Note: this story originally ran on April 22. The News-Journal and the Observer ran their stories on the matter today (May 5), so we’re re-posting it on the front page as a discussion refresher.

Wherever you live in Flagler County, including Palm Coast, expect your tax rates to go up next year—or services you receive to decline, in the unlikely case elected county and city officials choose to hold the line on taxes.

The reason: For the fourth year in a row, property values in Flagler County have fallen significantly. That means local governments’ general revenue pots, which rely on the property tax, will shrink proportionately to the loss in values absent a hike in the tax rate. Values in the county and every city have fallen by double digits for the third year in a row, according to preliminary numbers released by Property Appraiser Jay Gardner.

Click On:

- Taxable Property Values Plummet a Record 20%; Dire Numbers for Local Governments

- Tax-Averse Parents Send Per-Student Spending Tumbling in Flagler Schools

- Existing Home Sales Edge Up 5.2% in South, But Still at 15-Year Low

- School Tax Rising for Second Year, Compensating for Crashing Property Values

“Now you’re kind of to the point of it’s a quality of life decision,” County Administrator Craig Coffey said. It’s either a matter of sticking with the same revenue, which entails raising the property tax rate to generate that revenue, “or you’re going to have to make very draconian cuts that may not be the type of community people want to live in.”

Coffey, like Palm Coast Mayor Jon Netts, is seizing on a bare silver lining: values fell, but not as much as originally predicted, and there is, in fact, a reversal in the trend. The value decreases are still severe, but they’re shrinking, relative to the previous two years.

Here are property value losses, year over year, as of January 1, 2011:

Flagler County: 14 percent.

Palm Coast: 12 percent.

School Board: 13 percent.

Flagler Beach: 17 percent.

Bunnell: 11 percent.

Beverly Beach: 17 percent.

Marineland: 59 percent.

The Marineland number is an anomaly. Marineland has few properties. Its entire tax roll amounted to $11 million in 2010. And the sale of the dolphin attraction to the Georgia Aquarium, which took the property into non-profit status, lopped more than a third of the city’s taxable values off the books.

Gardner, the property appraiser, stresses that the numbers are nowhere near final, but are within a point of where they’ll be when presented to various government agencies later this year. “We think we’ve got our basic values ironed out,” Gardner said. “It’s better than last year but it’s bad.” The numbers are based on values in 2010, up to January 1, 2011. They are not necessarily a reflection of property values since. The values’ free-fall may have stopped.

There is a bottoming out of values, says Matthew Wilson of CoQuina Real Estate in Flagler Beach, with some nominal appreciation in some neighborhoods, though some pockets are still more troubled than others. The monthly depreciation of 1 percent or more that were taking place at the depth of the crash have stopped. “We remain in a buyer’s marker but we’re seeing sellers holding their line at this point,” Wilson said.

But local governments about to prepare their budgets for next year have to contend with those latest declines in value first, and they must do so after three successive years of severe cutbacks. “It probably means that the county will be forced into a millage increase,” Alan Peterson, who chairs the county commission, said. “Not necessarily a tax increase, but we may have to increase the millage. I’m not sure we can easily decrease our expenses by 14 percent, particularly when the sheriff is about 40 percent of the budget.”

Florida law is written in such a way that when property tax rates increase, it’s not considered a tax increase unless the revenue generated is greater than the revenue generated the previous year. If, for example, a property owner sees values decrease 14 percent and the tax rate increase 10 percent, the resulting overall tax burden would still be less than it had been the previous year. But different property owners will experience different effects of a tax rate increase, no matter what the final revenue is for their local government: last year. Peterson said a combination of spending cuts and a tax increase are likely, though what spending cuts is the question.

“Fat in government—there’s no fat in government anymore. You’re all about doing the bare necessities,” Coffey said. “There’s no rabbit to pull, out of the hat to save the day, it’s going to be tough and tougher choices.” Cumulatively, Coffey said, the county has lost a net $8 million in revenue since the beginning of the decline, after accounting for higher property taxes. Each additional 5 percent loss in property value equates to a loss of about $2 million, so the county is looking at a loss in revenue of about $5 million this year.

It’s not just the property values. Every local government is facing other steep increases in costs that have to be assumed, from energy to health care. The school board just signed a deal with United Health Care that increases the school district’s contribution to employee premiums by $500,000, the equivalent of half a percent of the entire budget—at a time when the district is also facing $3.5 million in budget cuts. For county government, every $1 increase in the price of gas translates to an extra $500,000 cost, because between county and sheriff’s office vehicles, the county consumes half a million gallons of fuel. That’s eating into the county’s budget on top of falling property values. On top of that, employees haven’t had a raise in three years, and may face a cut in pay should the Florida Legislature and Gov. Rick Scott approve an increase in how much public employees contribute to their retirement fund.

Cities will face similar pressures. Palm Coast didn’t raise taxes last year, but it lost $3 million in consequence, and now has the lowest reserves it’s had in its 11-year history. The city also opted to keep its property tax steady by essentially raiding its capital funds.

Palm Coast Mayor Jon Netts would like to maintain the city’s basic seervices without cutting taxes yet again. “I don’t know that it’s if it’s going to be possible, but we’ll certainly give it a try,” Netts said. “It is what it is. You have to identify your essential services and you have to fund them. If you can do that without raising taxes, that’s marvelous, but if you can’t I think the residents would rather have the services than save $50 a year on their tax bill.”

In Flagler Beach, where the property tax rate was raised last year to ensure essentially the same amount of revenue—which means the budget itself was not cut—the 17 percent projected loss in values is especially steep, because should tax rates again be raised as they were last year, the compound effect will be severe. “We knew that this was going to happen but didn’t know to what degree,” Acting City Manager Bruce Campbell said. “Now we know.”

Meanwhile, state lawmakers are batting about various proposals to cut property tax further, including one that would exempt up to 50 percent of the property taxes for new homeowners, and cap non-residential increases in assessments at 3 percent (as opposed to 10). Those proposals and others like them, should they pass, will further reduce local government revenue. Gardner, the property appraiser, scoffs at the proposals disconnection from local governments’ challenges. It’s all a matter of shifting burdens, not reducing taxes, Gardner said. “There’s no such thing as an exemption that somebody else doesn’t pay for, period.”

lawabidingcitizen says

Did I hear someone say draconian cuts?

The Flagler Beach commission better not blame Acting City Manager Campbell for the coming blood bath at budget time. Apparently Commissioners Mealy and Feind are planning to do just that with their statements that they want to wait to see how he handles the budget before they decide whether or not to give him a permanent job.

The mess was made by the former interim-manager, his sycophants on the commission and their mindless acquiescence to the CRA director’s multi-faceted spending programs.

Charles Ericksen Jr says

Leave it to local politicians,city managers and county administrators, to always be confused with less revenue, than what they had for the previous years. It’s just not in their blood, nor experience to find “cuts”, that could easly be implemented. Have you ever heard anyone of them actually mention specific figures? Let’s talk some, then.. Right now, a reduction in Ad Valorem revenue, would amount to about $1-2 million. If we have $10 million to spend on a City hall, just sitting there, why don’t we postpone the City Hall, “borrow the money”, and then retrun it to the fund, once the revenue comes back in..? Why don’t we postpone some of the capital projects, that we transfer monies out of other revenue streams, to make up the difference? Last year ,we transferred monies out of the general fund, to cover other expences..We “found”, $5.5 million to redo the “free Golf Course”. and this year it will still lose, $1.2 million,,,,The City talks about getting awards for it’s financial reports, but it must be for hiding the monies, so that regular residents cannot find it, But folks it is there..The total City budget is $175 million/year, and only 20% + of the needed revenue comes from out taxes. The rest comes from fees, grants, and other sources. So don’t be worried about the money…They could find it, if they wanted to.

revenge of the nerds says

No, I’d rather save $50 on my tax bill.

Palm Coast Mayor Jon Netts would like to maintain the city’s basic seervices without cutting taxes yet again. “I don’t know that it’s if it’s going to be possible, but we’ll certainly give it a try,” Netts said. “It is what it is. You have to identify your essential services and you have to fund them. If you can do that without raising taxes, that’s marvelous, but if you can’t I think the residents would rather have the services than save $50 a year on their tax bill.”

Alex says

Start with zero base budgeting.

Return credit cards

Cell phones

Platinum health care package etc.

Review capital equipment needs, including police and fire services.

Get a bunch of retired corporate budget cutters together and they will teach you how to cut.Those guys do it with such skill that you won’t know it when you got axed.

Rob says

Did this economy just tank last year?

Couldn’t anyone forecast that this tailspin would take at least five years, at best, before it began signs of a recovery? So what was the plan four years ago when the real estate market began to fall apart.

These politicians act like something just dropped out of the sky and fell on them yesterday.

Hint, there will be a year after this one.

By the way, what was the reason the city of palm coast declined to purchase hybrid vehicles, was it that there wouldn’t be a significant fuel savings cost.

Don’t despair the city of palm coast will build a brand new city hall for their meetings and offices.

Ron Vath says

With Campbell at the helm I’m confident he will include all known budget cost requirements in the budget. What has been the practice of previous manager(s) is to intentionally leave required budget spending out of the budget. Then, shortly after the budget is determined and solidified, these costs are dropped on the Commission with a request to “adjust the budget” and spend on the items.

These “bugget adjustments”are not generally transparent to the general public, since they do not impact the tax rate. The money is taken out of “reserves”-our city savings account.

To site an illustrative example, I now know our fire chief had been requesting roof repairs at our fire house for 2-3 years but the acting city manager evidentally never put the anticipated costs into the budget. It was not until the Chief claimed the building was getting “mold” problems that the issue was brought to the Commission. Of course, it was brought after the budget was established and the money had to be taken out of City “reserves”, with no budget accountability or tax millage support. The commission had no choice but to take the $50,000 out of the bank to fix the roof. Such shenanagins explain why our “reserves” have been appreciably reduced in the last 3-4 years. .

I’m not suggesting we increase our spending, just include necessary items in the bgudget to remain transparent. Unfortunately my complaints to staff regarding this practice never got any traction

Ron Vath says

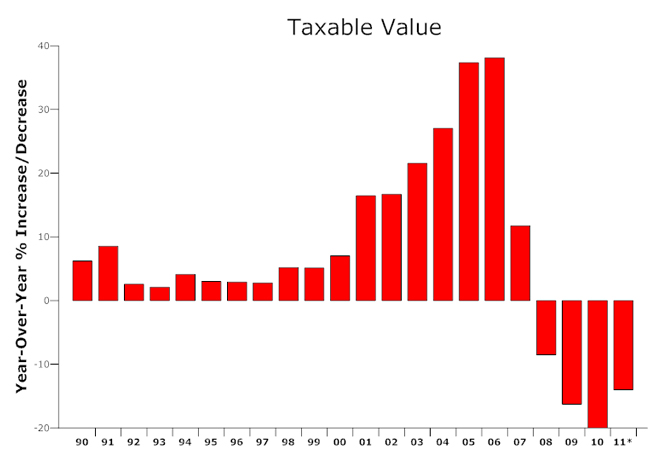

What would be a more interesting graphic is historical property valuation changes vs millage rate change.

Flaglerlive says

That would be a better graphic Ron. We’ll get those numbers soon.

Jim J says

NO NO NO to raising taxes.

Like someone else said – go to zero base budgeting.

Keep tax rates at current level or lowever them – I could care less if they legally can raise the rates – I thinke the Coundty Commission and Palm Coast City Council – need to hear the residents lound and clear – Lower the tax rates. Learn to live with less. Cut those pet projects (Like the City Hall). Do not I repeat do not use generla fund dollars for tennis center and/or golf course – they need to pay for themselves.

palmcoaster says

We all better keep and eye in the local government budgets to be approved and oppose any tax increases. Be specially aware of what county manager Coffey may want to do as county already is the second most expensive billing our homes taxes and for what services..?. They have plenty of tax income in this county for the services provided….is everyone aware what all those thousands of water front properties pay in taxes…what about $17,000 plus a year in some areas like the Intracoastal water front (what my friends pay)…Just my house at the end of a canal pays $3,400/year as shown in my tax bill below and this is since last year as It used to be $4,500 before in 09. Does anyone ever read their yearly bills? To pay over 1,000 of my taxes for the county services I receive, is flat out unfair as our services are provided by our city of P.C, except law enforcement. Can you all see the county bonds we are paying for the Taj-Mahal and the new court house; bond, bond bond.? Also $36 a year in mosquito control no longer provided as mosquitos eat us alive in my patio as soon as the sun goes down. Besides their comfortable administrative red tape fees that we support…. where is the spraying?…only in the Hammock Dunes and Ginn golf courses? While we were under ITT we sure didn’t have to endure the mosquito swarms…now I don’t know where the spraying goes sure not to Palm Coast and “we are forced to pay for it!. Always the excuse for a reason of the mosquitos swarms we complain and no long lasting compliance. St Johns River Water Management is the third question in my list we need to ask at $73. Have anyone ever read the list of hundreds maybe even more, professionals that our taxes pay to this entity? Red tape and administrative fees is what eats our taxes including the school taxes. They are always firing the teachers….while paying outrageous salaries to administrators that as far is my concern do not deserve such a pay, plus the benefit of the benefit of the benefit. You get a Superintendent today making a whopping over $160,000 plus a year depending the county and not including their juicy benefits and sometimes they do not even have yet their PHD’s. When it comes to county and city managers plus all their assistants sure the pay scale is pathetic from us tax payers view.

Some deserve it, but some don’t. My house valued for taxes at $226,000 with 50,000 exemption at $170,000;

FLAGLER COUNTY

GENERAL FUND $974.94

REMAINDER ESL $10.01

2005 ESL BONDS $14.41

2009 ESL BONDS $19.63

2005 OBLIGATION BOND $47.80 total county taxes $1,066.79 (for what?)

FLAGLER COUNTY SCHOOL BOARD

GENERAL FUND $1,109.52

DISCRETIONARY $200.78

CAP. OUTLAY $301.77 total schooltaxes $1,612.07

ST. JOHNS RIVER WATER MGMT $73.26

FIND 0.0345 $6.08

MOSQUITO CONTROL $35.91

CITY OF PALM COAST $616.64

Yes I know, if I don’t like it move.

Bigfoot says

At least now the citizens of Flagler Beach are hearing a small piece of the story on Bernie Murphy’s balanced budget act. Too bad Mr. Vath did not have the courage to bring these practices to the attention of the public during many commission meetings while Mr. Murphy was here. I thought Ron Vath was such a staunch advocate of Mr. Murphy, that Mr. Murphy was doing an excellent job. But now we are hearing some of the real story. We feel betrayed so far as any trust of anyone at City Hall is concerned, as new schemes are being put into practice without the public ever knowing..

Ron Vath says

Hi Bigfoot? Obviously you don’t appear to be aware of my activities while I was a Commissioner. On numerous occasins I broached the subject of “after the fact” budget requests( In the sunshine) and requested staff to stop the practice. But If you read my first statement, I never got any traction.

Also , when the question of Mr. Murphy’s residence came up for discussion, I motioned to have him, at least, rent a room in the city , to meet the requirements of our Charter. Check the record, this motion was never even seconded. Rumor is Murphy’s comment regarding this motion was that it ” would not be ethical to rent a room.”

Finally, if you read my official comments of Mr. Murphy’s ( which I had to request be done) on his annual appraisal report, you will find I was the singular Commissioner who made critical corrective comments. It’s public information, I would respectfully request you do your homework before commenting.

jimmythebull says

Alex says:

April 22, 2011 at 8:34 pm

Start with zero base budgeting.

Return credit cards

Cell phones

Platinum health care package etc.

Review capital equipment needs, including police and fire services.

Get a bunch of retired corporate budget cutters together and they will teach you how to cut.Those guys do it with such skill that you won’t know it when you got axed.

im with you. couldn’t have been said better.

walter says

i think we should make our protests where it counts. on election day and vote all the self-serving drift wood out of office.

Flagler Citizen says

Hey Ron Vath- Concerning the fire house, I am trying to determine if you feel the “shenanagins” were the work of the fire chief or the acting manager? How about if you “turn over a new leaf” and lay off the fire dept. for a while. Those guys do a great job for us and between the paid guys and the volunteers, provide one heck of a great service to our community!

Alex says

“i think we should make our protests where it counts. on election day and vote all the self-serving drift wood out of office.”

It is too late, the damage is already done.

The new guy or lady will do the same thing with slightly different nuances.

My question and concern is, what will happen after the property values start increasing?

Currently the tax bill go up. Will it go up at a faster rate?

John Smith says

Vath was not here for any of last years budget finals, he was working with FEMA remember he was out of town. So I do not see where he has any credibility on complaining about it and the way it was handled. AS FOR THE FIRE CHIEF VATH HAS A VENDETA against the best chief that has hit this town, he just wants to keep up the fight to oust our chief which would be a bigger loss to the city than Vath leaving. He should get his figures straight before he runs his mouth. He is not anybody anymore so what he has to say means a BIG 0.

John Smith says

Hey Walter you sound like a tea party voter. That is the LAST THING WE NEED TO DO is get some tea party commissioners in the city so they can bring it down along with Scott and Rubio. This last election was a start with Shupe and Carney in there, now we need to get rid of Settles. You and Sarah go have lunch somewhere.

Jojo says

We’re broke but Palm Coast powers to be still want to build a new City Hall? Didn’t we defeat that ballot already. Yet, I have a sneaky suspicion they are going to try and get this done one way or the other without our approval. My answer is still no. We don’t need it now. Get jobs going in this county first.

Jim J says

Palm Coast Mayor Jon Netts would like to maintain the city’s basic seervices without cutting taxes yet again. “I don’t know that it’s if it’s going to be possible, but we’ll certainly give it a try,” Netts said. “It is what it is. You have to identify your essential services and you have to fund them. If you can do that without raising taxes, that’s marvelous, but if you can’t I think the residents would rather have the services than save $50 a year on their tax bill.”

Mayor you are wrong – I’d rather save $50 on my tax bill. Stop wastful spending on capital projects the citizens do not want.

BW says

I particularly love the generic “we’re broke” and “stop wasteful spending on things that citizens do not want”. The arrogance that a small percentage of loud speaking people are the actual voice of the majority is absurd today. There is one very important principle I live by, “Do not complicate the simple, and don’t simplify that which is complicated.” These are complex issues that too many try to simplify especially these armchair political people who offer nothing in terms of ideas for actual and logical solutions, but rather like to spend their time spewing out the same old tired lines for everything.

The truth is that the City or County is not broke. “Broke” means having no money and no more revenue coming in. Prove to me how this area is “broke”. I’m glad Jim is hell bent on saving his $50 on his tax bill. Multiply that by the tens of thousands of households and list out which services you are willing to do without please.

Lin says

Simply, if tax revenues are going to be down because the appraised values are down (as stated in this news story), services have to be cut or tax rates raised — that sounds like a deficit to me. If my income is down, then I have to cut what I spend or find a way to make more money somewhere else, or both.

PC needs to stop talking about unnecessary spending (CITY HALL) and other spending plans like getting into partnership with commercial developers either in a small way or a big way like actually building a commercial building on spec and “hoping someone will buy it”. If that were a great business opportunity, the private sector would jump on it.

The majority can speak at the polls (oh, we already did that re new city hall) but it seems it has not stuck. The City leaders aren’t listening. Maybe we need to vote again and this time vote in leaders who know how to attract business and stop spending taxpayer $ unnecessarily.But the polls aren’t open tonight, so …

Jojo says

Well said Lin, I agree wholeheartedly with everything you said. When Palm Coast Data sells again for the umpteenth time perhaps the City can get their old building back. I’m sure they would be glad to.

Camelot says

If the fire house had problems with their roof then the problem should have been addressed by facilities maintenance. If the roof needed to be fixed and facilities maintenance could not do the work themselves then they should have added it to their budget. It is not the responsibility of the Fire Chief to fix the roof, but it is his responsibility to report it. No need to make the simple complicated, or the complicated simple.

If all the proper channels were followed correctly, the surprise cost of a new roof should never had been a surprise to anyone including council since it is a safety issue. Everyone needs to except responsibility instead of pointing fingers.

John Smith says

It is like They said the chief had reported it to the city but the city would never put it in the budget. Well its like like they also say is that they had the choice have another PD building to tear down and replace after it was checked for found mold or replace the roof. On the record at the last 3 budget yrs The chief had been to trying to put it in the budget but Murphey would not do it, contrary to what Vath might have to say about it he was NOT here for any of it and Miller could see the problem and took care of it. Which upset Vath because he WAS NOT HERE he was working for FEMA not the city. And His numbers are WRONG on what he is QUOTING in his post.

palmcoaster says

This kind of late reply is to PC running candidate for mayor Mr. Ericksen. As per data published in the Daytona Beach NJ enclosed below our Palm Harbor Golf Course had 1,213 .000 revenue and 1,222.000,expenses, then shows only a loss of about 9,000;

http://www.news-journalonline.com/news/local/southeast-volusia/2011/04/20/revenues-flat-as-public-golf-courses-compete-for-players.html

Palm Harbor Golf Course:

*Rounds played: estimated at 37,000.

2010 — Expenses: $1.222 million. Revenues: $1.213 million. Loss $.009 million

* — These figures represent the period from November 2009 when the city opened the club after its renovation to the end of the fiscal year, Sept. 30, 2010. As published.

City budget for 2011 the Palm Harbor Golf course has a budget of 1,492,000…?

Now is there was a loss in the inaugural year I hope that loss was taken by the Kemper Sports Management company chosen to run the business and not us the tax payers. Maybe if they just break even, they need to have less employees and more realistic lower salaries for the revenue they bring?

Because in business less revenue means, less work and less need for workers. The bulk of the revenue should be to maintain the course and not to gift themselves with VIP’s unrealistic salaries.

Maybe city would contribute to detail the real financial’s to us all, as we see confusing stories about it?