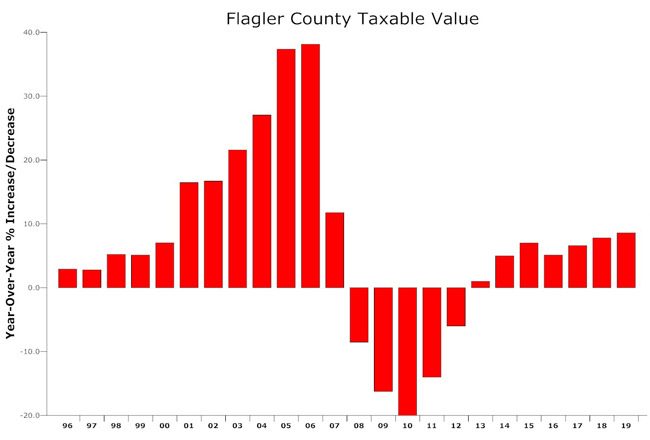

Property values in Flagler County and its cities have increased for the sixth year in a row, and at their best clip in 12 years, when the nation was entering the Great Recession.

Property values in the county as a whole increased by 8.58 percent, compared to 7.8 percent last year and 6.6 percent the year before, according to figures provided by Flagler County Property Appraiser Jay Gardner. Of that increase, $261 million reflects new construction.

In Palm Coast, values improved by 9.14 percent, and by nearly 13 percent in Bunnell, where the rapid development of Grand Reserve alone added $13 million property values to the city’s rolls, a substantial increase considering the entire city’s values add up to $200 million. In Flagler Beach, values increased by 11.62 percent, with some of the increase reflecting the return to property tax rolls of many homes and businesses that had been removed from the rolls after the floods of Hurricane Irma.

Property values are a driver of local government budgets. Generally, as values increase, local property tax revenue rises, assuming governments don’t proportionately reduce their tax rates. Even if they do reduce tax rates, new construction generates net new revenue. County government expects an increase in revenue of around $1.5 million.

Palm Coast is projecting a $2.6 million increase in revenue, based on keeping its tax rate flat, and a $2 million increase in the size of its budget. (The Palm Coast City County discusses its general fund budget Tuesday morning.) There is barely an increase in Palm Coast’s law enforcement budget, though the sheriff’s office, which provides policing for the city, had requested additional deputies. The total increase in law enforcement and fire budgets would be 5 percent each. (See the details of the budget proposal here.)

“We’re up there at a pretty nice number,” Gardner said of valuations, though values have a distance to go before recouping all the lost values of the Great Recession: countywide values stand at a little over $9 billion, still short of the $12 billion peak of 2006-07. Values have improved steadily and strongly each of the past six years. “Having nice growth has been good, I don’t mind it getting up as high as it is,” Gardner said. “Where we are now is strong but it’s not scary.” The scary numbers, he said, were when values would increase by nearly 40 percent year over year, as they did at the peak of the housing bubble.

For homesteaded taxpayers, the value increases don’t mean that taxes will increase much, regardless of their governments’ decisions. For example, in Palm Coast, should the council decide to go with the administration’s proposed tax rate of $4.6989 per $1,000 in taxable value (that is, keeping the existing tax rate), a non-homesteaded property that saw its value increase by 9 percent would also see a 9 percent tax increase. But homesteaded properties would see at most a 3 percent increase, or whatever the official inflation rate is for the year–whichever is less. The inflation rate has hovered around 2 percent in the past two years. In effect, that would be the most that a homesteaded property would see in property tax increase from Palm Coast.

The county and school rates would be different, but the county is not planning to increase its rate, but to cut it modestly (by 10 cents per $1,000 in taxable value). The additional revenue, County Administrator Jerry Cameron said, will allow for 30 percent of it to go to the sheriff, who’s asked for additional deputies, and some of the revenue to go into reserves, which are woefully low.

Without building back the reserves, “What we could possibly have is a reduction of our credit bond ratings, which would have a serious impact on our budget because we are leveraged,” Cameron said. He’s eliminating key administrative positions, including that of the deputy administrator, a deputy county attorney and an engineering position. Some of these positions have been vacant anyway.

Cameron may also have to use some of the new money to pay for temporary accommodations for the sheriff’s personnel, since the sheriff is not likely to get the additional space he needs at the county courthouse. “We have to anticipate we may end up having to rent space, ” Cameron said. “It would be a whole lot different picture on everybody’s budget if we didn’t have to anticipate that.” But having to rent additional space would have to come out of reserves, and “it would lower our ability to rebuild those reserves,” Cameron said. “It could easily amount to half a million dollars over a two-year period.”

For Bunnell, the big jump in values “puts us definitely in a better position,” City Manager Alvin Jackson said. Less than half the increase in values is from existing properties, the rest driven by development at Grand Reserve. But Jackson, who’s meeting one-on-one with each commissioner to hear their priorities, has a list of needs in the city. “Law enforcement continues to be a priority,” he said, with deteriorating equipment and aging vehicles making it necessary to develop a “replacement schedule.”

“I don’t want to get in the situation where everything is falling apart,” Jackson said. There are also needs in parks and recreation, road improvements and infrastructure. “We want to be able to play catch up as much as we can, and also address items that really enhance our economic development, roads, aesthetics.”

In Flagler Beach, the city manager hasn’t yet released a proposed budget, but Commissioner Rick Belhumeur said after a brief conversation with the manager that the plan there is for a tax rate increase sizable enough that Belhumeur called it “unacceptable, ridiculous and a lot of other adjectives.”

In a brief interview this afternoon, City Manager Larry Newsom said he only “guessed” that the tentative property tax rate may have to be set to around 6 mills, from the current 5.3, but he won’t know a figure until he meets with his finance director later this week, and the number will still be fluid. “I don’t appreciate a commissioner making comments about a millage rate that we haven’t even set yet, ” Newsom said. “But in order to run the city, it takes money.”

Alonzo Hudson says

Sound very good. Will the city and county use the money for the people in a good way?

Lin says

It does sound good for local government revenues but

If the rate stays the same and the values increase

It only means higher real estate tax bills for homeowners

That doesn’t sound good unless the homeowner is selling.

Higher tax bills = bad news for me. It’s only a paper gain for govt.

TheTruth says

Property values in Palm Coast rose 9 per cent so now the City of Palm Coast wants to raise taxes by 9 per cent, isn’t that special.