Brace yourselves: in 2009, no fewer than 2,362 millionaires got unemployment benefits, according to a study released Tuesday by the non-partisan Congressional Research Service. The year before, 2,840 did. Those were the two years of the longest recession since the Great Depression. It lasted 18 months. (The recessions of 1973-75 and 1981-82 lasted 16 months each.)

To ease the effects of job losses, Congress extended unemployment benefits to 99 weeks–longer than for any previous recession–though no state actually offers benefits for longer than 79 weeks. As states and the federal government face increasing burdens on their budgets, proposals have been introduced to means-test unemployment benefits by previous income. Five such bills have been introduced in Congress (two in the House, three in the Senate).

Since a 1964 Department of Labor decision forbidding the means-testing of jobless compensation recipients, current law forbids states from restricting unemployment benefits by income level. The Labo Department further expanded the restriction on means-testing to severely limit factors states may use to determine unemployment compensation eligibility. So states must issue unemployment checks regardless of the beneficiary’s background.

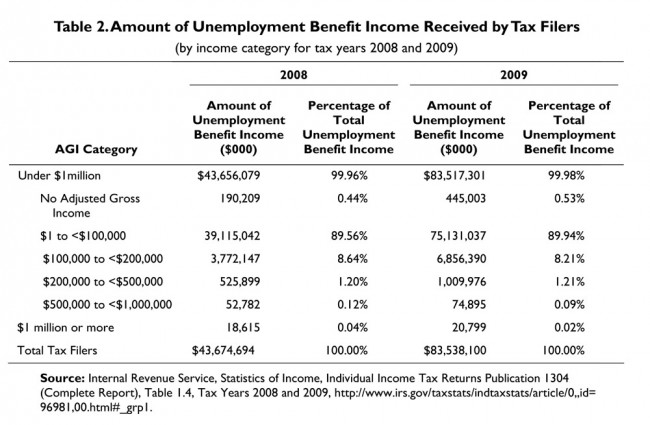

The 2,840 millionaires who got unemployment checks in 2009 represent 0.02 percent to 0.03 percent of all individuals filing for unemployment. In 2008, 9.5 million people with previous incomes below $1 million filed for unemployment. In 2009, 11.3 million people did. The overwhelming majority of those filers were in lower brackets: fully 91 percent had previously reported incomes of $100,000 or less. Some 7.5 percent had incomes between $100,000 and $200,000, and 1 percent were in the $200,000 to $500,000 range. Some 8,000 filers in 2008 had made between $500,000 and $1 million, and 8,335 were in that bracket in 2009.

Those millionaires collected a total of $18.6 million in 2008, and $20.8 million in 2009–compared to $43.6 billion and $83.5 billion for people who’d made less than $100,000. The full table of outlays appears below.

Putting aside visceral reactions to millionaires receiving unemployment checks, the Congressional Research Service warns that it’s not as simple as passing a law allowing for means-testing: “The potential administrative costs could outweigh the potential savings,” the research service concludes. “Although lawmakers could choose among different ways to administer the provision, one of the more cost effective ways may be to recoup UI [unemployment insurance] benefits through the tax system rather than make high-income groups ineligible for benefits.” For example, several bills in Congress now would impose an income tax rate (of up to 100 percent in some cases) on unemployment benefit income for tax filers with adjusted gross incomes above a specified threshold. That would discourage people in that bracket from filing for unemployment to start with.

Taking advantage of the existing tax system to administer the provision may be more cost effective than other approaches because the tax system already requires individuals to report their unemployment

benefits and other sources of income and it has a mechanism in place for individuals to pay back the value of UI benefits with a check to the federal government,” the research service states. “Although administering the provision through the tax system may be a relatively cost effective approach, there are some potential disadvantages. Adding a separate tax rate for UI benefits may further complicate an already complicated tax form. Among the alternatives, one could restrict UI benefits for those who have or are expected to have at least $1 million in earnings. For example, states collect information on earnings for each job covered under the UI system. UI benefits could be denied to those with more than $333,333 of earnings in a four-month period. This would be a cost effective approach in that the UI database, which contains data collected by the states, could be used to identify such individuals. However, the UI database would not identify those who have at least $1 million in total income when other sources of income (such as stocks) are taken into account. Moreover, it would not identify all married couples or households that have at least $1 million in earnings or total income.”

The full report appears below.

![]()

Millionaires and Unemployment Benefits: The CRS Report

Leave a Reply