Note: This is the first of two articles on Monday’s decision by the County Commission to seek a permanent new levy for beach protection. See: “For Flagler County, New Tax to Raise $7 Million a Year to Preserve Beaches Concedes Realities of Climate Change.”

![]()

In what Flagler County Commissioner Dave Sullivan called a “dramatic change for the county,” the commission on Monday agreed unanimously to move forward with what would result in a new levy on residents and businesses to pay for $7 million in annual beach reconstruction and protection–for ever.

The county is looking to adopt a resolution as early as next month and hold public hearings for the new tax–technically called a municipal service benefit unit “fee”–in September, with enactment later this year.

It is the county’s most emphatic concession to the indisputable realities of climate change, rising seas, and storms’ increasing ravages of the county’s 18 miles of shore, eight years into the shore’s continuing state of emergency since Hurricane Matthew struck as a tropical storm in 2016, serrating the coast’s infrastructure.

It is also the county’s surrender to another unavoidable reality: to preserve the beaches, considered to be Flagler County’s greatest asset, residents across the county–not just in Flagler Beach or Beverly Beach or Marineland–will have to shoulder a share of the cost in the same way that they pay for garbage services and stormwater protection, if in different proportions.

“The goal here is when we have a problem, we can write a check,” Commissioner Greg Hansen said. “As I’ve said many times, we’re the only county in Florida that does not have a [beach] financial plan. So we need to get this done.”

But the support of Palm Coast, Flagler Beach, Bunnell, Beverly Beach and Marineland is key. Each must approved the new levy by ordinance in the next few weeks before the county

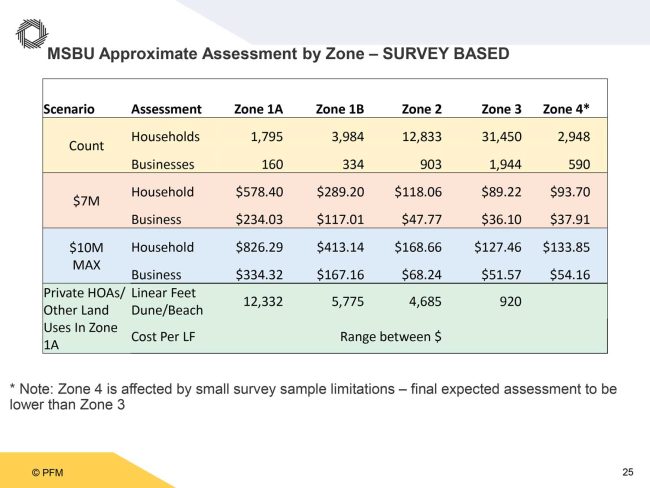

Here’s what that cost would look like, based on the county’s consultant’s preliminary estimates–keeping in mind that the actual numbers will likely look different once significant analyses are completed.

If the overall annual cost to the county were pegged at $7 million, as it currently is, the cost for households would range from $89 to $578, and $36 to $234 for businesses, depending on geography.

Beachfront households and businesses would pay the most: $578 and $234, respectively. Everyone else on the barrier island would pay $289 (households) and $117 (businesses).

The cost for households between the Intracoastal and I-95 would be $118, and for businesses, $48. For households between I-95 and either U.S. 1 or the Florida East Coast Railroad, the cost would be $89 for households and $36 for businesses.

West of U.S. 1, the cost would be $93 for households and $37 for businesses, though that latter set of figures would have numerous caveats yet to be determined. For example, the county administration currently had plans to exempt Daytona North and agricultural businesses.

In essence, the closer you are to the shore, the more you’d pay.

Alternately, if home owners’ or property owners’ associations fronting the beach were taxed at higher rates (the associations would be taxed rather than individual homes or properties), the range for everyone else would fall and range from from $25 to $550 for businesses and zero, on the west side, to $234 for businesses, assuming a $7 million annual cost.

“There’s many ways to create an assessment, infinite ways to create an assessment,” Stanley Geberer, senior managing consultant with Public Financial Management Group, whom the county hired to study how to raise money and gauge residents’ willingness to pay. PFM did so through 3,000 responses to surveys of residents by text and the web. “It has to be fair and reasonable. It has to be fairly apportioned between and among properties, and it has to demonstrate that a benefit has been received. So I think we’ve demonstrated that the benefit is received. Generally it is scaled from east to west, so that represents a fair apportionment between and among properties.”

It also has to all be approved by the cities, by ordinance, in the next few weeks.

“We do have to get consent from the cities through ordinance and this will need to happen before we can levy the amounts,” County Administrator Heidi Petito said. “We’ve got a lot of work to do. We would look to adopt this through levy in September at a public hearing.”

“If a city turns down the financing attempt, the County cannot impose the assessments within the territorial jurisdiction of that city if it is included in the assessment to be adopted,” County Attorney Al Hadeed said.

County commissioners asked a series of questions about the details: who would be exempt, who wouldn’t be, how is a $1 million beach home to be taxed similarly to a $30,000 trailer near the beach, and other details yet to be explained.

As a start, the commission was more comfortable with pegging Flagler County’s commitment to the $7 million a year than to $10 million, which was also among the options. But delaying the plan by a year could then move the overall cost closer to that $10 million.

The commission is also willing to use some of the money already generated by the tourist sales surtax to beach management to further defray that cost. That tax currently generates $1.6 million for beach management, according to this year’s budget.

That would immediately bring down the overall levies expected, to less than the lower ranges, and would start building the county’s beach management reserves–assuming no immediate storms wrecked that plan.

The county will determine if any businesses would be exempt, or whether there would be additional rates for home owners’ associations and other specialized properties, such as public buildings or state utilities. It would also have to determine how or whether to tax agricultural lands, which are exempt from fire assessments. Religious properties are also typically exempted. But one or another existing exemption doesn’t necessarily mean the residents should be exempted from the beach protection tax. “They’re still putting the garbage out on the curb on Wednesday. We still need to collect for that service,” Geberer said. Similarly, the county might want to see the beach protection tax the same way.

“The next part in my analysis is just understanding how a lot of the different communities up and down the beach are are funding this,” Commission Chair Andy Dance said. “We’ve seen examples of St. Johns County doing it, all the way up and down the East Coast, there’s different government agencies that are supporting this in order to renourish the beach.”

He noted a hurdle ahead: convincing the public that those skinny dunes the county has rebuilt on two occasions since Hurricane Matthew are meant to be temporarily protective, and are different from rebuilding entire beaches, as is now the plan. “So from a communication standpoint, we still have some of that work to do as well,” he said.

“There’s general agreement to go forward but the devil is in the details and how we’re going to establish the costs for each area,” Sullivan said.

The dollar figures were based on a survey that was itself organized by naturally-breaking zones. Zone 1 was the barrier island (with Zone 1a reflecting beachfront properties, and 1b properties that ara away from State Road A1A). Zone 2 was from the Intracoastal to I-95. Zone 3 was from I-95 to U.S. 1. Zone 4 was from U.S. 1 to the west end of the county.

“I think the numbers overall are very fair,” Hansen said. “But I think where we run into trouble is Zone 1B,” especially with the fairness aspect between wealthier and poorer properties that may end up facing the same tax, or fee.

![]()

Disgruntled says

Correct me if I’m wrong but Daytona North aka Mondex is in Flagler county. Why should they be exempt, and everyone else has to pay. Why do businesses pay less than homeowners when a business makes money… I pay enough for water, electric, and all the other BS taxes that we pay…. horrible idea

PeachesMcGee says

If I lived beachside okay. But I’m 8 miles west. I don’t go beachside.

I’m a native, the beach doesn’t interest me.

You wanted the beach lifestyle. Pay for it your damned self.

Sick of Ingrates says

I’m a FB resident and the VAST majority of visitors to our beaches DO NOT live here. You use it, you pay for it. Period. So sick of this us vs them BS. And that’s what it is.

Callmeishmael says

It’s actually not a bad idea to have the visitors do some cost sharing. Wonder if there is a way for the hotels to charge a beach renourishment/maintenance “fee” on behalf of the county/cities somehow in addition to whatever tourism “tax” revenue that is collected. Not sure if legal, but I can’t be the first person to ever think about it. . . I mean, Daytona charges tolls, but that’s for driving, which is not possible here. Where is the Chamber when it comes to beach maintenance?

Doug says

For starters, I don’t trust Commissioner Greg Hansen. He’s a typical local politician who’s been approached about a “no-wake” zone in the ICW. He is quick to pass the buck to everyone but the county when a Florida Wildlife Commission Major based in Tallahassee and familiar with legislating no-wake zones said it starts with the county. In the meantime, properties along the ICW continue to erode from the wakes caused by commuting yachts. Therefore, I’ll remain very skeptical of anything that has Hansen’s name attached.

As far as a county tax for repairing the beaches, if the county is going to continue to dump millions of dollars worth of sand to replenish what Mother Nature has washed away, ABSOLUTELY NOT. If the county goes about it correctly and builds the underground sea wall as they did on North A1A, I’d support such a tax as long as it’s fair. That goes for the existing multi-million dollar beach homes and future construction that are vacant 90% of the time.

Mike says

I say make the politicians pay with their money they receive from all the developers over the years they received and moving forward every developer and builder should pay a substantial fee. You want to build and develop every square inch there is,well then pay for it!

Robin says

First step is to forbid new homes going in directly on the dune line. That is insanity.

Shark says

All of a sudden they realize there is a problem after pissing away millions in the past. I hope they find someone to do the work who knows what the heck they are doing. The only solution is a seawall;

dave says

“the closer you are to the shore, the more you’d pay” and all Flagler County residents will have to pay is the plan. This ought to be good. .

Tony says

What climate change? According to Ronnie and the rest of the republican leadership there is no such thing. Not even supposed to talk about it according to Ronnie !!!

Truck loads of sand dont work people says

Absolutely not. This is ridiculous. Here, the wealthy pay LESS THAN half of what everyone else would pay:

Wealthy Share:

1975 x 578 = 1,037,510

2984 x 298 = 1,151,376

Total: $2,188,886 (by count)

Everybody Else’s Share:

12833 x 118 = 1,514,294

31450 x 89 = 2,799,050

2948 x 94 = 274,164

Total: $4,587,508

Don’t like it! Don’t fall for this! I vote use the nearly $5 mill generated from everyone else to move roads to adjust for shoreline change. I think it’s called eminent domain. Those who opted to live there can maybe pick up a first job and get your hands dirty in this thing called work.

Laurel says

Truck loads: If your home was near the water (and we know it isn’t), would you be happy if the government took your home under eminent domain? I wager not. Are you the only person who worked? Silly assumption. Is this your idea of fairness? Good thing you are not in charge.

Bryce Merritt says

Where are the tourists being taxed for their use of the beaches, and their part in the destruction of the dunes that one protected against storms? Many county residents never go to the beach, and yet they are being taxed to subsidize the businesses that benefit from tourists visiting. Why wouldn’t those that benefit the most from these projects be taxed just like the residents?

Billy says

Put a toll booth on 100 and sock it to everybody !!!

Brian West says

love that idea!

Jane Gentile-Youd says

Vacant land as well as abandoned commercial properties as well as unimproved land such as RV parks where property owners pay pennies on their expensive parking lots which are ‘unimproved’ (taxes are a joke residential properties pay 85%+/- entire ad valorem tax base. Very unfair to pay $200 a year for example on 2 acres vacant land but selling it for over a million with a 1 2 3 zoning change approval for whatever you want! This bull crap of unequal selective taxation MUST STOP in my frustrated opinion.

John Costa says

Why don’t they have that monstrosity of a hotel they put directly in the center of town pick up the tab !!! They will be the 1 making $$ bye bringing out of towners to the beach. 1st you ruin the view of the beach from the bridge now you want to tax the entire county to pay for it. The insanity never ends when it comes to other people $$ and how they can extract it in the name of new taxes.

JimboXYZ says

I think they should apply the charges based upon household size, every man woman & child. Parents obviously would pay more, but that’s fair, there are 2 adults, potentially 2 incomes & it’s their children. A household of 1 shouldn’t bear a bigger burden than a family of 3+ just because they live in the same or larger home. I do agree with the formula/model to apply a fee for those that are homeowners at ground zero. Not everyone utilizes the beach & that is evident from the parking situation for beach goers. 2020 Census and every house had to identify who lived there, relatives & dependents, just like a tax filing. It’s not like they don’t have a general idea of who lives at any given residential. Hey, if you go to Disney World, that’s how they do it for admission pricing, adult rates, childrens, seniors, handicapped. The beach is essentially a natural theme park attraction, like Disney World is a man made theme park attraction. Ability to pay has to account for something ?

Daniel Lopez says

Seems like a substantial amount of research still needs to be done.

But they want to implement this in a few weeks and have it ready in September!

Sounds like just another tax and cash cow.

Convenient that they now site climate change after repeated denials!

The Villa Beach Walker says

I hope the County Commissioners further define what they mean by beachfront. Most of the homes on A1A in Flagler Beach are across the street from the beach (west of A1A). Homes in Beverly Beach and Hammock Dunes are actually beachfront as they are on the east side of A1A.

I also hope that the Commissioners will consider an additional ‘impact fee’ for new construction anywhere on the barrier island.

FlaglerBear says

So…I’m already paying taxes to the St. John’s River (nowhere near me) water management district. The Florida Inland Waterway (nowhere near me) tax, and now they want me to pay for the annual and forever beach (nowhere near me) restoration tax. What’s next? The Mississippi River dredging tax?

Willie says

No Flagler Bear – the circus act running this town is going to charge to dredge the canals !!

JimboXYZ says

A lot of the comments are exactly how I feel about it. Remember this little glitch in the relative beachfront property war against the masses ? Turns out when it comes to dune renourishments, beach rebuilds, canal dredgings & whatever else. All of a sudden they want everyone to pay for that property maintenance. When you’re relatively wet foot/dry foot for ground zero you need to pay more, because you have that skin in the game, it’s your property that is becoming worthless not anyone else’s. I feel for my own brother, he made the mistake of buyout St Johns County river frontage with dockage. The first storms early into that relocation he had to fortify the dockage & land to mitigate any potential flooding. He has a 10 year plan & then he’s moving on from that, but pay he will until that day comes, as long as he’s on that mortgage deed. Don’t like it, sell off to another that is willing to own it for financial responsibility. Relocate to another location that is less of a catastrophic storm even that involves the Atlantic Ocean. That was the stance in 2018, nothing has changed in 2024 & beyond.

I always thought even when I relocated here, there would be a day that West of I-95 might become beachfront property. When you visit South FL, Dania Beach in particular, it’s not uncommon to see pine trees in beach front parks there. Fernandina Beach/Amelia Island (Hecksher Drive) is a 26 mile stretch of Atlantic Ocean beaches lined with Pine forestation. Anyone building more on the coastline is nothing more than a fool of the highest order, should pay for all of the rebuilds. Those developers bought the land and intend on sandbagging the rest with some formula to make their beach life a reality. It’s like homeowner’s insurance gouging, the rest of us are paying for the wealthiest of Fort Meyers from those storms. Anyone that was high & dry thru that was bilked to pay for mansions, yachts, exotic automobiles, pools & anything else the lifestyles of the wealthiest enjoy. There’s something to be said for living a modest lifestyle, rightsized & affordable. How did FL become this, look at those who are guiltiest, the one’s that want it all & share none of it when the sun shines 363 days out of the year. They just aren’t paying attention that the other 2 days that the 2 storms pass thru wipes out their investments of futility.

https://www.floridatoday.com/story/news/local/2018/04/13/what-you-need-know-floridas-controversial-new-beach-access-law/511217002/

Iraq war veteran says

As a 100% disabled war veteran, I live here in Flagler but have never been to the beach. Kinda hard in a wheel chair. I live on a fixed disability income that has been decreased by inflation and taxes. I can not afford this beach tax! I will be forced to either lose my home or stop eating. Please stop taxing us to death.

Shark says

If you are a 100% disabled veteran you should not be paying any taxes at all in Flagler County.

Sharon Stokes says

How does that work? My husband is a disabled vet.

FlaglerBear says

Log in to the “Flagler County Property Appraiser” website. Navigate to “exemptions” All are listed, including disabled veterans. They are eligible for a total tax exemption. Or call them.

Deborah Coffey says

What part of “NO” don’t they understand. We might as well flush all our money down the toilet. These idiots think they can STOP and OCEAN?

Atwp says

Tax increases is what these politicians love to meet about. How many residents enjoy the beach? Tax homeowners more than businesses what a joke. According to the Republicans climate change doesn’t but they want to increase taxes to preserve the beach because of. Flagler county is a Republican county, this is what Republicans do, deny the truth, tax the citizens out of their hard earned money. Flagler County continue to vote Republicans continue to expect less service and more tax increases.

David Schaefer says

Thank you . So True.

The dude says

Good thing governor meatball outlawed climate change. It would be way worse if he hadn’t…

In ten years, Flagler beach will be nothing but a sea wall just to the east of the A1A shoulder. And there’s nothing you MAGA morons can do about it now.

dave says

This whole thing seems like a “Stall Tactic” to do nothing right now along the dunes. If you live East of the ICW pay up. If ya live along the ICW or have canals behind your home pay up. Why should someone near Bunnell be forced to pay or someone that lives way out west 100 be forced to pay any amount.

Laurel says

Dave: I’ve been paying taxes for kids to go to school, all my life, and I had no kids. That argument has no merit.

dave says

Charles Hansen the Willie Wonka of Commissioners. Sold to the highest bidder.

Anyone paying anything needs to be based on the FEMA Flood Zone map. After all if you buy Flood Insurance its FEMAs program. IF you do not live in a impacted high risk flood zone well you don’t pay, if you do you pay based on the flood zone.

https://www.flaglercounty.gov/departments/growth-management/flood-zone-information/-folder-162

endangered species says

Climate change is banned in florida so all is good right? This shouldnt be needed then.

dave says

Climate change, in Fla isn’t that DeStantis position on changing the AC thermostat setting :)

RD says

It seems that nobody crosses the bridge; except the restaurants are full, the beach trash cans are overflowing, and the streets and parking lots are clogged with Florida plates.

Retired says

You can’t stop mother nature. If you build it she will tear it down. Nothing is ever solved by throwing money at it. Where you live is your choice. No one should have to pay for you. Pay your way.

FLF says

What happens when $7,000,000 is no longer enough to cover the “renourishment” process? We just keep raising the “fee” to everyone until A1A falls into the sea and now the FDOT decides it needs to move A1A westword at who’s expense? So we put in a new hotel, build a new 800 foot concrete pier that only adds to the “Coney Island” experience that I can’t find a parking spot to visit, a florida native, who’s lived here most of his life and wittnessed this beautiful place turn into a bloated sow of development and greed and now you want to hand me the bill to dump sand on the beach in perpetuity… Fill in the blank of what you can do with this proposal.

Laurel says

FLF: Yes, you understand. Don’t you just love “growth”?

Kenneth Davis says

Not a good idea, a permanent tax without a permanent solution. I am ok with a tax that’s not a blanket slush fund.

Laurel says

This county is undoubtedly the most resident-unfriendly place I’ve ever witnessed.

So, these real estate politicians think it’s a fair idea to charge residents two-three times as much as businesses, huh? Let’s see how that works: A business, that profits from tourism, should only pay close to a third of what residents pay, though the business has the ability to write it off on their taxes, but the residents do not. That means the vacation rental, next door to you, pays close to a third of what you pay, since the county defines vacation rentals as “commercial businesses.” So, the vacation rental owners, 90% of them live outside of town, outside of the county, outside of the state, and outside of the country, should pay close to a third less than the residents, while taking in profits from transients who are using our beaches and taking up parking. Yet, they can write it off. So the real estate buildings pay less than the residents. So the residents, who came here to enjoy their lives in a small, beach town continue to pay, pay and pay for the benefit of developers, real estate companies and businesses which profit off transients.

Looks to me that those unfriendly to residents money hackers are trying to turn Flagler County into one big party town for the profit of a few buddies, and the residents whom they don’t give a shit about, can pack up and go to hell.

Tell them NO! Then vote them out once and for all.

For Flagler Beach Citizens says

Totally agree, Laurel!

Citizens here are literally 2nd or 3rd class citizens, with tourists coming in at number one, businesses second.

From the article: Commissioner Greg Hansen said. “As I’ve said many times, we’re the only county in Florida that does not have a [beach] financial plan. So we need to get this done.” So, this goes from “nothing” to “urgent, urgent, emergency”.

Anyone reading this should really take a moment to think about what this says about the planning process here. Wait a beat…..oh, there isn’t one. So, as Laurel says, vote them out. And btw, that (vote them out) is a recurring theme on this website, so you REALLY need to THINK about who you vote for. You keep voting them in, so it seems pretty self defeating….

Laurel says

Flagler Beach Citizen: A candidate has a very small chance of being elected if not a Republican here in Flagler County. The candidates know that. So, the backup Republican candidates are mostly in cahoots with the current seat holders, and continue on with the same policies that benefit the few. People try to vote them out, but the replacements are of the same profit over residents mentality. We need Democrats and Independents voted in, but where are they? There is only one of each on the upcoming ballot. The people of Flagler County seem only barely interested in balance.

Speed Queen says

So what are people who get social security suppose to do when the homeowners taxes and insurance almost double and your car insurance goes way up and your grocery’s are sky high and gas is way up and then theres all of your utilities keep going up and your medicare keeps going up ? And now you want to add on another bunch of wasted money for beach sand. The ocean has been here a long long time and has done just fine. God does ‘t need your help to take care of his ocean.

Sylvia says

I’m a senior veteran 77 years old. My bills are so damn high already & I hardly use water & have my thermostat set on 80°. My social security doesn’t keep up with inflation already. Taxes, insurance, gas, groceries, the high cost of water in Flagler Co. It’s unbearable. And property taxes go up every year ❗The ones who live across the intercostal waterway, business, millionaires etc should pay for it. We can’t & have never eaten at a restaurant at Flagler Beach. Can’t afford anything there. Go occasionally for a walk but always carry a bottle of water.. Shame on the corrupt, powers that be for sticking us for another ignorant, costly idea. You can’t stop the ocean no matter what you do. I’m sure someone is lining their pockets in the process ❗

JimboXYZ says

Another requirement beyond guaranteed parking, since one is being taxed or levied a fee for a beach rebuild, should there be at least a saltwater fishing license that applies as part of the benefit of becoming a County/State resident ?

Mischa Gee says

First this should not be added to our water/sewer garbage bill as a Fee. It is a TAX, it should be addressed as one and get included in our yearly property tax bill.

Next, I think there is a screw loose in the minds of the County Commissioners if they think businesses who profit from being near the beach or in the county in general, should pay less than people who live on the barrier island and in the non-beach communities.

Sounds like this needs to be completely thought out again, before they move on it. Chances of that happening are probably close to never, since the ruling party is pro business at the expense of residents.

I’m not living the high life or the dream, as so few are. Life in Flagler County and Florida is more like living the nightmare and being priced into homelessness.

Between my Home Owners Insurance ( modest 1370 sq ft home), my Auto Insurance (2 older vehicles one 2001 Hyundai Sonata, and one 2016 Hyundai Santa Fe), and my Health Insurance (Medicare, supplemental, and Prescription Drugs) is costing me over $8,000 a year.

Add in the increases in utilities and soon, I won’t be able to use air conditioning, water my vegetable garden, shower regularly, or eat regularly. I am not alone. People here are starting think about selling and leaving the state all together. This is hitting the tipping point for many.

Businesses that profit from the residents and tourists should carry their fair share of this burden.

DLF says

Why not charge people who visit the beach to park their cars along A1A and in Flagler Beach. Most are out of town people enjoying my paying so they can come to beach free.

Tjmelton says

Since I live between 95 & route one, I understand my extortion fee would be $89 if the beach restoration funding becomes real. Since I rarely go there, I wonder if there would be more beach parking to access the beach we all would be paying for. Surely my $89 would entitle me to at least be able to park. Put this to a vote, before the whole thing becomes an unfair circus. Or does this become another money grab such as the “storm water treatment fee ” or unlimited out of control city building.

Tjmelton says

And by the way, if you want to experience real extortion, put in a pool, and see what they do with your property taxes. It’s nothing fancy, but the reassessment almost doubled. I should have expected this from a lame appraiser , who is used to doing whatever he feels justified.

Kaitlyn brown says

First off GO AFTER RON DESANTIS who has WASTED Floridas TAX PAYERS 💵. He needs to be held accountable for Bad decisions I bet he is being thoroughly investigated by DOJ on 1- NOT properly Itemizing the full 61.5 Mil hurricane Donations oversight was his wife not state ( Cassie did itemize only 22mil) and they tried to Have Wink news do a synopsis ( pathetic) nefarious . DOJ does know! 2-Used both Covid 💵 and Florida taxpayers 💵 for Expensive Jet service vs ( bus) for Kidnapping asylum seekers ( approved) . FLAGER you want to extort ( how most feel) everyone in with higher taxes. I noticed the article mentioned climate change ! RON DESATIS VETOED JOE BIDENS Green Package! Solar credits and other items ! FLAGER County You should only be taxing Beach Home owners within beach area limits some blocks behind and Business at the same level not less and make us pay. ST🅾️P TAXING us. We are already hit with ❌insurance! ❌ Don’t vote for these people Ron is destroying Fl that’s a prob no tax 💵 will help till he’s OUT by his term or DOJ .

Dune Master says

Why do politicians think that landowners are ATM machines?