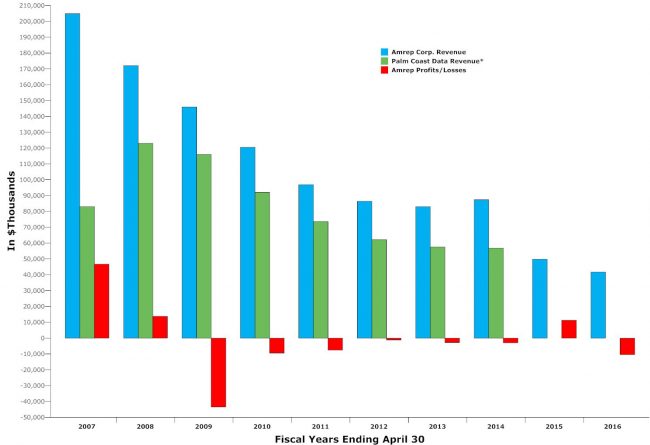

Amrep Corp., Palm Coast Data’s parent, has seen losses seven of the last eight years. Four weeks ago the Princeton-based company posted its biggest loss in eight years, $10.4 million for fiscal year 2016, as revenues continued to decline.

That bodes poorly for Palm Coast Data, which at one point a decade ago was the city’s largest private employer. It has been much diminished since, but has insisted on an optimistic outlook by diversifying some of its services, adding a few accounts (while losing others) and experimenting in new business sectors.

Amrep was once a much larger company of which Palm Coast Data was a substantial component, but not its largest. Just 10 years ago, Amrep had revenue of $205 million overall, with its operations spread between Palm Coast Data’s subscription fulfillment services (accounting for 40 percent of company revenue), newsstand distribution and product services, land sales in New Mexico through the Amrep Southwest subsidiary, and membership fulfillment services.

Today, the company consists of just two business segments–Palm Coast Data, and the scaled back real estate operation in New Mexico. The majority of the company’s revenue is through Palm Coast Data: two years ago the company’s financial reports stopped breaking down Palm Coast Data’s numbers on their own, folding them into Amrep’s, making Amrep and Palm Coast Data almost synonymous.

Amrep revenue in 2016 was just $41.7 million, down from just under $50 million the previous year and less than half its revenue in 2014. In 2016, Amrep’s revenue was one-fifth of its revenue at its peak in 2007. At the time, Palm Coast Data was consolidating all of Amrep’s fulfillment operations from three states into the Palm Coast plant and promising a big expansion locally that would add 700 jobs. That never happened. The company has steadily shrunk since, losing accounts and employees and selling one of its buildings at its campus on Commerce Boulevard.

Revenue had stabilized for a few quarters in 2013 and into 2014, raising homes that the company had turned a corner. The company posted a profit of $11.3 million in 2015, largely from what it called “discontinued operations.” But steep revenue drops resumed and have continued into 2016, with a two-year revenue change of minus 33 percent.

“When a company sees revenue shrink in consecutive years, shows negative two-year revenue growth and it’s trending consecutively lower, the importance of the negative trend is substantially higher,” Capital Market Labs, a news service focused on markets, reported Wednesday. “This is one to take note of for AMREP Corporation, right now. If revenue stays trending lower, AMREP Corporation could find all of the other earnings metrics hit weakness rapidly in the near future.”

The net loss the company reported on July 29 was equivalent to $1.27 per share, for its 2016 fiscal year. “The net loss from continuing operations for 2016 included pre-tax, non-cash impairment charges of $10,406,000 ($6,556,000 after tax, or $0.81 per share) while the results from continuing operations for 2015 included pre-tax, non-cash impairment charges of $2,580,000 ($1,625,000 after tax, or $0.21 per share),” the company reported in a release. “The 2016 impairment charges included a $7,900,000 write-down of certain long-lived assets of the Fulfillment Services business. The remaining 2016 impairment charges of $2,506,000, as well as the 2015 impairment charges, primarily reflected the write-down of certain real estate inventory in New Mexico and discontinuance of the development of certain software in the Fulfillment Services business. Excluding the impairment charges in both years, results of continuing operations for 2016 were a net loss of $3,668,000, or $0.46 per share, compared to a net loss of $1,959,000, or $0.25 per share, for 2015.”

“With the booking of the non-cash impairment charges of $10,406,000, the Company has completed a restructuring of its business and balance sheet that began in fiscal year 2014,” Company Chairman Edward Cloues II said in the release. “We have exited three businesses (magazine distribution, product packaging and fulfillment, and staffing), eliminated a very significant negative working capital position, reduced debt and balance sheet risk, and simplified our organization. This was a major task, and it was accomplished despite headwinds from our real estate business that was suffering through a severe industry downturn that began several years ago and is only now beginning to recede. Going forward, our focus will be on running our two remaining operations – real estate and fulfillment and contact center services – and seeking out opportunities for growth.”

Meanwhile, the company keeps rearranging the deck chairs: last week the company announced that Robert Wisniewski would be Amrep’s executive vice president and CFO, effective Nov. 1. He will replace Clifford Martin, vice president and CFO, who will return to his former roles as treasurer of the company and CFO of Palm Coast Data.

![]()

Note: Palm Coast Data employees are invited to contact the editor here to let us know of any internal developments relevant to the company’s future, as it is of central importance to the city’s economy. Contacts will be kept confidential. Don’t use your work computers.

woodchuck says

Didn”t we [ the city ] make a deal with Palm Coast Data to give them the old city hall for free for a surge of employment in an agreed amount of time or they would pay the City certain amount of money?Reminds me of the bakery lady in 2005 or 2006 who received a sum of money to stay open and keep employes and closed a short time later and new repayed the loan.

Marley says

That place is a hell hole, changed hands too many times and they treat the employees like used rubbers. I hope that company burns to the ground. anyone who puts up with that mess must be dense.

downinthelab says

Better to invest in Palm Coast real estate than New Mexico.

Slim jim says

Yes we made a deal with palm coast data….and a golf course….and a desalination plant…and a tennis club…and red light cameras…and so many more contracts that have lost TENS OF MILLIONS of TAX PAYERS MONEY!!!!

crzy cat lady says

I think your right woodchuck. The state of Florida gave PCD I believe the amount was $3 million & PCD was to produce the number of promised jobs in Palm Coast, if they didn’t they must return that money to the state. The last report was that they got a extension on that due date. I’m sure the good ol” state of FL would let them slide. No accountability. Just our hard earned tax dollars going down the toilet. No one that I have met has anything positive to say about working there.

Sw says

PCD are a bunch of overrated prima done s who were incapable of seeing the change forth coming. Let them bleed…..

Shark says

I guess netts and landon are thinking about how to bail them out with our taxpayer dollars!!!!!!!!!!!!!

Me&her says

They still pay our bills

shrinking violet says

Yes, they do provide paychecks for people. If they weren’t there, would be alot of people looking for work. Which there is little of in Palm Coast. Yes, they could certainly upgrade their style of management. They could develop a team of strongly loyal employees but instead look at an employee as simply another pair of hands. They have challenges….it’s a production environment. Volume of work can change drastically and staffing has to be constantly adjusted. It’s all about making money…which it has to be. It’s a business. But, respect to employees is necessary to be successful.

Smart Guy says

Palm Coast Data could be great again if they could hire some one to sell the business. Cater to new clients. And diversify its accounts. Be cheaper then any other company with the inserts. Go out there and get the business.

terminus says

We need to broaden our business and include utility statements (water, electric, cable). I would say CC or bank statements but that would require the entire company to be bonded and that’s not possible for some. There really are ways to increase business and that’s through widening our approach to clients. Also, it’s time to woo back some of the clients that left when PCD was being run into the ground by certain people.