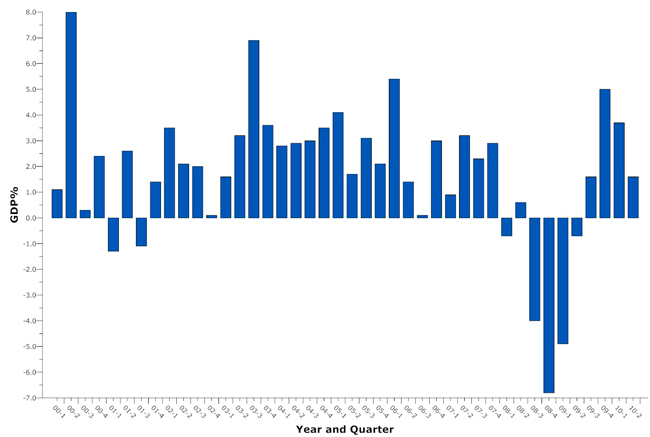

Real gross domestic product — the output of goods and services produced by labor and property

located in the United States — crawled at an annual, revised rate of 1.6 percent in the second quarter of 2010. That’s significantly down from an initial estimate of 2.4 percent last month, and dwon from the previous quarter’s annualized growth of 3.7 percent, and 5 percent in the last quarter of 2009.

Technically, a recession is when growth is negative in two successive quarters. That’s not the case. However, economic definitions may also diverge from conditions in the streets, as they are diverging now: if unemployment rises or stays high, the effects of a recession are still in place. Unemployment is at 9.5 percent. For the unemployment rate to stay even, the economy must grow at a rate of 2.5 percent. Today’s anemic growth rate suggests that, with federal stimulus dollars running out and no sign of a solid recovery anywhere, the unemployment numbers will rise again.

Last month’s collapse in housing sales to the lowest level on record, combined with median home prices falling top 2003 levels despite record-low interest rates, all point to worsening economic conditions. Those conditions will play a large role in local elections in November, particularly regarding taxation and economic development issues on Flagler’s ballot.

Friday morning, Federal Reserve Chairman Ben Bernanke said the Fed would likely resume buying huge chunks of long-term debt in an effort to prop up the economy. That means enlarging the federal debt, now at $13.4 trillion, further. The main problem Bernanke is hoping to ward off is Japanese-style deflation, which crippled the Japanese economy for most of the 1990s. Annual inflation is running at 1.2 percent for the past 12 months, and 0.9 percent when food and energy prices are excluded.

“The deceleration in real GDP in the second quarter,” the Bureau of Economic Analysis said, “primarily reflected a sharp acceleration in imports and a sharp deceleration in private inventory investment that were partly offset by an upturn in

residential fixed investment, an acceleration in nonresidential fixed investment, an upturn in state and local government spending, and an acceleration in federal government spending.” Federal, state and local government spending is not likely to continue in the third quarter.

Rafael Gomez says

Paul Krugman did

Bob K says

Confucius once said, “‘Hope and change’ does not an economy mendeth.”

. says

If a dbl dip is admited then it would prove that BIG speending by GOVERNMENT does not work to fix a bad economy.

George says

and republicans want to extend Bush tax cuts adding 3.1 trillion dollars over the next ten years to the deficit. republicans wish they had a plan to fix the economy, and all this time they have been crying about the deficit. the economy had few gains during bush’s 8 years. democrats didn’t gain control of both houses of congress until 2008 so you can’t blame that on the dems, its the continued failed policies of the gop that are killing economic growth.

Read the article below tea baggers!

http://www.washingtonpost.com/wp-dyn/content/story/2009/01/12/ST2009011200359.html