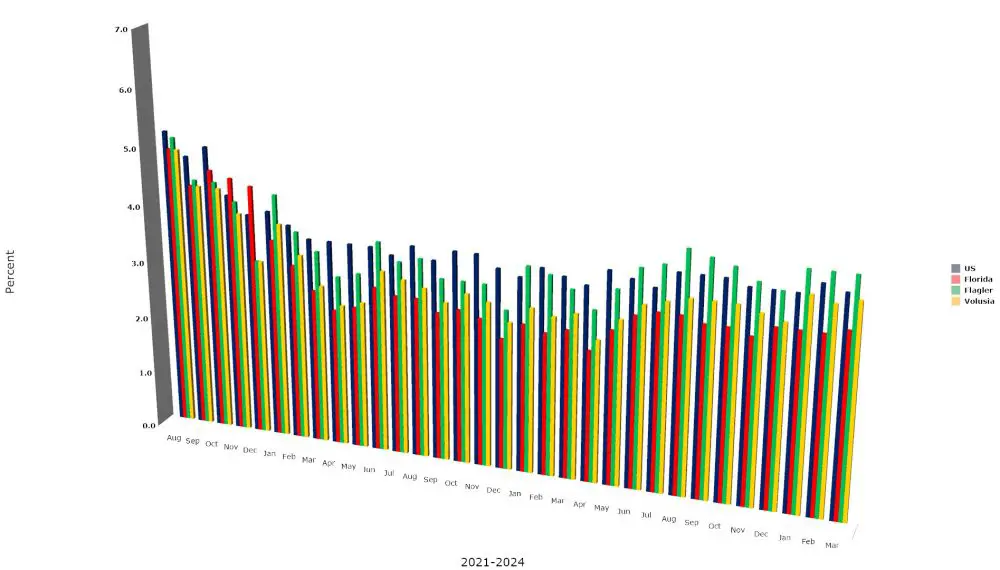

Flagler County’s March unemployment rate held at 4.1 percent for the third straight month, remaining above 4 percent for six of the last eight months even as county residents netted 134 new jobs and the number of the unemployed remained flat.

The workforce increased in proportion to the number of employed residents, and is now just shy of 52,000 in a county population exceeding 131,000: less than 40 percent of the county’s population is in the workforce, with 47 percent either over 65 or under 18.

The growth in Flagler County’s workforce has slowed slightly, growing by less than 900 people compared to a year ago. Workforce figures are an indication of working-age families moving to the county. The slowing pace of new workforce residents is reflected in the slowing pace of home sales, which are near a four-year low. That is one of several local economic indicators that, should they persist, may be of concern to those in the housing industry.

The number of sales closing fell for seven of the last eight months, according to the Flagler County Association of Realtors, ticking up slightly in February–for the first time since last July–to 185 sales, still the second-lowest number of sales all year. The lowest number was in January, at 161.

The median time for a house on sale to get to a contract, however, which had near a four-year high in January, shot up to 80 days, the longest time-span since January 2016, or more than eight years. The median time to a sale also rose sharply, to 122 days, the highest span since 2015.

Mortgage interest rates have again been rising amid fears of renewed inflation, reaching a national average of 7.3 in mid-April.

The median sale price of a single-family house in Flagler County fell to $355,000 in February, matching the figure in September 2023, which was the lowest median price since th first quarter of 2022, when prices were sharpy on the rise. The lower price means more people should be able to afford to buy. But the higher interest rates may negate the advantage. The median price across Florida this year is just over $400,000, according to Forbes.

The local inventory of single-family homes continues to climb. Excluding an outlying surge in January 2022, the supply has grown steadily almost ever month, from a low of a little over 200 homes to 1,059 in February, even as numerous new subdivisions are churning and adding homes at a rapid pace. The months’ supply of homes in the county has risen from a low of less than one month to 4.4 months in February–still low, but the trend says otherwise.

In March, consumer sentiment among Floridians decreased for the first time after improving for five consecutive months, according to the University of Florida’s Bureau of Economic and Business Research. The index dipped to 72, down from 74.1 in February.

“The drop in consumer sentiment was largely driven by Floridians’ views on their personal financial situation a year from now, which plummeted sharply in March,” said Hector H. Sandoval, director of the Economic Analysis Program at the bureau. “Additionally, expectations about the country’s economy over the next year dropped as well. While we anticipated a slight increase in consumer sentiment rather than a reversal, the decline suggests that Floridians may be growing more concerned about future economic conditions.”

He added in a release: “This concern aligns with the higher-than-anticipated inflation observed in the first two months of the year, which prompted the Federal Reserve to keep interest rates steady and might prolong the need for rate cuts in the near future.” Expectations of personal financial situations a year from now showed the steepest decline in this month’s reading, down 4.7 points from 88.4 to 83.7. These negative views were shared by all Floridians, but more steeply so among women and people older than 60.

Unemployment in Florida rose by a decimal point in March, to 3.2 percent, with 355,000 Floridians officially out of work. The state added a net 10,400 jobs in march, for a total of 211,100 over the past 12 months.

“Population growth is a big driver of all the growth we are seeing in Florida,” Jimmy Heckman, the Department of Commerce’s chief of workforce statistics and economic research, said Friday. “That just creates more opportunities and more demand for goods and services, which creates more opportunities for businesses, which creates more demand for labor.”

The state figures, the News Service of Florida reports, follow U.S. Bureau of Labor Statistics earlier in the week showed 303,000 Floridians quit their jobs in February, one of the highest rates in the nation and an increase of 35,000 from a month earlier. In the same time, the state estimated there were 557,000 job openings, up 20,000 from the prior month.

The state’s unemployment figure represents only the number of people willing to go through the state’s draconian requirements to receive unemployment checks, which last only 12 weeks and, with Alabama’s, are the second-lowest benefit in the country, at $275 a week (Mississippi is the lowest, at $235 a week.) The GOP-majority Florida House of Representatives in 2021 killed an attempt to raise the weekly benefit to $375, and to extent the eligibility period.

Florida’s $275 unemployment benefit has not been increased since 1998. Had it kept up with inflation, the benefit would be set at $532 in today’s dollars. Instead, the purchasing power of the benefit is $144, in 1998 dollars.

![]()

Joe D says

Unfortunately, it doesn’t look like things are going to improve much while the housing costs in Flagler County remain so high. All the new housing construction appears to be “luxury” housing and not affordable for moderate income families ($250k-300k home prices) to live, work and BUY in the County.

And all these gas prices inflated by Putin’s War, OPEC+ cutting oil (gas) production to jack up gas prices, and fears of Middle East Oil field disruptions, are only going to worsen things.

TR says

“luxury” housing? Really, most new homes in these new developments are on 40′ lots. with the neighbor so close you could pass things back and forth to each other. That is a far cry of a luxury home imo.

But get ready folks, regardless of what people say. The housing market is about to come tumbling down. It always has a tendency to happen every 10 to 15 yrs and we are right at the point. Hope all these so called smart developers loose their butts when it does, because they deserve it.

Stop The Insanity says

However, the developers and politicians refuse to see the light. They’re blinded by greed and incompetence. I have never seen this much development in such a short amount of time. They thought the housing boom would last forever. Recently, Sanford, Florida had the foresight to put a two year moratorium on building. What a novel idea.

Denali says

So riddle me this; If the price of gasoline is being driven by OPEC and others cutting production and fears of supply chain disruption why has the price of diesel gone up accordingly? Currently in mot parts of the country gas has risen to the price of diesel which has remained at its previous levels if not dropped in some areas. Someone is manipulating the price at the pump for a gain in the upcoming election and it sure as heck is not the D’s. Source; casual observations (and frustrations) over a 7,000 mile road trip to southern Michigan, central Arizona and back to Florida with a Mexico side trip included – gas there is pushing $5.75 – $6.00 US.

Ray W. says

Thank you, Denali, for pushing me to look into Arizona gasoline prices. I found an in-depth news article on the subject.

It seems that Arizona has no refining capacity whatsoever. All gasoline must be piped into the state. Some comes in from California. Some from Texas. The long distances involved increases costs.

Apparently, a second factor is that the pipeline capacity to import gasoline has not increased in recent years. As more and more people move into the state, demand for gasoline keeps rising. Demand now outstrips pipeline capacity, at times. In other words, right now, during high demand seasons, gasoline supplies often run short. Diesel fuel pipeline capacity apparently is not on the verge of undersupply.

Another unique issue that I had not heard of is that Arizona’s executive government decided some time ago to disavow use of national standards for clean-burning gasoline. The Arizona executive branch decided to impose its own administrative standards for gasoline blends. This means that Arizona has to special order clean-burning gasoline blends from out-of-state refiners. If Arizona would adopt the national standards, they could order gasoline from any refinery that has gasoline to sell. They decided to abandon that approach. Supply and demand being what it is, Arizona cannot any longer tap into the large national supply of clean-burning fuels; they have to special order their own blend.

As an aside, I came across a different article about a large Indiana refinery unexpectedly shutting down for six weeks. BP owns the refinery in northwest Indiana; it is the sixth largest in the country. An unexpected power outage on February 1st disrupted operations. For safety reasons, workers were sent home, and cracking stacks were opened. All partially refined products were burned off to reduce the risk of explosion. It took a long time to ramp up production back to normal. The refinery produces, when at full capacity, about 5% of the nation’s petroleum needs. This may partially explain why gasoline prices rose more than they usually rise in Flagler County in February and March. The gullible amongst us were blaming the administration, perhaps out of frustration and certainly out of ignorance. They, apparently, were at least partially wrong once again. Take out 5% of the nation’s gasoline products unexpectedly and prices almost certainly will rise. This is the normal operations of a capitalist economy, for better or worse.

Again, thank you for the prompting.

Ray says

I know I made a mistake and retired there in Palm Coast. After being here one year was enough. Constant building 24 seven all the trees being destroyed traffic overcrowding. Takes you a half hour to drive 3 miles and fighting traffic and people. That’s not what retirement life is for me. Glad I’m out of there.

Dennis C Rathsam says

RAY… Where did you go I want out too!

Atwp says

Well perhaps all of the building will slow down. Housing bubble on the horizon? In 2021 the Repubs stopped a bill that would have increased weekly benefits. People who voted for them really need the extra money. Good job voters. Look what you got.

The dude says

134 new jobs last year in all of Flagler.

Around 1000 +/- houses approved in Palm Coast alone last year.

Hmmmmm?

Crystal Lang says

TR, You are absolutely right, I used to walk in the morning up RT 1 and all thru Sawmill Creek/Branch and yes those houses are so close to each other and small and they have a freight train that goes by everyday. A year later I decided to walk thru the community again so to get thru my 5 mile walk I started counting For Sale signs lost count. So very sad. I read an article where one of the council members requested a slow down or a “give it a break” on building and it got voted down so I don’t see that happening here because David is making sure he approves every builder that comes thru Palm Coast before November so his pockets get bigger what a greedy, nasty person he is. I look on Realtor.Com from time to time just to see prices of homes etc.. and alot of the houses for sale are from the builders building the communities, I’m starting to notice builders that I never heard of or are from other states. I think they got wind of greedy David and decide to jump on the wagon before he is voted out. Sickening just sickening. So now that brings me to this question, what is going to happen to the Cows on the other side of Rt1 when there is no more land to clear on the other side, now that is a scary thought. Look, I said it before I will say it again, I came from up north not too long ago and built one single family home on a single lot (there is only 2 of us) I have no issue with that everybody has to live somewhere. Its the COMMUNITIES that have to STOP!!!!!

Tony says

With all of the Help Wanted signs why is there anyone collecting unemployment?

Ray W. says

Hello Tony.

Interesting and complex issue. For the last two or three years, the number of people applying for unemployment insurance coverage has been far below the national average established since 1967. Over the past 56 years, the average number of applicants has been around 365,000 per week. Over the past year or so, the number has hovered just over 210,000 per week. When a person is fired or laid off, they can apply for coverage. When they find a new job, they lose the benefits.

It seems that no matter how strong the national economy, people are being fired or laid off in large numbers each week. Some immediately get new jobs and never apply for benefits. Others begin getting the benefits but lose them when they find new jobs. Many people quit on their own and get new jobs; they cannot apply for benefits. When you have a nation with 330 million people and a 62% labor participation rate, millions of people can be switching jobs each week for whatever reason.

The problem might be one of matching the right person to the right job. If people in the restaurant industry know who the crappy employers are, they won’t work for them. Crappy owners of small businesses may find it hard to get good workers. As I have commented before, I defended the son of a funeral home owner. He told me of his father’s employment strategy. I found the father’s help wanted ad in the News-Journal classified section. It read: “Backhoe operator wanted. Minimum wage. No raises.” The son told me that eventually someone always applied for the job, until they soon quit. The father would call in the same ad, over and over again. The graves would always get dug.

Yes, you can see plenty of help wanted ads in the area. That might help you understand just how many bad bosses, how many exploitative bosses, are out there.

Endless Dark Money says

profits above all!! Well rick scott used to boast how he kicked so many off unemployment and put up lots of red tape to even get the 800 monthly max (one of lowest in the nation). So florida has the lowest number of people that qualify for benefits actually claim them as the systems dont work, they are understaffed, they make it a constant pain in a$$ to keep claiming. there are 72 fraud warnings to get you $200 pre tax weekly max, website doesnt work so travel here and wait for 3 hours to talk to a human.

The dude says

Florida man would rather illegally pick Palmetto berries, and run various grifts on the olds than get a real job.

Ban the GOP says

The help wanted ads are for positions that dont pay enough to survive on. unemployment has been so sabotaged by republicons no one claims it as you will still be homeless within the first month as you can get a maximum of 800 per month but the average rent in florida is 1700 per month. Basic elementary math says you cant pay half a rent let alone insurance, transporation, utilities, food, you know the basic needs. Its not like back in your day when you could work at the gas station and buy a house and car and raise two kids.

Macy says

We also made the mistake of retiring here. Fortunately we stayed 2 years and went back north. We never felt safe here. There’s always a lot of traffic and the prices of insurance and utilities was ridiculous. We visited Palm Coast 10 years ago. It was a nice quiet, smaller town, now it is approaching 200,000 and decided we didn’t need all the aggravation.

The dude says

Same.

We gave it five years.

The expenses doubled.

The politics got zanier.

The people got angrier and uglier to one another.

We had to get back to where people live their lives as opposed to what goes on in central Floriduh.

Endless Dark Money says

same, couldnt find employment to support family. Had to move to find an opportunity.

Anyone believe that 4.1% number cause its far from accurate. U6 number usually averages double that one .