Last Updated: 9:22 a.m.

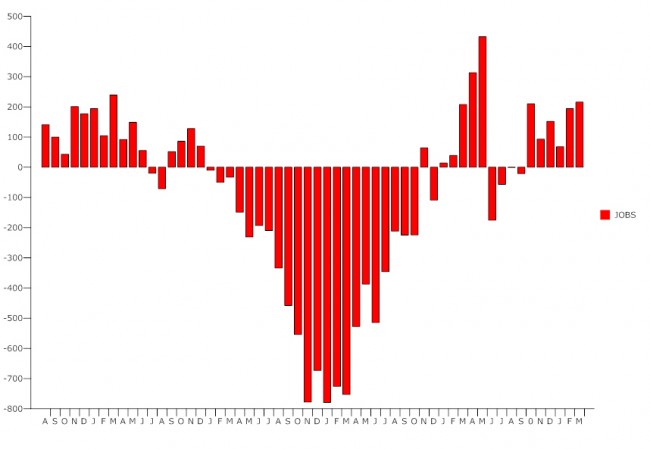

The national economy continues to improve as it added 216,000 jobs in March, the best job-production figure since last spring, although in April and May 2010, job creation was powered by temporary federal Census Bureau employment. Job creation in the last several months–almost 1 million net new jobs since October–has been powered mostly by the private sector.

Click On:

- Flagler Unemployment Drops to 14.9%, Lowest Since May 2009; Florida Improves to 11.5%

- February US Report: Economy Adds 192,000 Jobs, Unemployment Dips to 8.9%, Best in 2 Years

- For Unemployed, Length, Scale of Job Search Affects Wellbeing

- Economic Development Summit: Can Flagler’s 33 Elected Get It Up?

- Incentive This: Corporate Tax-Breaking Our Way to Job Creation

The unemployment rate fell for the second consecutive month, to 8.8 percent, a full percentage point lower than it was in November. Still, 13.5 million people are unemployed, not including 9.3 million people who are working part time not by choice but because they’re unable to find full time work. The figures also do not include the 2.4 million people who are only marginally attached to the labor force–people who are able to work but have quit looking for being too discouraged. When all three figures are added, the 25.2 million people in those three categories reflect a far more dire situation than that reflected by the 8.8 percent unemployment.

Among the 13.5 million unemployed, 45.5 percent have been unemployed for six months or more, up from 43.9 percent in February, making it harder and harder for those to find work.

And The Times cautions that “threats to a more robust recovery remain, of course, including a surge in energy and food prices, with the possibility of disruptions in oil production in the Middle East continuing to weigh on the financial markets. State and local governments have also been shedding jobs as they grapple with budget woes.”

Nevertheless, the overall trend is toward sustained, if not yet vast, improvements in the economy. The private sector job gains netted 230,000 in March, and February’s private-sector job gain was revised upward, to 240,000.

Here’s what Alan Ruskin at Deutsche Bank told the Wall Street Journal immediately after the report was released:

“The March employment report was one of the cleanest reports we have had in awhile and provided a clear-cut positive view on US growth. The highlights include all of slightly stronger than expected payrolls from both the establishment and household survey and a dip in the unemployment rate that now looks like it is genuine and will be sustained in the months ahead.

“Business services jobs is finally come to life and there are few distortions in the sector payrolls breakdown as well. The only areas that were softish was hourly earnings which may give the Fed some relief that domestic sources of inflation are more restrained than the international price pipeline. The combination of inflation and growth related data should be very good for US equities and is negative for risk aversion black swan trades like gold.”

Some highlights from the plus column: Education and health services–that is, health care–added 45,000 jobs, accounting and bookkeeping (now that it’s tax time) added 20,200, retail added 17,700, and manufacturing added 17,000.

On the negative side, government jobs fell again, by 14,000 jobs, driven by a 15,000 drop in local government jobs (and likely more to come at that level, particularly in Florida and Flagler County). Local government has lost 416,000 jobs since an employment peak in September 2008. The federal government in March added 1,000 jobs.

The average workweek for all employees on private nonfarm payrolls was unchanged at 34.3 hours in March. The manufacturing workweek went down by 0.1 to to 40.5 hours, while factory overtime was unchanged at 3.3 hours. The average workweek for production and nonsupervisory employees increased by 0.1 hour to 33.6 hours. Average hourly earnings were unchanged at $22.87. Over the past 12 months, average hourly earnings have increased by 1.7 percent, about in line with inflation, which means workers are only keeping up with the cost of living, not improving their standard of living. Average hourly earnings of private-sector production and nonsupervisory employees edged down by 2 cents over the month to $19.30.

Jojo says

Numbers can be deceiving. Why, just a couple of months ago national unemployment hovered at 12%. The weekly jobs created since along with the 216,000 created last week leave me, at least, scratching my head with a pencil eraser. What? How did the national unemployment rate go from 12% to 8.8% in such a short time with really no meaningful employment gain, Hmmm.

Awe, it came to me.

As the unemployed exhaust their unemployment officially, they are no longer counted.

IT’S THE 99’ERS STUPID

palmcoaster says

Tax imports and bring back our jobs. Tax also outsourcing services to preserve our jobs.

Jojo says

#7 Unemployment

The government needs to stop lying about how many Americans are unemployed. Some people have been unemployed so long, they have stopped looking. These folks deserve to be counted and we deserve the truth.

While you’re at it, food and gas prices need to be included in your inflation calculations. For us mere mortals, higher food and gasoline prices IS inflationary and does destroy our budgets.

Kyle Russell says

Jojo – Food and gas aren’t included in the Core inflation measures because they swing wildly due to market forces and world events. What is the Federal Reserve supposed to do about a civil war in Libya?

The Truth says

Here come the Republicans – whenever there is any bit of good news they’re always out to bash it every which way. Blame the government for lying, say it’s temporary, etc. Fox News continues to contribute to this negative attitude with their show after show that does nothing but bash everything about this country.