Note: a chart with the exact taxable values for each government agency appears at the foot of the story.

Flagler County’s taxable values rose nearly 7 percent, Palm Coast’s and Bunnell’s rose 6 percent and Flagler Beach’s rose 7.5 percent, adding to three years of successive gains since the Great Recession and lightening pressures on local governments somewhat as they prepare next year’s budgets.

But improvements are a double-edged sword. With more value comes more revenue for local governments, and more expectations from various agencies and the public. “It actually was somewhat easier when you were able to say no to everything,” County Administrator Craig Coffey said.

Now, the county, which every year has contended with budget gaps it had to close, is facing a gap again, of roughly $1 million, and is seeing big budgetary demands from constitutional officers, including a budget increase of $2.4 million from the Sheriff’s Office alone. The supervisor of elections and the clerk of court are also asking for more funding. The county’s fire services are set to add three more firefighters. Coffey has been looking to give all 600 county employees a raise for several years, but a 3 percent raise would add $1 million to the budget, essentially outstripping what new revenue would be generated from the higher values.

And that’s assuming the county were to not adopt the rolled-back tax rate, which assumes that it would take in as much tax revenue next year as it did this year (revenue generated by values from new construction aside).

Still, economically and psychologically, the higher values are a boon, especially to homeowners, a large proportion of whom have been struggling to get out from “under water,” meaning that they owe more on their home than it is worth. The last three years’ incremental improvements in value have also pared those ranks for the better.

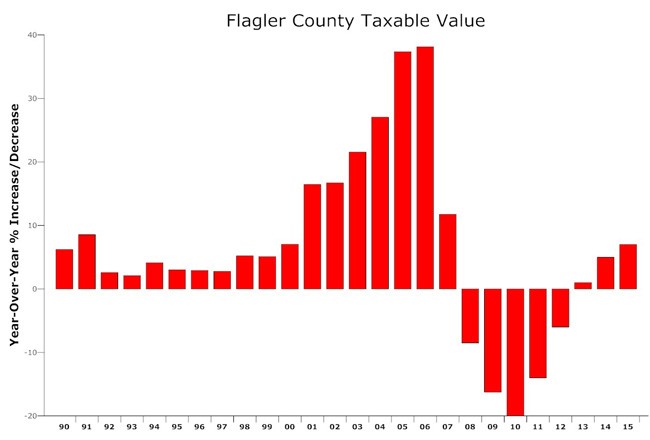

The improvements are part of a statewide trend: Miami-Dade’s values went up 8.6 percent, Lee’s 5.5 percent, Polk’s 7.2 percent, and Alachua’s just under 3 percent, to name a few. Flagler County’s estimated taxable value of just under $7 billion is still below its level of $7.9 billion in 2005, though by then the housing bubble had already been inflating at accelerating speeds, with values having nearly tripled since 2000. The $7 billion level is more in line with where values might have been had they kept rising at reasonable, historic rates, absent the Great Recession.

“We’re on the road to recovery,” Flagler Property Appraiser Jay Gardner said this morning. “We’ve gained $1 billion since the turnaround in round number.”

Improving values are a boon to property owners, and a different sort of challenge for local governments.

The county’s biggest winner is Beverly Beach, which saw its values increase 11 percent. But the number is a bit deceiving, given Beverly Beach’s size: the small town north of Flagler Beach has a total taxable value of $53.5 million, and had a new subdivision go in with $2.4 million in new construction. That created the disproportionate jump in its values. Marineland had the lowest value increase, at 2.7 percent, though Marineland has fewer than 10 inhabitants.

“Values increased throughout the county a little more than they did last year, which is good,” Gardner said. “It’s not crazy, we’re not looking at a runaway train like we did in the housing boom.”

The county had $120 million in new construction. That’s significant when it comes to tax rates. Should the county–or any local government–decide not to raise taxes, it would have to set its tax rate at the rolled-back rate. But revenue from new construction is considered net new revenue, over and above the rolled back rate. The new construction in the county might generate $1 million in tax revenue, but that’s before Palm Coast’s and Flagler Beach’s Community Redevelopment Areas’ tax prisons are calculated: CRAs are geographic zones within cities where all property tax revenue from a certain date forward is captured and remains within that zone,. even to the detriment of county revenue. The county loses about $1.2 million in such revenue, mostly to Palm Coast, every year. Some of that new construction this year will similarly see its new tax revenue imprisoned by the Palm Coast CRA, which does not expire until the early 2030s.

The county’s budgeting figures have been based on a 5 percent property value increase, Coffey said. The calculations have been purposefully conservative. Any improvement on tat number makes budgeting a bit easier in the weeks ahead. “We have a gap to close,” Coffey said, “every year we have a gap to close because we have new pressures” and expectations from other constitutional officers. “Typically you don’t rollback 100 percent because you tread water for so long. For years for example the sheriff’s office didn’t buy new cars. That’ll get you by for a few years but now he has to buy them.”

In July, the property appraiser’s office will send more refined numbers to the Florida Department of Revenue. In August, it will send “Truth in Millage” notices to all property owners, listing their proposed tax rates across jurisdictions. Those values are already posted at the property appraiser’s website. Gardner wants property owners to study their numbers and to question them if they think a mistake has been made. “What I want people to do is point out where we’ve made mistakes,” Gardner said.

Property owners have 25 days from the day Gardner mails the notices to challenge the numbers through a petition to the county Value Adjustment Board. But Gardner stresses that it needn’t get that far. “It’s ridiculous for anyone to file a petition to the board without contacting us first,” the property appraiser said. “If we have a mistake, we’ll fix it.”

Last year, not a single petition was filed before the adjustment board.

![]()

June 1, 2016 Estimate of Taxable Value

| Taxing Authority | 2014 Final | 2015 Final | 2016 Estimate | Percent increase | New Construction Dollar Value |

|---|---|---|---|---|---|

| Town of Marineland | $3,571,334 | $3,694,290 | $4,800,000 | 29.93% | 0 |

| Town of Beverly Beach | $48,190,295 | $54,164,402 | $59,000,000 | 8.93% | $3,579,637 |

| City of Bunnell | $143,195,702 | $150,592,606 | $154,000,000 | 2.26% | $771,500 |

| City of Flagler Beach | $488,420,240 | $532,443,692 | $565,000,000 | 6.11% | $7,419,688 |

| City of Palm Coast | $3,892,358,641 | $4,129,619,115 | $4,290,000,000 | 3.88% | $77,691,833 |

| East Flagler Mosquito Control | $6,248,120,455 | $6,668,486,786 | $7,020,000,000 | 5.27% | $129,010,561 |

| St. Johns River Management District | $6,677,046,129 | $7,130,202,650 | $7,510,000,000 | 5.33% | $148,414,471 |

| Inland Navigation District | $6,677,046,129 | $7,130,202,650 | $7,510,000,000 | 5.33% | $148,414,471 |

| Flagler County | $6,538,506,828 | $6,987,545,919 | $7,350,000,000 | 5.19% | $147,701,300 |

| Flagler County Schools | $7,423,261,366 | $7,938,754,018 | $8,350,000,000 | 5.18% | $153,026,712 |

Rick Belhumeur says

I’ve got three properties in Flagler Beach that the taxable value went up 38%

Palmetto Bug says

That bar chart looks a bit like the state of New York!

Al_Zeimers says

Whats the criteria for a property tax increase? We need more money for our pet projects and by the way the hell with what the citizens needs are. Oh and quite complaining the gas prices are going up and we need to be in line with them.