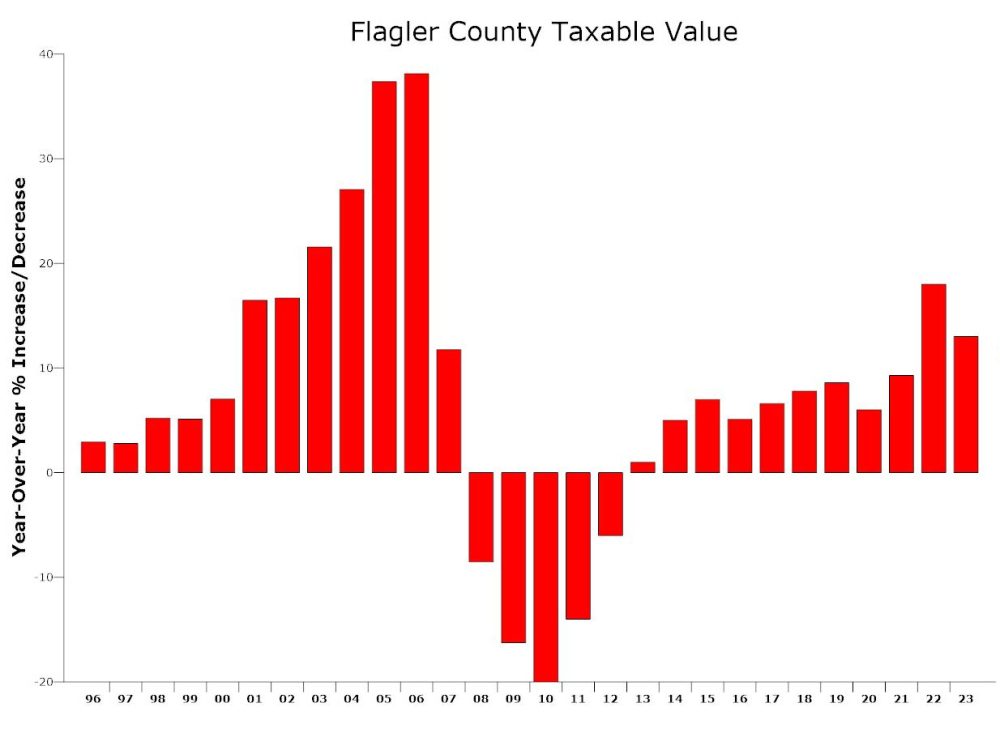

Property values didn’t rise as sharply this year as they did in 2022. But the increase is still the second-highest in 16 years, generating substantial new revenue for local government budgets.

Taxable values rose by 12.8 percent in Flagler County county, compared to 18 percent last year. In Palm Coast, taxable values rose by 13 percent, compared to almost 20 percent last year. Flagler Beach values rose by 9 percent (down from 14.5 percent last year) and Bunnell values rose by 13.3 percent (down from almost 22 percent).

“Obviously what we hear is the values are plummeting, it’s not the same, the market is dead,” Property Appraiser Jay Gardner said. That’s not what he’s seeing. “We didn’t see a decrease.”

Taxable values drive property tax revenue, and revenue that local governments generated from new construction is a windfall that doesn’t count as a tax increase. Palm Coast, or example, had $437 million in taxable new construction. That will equate to $2 million in new revenue that would not be part of any tax-increase calculation. The money could potentially be used to limit or offset a tax increase, though local governments in recent years have been using the rise in property values to keep their property taxes flat rather than roll them back, thus generating yet more revenue.

In Flagler County, $641 million in new construction (which includes all the new construction in the cities as well as in unincorporated Flagler) will add $5.2 million to the county’s coffers, based on the current tax rate.

Flagler Beach saw only $13.1 million in new construction, which will add a mere $71,300 to city coffers at current rates. Bunnell will see $168,000 in new revenue from new construction. The city has been benefiting from the continuing expansion of the Grand Reserve subdivision.

Local governments stand to net even more revenue if they do not roll back their property tax rates to the so-called rolled-back rate–the point at which the revenue generated next year will be the same as this year, outside of new construction revenue. Even if tax rates stay the same, revenue would increase because property values are increasing. That’s why under Florida law, any year-over-year revenue greater than the previous year is considered a tax increase on property owners.

The majority of homesteaded property owners will not see that increase, even if their home value has gone up by 10 or 15 percent. The reason: taxable values are caped at 3 percent.

For commercial, industrial, rental and non-homesteaded properties, the cap is at 10 percent (and there is no cap when it comes to school taxes). And of course when new homeowners move in, they pay taxes at that home’s full value. So two identical homes ion the same street could have tax bills that differ by $10,000, depending on how long one has been homesteaded and the other not.

That’s what’s driving protest before local government boards at ta time. It’s not the homesteaded property owners who are complaining. Their taxes have barely budged in over 10 years, and in inflation-adjusted dollars, their taxes have actually fallen. But new homeowners, especially those who thought they’d be paying the same level of taxes as the previous homeowner, are getting the full brunt of taxes, unprotected by the cumulative 3 percent cap.

In effect, non-homesteaded properties, including renters, are subsidizing homesteaded homeowners’ lower property taxes. That fact is starkly illustrated by the difference in taxable values as opposed to just values. In Flagler County, all properties collectively had a value of $24 billion on January 1, a 6.8 percent increase over last year. But only $14.3 billion of that was taxable. The rest–fully $10 billion–is “protected” by exemptions such as homestead, the additional $50,000 exemption for seniors, which in a county where nearly a third of the population is 65 and over, wipes out a large amount of taxable values, plus exemptions for the military disabled.

The same calculus applies to Palm Coast and the other cities. Palm Coast had a total of $15 billion in property values. But only $8.6 billion of that is taxable.

The disparities are evident between new and homesteaded homeowners, and are buffered to some extent by continuing increases in values.

“It’s still a pretty good year. Now, what’s going to happen next year, it’s slowing down,” Gardner said.

Home-mortgage interest rates, while still low by historical standards, peaked at nearly 7 percent last October, falling slightly since, but to remain in the 6.5 percent range after bottoming out below 3 percent between 2020 and early 2022. (By way of comparison, interest rates peaked at over 18 percent during Ronald Reagan’s first term, and remained above 10 percent for most of his second term).

The Flagler County Association of Realtors in April reported that 259 single family home sales closed in April, down 13 percent from a year earlier, for a median sale price of $375,000. Active listings are up 157 percent year over year, from 302 a year ago to 777 in April. The median time to sale has nearly doubled, the monthly supply of home inventory has increased from just one month to three. Those are all indications of a cooling housing market.

“I personally don’t expect it to be like it was in 2007 when we fell off a cliff,” Gardner said. “These aren’t investors doing this, these are end users,” people buying homes to live in them, as Florida attracts roughly 1,000 new residents a day, and the Flagler-Palm Coast area continues to attract retirees in disproportionate numbers. “So I’m not scared we’re going to have another crushing economy.”

c says

It doesn’t matter how you calculate it, it has been proven by the past that no matter how much revenue increases, the Palm Coast City government will find a way to waste it – while ‘overlooking’ many, many things that need some TLC in Palm Coast.

Jay Tomm says

When the bottom falls out, & it will, Flagler will be in trouble. I’m sorry but 10K sq ft lots are NOT worth $50-$60K. All the new construction I have seen has happened in the last year & before rates rose to now 6-7%. If you follow the $$, 3 LLC’s out of Orlando are buying up lots in mass numbers. And these are sub LLC’s of foreign $ backed builders. Look up the PA’s own website. One LLC has bought over 70 lots in 2 years. And look at the people moving to PC. Not 20-30 somethings…

Dennis C Rathsam says

TAXES, TAXES, TAXES,…..And we still have shitty roads, uncontrolled traffic, a splash pad, that our kids enjoy daily? We have no sewers, we have no curbs we dont even have a real police dept….Even Mayberry had Andy & Barney….Wheres all the money going?Could there be too many hands in the cookie jar? I think its time for some esssplainin, or maybe a city audit?

Laurel says

No matter the windfall, your taxes will not go down.

“WESTWARD HO!”

Diminishing Returns says

“It’s still a pretty good year. Now, what’s going to happen next year, it’s slowing down,” Gardner said.

Could see some real austerity if inflation remains at five percent or more but taxable values increases are stuck at 3% by state law.