The Live Wire is an experiment. Think of it as a cross between a book of hours and a web version of the doors of perception. You contributions are welcome, in the comments or by email. The previous Live Wire edition is available here.

![]()

Today’s Live Wire: Quick Links

- You call This a Recovery?

- Should population trends justify local growth-plan changes?

- Thousands of Dead Voters, Still Voting

- Your Taxdollars in Stock Market Sinks

- Bill Clinton on the Daily Show

- Sunshine Law Seminar in St. Augustine

- Palm Coast: Walmart-Adjacent Development in Foreclosure

- How Disney Is Changing Education in China

- Free Movie in Central Park

- Poem of the Day: John Ashbery

![]()

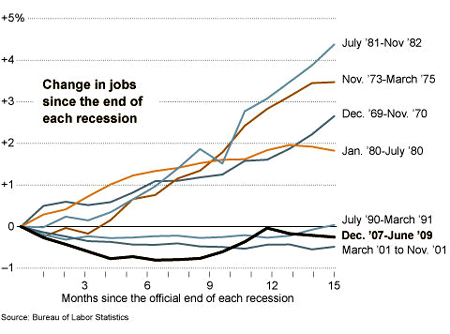

Recessions aren’t what they used to mean. They used to mean that economic growth went into reverse, which doesn’t mean anything to anyone except when it’s translated to the real-world realities of slower growth: joblessness. If jobs aren’t being created, and are in fact being lost, it’s recession in the real world, whatever other economic indicators say.

Conveniently for politicians and by economists, it’s no longer that simple. From The Times: “The United States economy has lost more jobs than it has added since the recovery began over a year ago. Yes, you read that correctly. The downturn officially ended, and the recovery officially began, in June 2009, according to an announcement Monday by the official arbiter of economic turning points. Since that point, total output — the amount of goods and services produced by the United States — has increased, as have many other measures of economic activity. But nonfarm payrolls are still down 329,000 from their level at the recession’s official end 15 months ago, and the slow growth in recent months means that the unemployed still have a long slog ahead. […] The announcement also implies that any contraction that might lie ahead would be a separate and distinct recession, and one that the Obama administration could not claim to have inherited. While economists generally say such a double-dip recession seems unlikely, new monthly estimates of gross domestic product, released by two committee members, show that output shrank in May and June, the most recent months for which data are available. Output and other factors would have to shrink for a longer period of time before another contraction might be declared.” The full non-recovery.

Conveniently for politicians and by economists, it’s no longer that simple. From The Times: “The United States economy has lost more jobs than it has added since the recovery began over a year ago. Yes, you read that correctly. The downturn officially ended, and the recovery officially began, in June 2009, according to an announcement Monday by the official arbiter of economic turning points. Since that point, total output — the amount of goods and services produced by the United States — has increased, as have many other measures of economic activity. But nonfarm payrolls are still down 329,000 from their level at the recession’s official end 15 months ago, and the slow growth in recent months means that the unemployed still have a long slog ahead. […] The announcement also implies that any contraction that might lie ahead would be a separate and distinct recession, and one that the Obama administration could not claim to have inherited. While economists generally say such a double-dip recession seems unlikely, new monthly estimates of gross domestic product, released by two committee members, show that output shrank in May and June, the most recent months for which data are available. Output and other factors would have to shrink for a longer period of time before another contraction might be declared.” The full non-recovery.

Should population justify local growth-plan changes?

It’s a belated echo to Amendment 4, the proposed constitutional amendment that would require voter approval before local governments change their comprehensive growth plans–those large-scale blueprints setting out what type of growth and how much of it takes place in a city or county. One of the most recurring justifications for those so-called “comp plan amendments” is population growth. It’s the justification Palm Coast is using as has or is moving toward approval of three mega-developments on its rim that would, together, add some 12,000 homes to the city’s census. Now the Florida Department of Community Affairs is proposing a new rule that would allow DCA to determine whether population may or may not be taken into account when comprehensive plan amendments are submitted.

It’s a belated echo to Amendment 4, the proposed constitutional amendment that would require voter approval before local governments change their comprehensive growth plans–those large-scale blueprints setting out what type of growth and how much of it takes place in a city or county. One of the most recurring justifications for those so-called “comp plan amendments” is population growth. It’s the justification Palm Coast is using as has or is moving toward approval of three mega-developments on its rim that would, together, add some 12,000 homes to the city’s census. Now the Florida Department of Community Affairs is proposing a new rule that would allow DCA to determine whether population may or may not be taken into account when comprehensive plan amendments are submitted.

“DCA says some counties have approved far more residential development than is needed based on future population projections,” Bruce Richie’s FloridaEnvironments.com reports. “A Senate committee review in 2008 said the department needed to adopt a rule to use when requiring a population needs analysis for proposed land-use changes.” But what if the rule change doesn’t take place before Gov. Charlie Crist’s term runs its course? “While Sink says on her website that she supports DCA reauthorization, Scott does not say on his website where he stands on growth management other than saying, ‘We must be good stewards of our natural resources.'” Spoken like a true used Isuzu salesman. The full post.

Thousands of Dead Voters, Still Voting

A Sixth Sense story from the Sun Sentinel: At least 14,000 dead registered voters are still on Florida’s voter registration rolls just six weeks from the general election. “State elections officials pledged to clean up the voter rolls two years ago after a Sun Sentinel investigation found they included more than 28,000 people who had died and 33,000 felons whose civil rights had not been restored. The latest list shows more than half of those ineligible voters were removed, but the rest, along with newly added felons, remained on the rolls. […] The Sun Sentinel compared databases from the Florida Department of Corrections to the voter rolls as of the end of August and found more than 9,700 possible matches. The number is conservative because it excludes cases where a middle name or initial was missing as well as inmates released prior to October 1997.” The full story.

Your Taxdollars, in Stockmarket Sinks

From a St. Petersburg Times investigation: “Going back at least seven years, state money managers had been trying to find a way around rules that restricted them from buying certain risky securities. Time and again they asked, time and again lawyers told them no. But so eager were Florida’s money managers for higher yields, they bought them anyway. In two months at the brink of the housing market meltdown in 2007, the state invested at least $9.5 billion in securities it was not authorized to buy, a review of confidential memos shows. […]

Bill Clinton on the Daily Show

From the Sept. 16 episode, in case you missed it:

| The Daily Show With Jon Stewart | Mon – Thurs 11p / 10c | |||

| Bill Clinton Pt.1 | ||||

|

||||

Sunshine Law Seminar in St. Augustine

The First Amendment Foundation‘s Barbara Peterson is leading a free, three-hour seminar on Florida’s government in the sunshine laws–open meetings and public records–on Oct. 4 at the St. Augustine Record at 1 World Golf Place in St. Augustine. Anyone from the public may attend. Note that the sunshine seminars have been approved for five CLER credits for attorneys (who must pay a $50 fee) and for for continuing education credits with the Florida Association of Court Clerks and the International Institute of Municipal Clerks.

When it comes to open records and open government, local governments are notoriously chronic violators, especially when it involves members of the public who are not familiar with the law. Violations are often due to ignorance rather than malice. This is the sort of seminar that government agencies can take advantage of to train their employees, at no cost, especially their front-line employees who deal with the public, to learn to better apply and respect the law on the public’s behalf.

The registration form is available here. The First Amendment Foundation can be reached at 800/337-3518 or 850/222-3518.

See Also:

- What Bunnell Could Learn from the County’s Courtesy Notices on Government Meetings

- Bunnell’s Crain-Brady Leads Half-Secretive Meeting of 4 Gov’t Agencies on Carver Gym

Palm Coast: Walmart-Adjacent Development in Foreclosure

From GoToby: “Another developer with plans for Palm Coast is in trouble. Libertyville, Illinois based JX Properties’ 507.8 acre tract behind the site of the planned new Walmart Supercenter is in foreclosure. A Lis Pendens was filed with the Flagler Clerk of Courts office on Sept. 2 by BankAtlantic, which holds a $7, 070,000 mortgage on the property. JX Properties paid Wisne Land LLC $7,000,000 for the three contiguous parcels that make up the tract in December 2003. Subsequently, a Development of Regional Impact (DRI) and a Development Order were approved for a mixed-use neo-traditional neighborhood community. The tract fronts SR 100, running north behind the planned new Walmart location. As planned, a four lane spine road would dissect the development, running from SR 100 to Old Kings Road where it will align with Town Center Blvd. adjacent to the Lehigh Trail. There is a large lake on the property easily visible from SR 100.” The full story.

How Disney Is Changing Education in China

A fascinating story in The Economist describes a new system of schooling to teach English, set up by Disney in China: “Children as young as two toddle in and climb the stairs. At first glance, their classrooms look like dreary boxes, but two of the four walls are interactive video monitors. Each lesson is assisted by virtual mermaids, ducks, mice and other Disney icons. Touch the answer to a question (a fried egg, for example) on one screen, and it plops out of the sky on the other. While teachers instruct, the classroom seems to move. Most students seem happy and engaged. As they ask each other questions, their English sounds no less articulate than that of similarly-aged Americans. Thousands of Chinese children have signed up for Disney’s schools since the first one was opened in October 2008.”

A fascinating story in The Economist describes a new system of schooling to teach English, set up by Disney in China: “Children as young as two toddle in and climb the stairs. At first glance, their classrooms look like dreary boxes, but two of the four walls are interactive video monitors. Each lesson is assisted by virtual mermaids, ducks, mice and other Disney icons. Touch the answer to a question (a fried egg, for example) on one screen, and it plops out of the sky on the other. While teachers instruct, the classroom seems to move. Most students seem happy and engaged. As they ask each other questions, their English sounds no less articulate than that of similarly-aged Americans. Thousands of Chinese children have signed up for Disney’s schools since the first one was opened in October 2008.”

Tuition isn’t cheap: $1,800 a year. But Chinese are lining up and thickening waiting lists. “Each classroom has a local and a Western instructor. Images have been Sinified: rice, for example, comes in a bowl, not heaped on a plate. More than 300 songs, all tied to animations, provide mnemonic help. Some 60 books augment the course materials. Everything has been checked with China’s wary censors.” (Disney, of course, won’t let real freedom get in the way of its devotion to its own version of a free market.)

“Studies commissioned by Disney estimate that the market for children’s English-language education in China is growing by 12% annually and will reach $3.7 billion by 2012. […] For the company that can learn how to help little emperors learn, the rewards will be immense. And for Disney, the business has an added bonus: Chinese children weaned on Mickey and Goofy may one day demand to be taken to a theme park.”

Today’s stock pick: Disney Co. The full story.

Friday, Oct. 8, the free movie in Central Park in Town Center will be “Monster House,” the 2006 Gil Kenan cartoon featuring the voices of Steve Buscemi and Fred Willard, among others. The movie will be shown at 7:30 p.m. in Central Park, just north of Flagler Palm Coast High School on Bulldog Drive. Bring blankets, chairs, bug spray and plan to come early. For more information, please call Palm Coast’s Parks and Recreation Department at 386/986-2323.

Friday, Oct. 8, the free movie in Central Park in Town Center will be “Monster House,” the 2006 Gil Kenan cartoon featuring the voices of Steve Buscemi and Fred Willard, among others. The movie will be shown at 7:30 p.m. in Central Park, just north of Flagler Palm Coast High School on Bulldog Drive. Bring blankets, chairs, bug spray and plan to come early. For more information, please call Palm Coast’s Parks and Recreation Department at 386/986-2323.

Poem of the Day: John Ashbery’s “Just Walking Around”

What name do I have for you?

Certainly there is not name for you

In the sense that the stars have names

That somehow fit them. Just walking around,

An object of curiosity to some,

But you are too preoccupied

By the secret smudge in the back of your soul

To say much and wander around,

Smiling to yourself and others.

It gets to be kind of lonely

But at the same time off-putting.

Counterproductive, as you realize once again

That the longest way is the most efficient way,

The one that looped among islands, and

You always seemed to be traveling in a circle.

And now that the end is near

The segments of the trip swing open like an orange.

There is light in there and mystery and food.

Come see it.

Come not for me but it.

But if I am still there, grant that we may see each other.

And Keep in Mind

Dorothea says

Regarding the Florida State Pension Fund:

Absolutely disgusting abuse of taxpayers’ money. The SBA is the Florida State Board of Administration. For those that did not read the article, here’s a few quotes.

The State Board of Administration invests more than $140 billion of public money, most of it for the state retirement system. It also manages a fund that pools money from hundreds of Florida towns, counties and school districts.

The SBA made many of the bad purchases around the time Lehman hired former Gov. Jeb Bush as a consultant. Bush has said he played no role in the sale of securities to the SBA.

“It’s one thing for Wall Street to go down dark alleys and through speed traps when they’re not satisfied with the securities laws,” Cox said. “But it’s another thing to find government blowing through the securities law with the same belief as Wall Street.”

Jack Kiefner, a St. Petersburg securities lawyer, reviewed documents obtained by the Times. He said they show the SBA asked the same questions over and over, refused to take no for an answer, tried to come at it from different directions and relied on technical arguments to buy highly risky products it should never have bought.

Kip Durocher says

“The SBA made many of the bad purchases around the time Lehman hired former Gov. Jeb Bush as a consultant. Bush has said he played no role in the sale of securities to the SBA.”

Sure jeb ~ just a great big coincidence !! (wink,wink).

Same as you played no role in the savings and loan swindle after your uncle ronnie opened the S&L cookie jar for all you young republican boys, including your brother. How much did you Miami S&L business decisions cost taxpayers when it all failed jeb? How much salary? did you get to keep for running the place into the ground? Was it republican cronies(appointees) running the Floirda SBA? Just another of those coincidences that always seem to happen when the republicans are around managing the money?

http://www.campaignwatch.org/more1.htm

Seems dubya was too inept to aquire his fortune in tax money so he was bought a sports team and told to go sit in the stands and eat popcorn while someone else made his fortune for him.

Dorothea says

Bush Brothers don’t just sip from the public trough, they’re gulping it down as fast as they can.

Don’t forget Neil Bush, Jeb and Dubya’s brother. This quote is from the Bloomberg Business Week:

No Bush Left Behind

Across the country, some teachers complain that President George W. Bush’s makeover of public education promotes “teaching to the test.” The President’s younger brother Neil takes a different tack: He’s selling to the test. The No Child Left Behind Act compels schools to prove students’ mastery of certain facts by means of standardized exams. Pressure to perform has energized the $1.9 billion-a-year instructional software industry.