continues to increase.”

– U.S. crude oil production is projected to continue its steady increase from 2022 to a new record high in 2025 of 13.5 million barrels per day, up from 2024’s record yearly average of 13.2 million barrels per day. Right now, the monthly average production per day is 13.4 million barrels.

As an aside, in January 2009, when President Bush left office, the U.S. was producing an average daily quantity of just over 5 million barrels of crude oil per day.

Then came to Shale Revolution from 2009 to 20015. At its growth peak during the Obama years, the U.S. averaged just under 10 million barrels per day for a month. At around this time, I paid $1.50 per gallon for gasoline, if only once.

The crude oil extraction level steadily rose during the Trump years to 12.9 million barrels per day for the month of January 2020.

By May 2020, due to pandemic-related economic turmoil, U.S. crude oil production had fallen to a monthly average of 9.7 million barrels of crude oil per day.

By January 2021, U.S. crude oil production had rebounded to an average of 11.2 million barrels per day. It has steadily, if slowly, increased ever since.

Make of this what you will.

Me? It is obvious that for the past four years the U.S. energy extraction industry has been drilling, Baby, drilling. It could have been drilling more, but American energy producers need to protect their profits.

If American energy extractors drill too much, profits drop, supply and demand being what it is. For example, at the onset of the pandemic in February 2020, American energy extractors had hired 790 active drilling rigs of all types. There were vertical oil drilling rigs and both oil and natural gas horizontal drilling rigs.

By August 2020, a mere six months later, only 250 active rigs of all types were in operation. International crude oil prices went negative for many American extractors, meaning that the price paid for crude oil dropped below extraction costs. Exploration for new sources of oil and natural gas virtually stopped.

This was the time that gasoline prices were at $2.00 per gallon. The gullible among us fell for the lie uttered by the professional lying class of one of our political parties; they became convinced that Trump had something to do with low gasoline prices. In reality, relatively few people all over the world were still buying gasoline.

The pandemic caused the low prices.

–

Sherry says

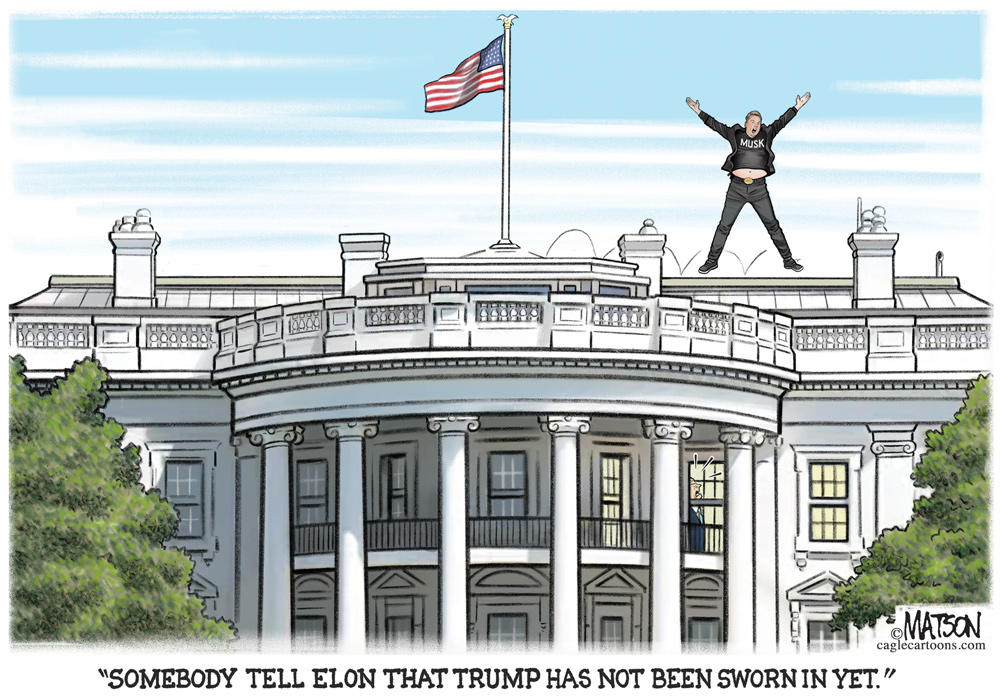

As I’ve said before, Musk is already much too powerful. He has the potential to be extremely dangerous, even more so than trump. Thank goodness he was not born in the US and therefore cannot be President. But, look for back room efforts to change our constitution in that direction. . . Musk is certainly willing and able to buy corrupt congressional/maga votes.

Ray W, says

Here is Bloomberg’s take on Trump’s promise to Drill! Baby! Drill!

“The pandemic tanked prices, caused labor shortages in the shale patch, stranded imports of equipment in ports and prompted banks to dial back lending to the sector. Dozens of bankruptcies followed. But those that survived were forced to lower costs and become more efficient, positioning them to begin growing again when oil prices rallied in late 2020.

“Under Biden, the US solidified its position as the world’s top oil producer, now pumping 50% more barrels per day than Saudi Arabia.

“That pace will be hard to maintain. A $290 billion wave of mergers and acquisitions in the past two years means many of the independent producers that were driving production growth during Trump’s first time in office were bought or merged into larger entities that reined in capital spending and boosted shareholder returns.

“Among the deals, Pioneer Natural Resources Co. was bought by Exxon, Endeavor Energy Resources LP was taken out by Diamondback, and CrownRock LP was acquired by Occidental.

“Ultimately, though, oil prices could be the biggest obstacle to US growth, according to Raoul LeBlanc, vice president for North American unconventionals at S & P Global Commodity Insights.

“‘At $70, shale independents can both grow and generate free cash flow,’ he said. ‘But at $60 they have to make a choice — and we believe they’ll choose cash for the shareholders.'”

Make of this what you will.

Me?

OPEC+ announced a few months ago that it intended to increase overall crude oil production, though it has since repeatedly delayed implementing its decision.

Guyana continues to ramp up crude oil output from a huge offshore platform. Guyana has such huge untapped oil reserves that Venezuela has threatened war, claiming that the entire region belongs to Venezuela.

Brazil continues to increase its own crude oil production.

Canada’s western tar sands fields are now transporting crude oil to Vancouver for export after opening a new pipeline.

American energy producers keep setting record levels of production after record levels of production under the Biden administration, mainly driven by growth by smaller independent energy producers. The bigger shale oil companies long ago reined in production in order to maximize shareholder returns. Several of the smaller independents have been gobbled up by the major companies.

Chinese manufacturing capacity has been dropping for six straight months. It’s demand for crude oil imports keeps dropping.

International crude oil prices have been steadily dropping throughout 2024 as a worldwide glut of oil builds. West Texas Intermediate is hovering in price around the $70 per barrel figure. If prices drop much lower, the remaining smaller independent American energy producers might indeed have to choose between returning value to their shareholders by curbing production or selling oil at lower prices to support lower gasoline prices for the general public. Which do each of you think they will choose?

Time will tell if the professional lying class of one of our two major political parties sold a bill of goods to the gullible among us. Maybe the rest of the world’s crude oil producers will just stop competing with us for oil revenue and let American companies do all of the drilling and keep all of the profits.

Ray W, says

According to a July 2024 electrek article, BYD, China’s largest EV manufacturer and second-largest battery manufacturer (behind CATL), introduced a compact SUV model called the Yuan Up.

The base model, termed 301km Leader, has a 187-mile range and costs $13,300.

The next level, termed Vitality Edition, travels 250 miles and costs $13,700.

The 401km Leader version also gets a 250-mile battery range with upgraded trim; it sells for $15,100.

The 401km Superior model sells for $16,500.

Exterior dimensions for the compact-class Yuan Up are smaller than Tesla’s Model Y. Each model comes with a 94 hp motor and can fast recharge from 30% to 80% in 30 minutes.

BYD is branching into the truck marketplace, with luxury vehicles and electric supercars on the way.

Make of this what you will.

Me?

The Yuan Up is not a city-car class micro vehicle. It is not a subcompact SUV. It is a compact class vehicle, and it starts with an MSRP of less than $14,000.

Yes, there seem to be legitimate allegations of forced labor that can lower manufacturing costs, allegations that BYD denies. On the other hand, BYD seems to have scaled up its battery manufacturing sufficient to significantly lower production costs of its vehicles.

I will repeat this over and over again. Ford’s CEO traveled to China last year. He drove a Chinese extended-range electric car while there. He had one of the cars shipped to the U.S., where he drove it for six months. When interviewed by a podcaster, he admitted that he did not want to stop driving the car. He stated that the American car industry was years behind the Chinese in EV development.

An American labor specialist recently opined to another publication that allowing Chinese cars into the American marketplace without tariffs would constitute an “extinction level event” for the American car industry.

Ray W, says

Yesterday, an Autoblog headline read: “BYD’s explosive growth may topple Ford’s spot in global rankings by year-end”

Here are some bullet points:

– The top six international automobile sales leaders are Toyota, Honda, Hyundai/Kia, Stellantis (Fiat/Chrysler), GM, and Ford.

– In 2023, BYD sold slightly more than 3 million vehicles.

– All BYD vehicles are electric, either fully electric or some form of hybrid, including EREV models.

– Through November 11 this year, BYD sold 3.25 million vehicles in over 70 countries across six continents. 1.1 million vehicles sold in the third quarter, with more than 500,000 selling in October.

– BYD plans to build factories in Thailand, Turkey, Hungary, and Brazil, among other possible sites.

– BYD’s third-quarter revenues hit $28.2 billion, topping Tesla’s $25.2 billion, though Tesla’s $2.2 billion profit beat BYD’s $1.6 billion. Yes, Tesla benefitted from a $7,500 federal tax credit, while BYD received EV grants from China’s government.

– In 2020, China’s entire automobile industry held slightly more than a third of the country’s domestic vehicle marketplace. Four years later, Chinese manufacturers now hold 60% of the growing sector.

– With Chinese cars taking a greater share of the world’s personal transport marketplace, other manufacturers are seeing diminished sales numbers.

– Nissan has cut global production by 20% this year and is laying off 9,000 workers. It cut its annual profit forecast for 2024 a second time, this time by 70%, down to $975 million. Nissan recently sold a third of its Mitsubishi stock holdings to raise cash.

– Stellantis saw two consecutive quarters of sales declines of 20% each quarter. Its Jeep joint venture in China filed for bankruptcy in 2022.

– Volkswagen plans to close at least three factories, and it plans to cut worker pay by 10%.

– Both BMW and Mercedes-Benz announced “profit warnings” in October.

– “Hyundai and Honda are also struggling in China, and Mitsubishi withdrew from the country entirely in 2023. Ford and General Motors are also cutting their production capacities in China. Tesla stands as an exception, with the American automaker’s sales increasing by 6%.”

– “Legacy automakers are struggling amid the switch to electric and plug-in hybrid vehicles that meet the needs of consumers at an affordable price. Sales figures and revenue don’t lie, but some executives seem to have had their heads buried in the sand until recently. Now, the question is whether it’s too late to right the ship.”

Make of this what you will.

Me?

I looked up total vehicle sales worldwide for 2023. I got different figures from different sites, but it seems that just over 75 million overall sales took place last year. More than 25 million of those sales occurred in China.

I then looked up BYD.

A Chinese company originally formed to build NiCad batteries, it has since grown to become the world’s second largest battery manufacturer.

It has a research and development department manned by over 100,000 researchers.

Decades ago, it bought a military vehicle factory and converted it to build gasoline-powered cars.

It introduced its first battery-ICE hybrid in 2008 and followed the next year with its first BEV.

At around this time, Warren Buffett, via Berkshire Hathaway, saw potential in the company and bought into it; it still holds BYD stock.

In just 16 years, it is now poised to pass Ford as the world’s sixth largest vehicle manufacturer.

I recently commented on the fact that Chinese electric vehicle manufacturers built 1.4 million vehicles in October, a clip of about 17 million units per year on an annualized basis, with nearly 500,000 units exported to other countries during the month.

Canada, the EU nations, and the United States recently imposed tariffs of differing percentages on Chinese-made electric vehicles, which trumpets the dangers domestic automakers face from Chinese electric vehicles.

I have commented on this many times. The professional lying class of one of our two major political parties long ago persuaded the gullible among us to reject any form of electric vehicle. Much of the rest of the world knew better than to listen to such liars.

There is no doubt in my mind that in 2008 American car manufacturers possessed the innovation and technical capacity and the manufacturing capability to outcompete BYD, which was just learning how to build cars. Now that we have ceded two decades of research and development to Chinese battery makers and automakers, they can build electric vehicles for far less cost than we can build gas-powered vehicles, and they can still turn a profit. Better and less-expensive batteries are on the way, but American automakers are not likely to gain their share of the profits as they had their heads buried in the sand. We listened to the collectively most stupid among us and gave our technical and manufacturing advantages away.

Current Chinese EV models offer better fuel mileage in EREV form, fewer standardized maintenance task like oil changes, spark plugs, air filters and a number of other commonly replaced parts because the EREV ICE models seldom start their engines (one study I read showed that up to 90% of daily drives do not start the gasoline engine to generate electricity).

Regenerative braking systems offer longer brake pad life.

A car that costs less to replace, if totaled, should carry lower insurance premiums.

In sum, less money to buy, less money to drive, less money (hypothetically) to insure, less money to repair and maintain.