When their latest round of budget handwringing ended Monday morning—the sixth of the summer, with several more to go—a Flagler County Commissioners Charlie Ericksen wondered if there was a commissioners’ equivalent of a witness protection program.

“We’re going to need one,” Commissioner Barbara Revels said. She may be right.

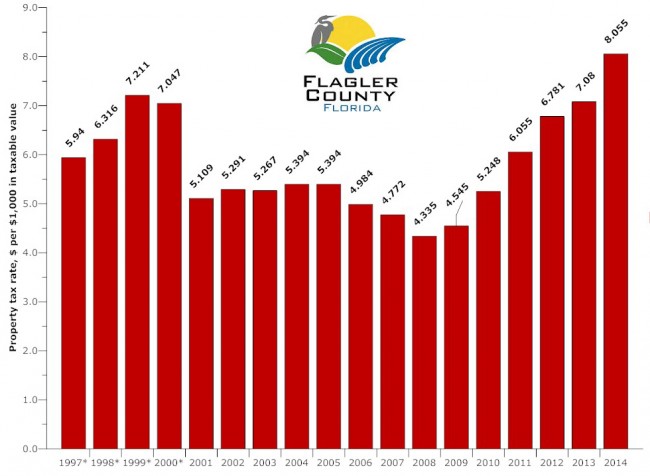

County tax rates—and bills—are set to go up significantly for most for the first time since the beginning of the recession. Commissioners have agreed to tentatively set next year’s property tax rate at $8.055 per $1,000 in taxable. That’s a 14 percent increase over the current rate, and it will average out to an almost $100 increase for a house valued at $150,000, and with a $50,000 exemption.

Commissioners set that rate as the maximum they may finally set come September. They still intend to look for ways of lowering it, and they may. But they won’t be able to lower it much, because the majority of the increase is required by mandatory spending. Last year they ended up raising the rate 14 percent as well, but half that increase was offset by declines in property values.

For tax payers, the coming tax rate increase will hurt doubly.

In previous years, tax rate increases didn’t mean much because they were either entirely or more than offset by decreases in property values. The end result was lower tax bills for most, even as tax rates went up. That’s over. Property values on average went up for the first time in six years in 2013. They went up only a fraction. But that means that for the first time in six years, tax rate increases will be virtually equivalent to tax bill increases.

In addition, residents of Palm Coast, Flagler Beach and Bunnell are also looking at significant tax rate increases that will not be offset by property value declines. That will compound the hurt of tax bills when they arrive in the mail. And that’s in addition to other increases residents and businesses see no differently than taxes when they calculate their bottom lines: increases in electricity and water and sewer rates, and increases in car and health insurance premiums.

Cue the commissioners’ protection program.

County Administrator Craig Coffey again laid out what commissioners must pay for as opposed to what they could forego. But even items on his non-mandatory spending lists had the feel of quite mandatory needs.

First, the absolutely mandatory needs: Flagler County Fire Flight, the emergency helicopter, must be upgraded. That’s $85,000. The county has to match Medicaid reimbursements. That’s $455,000. The state’s retirement fund, a responsibility the Legislature artificially delayed in order to give the illusion of a cost decrease last year, will cost Flagler $870,000. Property liability insurance, the medical examiner’s office and dollars that must be shifted to other cities because of their enterprise zones, or community redevelopment agencies (where taxes once due the county are locked in those zones, such as Palm Coast’s Town Center, and belong only to the cities running them) all add up to $275,000.

So in the coming year, the county is looking at mandatory cost increases of $1.6 million. Those are not budget increases the county is choosing to impose on taxpayers. They’re cost increases imposed on the county, and the county has no choice but to pay for them. It could be argued that the helicopter’s costs are optional. That’s only if the helicopter’s safety were to be considered optional—or if the helicopter were itself to be considered optional, which is not the case: residents and commissioners depend on the helicopter’s life-saving value during wildfires, road accidents and police incidents.

That’s not including non-mandatory requirements that are nevertheless crucial for ongoing operations, such as $200,000 for the county’s reserves (“The use of reserves has kind of caught up with us,” Coffey said), which are depleted. Some $311,000 in capital equipment and other costs that add up to $643,000.

Additional needs Coffey calls non-mandatory “challenges” add up to $1.8 million. Those include seven additional employees—a deputy county attorney, planning and engineering positions, and others—totaling $386,000, a 3 percent cost of living raise for all employees (almost $1 million), expanding library costs ($80,000) and a health insurance increase, plus other smaller costs.

It was not enough to lower the tax bill much.

“I realize that’s only an introductory number, but that’s still is about 91 bucks on that $150,000 home, as an increase, which is probably 11-12 percent,” Ericksen, who hadn’t yet thought of commissioner protection, said. “We’ve got to do some more cutting.”

“I agree with Charlie,” Revels said. Revels does not face another election until 2016 (an earlier version of this story incorrectly stated Revels’s next election as 2014). “I know that if we decide that we accept this number to just move forward with trim,” she said, referring to the “truth in millage” acronym (the legally required notice the county publishes, noting the highest tax rate it may set this year, though it could choose to set the rate lower once it settles on a final number in September), “that you’re going to hear from your constituents because every other taxing district except probably St. Johns”—the water management district—“is going up, so the cumulative effect of what citizens are going to feel on their tax bill is going to be big.”

“But you’ve got to keep in mind we were cutting fast and furious when a lot of these weren’t,” Commission Chairman Nate McLaughlin said. In fact, last year’s county tax increase was still enough to be a net cost to most taxpayers, even after value declines were taken into account. It’s school taxes that went down the steepest last year.

“If there are other cuts that can come out of it, great, not a problem,” Commissioner Frank Meeker said, “but are we going to get it to the point where there’s not going to be a millage increase this year? I haven’t seen that as an option.”

“No, I don’t think anybody suggested it,” Ericksen said, “but I think we’ve got to do better than 91 bucks.”

Commissioners debated the value of specific line items, looking for cuts—the manatee protection plan the county is still without, drug court, a new trial-release program,.

That $100,000 program would pay for two positions and would enable the county to monitor people awaiting their court date, but to do so without sitting in jail at a $90-a-day cost to taxpayers while giving judges more leeway in dealing with ongoing cases. “This is just one of many programs that are going to come forward in an effort to keep the jail population down,” McLaughlin said, and that one has already been pared down.

“At a time when we actually have a manageable population,” Revels said, “is a time when we should be working at how this would work in the future for when that jail population will balloon back up, it absolutely will, we know that, and be ready for it then, but not start a program now, when our population is down.”

McLaughlin believes now is the time, when the population is manageable, “to work the kinks out, to develop what’s going to work for Flagler County. What works for Volusia doesn’t work here.”

That decision, like many others, was left hanging, with commissioners satisfied to set the tentative tax rate and opt for an across-the-board cost of living raise for all employees (rather than a flat payment). The raise will be less than 3 percent, but likely more than 2 percent. The 2.5 percent figure Coffey was proposing appeared to have the most support.

The public-comment segment drew only three people, two of whom made specific proposals. Former County Commissioner Alan Peterson suggested saving half a million dollars by eliminating one of two proposed new ambulance purchases, “saving” $250,000, delaying the $100,000 pre-trial release program, and forego increasing reserves by $200,000. Jim Ulsamer, chairman of the library’s board of trustees, recommended saving some money by foregoing about $20,000 tentatively appropriated to it, and leaving it to the Friends of the Library to paint some high-profile areas of the building.

Those proposals may yet find some support.

gator says

you know i’m so tried of ya’ll raisen taxs,and then gave your self raises, and we the people out here don’t have money for food,whats wrong with this picture.you are getting richer and i my self can ‘t by food, or med.or gas.between school crap and ya’ll i can ‘t live. i like you to live on what i get a month and see if you could make it, sure hope you like crackers,cause sometime thats all i have. so you people are stealing from us that is trying to live on nothing.and you walk around laughing at us.you know you people need to open your eyes

Magnolia says

It must be horribly frustrating to be elected officials in a time when so many people have lost their homes and jobs.

It’s going to be an easy election season. We need politicians who understand that we must live within OUR means, not theirs.

confidential says

Don’t waste 1.75 million, that we do not have, on an old decrepit hospital.

The county doesn’t need more legal, engineering or administrative employees or legal and engineering higher budgets. This economy tanked, so did the work received by the county to process. Who are they kidding..? County employee increases..? They just should be content to hold a job and benefits when a high percentage of the taxpayers paying their salaries are without a job! Are they aware that unemployment here is double digits again? That businesses continuo closing and firing their employees…lately Hancok Bank, Perkins and McCharacters restaurants plus many others. When the County Commissioners are going to stop rubber stamping all that County Manager Coffey presents..?

Are we heading the way of Detroit with runaway spending..? What are you going to do when people will start moving away maybe even more abandoning their homes, not paying their taxes and living the county to collect, if they can? We are still paying the mortgages for the Ginn Hangar, Cakes Across, now the Plantation Nonutility, TajMahal, Kim Justice Palace, EMS Over Done infrastructure and its VIP’s.

Tighten the belt, as we, the taxpayers have to do. Did any of your infrastructure excesses forced in our depleted pockets, help to create any jobs… NO!

Kip Durocher says

that hospital buy is just friends helping friends with the taxpayer’s money. it should have been condemned before the hospital moved out. only piece of property in that whole area that doubled in value in the last two years.

Kip Durocher says

I have no problem with an extra $100.00 on my taxes if it is managed and spent wisely.

Magnolia says

@ Kip, fyi, I haven’t seen that happen in 12 years.

BW says

This is NOT the time to raise taxes. We went through this recently with the schools, property taxes are obviously the key. You will raise more by continuing to increase increase the population and that means home buying. The housing market is in recovery and it’s fragile. Raising taxes can threaten that recovery and a stall or decline at this point in the local housing market be be devastating.

There are challenges, and we all get that. But our local government has tried to be way more than they are. Axe the economic development department. That’s not our government’s job. They can play somewhat of a role, but developers and other business is going to bring that in. It’s not doing anything and is a waste of resources at this point. Put off the deal on the jail until later.

Say NO to raising property taxes.

Gracie says

This really is not the time to Raise Property Taxes. I agree with Confidential statemnts above. We still have not bounced back from our recent past in Palm Coast. Not to mention the lack of employment. Employment numbers do not reprensent the salaries of what we are working for here in Palm Coast or those without employment and our poverty level. Drugs, Robberies all on the rise along with arrests. Palm Coast needs to help the current home owners that were able to survive thru this last recession and remain in our homes, especially those of us that have children and are working for a living. We truly are the class of residents that will be hurt by any increases in our current Property Taxes. My company has had a freeze on raises for 2 years now… not sure why the City wouldnt follow suit and do the same.

Election time no matter how far off is closer every day. And time for the Residents to start paying attention and start voting for change.

Marissa says

Here we go again, giving up a cup of coffee a day thing. Stop buying and get spending under control. Next election and future elections are going to be easy.

confidential says

Can anyone imagine what a 8.055 mill if passed now, is going to do to our taxes when our homes will increase rapidly in value…those so called $100 increase in a hypothetically 150,000 median home appraised, will multiply like rabbits into hundreds more. Simply because then BOCC will not back up for sure the 8.055 mill, comfortably seated into spending even more.

I get pretty sick and tired of the old story being spread around about that our fellow families in financial distress that can’t afford higher taxes, are in that situation because they do not want to work! What a travesty! Do you think that thousands of Flagler county tax payers that loose their jobs before and now to Hancock Bank, Perkins and McCharacter’s restaurants and other businesses did because they do not want to work? Typical conservative distorted excuse to justify the financial catastrophe they engineered after 2001 and further now on top of the runaway inflation generated by the Oil Barons in all our consumables our local elected to represent us, want to raise taxes after raising utilities.

Magnolia says

@Confidential: What has Teflon Man been doing about any of this in the 5 years since he took office? Play more golf? Travel to Martha’s Vineyard? Hawaii?

No wonder we’re screwed. It is not Republicans who are raising your taxes.

Just Another Opinion says

Didn’t get the school tax so go to the next source AND one we can’t vote on either…We’re STUCK with YOU raising OUR property taxes, and you get a raise, spend millions on that stupid hospital, that needs completely stripped down and removed..That building is full of asbestos

We don’t pay our property taxes, you know what would happen.. You all are sitting pretty while we struggle to make ends meet..

Your saleries are already way high…Try taking a CUT in your saleries…You have your tea parties and make decisions for all of us.. You can bet, next time to vote you out, You WILL be voted out..

Thanks for nothing…

Obama 2013 says

I am so tired of these baby boomers commentators. Tighten the belt, don’t raise my taxes don’t take my guns, Obama this, Liberal that, spend wiser, fire this person, shut this down…blah blah blah .

My generation has been crushed by your lack of ethics and wise decision making because you looked out for yourself and not the future. No wonder you called us X, because you never gave us a chance!

Your parents came back from wars and depressions to build this country and all you do to make them proud is take and take for yourself. Even the men and women you elect to congress, Senate and local seats are slowly starting to fade away because my generation isn’t dealing with your BS anymore.

AS much as you sky is falling loudmouths hate to admit it, the economy is getting better. People are buying houses in Flagler County, Demand is the highest is has been in years, the APR for a home loan is going up because the demand is increasing. Jobs are being added to the roles, and people are looking to change jobs because the are more opportunities.

So .27 cents a day more to live near the ocean, have a nice house, have parks and good schools and good local services for Fire, Police and maintenance ? Round it up to 0.35 for me and send me the bill. I pay mine, I don’t ask mommy and daddy to bail me out.

Joe Joe says

If $100 more is needed to truly make the county function better, fine. If you can’t afford $100 over a year you shouldn’t own a house…

Binkey says

I’m sorry if you did not plan well enough for your retirement that you can’t afford to live in this community, but I expect my community to have certain standards and provide services and it costs money to provide these services. I have no problem with my taxes being raised, but like Kip Durocher says, I want the county to spend wisely.

I think county and city governments better get a grip on what is happening with rentals though. The rentals in my area are one transient troubled family after another. They pay to get into the house and never pay again and they tear up the place and have people in and out all the time

Please don't do this says

Hi. I am retired and after the company that I worked at for 22 years went under I now live on only my social security. I barely am able to keep up with the raising utility bills (water especially) and medication costs. If you raise my taxes I will lose my house..there is no other end. Can’t you please just learn to live within your means and stop the extra spending? Often, at the end of the month when I run out of food I am very sad and I wish that our elected officials could see how they are hurting us. I’m praying you will see. God bless.

Lonewolf says

As democrats my wife and I were concerned about moving to a red state like Florida. I told her the good thing was that republicans hate raising taxes! In the 2 1/2 years we’ve been here that’s all that’s happened…taxes going up and up. Boy was I wrong

Realty Check says

Here we go, you make too much, we will vote you out, the same old sad story and then no one shows up at election time. I know taxes must go up, I understand hoe economics work. My problem is all the wasteful spending that goes on, I stay start with Commissioners Nate & Barbara, let the new commissioners know we will not stand for wasteful spending. I see the need for an increase, all things go up including county jobs which come from tax dollars, just don’t blow it on a dilapidated worthless building. The housing market has nothing to do with the increase, taxes are paid on a property weather a home is occupied or not, as far as the mil rate, we are safe for the next 10 years before we see property values back to where they were in say 2002.

fruitcake says

Continue to live within your means…..There is still Plenty of fat to cut before raising taxes!