Federal government employment fell by 143,000 jobs as more temporary census jobs ended in June, offsetting a gain of 71,000 new jobs in the private sector. The net loss of 131,000 jobs is more than double the job loss economists expected. It left the overall unemployment rate at 9.5 percent.

In more grim news, the May unemployment numbers were revised, from a loss of 125,000 jobs to a loss of 221,000.

In June, the economy added 83,000 private sector jobs, though total payrolls declined 125,000 because of the end of tens of thousands of temporary census jobs, according to the Department of Labor and the Bureau of Labor Statistics.

Click On:

- Word on the Street: Palm Coast Data Adding 100+ Jobs

- June: Flagler and Volusia Unemployment Rising Again

- June: US Economy Loses 125,000 Jobs

- May: Census Jobs Help Lower Unemployment; Flagler at 15.1%, Florida at 11.7%

- Complete May 2010 Florida Unemployment Report

- April: Flagler Unemployment Lowest in a Year

- April: National Job Creation Soars by 290,000, Unemployment at 9.9%

- March: At 16.6%, Flagler Unemployment Crawls Lower

- Franklin D. Roosevelt’s Second Bill of Rights: For Workers

- Where and how to file for unemployment

The number of long-term unemployed (those jobless for 27 weeks and over) was little changed at 6.6 million. They made up 44.9 percent of the unemployed. Those working part time involuntarily, either because their hours have been cut back or because they can’t find full-time work, totaled 8.5 million in July. That number has declined by 623,000 since April.

Some 2.6 million people are unemployed and not counted in the unemployment data, because they’ve stopped looking for work in July or longer. That number is up 340,000 from a year earlier. By not including those numbers in the overall unemployment rate, the rate is artificially kept lower than it really is.

Gains and Losses

Here is the breakdown of jobs gained and lost in July:

- Manufacturing employment increased by 36,000 over the month. Motor vehicles and parts had fewer seasonal layoffs than normal for July, contributing to a season-

ally adjusted employment increase of 21,000. The industry had added 32,000 jobs in the first 6 months of the year. In July, employment in fabricated metals rose

by 9,000. Manufacturing employment has expanded by 183,000 since December 2009. - Health care added 27,000 jobs in July, for a total of 231,000 new health care jobs over the past 12 months.

- Transportation and warehousing jobs went up by 12,000, mining employment went up by 7,000.

- Federal and state government jobs declined by 202,000, of which 143,000 were census related. Local government lost jobs too.

- Employment in professional and business services was down 13,000. Temporary jobs were down 6,000.

- Employment in financial activities continued to trend down, with a decline of 17,000, with an average job loss of 12,000 in that sector this year, compared with an average monthly job loss of 29,000 in 2009.

- Construction employment was down 11,000.

- Employment in other private-sector industries, including wholesale trade, retail trade, information, and leisure and hospitality showed little change in

July.

Average hourly earnings of all employees on private payrolls increased by 4 cents, or 0.2 percent, to $22.59 in July. Over the past 12 months, average hourly earnings have increased by 1.8 percent.

“A poor payrolls number today could raise fears about the U.S. recovery and this could spur investors to reduce their portfolio of risky asset classes,” Joshua Raymond, market strategist at City Index, told clients in a note quoted by the Wall Street Journal.

On Thursday, retailers reported that sales at stores that had been open a year or more increased 2.9 percent, a more sluggish increase than expected, and an indication that consumers are either not willing to spend yet, or that they don’t have money to spend. Discount and department stores did best, with sales there increasing 3.9 and 3.6 percent. Retailers catering to teenagers did worst, with a mere 1.5 percent increase in sales over last year. The numbers are alarming in that they’re being compared to July 2009 numbers, when sales at stores open a year or more had fallen 5.1 percent. In other words, sales volumes have not yet recovered back to their pre-2009 levels.

The jobs report may affect interest rates set by the Federal Reserve. “The mainstream view at the U.S. central bank is still that the slow recovery, which began around July 2009, will continue and that a pledge to maintain interest rates near zero for an extended period should be enough to keep consumers spending and companies investing,” the Journal reports today. “But some officials are starting to worry that with unemployment still so high and consumer prices recently dropping, the U.S. economy runs the risk of falling into a Japan-like deflationary trap of very slow growth and falling prices.”

With the unemployment rate staying in the 9.5 to 9.6 percent range, economists expect no change in the Fed’s approach. If the drop is steeper, the central bank might “reinvest proceeds from maturing mortgage bonds into U.S. Treasurys,” the Journal reports, which would “tell financial market the central bank is taking the risk of an economic slowdown seriously. The central bank’s other options include making a more explicit pledge to keep short-term rates near zero or starting new asset purchases, but the latter is only likely if things get really bad.”

dlf says

I guess we can blame Bush for this increase in the jobless rate, after all he has only been gone for a year and and 7 months. I wonder how hope and change is working out for these 131,000 people, if you think that number is correct . Nine and half per-cent is only the people who collect money from the goverment, the real number is closer to 15-17%. I love how they twist the numbers to make it look like it is not too bad and is because of x-y–z, certainly not to place blame on the Great One. When is he going to stop traveling all over the place and start doing some thing to produce more job, China did it. But he spends his time trying to find new ways to spend the money we don’t have, he is good at that.

dlf says

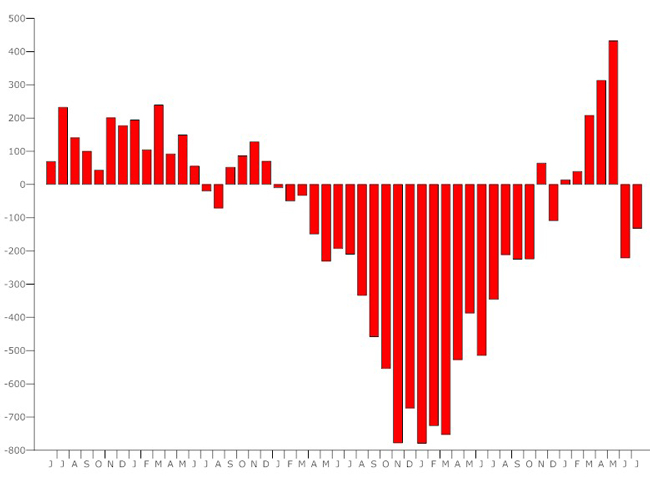

What did this graph show and what is it based on, we need facts, facts and some source.

Hal (GT) says

Unemployment rate steadies at 9.5%?

Sounds positive. But only thing I saw today that was positive is what gold and silver did. Looks like more investors are piling in.

FlaglerLive says

You’re right Hal. “Steadies” was a poor choice of words. “Stalls” is more accurate. Dlf, as the article states, the numbers are all based on the Department of Labor’s and Bureau of Labor Statistics’ figures.

Bob K says

I blame the lackluster economy on the current president. Yes, he DID inherit a mess; that’s not his fault. However, all the uncertainty and debt he is adding are killing confidence in the future. Businesses, the true creator of jobs, don’t know what to do. They don’t understand the effects the healthcare bill will have on them, because even the people who passed it don’t know. We are lied to on a daily basis by the liar-in-chief. Taxes are poised to go up on many levels, which, the great one doesn’t seem to understand, takes money out of the economy. Businesses are sitting and waiting him out. He even blindly imposed a moratorium on offshore drilling, killing even more jobs. I like to compare the economy to a campfire; if you lay a good foundation of kindling wood and then put on bigger logs, you’ll have a nice fire for the evening. You can even start the fire by throwing gasoline on it. The “stimulus,” and endless printing of money is the gasoline. Unfortunately, they are throwing gasoline on a pile of rocks. Once the gasoline burns out, there will be nothing left.

Clliftonofhesperia says

What is sad in this report is it doesn’t include the required adjustment to population growth. In other words, since every month new people enter the job market, we are actually stagnant. Plus, the negative job numbers on that chart show we are losing jobs. Going backwards more slowly ISN’T moving forward.