(© FlaglerLive)

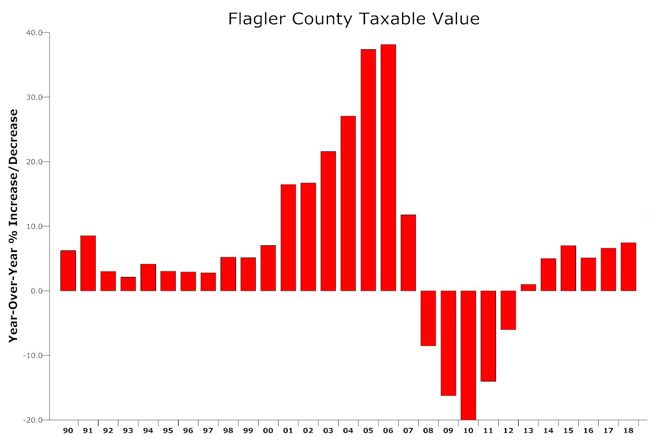

Flagler Property Appraiser Jay Gardner this week issued the annual estimates of taxable value for the county, the school district and Flagler’s cities. It’s good news: values countywide are up 7.45 percent, the best year-over-year increase since the Great Recession. Last year, values increased by 6.5 percent.

“Obviously the good thing is that we’re steadily increasing, but it’s not crazy,” Gardner said.

Increased values means more money in local governments’ coffers. How much more is debatable: while increased values due to new construction add net government revenue without need to raise taxes, other increases in value do not: governments that don’t lower their tax rate to account for the new revenue are in effect imposing a tax increase, according to Florida law. To keep their revenue in 2019 the same as it is this year, they must adopt the so-called rolled-back rate, which would lower the tax rate. Most governments have not been doing that in recent years, preferring to take advantage of new revenue by adopting the equivalent of modest tax increases (or steeper ones, in Flagler Beach’s case last year).

Palm Coast’s values have increased almost 8 percent, Bunnell’s 9 percent, and Flagler Beach’s just 4 percent. Taxable value in the county now stands at $8.47 billion, but that’s still a long way from the pre-recession peak of over $12 billion, a figure vastly inflated by irrational prices and speculation.

“The worm has turned, it’s different. I’m glad to see our economy moving strong,” Gardner said, echoing the assessment of realtors.

As always with any good news on taxes, there are caveats, and this time some serious ones.

There’s Amendment 1. This November, all Florida voters will be asked whether they want to increase the homestead exemption from $50,000 to $75,000 on homes valued at $100,000 or more. In other words, a home valued at $200,000 would have a $75,000 exemption. Gardner, like many government officials, are taking it almost for granted that the proposed constitutional amendment will get the 60 percent majority it needs to pass even though Gardner, like other officials, don’t see this as a tax break. They see it as a tax shift.

If the added exemption becomes law, it will have serious consequences for all local government budgets except schools (the exemption doesn’t apply to school tax values). In Flagler County, County Administrator Craig Coffey is estimating a revenue reduction of $3.8 million. That would be a shock to the system. To make up for it, the property tax rate would have to increase, resulting in what he too called a “tax shift” in his budget presentation to county commissioners on Monday. The new tax law would become effective in October 2019, making this year’s new revenue potentially illusory–absent a tax increase. Strategically, many governments in anticipation of next year’s revenue loss seek to spread the tax increase they’ll need to make up for it over two or three years, so taxpayers don’t see a dramatic hit in a single year. That means calculating a tax increase this year. City governments will also be just as dramatically impacted by Amendment 1.

The second caveat in this year’s numbers is more customary: every year since the recovery began, local governments have been expanding again, with long lists of needs and wants. This year is no different. The county’s list of needs adds up to $3 million in needed new revenue. The sheriff’s budget alone (which is approved by the county commission) is looking for a $1.1 million increase, including the cost of 10 new deputies (an increase driven by the new state law requiring a cop be stationed in every school). The county is also seeking to add three more firefighters to its ranks, a $225,000 cost, and is looking at added retirement costs of $310,000. The county also wants to add positions, among them a public safety systems coordinator ($80,000).

Improvements in valuations, Gardner said, are driven by increased construction and a more brisk housing market: the majority of developments have been residential, with commercial activity lagging behind by two to three years. The housing market, Gardner said, is showing a lower supply of homes, keeping builders and realtors busy.

“Florida’s continuing significant growth is resulting in low inventories of resale homes and housing shortages, especially in the entry-level to median price range,” said Matthew Wilson, broker-owner of Ion Real Estate in Flagler Beach and the chairman of the Florida Realtors Research Committee.

Much of Flagler’s growth is in the retiree market. “Buyer households with more than the married couple are more apt to include a parent or adult child,” Wilson said. “I received significantly more inquiries about available medical care than about the quality of schools.” He added: “There are already a number of citizens who live in Flagler County commuting to Orlando, Jacksonville or Daytona for work. The ongoing recruitment of new industry and the increased recognition of Flagler as a desirable bedroom community should result in more households with children relocating to the area.”

The tight real estate market in certain sectors may be an indication of future trends and values. “There is a generational shift in the larger market with baby boomers ceding their dominance in the home buying market to the millennial generation,” Wilson said of homebuyers in the 19 to 32 year old age range. “This group is characterized as ‘first time’ homebuyers and tend to purchase entry-level priced condos and homes. There are few properties in our area that match this need. The dearth of properties in this category also is a consideration for companies considering our area.”

Richard says

I would rather see a senior exemption of $25K versus an overall $25K increase exemption for everyone. After all seniors are on a fixed income whereas younger home owners are still income earners.

Anonymous says

If the county would stop buying up private lands and playing county realtor that too would be more revenue—once the county buys real estate we tax payers have to pick up that revenue loss. Also, the county needs to do some evaluations and look where they are duplicating services and can consolidate positions and lower wages…there are far too many persons making big fat salaries, many near or more than what elected constitutional officers are paid who have to pay every 4 years to keep their jobs http://www.news-journalonline.com/news/20170812/top-dollar-database-lists-volusia-flagler-public-salaries

The Board of County Commissioner’s need to get involved in what their out of control county administrator is doing and bring their employees wages back back down within reason.

Values go up, taxes go up, and we aren’t getting pay raises in appropriate proportions to off set the increases.

tulip says

So if this amendment passes, the benefit goes mostly to the wealthy whose homes are assessed at 200Kor more. The average person doesn’t benefit from that. My house is assessed at almost 99,000.00 so I don’t benefit at all and even if it was assessed at $125 thousand, I would not get the entire extra 25,000, bringing me to 75K, it would be just a portion of that amount.

I’m sure that whoever writes the wording for the proposal will make it sound great and kind of not mention the affect on other parts of our taxes, as mentioned in this article, or the fact that those who have nice but less expensive homes lose and will have to pay more to make up for the benefit the wealthy get.

This proposal has been on the appraiser website http://flaglerpa.com/ for a few weeks and,when a person reads it, it doesn’t put up any red flags until someone gives it serious thought. Unfortunately most people don’t do that and they don’t even know if they qualify or not. Go to the website, type in your name or street address and look at the info, that will show whether your home qualifies.

As usual the regular person gets very little, if any benefit, and the rich get a lot of them and we pay for it with higher taxes. Grrrrrrrrrr

Anonymous says

Rev shortfalls will be the burden for the genersl populous

Pogo says

@How would crooked ricky vote?

Who profits? Follow the money. Consider this:

Florida Amendment 1, Homestead Exemption Increase Amendment (2018)

“…Ballotpedia has not yet found any editorial board endorsements in support of this measure. If you know of one, please email [email protected]…”

“…Background

Homestead exemption

Flordia’s first homestead exemption was approved in 1934, when voters approved Amendment 2. The exemption was intended to help residents keep their homes during the Great Depression, according to Steve Bousquet, a reporter for the Miami Herald.[8] Amendment 2 exempted the portion of home values between $0 and $5,000 for residents of Florida.

In 1980, the Democratic-controlled Florida State Legislature referred to the ballot Amendment 1, which increased the homestead exemption from $5,000 to $25,000. Democratic Gov. Bob Graham also promoted the ballot measure. According to the Associated Press, the increase resulted in a majority of homeowners in 20 of 67 counties, mostly located in northern Florida, not paying property taxes in 1981 because properties were assessed below the maximum exemption.[9]

The homestead exemption for non-seniors remained the same until 2008, when voters approved a legislative referral also titled Amendment 1. Amendment 1 of 2008 exempted the portion of home values between $50,000 and $75,000 from property taxes. Between the 1980 amendment and the 2008 amendment, homeowners were eligible to receive a $50,000 exemption on their homes—the amount between $0 and $25,000 and the amount between $50,000 and $75,000.

Fiscally-constrained counties

As of 2018, the state constitution reserves the power to tax a property’s value for local governments—such as counties, cities, school districts, and certain special districts—not the state government.[10] Therefore, Amendment 1 of 2018 would impact the revenue of local governments, as these governments tax the value of properties and spend the revenue.

In Florida, counties that are considered fiscally-constrained counties—defined as rural counties and counties where a one mill levy would raise no more than $5 million annually—receive funds from the state government to offset decreases in revenue caused by certain homestead exemptions. House Bill 7107 (HB 7107), passed in 2017, would require the state legislature to provide funds to fiscally-constrained counties to offset decreases in property taxes caused by the passage of Amendment 1 of 2018.[11] State fiscal analysis estimate that fiscally-constrained counties would have revenue loses around $10.5 million annually.[10]

The following is a map of fiscally-constrained counties, as designated by the state for fiscal year 2016-2017:…”

Link to full article

https://ballotpedia.org/Florida_Amendment_1,_Homestead_Exemption_Increase_Amendment_(2018)

Jim B says

Richard, I understand many senior rely on social security but at least there is usually a small increase based on inflation each year. I would say I am on a fixed income because I haven’t gotten a raise in over 3 years. Plus then that would put a larger portion of the tax burden on non-seniors who live here. Lets be fair and share the burdens across everyone who decides to live here.

Will probably hear from those about people who don’t have children in the school system, or never had them in FC school systems, rant about school taxes and why they should pay them. In that case I don’t want to pay any senior related services because I can’t/don’t use those.

The issue is to make sure our elected officials and the managers for city/county are held responsible for keeping expenses under control. When selecting projects, make sure they benefit the majority of the people and not small groups like the tennis center and gold course.

jw says

Get ready for the bubble to pop!

Johnx says

Atlanta fed is predicting 4.8 GDP growth second quarter. This Summer will be a feeding frenzy for the businesses that survived the hurricane. Hold the line.

tulip says

Seniors who are low income pay very little property tax, and it’s based on their income, which is generally just social security. The tee tiny raise they receive, gets eaten up by an increase in medicare deduction from their check, so the “raise” amounts to almost nothing in actuality. Seniors who have a larger income such as dividends from stocks and bonds, interest, social security, and other sources, pay their own way like everyone else.

The reality is that

People who can afford more expensive houses may get another deduction if it passes, and I’m sure it will. Those who have nice, but less expensive homes and therefore a lower value, will gain nothing from this, but will have to pay more in taxes to help make up the deficit because of the decrease in revenue that will be brought in. Even if someone has a little bit more over 100,000 value, say it’s 125K, you won’t receive the entire extra 25,000, only a portion of it, so it’s still not a good deal.

It boils down to the fact that the wealthy benefit more than the others, whether they are seniors or not. People need to pay attention to this bill and it’s pros and cons and how it will affect them personally before just casually voting on it.

The school tax is not affected and everyone pays their share. I don’t mind that because, when my kids were in school, it was paid for by the residents and now it’s my turn to pay my share to the next generation. It’s how the money is used that bothers me.

Does anyone know how this will affect businesses?

RayD says

As heck, just build more. Economies of scale, spread out the load. Build them and they will come. Well, until it’s over built again.

thomas says

We need the Rollback Rate.