By Sarah Anderson

With all the debate over Donald Trump’s tax-dodging, I’ve been wondering how taxes have played into presidential politics in the past.

For some answers, I turned to Bob McIntyre, head of the nonpartisan research and advocacy group Citizens for Tax Justice. For 40 years, McIntyre has been on the frontlines of efforts to make our tax code fairer.

When asked what American president he considers the worst on tax fairness, his initial response was “Yipes, there are so many.”

After some consideration, he bestowed that honor on Ronald Reagan, whose 1981 tax act slashed taxes on the rich.

The top marginal tax rate dropped from 70 percent to 50 percent (before being cut even further to 28 percent in 1986). And, even more harmful, according to McIntyre, was the bill’s vast expansion of corporate tax loopholes.

Ironically, though, when I asked what president has done the most to advance tax fairness, Reagan’s name came up again — not as number 1, but as the runner-up.

While Reagan is a big hero of anti-tax Tea Partiers, later in his presidency, he agreed to raise taxes several times to address mounting budget deficits.

McIntyre was particularly involved in the fight over Reagan’s 1986 reform, after cranking out reports for a decade that documented rampant tax-dodging among America’s largest corporations and wealthiest individuals.

The loophole-closing 1986 reform was still not enough to solve the problem of insufficient revenue to pay for federal spending. But by creating a broader tax base, Reagan set the stage for President Bill Clinton’s increases in the tax rates on the highest earners.

The loophole-closing 1986 reform was still not enough to solve the problem of insufficient revenue to pay for federal spending. But by creating a broader tax base, Reagan set the stage for President Bill Clinton’s increases in the tax rates on the highest earners.

The top marginal rate rose to 39.6 percent in 1993, where it stands today.

The combination of the 1986 and 1993 reforms was essential to the balanced federal budgets that occurred in the late 1990s, according to McIntyre.

But of course, then President George W. Bush blasted a cruise missile-sized hole through all that fiscal responsibility with a new round of tax cuts and a spike in war spending.

So who was the best president for the cause of tax fairness?

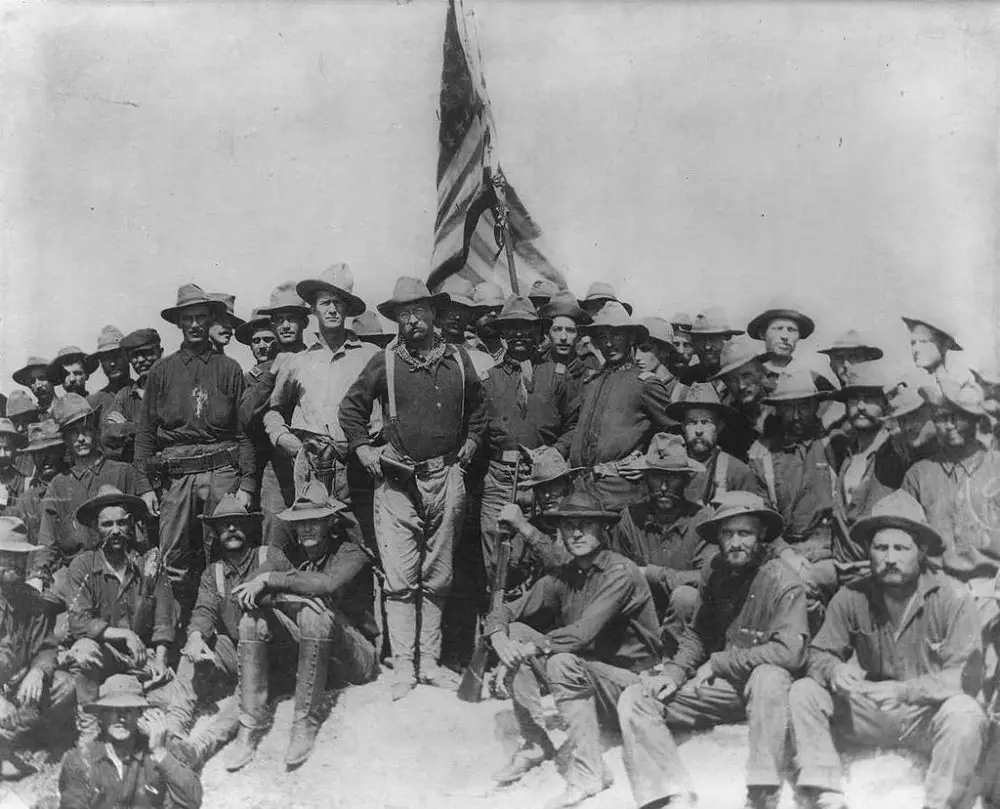

Again, the answer was surprising: Teddy Roosevelt, but not because he was a strong advocate of progressive taxes (which indeed he was). Instead, McIntyre says TR deserves the honor because of the unintended consequences of his pettiness.

To understand his argument requires a bit of a history refresher.

In 1912, Roosevelt, who’d held the nation’s highest office from 1901 to 1909, decided to throw his hat back in the ring because he was dissatisfied with the presidential performance of his former protégé, William Taft.

When TR failed to beat Taft for the nomination, he founded his own party — the progressive, so-called “Bull Moose” Party — and while he didn’t win the election, he succeeded in splitting up the Republican Party.

This, McIntyre points out, led to Democratic takeovers of previously Republican state legislatures, which was critical to delivering the three-quarters of states necessary to ratify the 16th Amendment.

“Without Teddy’s petulance,” McIntyre told me, “the amendment authorizing a federal income tax would almost certainly have failed to be adopted.”

So how does one stay motivated to keep fighting for fair taxation for 40 years? “Perhaps I have Sisyphus as my hero,” McIntyre said.

Trying to stop big corporations and billionaires from rigging the system does indeed seem like pushing a rock up a hill over and over. But until we elect public servants willing to stand up to these powerful forces, we have no choice but to keep pushing.

![]()

Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies and is a co-editor of Inequality.org.

Anonymous says

Hmmm this sets the point of view IMO ~ With all the debate over Donald Trump’s tax-dodging,~When asked what American president he considers the worst on tax fairness,, he bestowed that honor on Ronald Reagan, whose 1981 tax act slashed taxes on the rich.~The combination of the 1986 and 1993 reforms was essential to the balanced federal budgets that occurred in the late 1990s, according to McIntyre.

Trump did NOT dodge tax laws he followed them. Amazing how the left sees one following the tax laws as wrong when it cuts taxes. Again to the left tax fairness has NOTHING to do with the “fairness” of the taxing being done. How is it “fair” that some will pay over 50% of all their earnings and other actually get moneys “BACK” in “refunds that they NEVER paid just how is such a system “fair”? Also the outright lie that we ever had balanced budgets in the 90s. don’t take my or his word just look up IF our debt went up,down or stayed the same in those years. When one finds out they did go up then ask how could we have had a balanced budget.

jasonb says

Hard to tell exactly what Trump did on his taxes since he has still failed to provide them, as Presidential candidates have done for 40 years.

ken says

The author calls the Citizens for Tax Justice non-partisan.

In this case, non-partisan is lib-speak for leftist.

Here is how Wikipidiea describes them:

“CTJ is generally considered to be a left-wing organization.”

footballen says

Just as hard to tell if the 36 people who mysteriously died often referred to as the “Clinton trail of bodies” were actually any fault of the Clinton’s since they refuse to even speak on the matter. Just like she avoids speaking about paying demonstrators to violently protest Trump’s rallies. Just hard to tell huh?

Anonymous says

It’s amazing to me that what the Left never seem to realize is that all those thousands of employees of Donald Trump pay a lot of taxes and all those tax dollars initially came out of Donald Trumps pocket. I would like to see him make even more money so he can provide thousands of more jobs.

funny says

I say screw it let her win, so us hard working people all quit our jobs and live off of uncle sam like the left does. Lets see where they will get their tax money then!

anon2 says

If Donald Trump told his followers that the sky is green, they would likely believe that the sky is green. As for those “thousands” of Trump employees, how many were foreign and/or undocumented workers like the 200 Polish workers that built the Trump Tower? How many contractors did Trump put out of business because he did not pay them?

http://money.cnn.com/2016/07/28/news/donald-trump-foreign-workers/

Likewise, the “paid” protesters was another TRUMPed up story. Read the true facts here:

http://www.politifact.com/truth-o-meter/article/2016/oct/20/trump-says-clinton-and-obama-caused-violence-his-r/mp hired

The Clintons did not kill anyone. That lie was debunked years ago.

http://www.snopes.com/politics/clintons/bodycount.asp

Donald Trump's Tiny Fingers says

footballen, snopes is your friend.

http://www.snopes.com/politics/clintons/bodycount.asp

http://www.snopes.com/craigslist-ad-trump-rally/

Anonymous: he’s not providing jobs to anyone if all he does is put his name on things.

ken: you’re right, it’s generally considered to be a left-learning organization. It’s research has also been quoted many times by republican politicians to support whatever position they have that agrees with their results. Your point?

A Little Common Sense Please says

All business people look for business deductions which are legal and save them money. All welfare and grant recipients look for a every loophole that will get them the free money offered by the government-its the same thing just in reverse. If those people are so worried about our military and our governments economic well being, they would get a job and pay taxes instead of mooching off the rest of us who do pay taxes.