Taxable property values rose 5.32 percent across Flagler County according to the June estimates from Flagler County Property Appraiser Jay Gardner. After three successive years of rising values, it’s a sharp decline from last year’s 8.6 percent increase, but still a strong enough gain, local city managers and elected officials say, that it will likely help tax rates from rising.

Bunnell was the exception: it saw its values increase again by nearly 10 percent, as was the case last year, powered by continued residential construction growth in Grand Reserve, the subdivision on pace to almost double the city’s population of 3,000 within a few years. In 2019, 80 homes were built in Grand Reserve. The subdivision is on pace to build 70 more this year. By the time it’s completed, Grand Reserve would have 836 homes.

Flagler Beach’s valuations increased 5.3 percent. Palm Coast’s increased by 5.8 percent, and the school board’s increased by 4.7 percent though the board’s budget is largely controlled by state formulas.

“I’m happy with it, I feel good, I feel like it would be nice if we can continue this. I don’t want to see it drop off too much,” Gardner said. He’s not seen much of a change despite the Covid emergency. “I haven’t seen anything that’s really showing a huge reaction. The realtors are out on the front lines of this and a couple I’ve talked to haven’t noticed a huge decrease.” They’ve spoken of a shrinking inventory of properties available for sale, which doesn’t hurt prices or values.

“That indicates we’ll get a few more dollars on our property taxes, so I think that’s essentially good news for Flagler County,” County Commission Chairman Dave Sullivan said today. “It’ll enable us to hold the millage rates where they are now at the moment.”

The county and cities are in the midst of drawing up their budgets for the next fiscal year, which begins Sept. 1.

The increase in valuations, Palm Coast City Manager Matt Morton said, “helps with variable costs of operations, materials and supplies and helps keep operations aligned to succeed through and with annual inflation.” Earlier this week he turned down a $7,000 raise and told the city council that there would be no raises of any sort across the board this year as the city prepares for a difficult budget year as a result of the coronavirus emergency.

The bulk of local governments’ general fund budgets, however–which pay for police, fire, parks and recreation, code enforcement, government administration and other such services that directly impact residents–rely on property tax revenue, which is not being affected the way sales tax revenue has been affected. At least not yet.

“I don’t think the full impact of Covid-19 has been felt,” Sullivan said. “However, we did know there was going to be an increase. We didn’t know the number.” County officials had feared the increase in values would be as low as 2 or 3 percent. “Five percent is excellent because that assists us in maintaining your counties services.”

Palm Coast Mayor Milissa Holland said the council has not yet seen the budget to assess the valuations’ impact, nor finalized the coming year’s strategic plan, or goals. “What I can tell you is that integral to Palm Coast’s history is fiscal responsibility and a conservative approach to spending,” Holland said. “That will continue to be our approach as we assess the financial impacts of Covid-19 and ultimately plan and adopt a budget to serve our community and deliver services.”

Counties and the cities are also in line for a $6.6 million allocation under the federal CARES Act, the stimulus package Congress passed in response to the coronavirus emergency. Governments in the 50 states got $139 billion to help offset the effects of the virus on their economies. Florida’s share is $8.3 billion. The state’s 12 most populous counties have already received their allocations. Flagler and 54 other counties have not. There’s been dissatisfaction from the counties and cities toward the DeSantis administration for not releasing the money, Sullivan said, with the Florida Association of Counties and the Small County Coalition of Florida exerting pressure on the state to get the money moving. The delay is preventing local governments from developing their budgets as fully as they wish, not knowing what sums they’ll have in hand.

“We’re talking a lot of money and it’s the CARES act money working its way down into the states, it’s supposed to be done based on population,” Sullivan said. Cities’ share will be doled out from the county’s allocation.

Sullivan said he sees the county’s tax rate remaining flat, at $8.129 per $1,000 in taxable value (what amounts to $1,016 for a $175,000 house with a $50,000 homestead exemption).

Bunnell City Manager Alvin Jackson and Flagler Beach City Manager Larry Newsom are also expecting tax rates to remain static.

“My goal is not to propose any type of increase on the millage,” Newsom said. “The question is going to be do we do rollback or do we hold steady with the additional funds, and I really can’t say at the end of the day. It’s going to be up to the board.”

Newsom is referring to the difference between keeping tax rates equal from year to year as opposed to going back to the rolled-back rate. Keeping tax rates the same doesn’t mean taxes will not rise. Under Florida law, if tax rates remain the same, but a county’s revenue is increasing, then it’s considered a tax increase, because the higher a property’s value, the more taxes it will pay, even if the rates remain the same. To keep a property owner’s tax bill from increasing, a government would have to adopt the so-called rolled-back rate, the rate at which revenue would remain the same from year to year, thus negating the effects of valuation increases. But doing so would also limit government revenue even as government responsibilities are increasing. (See a definition of roll-back here.)

Jackson is all for keeping property tax rates flat, but he’s opposed to going to roll-back. “I can tell you as a public manager I’m not a proponent of rolling back because basically the growth we’re experiencing is the return on the investment, as I call it,” Jackson said today. “So you have to be able to keep up with your infrastructure, your public safety, and as you’re growing it costs you more and more to do that. In a perfect world the growth should be paying for the services we provide.”

Jackson said next year’s tax rolls should show further improvements, not just from Grand Reserve but from more industrial and commercial developments, with the arrival of a food truck manufacturer and an asphalt company, and the selling of a commercial building to a company on U.S. 1. “It’s exciting though, we are making steps and great things are happening,” Jackson said.

Bunnell’s priorities this year are infrastructure and public safety. In Flagler Beach, Newsom is projecting raises in the utilities department, to keep those wages competitive, he said.

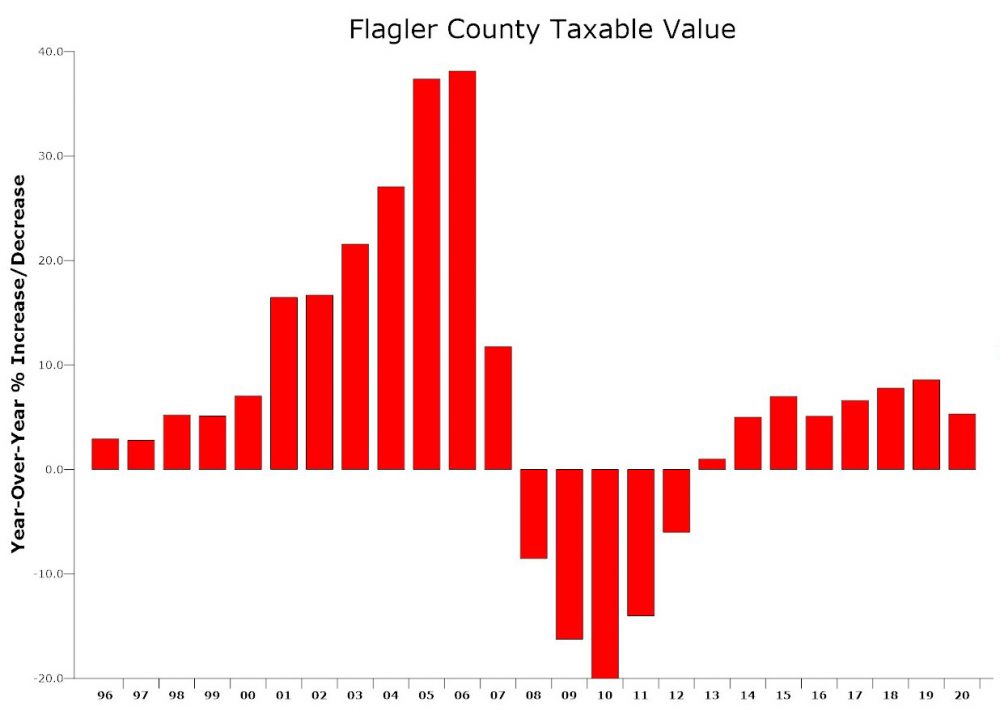

Flagler County’s property values are still a distance from their 2007 peak, at the height of the housing bubble. Valuations peaked at $12.2 billion in January of 2007. The bottom of the market was $6.2 billion. It has since climbed back to $9.7 billion. “We’ve got a ways to go. Some areas are getting pretty close,” Gardner said. “It’s nice that it’s not crazy, that it’s not scary, we don’t need that, we need it to be steady.”

![]()

Flagler County Taxing Authorities, June 1, 2020 Estimate of Taxable Values

| Taxing Authority | ||||

|---|---|---|---|---|

| Marineland | 5,467,005 | 11,000,000 | 101.21 | 0 |

| Beverly Beach | 79,693,922 | 83,000,000 | 4.15 | 890,000 |

| Bunnell | 196,488,489 | 218,000,000 | 10.95 | 16,000,000 |

| Flagler Beach | 724,592,484 | 763,000,000 | 5.30 | 10,000,000 |

| Palm Coast | 5,452,405,189 | 5,770,000,000 | 5.82 | 150,000,000 |

| East Flagler Mosquito Control | 8,748,241,032 | 9,200,000,000 | 5.13 | 236,000,000 |

| St. Johns River Water Management District | 9,396,127,668 | 9,900,000,000 | 5.36 | 275,000,000 |

| Florida Inland Navigation District | 9,396,127,668 | 9,900,000,000 | 5.36 | 275,000,000 |

| Flagler County | 9,220,353,744 | 9,710,000,000 | 5.31 | 270,000,000 |

| Flagler County Schools | 10,407,259,729 | 10,900,000,000 | 4.73 | 280,000,000 |

Note: Bunnell's values as calculated by the property appraiser in the chart reflect year-over-year estimates. Bunnell government said its actual final values for 2019, in its books, was $199 million rather than $196 million, thus lowering its expected increase in 2020 to just under 10 percent.

Simon says

Yep just keep on screwing the elderly people who only have the homestead deduction. Every year it goes up for these hair brain reventavations. We do not need a new pier. Dune will be swept away with the next storm. Millions of dollars when you will not fine dune walkers. Lots of lousey purchases for sheriff’s office, guess we have and unlimited budget. God help up with this administration.

jake says

The city leaders of Flagler Beach will be disappointed, their poor decisions always require more funding. So instead of increasing the tax rate for property, they will simply increase the tax rate of the water and sewer base rate, the stormwater fee, and the refuse charges. These fees have increased 100% in the last few years brought on by bad choices of the City Commission, and the voters that elected them. It would be more productive to see intelligent people running the city, but with the environment related to politics is so repulsive, the brightest among us don’t have the stomach for the nonsense