In 49 states and the District of Columbia, it’s against the law to drive without car insurance. Nevertheless, more than 12 percent of all U.S. drivers are uninsured.

In Florida, the rate is almost one in four drivers, the second-worst rate in the nation after Oklahoma.

In 2012, the most recent year for which statistics are available, uninsured motorist claims totaled $2.6 billion, a 75 percent increase from the previous decade, according to a recent report by the Insurance Research Council (IRC). Those costs, largely borne by insurance companies, are passed on to insured drivers in the form of higher premiums.

States have tried a variety of ways to get motorists to buy car insurance. Some states require drivers registering their cars to show proof of insurance. In many states, uninsured drivers face stiff fines, but some of the states that have such penalties on the books often fail to enforce them. Furthermore, researchers have found that states with stiffer penalties, which can range from a maximum of $200 for a first offense in California to up to $1,500 for a first offense in New York, do not necessarily have the lowest uninsured rates.

Patrick Schmid, the IRC’s director of research, cited a variety of possible reasons for the apparent ineffectiveness of the penalties. “If the uninsured don’t know the penalties are harsh, how would the penalty sway them?” Schmid said. “Alternatively, perhaps some states with harsh penalties installed them because they already had high rates of uninsured motorists.”

In some cases, states don’t have the resources to implement the mandates, according to a study by the Financial Responsibility & Insurance Committee, a working group of the American Association of Motor Vehicle Administrators (AAMVA).

Ten states (Alaska, California, Iowa, Kansas, Louisiana, Michigan, New Jersey, North Dakota, Oklahoma and Oregon) have “no pay, no play” laws that limit an uninsured driver’s ability to claim damages if he or she is in an accident with an insured motorist. But the IRC found that “no pay” laws had only a modest effect on uninsured rates, reducing them an average of 1.6 percent.

Other states require insurers to provide data on all insured drivers, so that the state can match registered cars with insurance policies. But that strategy tends to produce numerous errors, resulting in law-abiding drivers being flagged for not having insurance.

In 2012, the American Civil Liberties Union challenged a 2010 Indiana law that allowed the state to randomly target drivers who had previously driven without insurance and require them to provide proof of insurance or face suspension of their license. The case was brought to court after a mother of six had her license suspended when she could not prove that she had insurance, even though she did not have a car. The state’s Bureau of Motor Vehicles eventually reinstated the licenses of 4,000 drivers.

“There are all kinds of schemes out there” to get drivers to comply with state insurance laws, said Mike Chaney, the Mississippi Insurance Commissioner. “But they haven’t found one that works.”

Major Barrier Is Poverty

There is no “typical” uninsured driver. Some don’t have car insurance because they resent the requirement—“Live Free or Die” New Hampshire is the only state that does not mandate it. Others don’t have it because they are undocumented immigrants who lack driver’s licenses, which are needed to get insurance in many states.

Most of the uninsured, however, don’t purchase car insurance because they can’t afford it. The number of uninsured drivers peaked at 29.9 million in 2009 during the Great Recession and then dropped to 29.7 million in 2012, the last year for which data are available.

Car insurance rates have risen more slowly than other expenses in recent years, but insurance ranks below necessities such as food and housing for drivers struggling to make ends meet.

According to the Insurance Information Institute, a New York-based organization that tracks the insurance industry, overall expenditures for car insurance increased by 10 percent between 2010 and 2011, while food expenses increased 21 percent; housing costs increased 29 percent; public transportation costs increased 29 percent and health care costs increased 52 percent.

“It’s not a racial or immigrant issue,” Chaney of Mississippi said. “It’s an issue that people cannot afford to pay the money upfront. That’s also true for health insurance, which tends to go hand-in-hand (with car insurance).”

“When you have a large Medicaid population, you have an increase in the number of folks who are living on the edge. They have to make choices about grocery money, buying a car, paying the light bill or paying the rent.”

State Variations

Uninsured rates vary greatly from state to state, but they tend to be highest in states with high poverty rates.

“Auto insurance has gotten more affordable over the years, but it can still be a difficult purchase for a low-income household,” said James Lynch, the Insurance Information Institute’s chief actuary. “Auto insurance affordability is correlated with the percentage of uninsured motorists. States with lower rates of uninsured motorists tend to have more affordable insurance. States with higher rates of uninsured motorists tend to have less affordable insurance.”

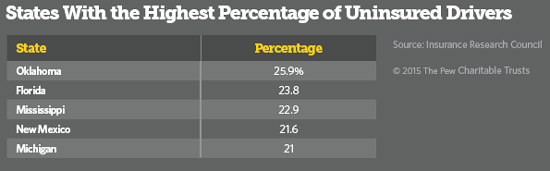

Oklahoma, which has a poverty rate of 16.8 percent, according to the U.S. Census Bureau’s American Community Survey, has the highest percentage of uninsured motorists, at 25.9 percent. Florida’s poverty rate is 17 percent and 23.8 of its motorists are uninsured. Meanwhile, in Mississippi, which has the highest poverty rate in the country at 24 percent, the uninsured rate is 22.9 percent.

Oklahoma, which has a poverty rate of 16.8 percent, according to the U.S. Census Bureau’s American Community Survey, has the highest percentage of uninsured motorists, at 25.9 percent. Florida’s poverty rate is 17 percent and 23.8 of its motorists are uninsured. Meanwhile, in Mississippi, which has the highest poverty rate in the country at 24 percent, the uninsured rate is 22.9 percent.

Massachusetts has a poverty rate of 11.9 percent, and only 3.9 percent of its motorists are uninsured, the lowest rate in the nation. In Maine, which has a poverty rate of 14 percent, 4.7 percent of its drivers are uninsured, while in New York, which has a poverty rate of 16 percent, 5.3 percent of motorists lack insurance.

But there is not always a strict correlation between poverty and the uninsured rate. Louisiana, which has the third highest poverty rate in the country, at 19.8 percent, has an uninsured rate of 13.9 percent, only slightly above the national average and considerably lower than its neighbor, Mississippi. Louisiana’s “pay or play” law might have helped keep the uninsured rate down, Chaney suggested.

California, which has more licensed drivers than any other state, also has the highest number of uninsured motorists—between 3.6 million and 4.1 million, or 14.7 percent. (Its poverty rate is 16.8 percent.) The state has tried since the 1990s to entice motorists to sign up for insurance with the nation’s only state-run program for low-income motorists. But relatively few low-income drivers have taken advantage of the program. The average Californian pays$1,962 per year in auto insurance.

Last week, California Insurance Commissioner Dave Jones announced that his department would step up its recruitment efforts, as the state prepares to offer new licenses to nearly 2 million undocumented immigrants who were previously barred from getting licensed. This year, new motorists signing up for driver’s licenses under the “Safe and Responsible Driver’s Act,” or “AB60,” will be handed a fact sheet advising them that auto insurance is mandatory in the state.

(Last week’s injunction blocking President Barack Obama’s executive actions on immigration will not affect implementation of the California law, according to a staff member with the California State Assembly.)

“We want everyone to have auto insurance,” Jones said. “It helps the individuals who are driving and provides protection for their families. But it also helps those who might be in an accident with them.”

karma says

I see “Obamacar” in the making. The taxpayer(pays in) will be paying for there own insurance and Subsidizing the poverty class policy.

FidFed says

What I do know is Auto Insurance rates in Florida especially Miami Dade (rated #1 in FL) Broward / Palm Beach (rated #2 in FL ) are paying the highest rates in the Nation.

Atlanta GA rates are 50% less than South FL? The question is why? I have been cited all type of BS answers, heavy traffic, more cars on the road etc. Again these excuses pale by comparison to Atlanta, GA Traffic.

Then again there are the run in rear scams. None Insured drivers ramming you in the rear and suing the hell out of you. There has to be a record of these people that continue doing this. (no insurance no claim)

The real reason is Auto Insurance companies can do what ever they want in FL, and the “Department of Insurance” called ( Florida Office of Insurance Regulation ) are doing nothing because of political reasons. I for one am extremely tired of the crap the Insurance companies play. It is why I believe that 25% are uninsured and another 50% don’t have enough coverage. That leaves us suckers to pick up the pieces.

NO fault was supposed to have fixed these problems, instead it created more.

For Instance:

Why should I have to pay higher premiums because someone hit me?

What does having a college degree have to do with rates?

What does owning a house have to do with it?

What does how many miles do you drive have to do with it ?

Suggestions:

a) no one will drive unless they have full coverage

b) Insurance companies have to provide reasonable rates at least what the national average cost is.

c) You cannot sue if you don’t have auto Ins (no pay, no play) that would stop a lot of Lawyers hawking ” I can get what you deserve”.

The bottom line is over the past 40 years in FL my policies have been downgraded due to the massive increases ( Progressive just raised it rate 16%) every 6 months.

tulip says

Florida, or any other state, can just refuse to register a car without insurance already on it. Simple. If a person chooses to drive a car with no plates., gets caught, then car is confiscated. If a driver renews his or her tags, proof of insurance has to be given. However, many of these same people cancel the insurance after the car is registered or renewed. If that happens, why cant the insurance company notify the DMV that a person has cancelled, the DMV “flags” the name on the computer, suspends the drivers license and at the end of 6 months when renewal time comes around, the person has to turn in the tags.?

Anon says

People need to get to work and the public transportation option is rarely there. Did you not read the part of the article where it says higher penalties don’t mean more insured people?

It’s a matter of poverty just like with the lack of health insurance in this state.

Sean O'Brien says

Florida law is already structured almost exactly like this. Your insurance company is already required to immediately notify the state if you cancel your policy or if they cancel the policy for nonpayment. If you have a valid registration and cancel your insurance on that vehicle, you must turn in the license plate to the DMV. If you do not, your license is suspended and a registration hold is placed on your account so that you may not conduct any motor vehicle business in the state unless you do one of two things: relinquish your tag; or purchase insurance on the vehicle and provide proof.

marty says

“However, many of these same people cancel the insurance after the car is registered or renewed. If that happens, why cant the insurance company notify the DMV that a person has cancelled, the DMV “flags” the name on the computer, suspends the drivers license…”

What a great idea! Why doesn’t the state do this? oh, wait – they actually do and have for many years…is this a FOX News talking point?

FidFed says

The DMV “flags” your lic and sends you a notice with a form to fill out every time you cancel a auto policy even if you switch Insurance companies.

Charles Ericksen Jr says

If you as an insured driver elect the “uninsured endorsement” on your own policy, you are already subsidizing the uninsured driver, I pay 12% MORE to have the coverage to protect myself against them. .

If you want to register a car , you must show proof of insurance, The Insurance company then must notify the State of FL, whenever a policy is cancelled. …The State is 6 months behind in following up with the cancellation and by that time the driver who cancelled has moved..

confidential says

Have you had the courage to ask “your Republican Governor and Legislators majority for a long while in Florida” why are they 6 months behind in following up in something so important like letting the car insurance lapse? Or maybe you as Republican keeping up with a good social relation with them in Tallahassee , do not even ask…to save your “seat? That is why we had Hutson and Thrasher till now your party buddies to ask them to do something about it. Not that we, the good insured drivers are subsidizing the non insured with our non insured motorist additional fee in our policies.

That you should have been doing instead of working relentlessly at attacking and plotting against our honest last SOE Mrs. Weeks while part of a county intended manipulation of the local electoral process…

Billy says

The best and easiest way to fix this, while allowing people to afford this overpriced insurance is to add 10 cents to each gallon of gas. This is put in an insurance pool which covers anyone who drives! If you want to save money, drive less or car pool, the more you drive the more you pay! Also create a committee to determine the validity of claims to stop the people who just want free settlement money as their only income! This will be one less bill we all don’t have to pay monthly and everyone’s covered. Plus, this b/s about paying higher premiums because you don’t have great credit can stop…… I know my credit doesn’t effect my driving and the safety of my family…. Just because medical claims destroyed my score!

Brad says

Oh, well that’s an easy fix. Here’s how you do it . . .

1. Create a government run exchange

2. Anyone below a certain income level give them insurance for free

3. Raise the prices considerably for everyone who already has insurance

Sound familiar?

Groot says

That is exactly what we thought Brad. My wife’s ACA compliant plan is now $380 per month. Can you imagine what that would do to our auto insurance rates around here?

tomc says

Here we go again…another government program in the making.

I am so tired of having to pay for the wants of other people.

Groot says

This would explain why we have been hit a few times and the offender bolts. No insurance=no car and jail time. Take the vehicle.

Dana says

A perfect illustration of how useful, well-structured public transit benefits all citizens, whether or not they use it.

Outsider says

Which will of course be subsidized by everyone else. The whole “Well you are going to have to pay for them anyway” is a complete line of B.S. All it does is create a larger and larger dependent class which will be happy to live off the hard work of others. I know not all people are in tough situations because they want to be, but there IS an element who will take whatever they can, and we just can’t afford more and more dependency. That fact would be quite apparent if we couldn’t borrow from ourselves and print more money, which is the only reason the uninformed think all is well.

FFS says

You know what sucks? If you’ve suffered any credit issues (a dying parent or child can do that to you via no fault of your own, unless you’re heartless and just let them die and stay focused on your work – to hell with the sick bastards!!! Let ’em croak! And yes, both of my parents are dead, bless ’em), you can count on an ugly insurance rate. I have a Safe Driver stamp on my license and I pay HUGE premiums. The poor stay poor. To hell with all of us. I’m just waiting for my turn to get sick and die. I have a high deductible health plan through work. I can’t afford to pay out $12k this year for my out-of-pocket expenses and it’s the only plan offered, therefore I must take it, and so my health deteriorates. I actually (and I’m not even being sarcastic) look forward to bucket kicking and calling it quits. This disgusting mentality of people who sit there sucking up their social security while bitching about poor people… “I paid into it!!” well.. maybe so, and so have I. So did my parents, but they died too young to collect, as will I. So some other geezer will collect our share. That’s life. It isn’t always fair. Suck it up and quit moaning about it or start writing your local reps (fat lot of good that does). I think we are ALL worn out from trying to make this country a little more tolerable (and/or tolerant). Someone is always going to be pissed off about something. I happen to be pissed off that I pay crazy rates for auto insurance even though I never had an at-fault accident. That makes me mad enough to consider refusing to pay the premium. I am, after all, one of those useless poor judgment proof pieces of garbage that Fox News would crucify on live national television if they could find legal means to do it. So.. why not? Let the chips fall where they may.

#1 Gator Fan says

What state are you people living in? The car insurance companies have always notified the Department of Motor Vehicles in Florida 30 days after an insurance lapse and the driver’s license can be suspended. I think you’re confusing Florida with that hell-hole known as New York.

Anonymous says

#1 Gator Fan, did you read the 6th paragraph? What about accidents occurring within the first 30 days? Resources can’t keep up with the thieves and that’s exactly what they are. One stole $500 from me last spring – slipped through and l’m fully covered. Thankfully Allstate saw fit not to raise my rates or the bleeding would have gone on. Word on the street is 25% is low balling it. 34 years, 3 accidents, 0 my fault, twice screwed. So my family’s at 66%.

Anonymous says

Car insurance rates should be based solely on an individual’s own driving record. Years ago, the insurance companies got with the politicians and wrote this horrible discrimination based on credit into the law. We don’t allow discrimination for this sort of thing based on the collective driving performance of different races, gender, or religion. One has nothing to do with the other.

Too many poor people who are good drivers are affected by this, just because they can’t break the cycle of bad credit. It’s easier said than done. We as a society need to be getting real about mass transit for sustainability, anyway. Look at all the cars on the road, and the growing population; this free-for-all can’t go on much longer. One drunk idiot and I-4 gets backed up for hours.

sw says

grow up and buy Insurance

william s harvey says

It used to be if you were under 25 and not married, than when you got married and turn over 25 it was your credit score, than college and non college policy holders, how far you drive, where do you live, if you are gay or straight, male or female , white or black, BS reasons after reasons. its all about money for corporate america

Sherry Epley says

Right On Dana. . . Anyone who has traveled in Europe knows that GOOD public transportation in Florida would be beneficial in several other ways:

1. Much better for the environment. . . especially air quality

2. Less traffic congestion

3. Much more convenient for the elderly. . . who often are forced to drive when they are not “safe” drivers.

4. Allows more convenient transportation to work and school

5. Decreases the need for parking lots

6. Encourages exercise in walking to and from public transit stops

Ever watch Roger Rabbit and really understand the message? Big Oil and Big Auto actually “paid” (AKA lobbied) to have tram rail lines removed from cities in the USA many years ago. . . all in efforts to “line their pockets”. Those same cities today are investing multi-millions to build metro lines that would essentially provide a newer version of the same service ripped out all those years ago.

When will we ever learn?

Lancer says

Sherry…

…and anyone who has traveled in Europe should know that our country is infinitely larger and more spaced out. While government transportation is already incorporated into larger metro areas, it has failed miserably in rural areas. It is a financial black hole that cannot be justified.

Rob says

All the lower income minorities are moving to Florida in large numbers. Hispanics, legal and illegal, have minimum coverage if any at all.

The Hispanics love to play Fast and Furious on our streets and the white trash rednecks drive such beat up trucks, why insure them…sad but true.

Derek says

How about requiring a policy that cannot be cancelled until the next tag renewal is due? How you work that out is between you and your insurance company, but you must arrange for a full year(or whatever your state requires) to be in force before registration is issued or reissued.