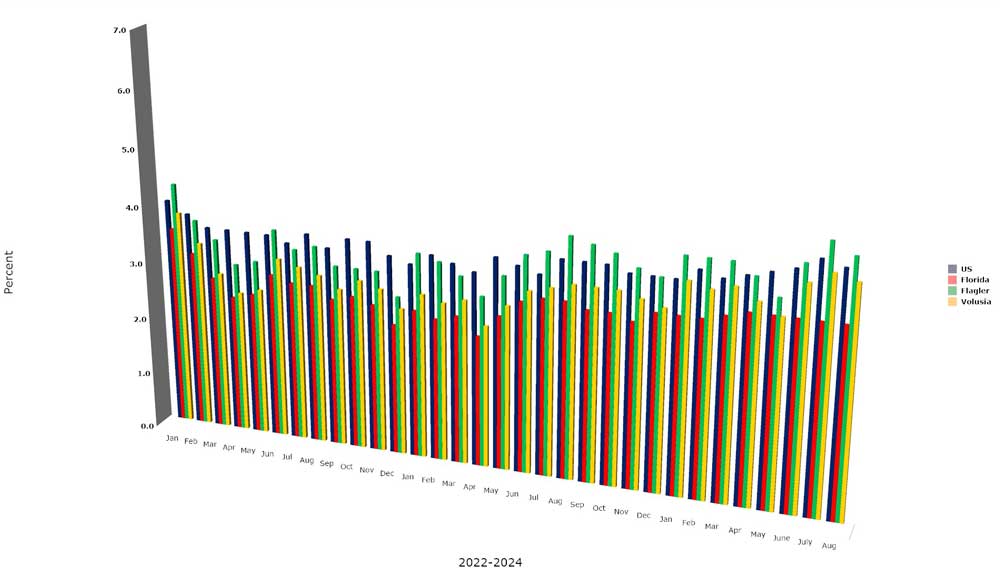

After rising to a three-year high last month, Flagler County’s unemployment rate declined a statistically insignificant fraction, to 4.4 percent in the state Department of Commerce’s seasonally unadjusted report issued this morning. Florida’s seasonally adjusted unemployment rate remained unchanged for the fifth consecutive month at 3.3 percent, though the unadjusted rate is at 3.7 percent, while both rates undercount discouraged workers who have abandoned the workforce, and under-employed workers.

Flagler County’s unemployment rate declined slightly only because the labor force declined by more than 100 workers, about the same decline in the number of unemployed persons (2,275). The number of people holding jobs also declined slightly, to 49,327.

Flagler County had been steadily approaching the symbolically significant threshold of 50,000 employed workers last year, and crossed it exactly a year ago, but only in September, when it reached 50,138 for the first time in the county’s history. The county has not only struggled to stay close to that number. It has shed almost working people since, strongly suggesting that the influx of working-age individuals and families has slowed sharply, if it hasn’t stalled.

The local housing market continues to move steadily but nowhere near torridly, and with one troubling indicator: The local inventory of available housing is now at 1,225 single family homes–the highest number in 13 years. It was last at that level in may 2012, when the inventory was shrinking fast in the recovery from the housing boom. Flagler’s inventory has been rising almost every month for the last 18 months. The supply of homes is at 5.1 months, the highest level in 10 years. That is not particularly good news for developers with large projects under construction or just clearing their last regulatory hurdles.

On the other hand, housing economists consider the 5.5 mark in housing supply the level at which it is neither a buyer’s nor a seller’s market. Flagler County happens to have been a seller’s market for several years running. The federal reserve’s decision this week sharply to cut the prime lending rate is expected to boost a new round of lending at cheaper rates, likely helping homebuyers and, by extension, the housing industry.

Meanwhile single-family home sales in Flagler County continue, with just over 2,000 single-family home sales closing in the last 12 months, according to the latest report by the Flagler County Realtors Association, with over a third of those sales for cash. Cash sales reflect buys by investors or retirees with ready money, as opposed to younger families that typically need a mortgage to buy a house.

The median sale price is at $370,000, very near where it’s been for the last 12 months–another sign that the housing market is neither hot nor cold, though it now slightly favors buyers over sellers. Buyers are paying on average 94.6 percent of the original list price, so if a house was selling for $300,000, a buyer was able to push the price down to $283,800. It is taking over two months for a house to go from sale sign to contract and in August the 66 days it took to get to contract was the third-longest stretch since before Covid.

Paradoxically, consumer confidence among Floridians rose for the third consecutive month in August, reaching its highest level in the past three years at 76.4 points, up 1.6 points from a revised figure of 74.8 in July, according to the University of Florida’s Bureau of Economic and Business Research. National consumer confidence also increased after four months of decline.

“Floridians grew more optimistic in August, driven by increased confidence in their personal financial situation and the national economy over the next year,” said Hector Sandoval, director of the Economic Analysis Program at the bureau. “Recent data shows that annual inflation fell below 3 percent in July. While employment figures have been revised downward, indicating a cooler labor market, second-quarter real GDP growth was revised up from 2.8 percent to 3 percent due to stronger consumer spending.”

There were 368,000 unemployed Floridians according to the state’s official tally. That tally reflects only the number of unemployed who qualify for the state’s 12 weeks of unemployment checks (the shortest benefit period in the nation). The checks top off at $275 a week, also at or near the lowest amount in the country. Once an unemployed person has run out of benefits, that person is no longer included in the unemployment tally. There are just under 10 million employed Floridians.

Jay Tomm says

And lets not forget the around 1500 additional homes that are being built now or over the next couple of years.

I can’t see how people can move to Flagler when houses, taxes, insurance, costs all over are high. How does one afford a house making 14/hour in the service industry, or 20/hour in local gov?

Atwp says

Supply and demand. The supply is there, what about the demand. Am sure the demand will increase because of the interest rate drop. Good employment is one of the keys to purchasing power. Will see what will happen during the end of this year and the beginning of next year.

Same old story says

What interest rate drop. I went to restate my TBill investment and the interest rate has dropped from 5,2% to 4.6% or .50& yet the mortgage rates and credit card rates stayed the same Why?

Billy says

Just wait for all the foreclosures to add to that list!

Dennis C Rathsam says

Looks to me the smart folks already left this sinking ship!

wow says

… “over a third of those sales for cash” so wealthy people buying AirBnbs or well off retirees? Not even people looking for/needing a job.

Deborah Coffey says

Lower interest rates should help. But, we are overbuilt without a thought for needed infrastructure and good jobs. What does Palm Coast produce?

Billy says

Traffic, crime, crack houses.

Tony says

Why is the unemployment rate so high? Most every place I go is advertising for help.

Ray W says

Hello Tony.

The unemployment rate is not high. Standard economic theory places the ideal unemployment rate at 4.0%. Nationally, we are at 4.2%.

The simple fact is that we don’t have enough immigrants to fill all of the open jobs. Birthrates by American women fell below replacement rate some 18 years ago; it continues to drop. The number of American-born workers in the labor marketplace is dropping as boomers age out of the prime labor pool (25-54). If we want our economy to continue to grow in productivity, we will need more and more immigrants over time to provide the necessary labor.

The issue of whether you or anyone else likes this idea is unimportant.

Immigration numbers have been comparatively greater than average in recent years, yet we still need more and more immigrant workers.

Changing child labor laws to allow Florida children to start working at a younger age and to work longer hours without breaks is only a stopgap measure, yet it shows that Florida’s legislature and governor recognize what happens to Florida when they run off immigrants over the past two years.

I don’t know who it was who came up with the stupid idea that we needed to make driving an undocumented immigrant to church, or to the grocery store, or to work a felony, but someone was that stupid and others fell into line. Whole families of lawful immigrants left the state rather than risk prison by driving a nephew to the grocery store. They can find work elsewhere. Florida farm bureau spokespersons have repeatedly commented to reporters that farmers planted less acreage than normal this year because they didn’t know if they would be able to find sufficient pickers when the crops ripened.

That Florida’s governor signed a bill prohibiting Florida municipalities from regulating farmers who build temporary homes to minimal federal standards in order to house H2A visa-approved farmworkers shows that Florida’s leaders know that they ran off immigrants over the past two years. They want them back and they don’t want cities imposing higher building standards on the flimsy housing that federal law requires for housing lawful immigrant farm workers.

Hmmm says

Unemployment rates arent calculated by businesses looking for help. Its calculated by individuals out of work.

Ray W says

Okay, Hmmm.

Two things can be right at the same time. Businesses looking for help is a statistic different from that for calculating the number of the unemployed.

Businesses can need more workers, and the unemployment rate can stay the same. There are many variables that make this possible.

According to the BLS, which provides labor statistics, the total number of non-farm jobs in America in February of 2010, during the Great Recession, hit a low of 129,865k jobs. The latest figure, August 2024, 14 1/2 years later, is 158,779k jobs, which is just under 29 million more jobs. Over those 174 months, that comes to 172k jobs added per month, on average, for 14 1/2 years. That’s a gain of over 20% to the total non-farm labor force.

On the other hand, the birth rate for American women dropped below replacement level nearly two decades ago, and it continues to drop. Yes, it takes time for the native-born population growth to level off, but it is clear that we have been adding many jobs to the workforce over the past nearly 15 years without adding that many new workers to the American-born worker count.

So where are most of the new workers coming from? It has to be from immigration! We need more immigrants. We have long needed more immigrants.

Many economists argue that the ideal ratio of open jobs to unemployed workers is between 1.0 to 1.2 posted job openings per unemployed person.

Due in part to the national economy adding so many new jobs month after month for years after the pandemic. and due in part to the labor pool of American-born workers leveling off over the years, the number of unfilled posted jobs openings has been abnormally high for years; it reached two open jobs for every unemployed person is early 2022. I have argued repeatedly for some time that we have needed every immigrant we could get to keep the comparatively strong economic recovery on pace. We finally reached a normal ratio of open jobs to unemployed persons two months ago. Maybe the demand for more immigrant workers will begin to taper off.

Celia Pugliese says

Immigrants needed to do some jobs were deported or scared off from Florida and they do really good work that others won’t do.

Brian F says

We paid our home off early so we could cancel our Homeowners Insurance and Wind Policy which raised from $4,500 per year in 2023 to $12,000 in 2024 without ever filing a claim. And we are miles inland and not in a flood area. Insurance is OUT OF CONTROL in DeSantis’ Florida. Maybe if he worried more about the residents and less about taking bribes from “Big Insurance” people would still be moving here. I know lots of people that are getting out of this state because of the high cost of living.

Stop The Insanity says

Lol. Who couldn’t see this coming? Build it and they will come no longer has merit. The housing bubble is about to burst. Hopefully before another parcel of land is bulldozed. The greedy developers and politicians destroyed paradise. Their day of reckoning is approaching.