The school tax rate is going up 6.3 percent. In Flagler Beach, it’s going up 22 percent. Palm Coast is keeping is tax rate the same, but only by taking $1 million out of reserves to finish out this year and shifting between $2 and $3 million from its capital (or infrastructure) fund to its general operating fund.

Earlier today, it was Flagler County’s turn to consider its proposed rate for next year to afford a proposed $132 million budget. The county’s is the second-largest tax bite on any property owner’s bill, after the school board’s share. And it’s going up considerably, too—by 15.4 percent. That doesn’t necessarily mean your tax bill will increase by that much. The rate is going up to compensate for collapsing property tax values. In 2008, the county taxable values added up to $12.2 billion in the county. Next year, taxable values will be $7.7 billion, a staggering decrease.

The county is raising the rate but will collect a little less money next year than it did this year.

The proposed rate, which Flagler County commissioners will likely adopt on Aug. 2, will be $6.055 per $1,000 in taxable value, up from $5.2479 per $1,000 this year. For a $150,000 house with a $50,000 homestead exemption, that translates to a county tax bill of $606, an $80 increase, assuming the value of the property in question has remained the same. That’s not the case with most houses. But individual property tax bills will fluctuate. Few will go down significantly.

The proposed tax rate is the highest in at least 10 years. It includes an additional $0.25 per $1,000 that reflects the environmentally sensitive land tax, which collects money to preserve environmentally sensitive lands around the county. It also includes $0.27 per $1,000 to finance the county government building and the courthouse, a levy voters approved in 2004.

During a budget workshop on Thursday, commissioners heard from several constitutional officers who presented their budget, including Clerk of Court Gail Wadsworth. The constitutionals were asked to keep their budgets flat. Wadsworth’s budget is requesting an additional $234,000, including more money for staffing and technology. Commissioners balked. That money isn’t part of the proposed budget, which means that to provide the $234,000, commissioners would have to set an even higher tax rate.

Three of them—Chairman George Hanns, Milissa Holland and Brabara Revels—are opposed to any rate higher than the one floated on Thursday.

Commissioner Alan Peterson, never known as a friend of higher taxes, found himself battling to advertise a higher tax rate, saying the lower rate commissioners were sticking to means that no matter what happens in the next few weeks, they could not bump it up to account for unforeseen demands on the budget. “I’m absolutely opposed to it. I think this is very foolish and just puts us in a potential problem down the road. We’re not committing anything. We’re setting a tentative rate,” Peterson said.

Commissioners won’t adopt an actual tax rate until September, after they’ve given the public—including various pressure groups—time to address the budget and make their case for more funding. But by law, commissioners are not allowed to adopt a budget with a tax rate higher than the tentative rate they will advertise in early August. They can always adopt a lower rate—never a higher rate. That’s what Peterson was arguing for: go for the higher rate for the next few weeks, and lower it when it comes time to adopt the actual rate in September.

His fellow commissioners wouldn’t go for it, fearing even the suggestion of a higher rate might cause a backlash. “I’m not interested in increasing the millage whatsoever,” Holland said.

The budget is far from done: besides the clerk of court’s new costs, which have to be covered somehow (or cut), commissioners will have to deal with tens of thousands of peripheral costs that aren’t yet in the budget. They heard a little salvaging news from Suzanne Johnston, who said she’ll likely be collecting an additional $100,000, possibly $200,000, in delinquent taxes, which will be added to the county’s reserves.

Should the commissioners adopt a budget that still reflects missing dollars for certain demands, they’ll do what they’ve done on previous occasions when the money hasn’t been budgeted: they’ll dip into their reserves. That’s what reserves are for, Hanns said.

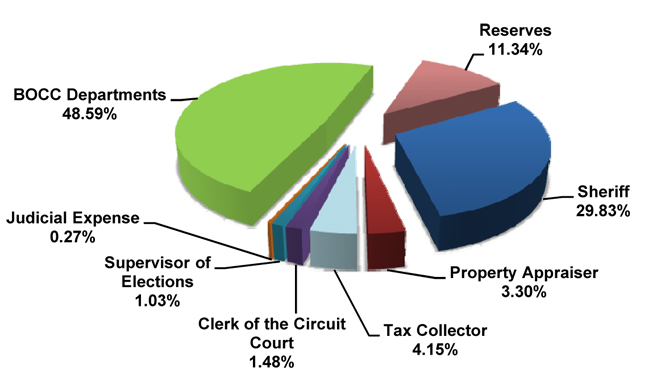

The general-revenue reserves stood at $5.8 million. The general fund in next year’s budget totals $65.5 million, a $2.5 million decrease from this year. Since 2007, county government has eliminated 71 positions overall. County staffing next year would add up to 662 positions, compared with 661 this year and 733 in 2007.

Charlie says

Tax increase in the County, but none in the City? Just watch what happens folks,..The City has only announced it’s General Fund budget, they haven’t yet discussed, the Enterprise funds and Utility Fund. Get ready for increases in fees and services, Betcha.

kmedley says

Until government, whether it’s local, state or federal, learn to cut spending first, as most of us have done in these trying times, and impose salary freezes and say NO to tax increases, then We the People will always be subject to tax increases to make up for their inabilities to budget and run the government as if it were a business.

I find it interesting the Clerk is seeking additional funding. From what I understand, she recently filled the position of Chief Deputy Clerk. Couldn’t this have been placed on the back burner? The position had been open since the death of Phil Pulliam.

She’s requesting funding for technology. Didn’t she recently fire her IT group? Why couldn’t the County IT team provide service to all of the Constitutional Officers? Maybe their department would need to be expanded as far as personnel; but at least an entire department for each Constitutional wouldn’t be required.

Those in charge of the taxpayer purse strings need to set a goal, such as No Increases, No Tax Hikes and then they need to learn to say NO to any increases sought by any department.