To include your event in the Briefing and Live Calendar, please fill out this form.

Weather: Showers and possibly a thunderstorm. High near 86. Chance of precipitation is 80%. Tuesday Night: Showers and thunderstorms. Low around 73. Chance of precipitation is 80%.

- Daily weather briefing from the National Weather Service in Jacksonville here.

- Drought conditions here. (What is the Keetch-Byram drought index?).

- Check today’s tides in Daytona Beach (a few minutes off from Flagler Beach) here.

- Tropical cyclone activity here, and even more details here.

Today at a Glance:

The Palm Coast City Council meets in workshop at 6 p.m. at City Hall. For agendas, minutes, and audio access to the meetings, go here. For meeting agendas, audio and video, go here.

The Community Traffic Safety Team led by Flagler County Commissioner Andy Dance meets at 9 a.m. in the third-floor Commissioner Conference Room at the Government Services Building, 1769 East Moody Boulevard, Bunnell. You may also join virtually by computer, mobile app or room device. Click here to join the meeting. Meeting ID: 276 236 998 121 Passcode: CyEKoW [Download Teams | Join on the web]

The Flagler County School Board meets at 3 p.m. in workshop to go over the items on its upcoming school board meeting two weeks hence. The board meets in the training room on the third floor of the Government Services Building, 1769 East Moody Boulevard, Bunnell. Board meeting documents are available here.

The Flagler County Planning Board meets at 5:30 p.m. at the Government Services Building, 1769 East Moody Boulevard, Bunnell. See board documents, including agendas and background materials, here. Watch the meeting or past meetings here.

The St. Johns River Water Management District Governing Board holds its regular monthly meeting at its Palatka headquarters. The public is invited to attend and to offer in-person comment on Board agenda items. Note: meeting start times vary from month to month. Check here to verify the time. A livestream will also be available for members of the public to observe the meeting online. Governing Board Room, 4049 Reid St., Palatka. Click this link to access the streaming broadcast. The live video feed begins approximately five minutes before the scheduled meeting time. Meeting agendas are available online here.

The Flagler Beach Library Book Club meets at 5 p.m. at the library, 315 South Seventh Street, Flagler Beach.

Random Acts of Insanity Standup Comedy, 8 p.m. at Cinematique Theater, 242 South Beach Street, Daytona Beach. General admission is $8.50. Every Tuesday and on the first Saturday of every month the Random Acts of Insanity Comedy Improv Troupe specializes in performing fast-paced improvised comedy.

Notebook: Ever since Aristotle’s infatuation with teleology–Instagram translation: everything happens for a reason–and the Enlightenment’s invention of “progress,” we like to think that history marches forward like a swarm of Deepak Chopras. The Declaration of Independence was written by a slave-holder for slave-holders, but as Ronald Reagan would say, aren’t you better off today than you were 249 years ago? History is more bipolar. We need only look back at how Barack Obama’s disbelieving walk onto the platform at Grant Park before a nation weeping with disbelief that November night in 2008 gave way eight years later to the man from Trump Tower’s Hades, riding that escalator back up and into the whitest White House since Woodrow Wilson whooped to “Birth of a Nation” in the White House screening room. The Biden interregnum now feels like Bobby’s Bad Dream in “Dallas.” Trump campaigned on a platform of anti-pluralism and won. His predecessors in the genre–Goldwater, Nixon, Reagan, the second Bush–only dog-whistled their desire to turn back the clock on some rights, and mostly as a distraction from their wars (on regulation or non-whites across time zones, whichever). Trump was explicit: civil, voting, women’s, gender and immigrant rights, plus regulations, all bad. Or “sad,” in the Trump lexicon. We’re now full in that great regression, aided by a majority of Supreme Court justices who seem to get most of their culture-war jurisprudence from Cotton Mather’s Wonders of the Invisible World. The question is whether Trump will be our ages’s Jonathan Edwards, sermonizing us with such grotesque determinism that his compulsive excesses become the seed of trumpism’s doom. It seems inevitable. But pendulums will not be rushed. Nor should we fool ourselves gain that whatever follows will have anything to do with progress.

—P.T.

Now this: The lecturer, from the YouTube summary: Jamie Warren has a Ph.D. in American History from Indiana University, and she is an Assistant Professor at BMCC-CUNY where she teaches American history, the history of women and gender, and women’s studies. Her research focuses on slavery in antebellum South with a particular focus on death, the body, and the philosophy of history.

![]()

The Live Calendar is a compendium of local and regional political, civic and cultural events. You can input your own calendar events directly onto the site as you wish them to appear (pending approval of course). To include your event in the Live Calendar, please fill out this form.

January 2026

Palm Coast City Council Meeting

In Court: Angel Marie Sexton Sentencing

Flagler Beach United Methodist Church Food Pantry

In Court: Kristopher Henriqson

Weekly Chess Club for Teens, Ages 10-18, at the Flagler County Public Library

Flagler Beach Library Writers’ Club

Random Acts of Insanity Standup Comedy

Contractor Review Board Meeting

Flagler County’s Technical Review Committee Meeting

Flagler Tiger Bay Club Guest Speaker: Jeff Brandes

Separation Chat: Open Discussion

The Circle of Light A Course in Miracles Study Group

Palm Coast Planning and Land Development Board

For the full calendar, go here.

The return of Congress from its August recess brings a critical inflection point for President Trump, who has used the first phase of his second term to swing a wrecking ball through the American establishment with astonishing speed and force. From MAGA enthusiasts to No Kings protesters, whether one sees outdated shibboleths justly demolished or a precious inheritance tragically wasted, everyone agrees on the astounding scope of the changes wrought: the global economic order upended, the border secure and deportations underway, foreign aid programs gutted and entire agencies shuttered, Ivy League universities brought to heel. But what now? Each of these actions was a necessary first step toward the kind of reform championed by the administration’s officials and supporters. New trading relationships cannot take form until partners accept that the old arrangements are over. Employers will not begin thinking about how to create jobs that Americans will do until they lose easy access to a supply of illegal and easily exploited workers who will take jobs that Americans won’t. Universities have shown for a decade that enough money on the line will send them scurrying to develop a new campus in Qatar, but no amount of criticizing and cajoling would move them one inch closer to the cultural mores or economic priorities of the nation on which they depend. […] It’s the next stage, however, that will define Mr. Trump’s legacy: Can he and his administration move past the demolition, clear the debris and, well, build back better? The pain imposed thus far has been intentional, is proving tolerable and will be well worth the cost if it helps to move the economy and various national institutions onto a stronger long-term trajectory. But without follow-through the nation will see the pain without much gain. Does he have the will to pursue his promise of a new golden age for American workers and their families?

–From “This Is the Moment We Find Out if Trump Is for Real,” by Oren Cass, New York Times, Sept. 3, 2025.

Pogo says

P.T.

You’re in top form today.

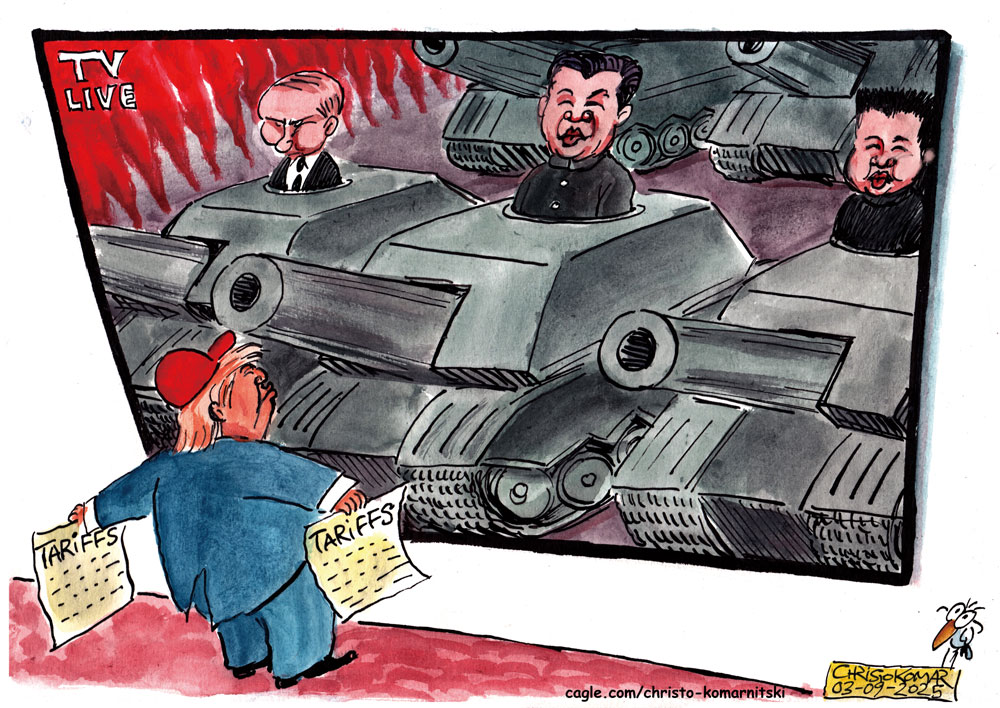

What, I wonder, causes the focus of all attention on the dilapidated monster who is a priori too lazy, self-involved, and grossly inadequate a person, alone, to credit for this bleak moment. Today’s cartoon, indeed, explains — and answers, in very large part, the question.

My compliments — and gratitude.

Pierre Tristam says

Thank you Pogo. The other day I was reading an old review by John Updike on Al Capp, and of course he mentioned your namesake, which made me smile: we still have ours.

Ray W. says

Fortune expended effort on attempting to understand the growing plight of the American farmer in a brave new world of tariffs.

Here are some bullet points from the article:

– Agriculture produces $9.5 trillion each year to the American economy, “representing 18.7% of total national economic output.”

– The farm sector directly or indirectly employs over a million workers “across farming, manufacturing, transportation, and related industries.”

– “In 2023, every $1 billion in U.S. agricultural exports supported approximately 5,997 jobs. Soybeans and corn bulk exports alone supported over 212,520 jobs. The economic multiplier effect means disruptions to soybean trade ripple through manufacturing, logistics, and rural communities nationwide.”

– The story starts its focus on the soybean sector as follows:

– “U.S. soybeans currently face a 20% retaliatory tariff disadvantage compared to South American competitors, pushing the total duty rate on American soybeans to 34% when combined with other taxes.”

“American soybean farmers are heading into harvest season without a single order from China, historically their largest customer, raising alarm bells about the agricultural sector’s stability and broader implications for the U.S. economy.”

– The president of the American Soybean Association, Caleb Ragland, representing America’s 500,000 soybean farmers, announced in a TikTok video:

“Right now, we’re in a very dire situation.”

– Mr. Ragland told a CNN interviewer:

“China takes more of our soybeans than all other foreign customers combined.”

He added that 50% of all American soybeans are exported and that China represents a quarter of total soybean demand.

– In a normal year, one-third of annual sales are booked by this time of year, a percentage that represents some 8% to 9% of the entire U.S. soybean crop. Right now, the total amount of Chinese soybean purchases is zero.

– In an August 19 letter to President Trump, the American Soybean Association warned:

“China has contracted with Brazil to meet future months’ needs to avoid purchasing any soybeans from the United States.”

– Current soybean futures prices are 40% below what they were three years ago, at $10.10 per bushel. Estimated average production costs for soybeans are $11.03 per bushel. Mr. Ragland’s current crop will lead to $750,000 in losses if prices remain the same, “forcing him to rely on loans to bridge the financial gap.”

Said Mr. Ragland:

“Right now we’re planting a crop that looks like it will be produced at a loss. … By fall, when the soybeans are harvested and ready to sell, we’re gonna need a drastic improvement in our markets or it’s gonna get even tougher for farm families all across this country.”

– The 2025 U.S. soybean crop is estimated as the sixth largest in history, at nearly 4.3 billion bushels. Without Chinese demand, “this abundant supply threatens to further depress prices and worsen farmers’ financial distress.”

– The current situation “echoes the 2018-2020 trade war, during which U.S. agriculture lost $26 billion, with nearly $20 billion in soybean losses alone.”

Make of this what you will.

Me?

Tariffs are a tax. If a tariff on a particular product is too high, it can be, in effect, an embargo on that product, not a tax. It may be that a 34% effective tariff rate on soybeans is, in effect, an embargo on soybean exports, with all the ramifications to our economy that an embargo on agricultural export brings.

And if this come to be true, just who among us will be the one who takes responsibility for this situation? Will it be the gullible fools who gave a mandate to the current administration to impose tariffs on the world who will take responsibility for their action?

Much has been made of the reordering of international supply chains. What happens when others nations take the step to forever severe supply chains with America. The Chinese are severing supply chains with America with soybeans. The whole world is seeking travel and leisure opportunities in locales other than the U.S. Each of these actions harms our economy.

The reporter mentions the “economic multiplier effect”. All my adult life, stories about the economic multiplier effect explain that the effect in the tourism sector is between a multiple of three and a multiple of seven. The economic multiplier effect in other economic sectors may be different. For example, buying gasoline results in very little of the money spent remaining in the community to multiply. Buying cabbages or onions or potatoes at a farmer’s market means that almost all of the money stays in the community to multiply. Repairing a used car at a local mechanic’s shop or at a locally owned dealership means that some of the money spent stays in the community, but most on the money spent on parts leaves the community.

Every city council member and every county commission member across the state understand that when a tourist family spends a week in their jurisdiction, renting a motel room or a home and buying groceries or going out to dinner, the amount they spend will be multiplied by a factor ranging from 3 to 7 times, depending on what is purchased or how the money is spent.

When a portion of the usual Canadian visitors decide to stop spending money here in Flagler County, the true economic cost of that decision is a multiple of that which is not spent here. Each $1,000 not spent in Flagler County by a Canadian snowbird who no longer visits, when multiplied, means between $3,000 to $7000 loss in local economic impact.

Ray W. says

A recent Seeking Alpha articles focuses on a “record” American farm trade deficit in July.

Here are some bullet points from the article:

– “Farm imports outpaced exports by $4.97 billion in July, a 9% increase from a year earlier and the largest deficit ever recorded for that month, according to Department of Agriculture data released Monday.”

– From January through July, “the deficit reached an unprecedented $33.6 billion.” Farm imports over that term rose 8% to $132 billion, while farm exports fell over the same term by 1.3% to $98.8 billion.

– The author writes that “[t]he deficit may widen further as a fresh round of tariffs, layered on top of levies introduced earlier this year, took effect in August.”

– For decades, the U.S. agricultural sector experienced “consistent trade surpluses.” A trend in the agricultural sector that began during President Trump’s first term has resulted in America becoming a “net importer.”

Make of this what you will.

Me?

Just because America reversed a decades long trend of agricultural net positive export figures after President Trump imposed tariffs on China in 2018 and China reciprocated by imposing tariffs on U.S. agricultural products doesn’t mean that President Biden couldn’t have done things to reverse the new downward export trend when he was in office.

But I have long argued that once a sector, such as the American agricultural sector, loses market share to its competitors, it is hard to regain the lost market share.

OPEC is willing to flood the world’s crude oil marketplace with oil in order to restore market share lost after OPEC voluntarily cut its production figure, but it has the capacity to do that. What Trump did in 2018 with his tariffs on China was teach Brazilian farmers how to grow soybeans. Seven years later, China no longer needs our soybeans.

I can’t wait for all the Trump supporters to accept responsibility for their actions.

Ray W. says

In a Saturday note to investors generated by Torsten Slok, Apollo Global Management’s chief economist, writes a Fortune reporter, Mr. Slok observed that “job growth in tariff-impacted sectors is negative, while those not affected by tariffs have seen slower growth but remained in positive territory.”

According to the reporter, Mr. Slok sees March as the start of the trade war. He lists the sectors impacted by tariffs as manufacturing, mining and logging, construction, wholesale trade, retail trade, transportation, and warehousing.

As foundation to the story, the reporter writes:

“Trump’s on-again, off-again tariffs have made that pinning down the exact start of his trade war a bit tricky. In February, he signed an executive order to impose tariffs on Canada, Mexico and China, but put the ones on Canada and Mexico on hold till March.

“In April, he unveiled his ‘Liberation Day’ tariffs on nearly all countries, but put those on hold after a week amid a market crash. Since then, Trump has reached deals with several trading partners while talks with China continue. But for more than 90 countries without such deals, so-called reciprocal tariffs took effect in August, though they also face a major legal challenge.”

Since March, per the reporter, a “deep-dive” into Bureau of Labor Statistics shows that “across all tariff-impacted industries, payrolls fell by a net 90,100 after February — the last pre-trade war month. By contrast, payrolls overall grew by 385,000 during that span, as the health care and hospitality sectors, which are less affected by tariffs, have been the main drivers of job growth.” In manufacturing, 41,000 jobs have been lost. In wholesale trade, another 34,000 jobs have lost. Construction has been flat, neither losing or gaining jobs. Retail jobs added 19,000 jobs over the six months. Mining and logging, which category includes oil and gas extraction, lost 16,000 jobs.

The reporter claims that in recent months, more industries have been cutting jobs than adding them. Moody’s Analytics chief economist, Mark Zandi, said that this industry-wide event happens “only when the economy is in recession.”

Make of this what you will.

Me?

I am not ready to adopt the idea that the American economy is in recession, but I can’t ignore the obvious.

The jobs market is weakening in a way we have not seen in a long time. Inflation is rising. Consumer confidence is wavering. Exports are still down. Imports are up. The market yield for long-term bonds (30-year T-bills) is way up, still close to 5%. The American dollar, when compared to a “basket” of other national currencies, is unusually weak.

Red flags wave from multiple different economic models.

Trump administration officials no longer crow at the strength of the American economy. Instead, they are saying things like we need to wait a year before we see the economy taking off. Who knows if they are correct? I hope they are.

Ray W. says

During a Fox News segment called “America’s Newsroom”, host Bill Hemmer interviewed Kevin Hassett, who is the Trump administration’s Director of National Economic Council.

When Hemmer asked Hassett to clarify a comment about Hassett’s expectation that September’s jobs number are going to show a comeback, Hassett said:

“Yeah, and there’s another big revision next week, but the point is that these numbers, the reason why they’re getting revised so much is that the numbers are based on surveys and people are not filling out the surveys until the last minute, and so the share of surveys that have actually been filled out at the beginning of the month is way lower than it used to be.”

Make of this what you will.

Me?

If Director Hassett is accurate, then the fault in the initial monthly jobs estimate has nothing to do with the performance of BLS employees. Rather, the fault lies in the fact that fewer and fewer individuals and businesses are filling out the surveys on time. If everyone filled out their surveys on time, there would be little difference between the initial estimate and the later revisions.

Make of this what you will.

Me?

I have been arguing for a long time what Director Hassett just admitted during a Fox News interview. The initial monthly jobs report is an estimate, and nothing more than an estimate. When more data comes in, the estimate is revised, as it should be. There is nothing wrong with the jobs reports. They are not bad. They are less good than than they can be because surveyed people and businesses don’t act as quickly as they could.

Pogo says

@Necessity

… is the mother of invention.

https://www.bing.com/search?q=Necessity+…+is+the+mother+of+invention

Trump has reminded the rest of the world of this every time he draws a breath, and the rest of the world it is behaving accordingly.

Tic toc (not the app, children) mothertruckers — the expiration date on Trump’s crap is already lo-o-ong gone.

Ray W. says

Slate just published a story titled “Here’s What Happened the Last Time a U.S. President Bullied the Fed Like Trump”

As foundation for the story, the reporter wrote:

“By law, the Federal Reserve operates independently of the executive bank. So does the Federal Deposit Insurance Corporation, or FDIC, which insures anyone with a U.S. bank account. As does the National Credit Union Administration, which insures local credit unions, and the Federal Trade Commission, which makes sure that the biggest corporations in the nation and the world play by the same rules as everyone else.

“Congress specifically designed the Fed (like the FTC) to operate with independence, so that it can leverage its unique expertise to make decisions that are best for the long-term well-being of the American economy and the American people — not to score short-term points for the primary benefit of a sitting president. In a 2010 speech, Federal Reserve Chairman Ben Bernanke explained, “Policymakers in a central bank subject to short-term political influence may face pressures to overstimulate the economy to achieve short-term output. … Such gains may be popular at first, and thus helpful in an election campaign, but they are not sustainable and soon evaporate, leaving behind only inflationary pressures that worsen the economy’s longer-term prospects.”

Now that the foundation has been set, here is the author’s point about president’s bullying the central bank’s chair:

“In the run-up to the 1972 general election, President Richard Nixon exerted enormous pressure on Federal Reserve Chairman Arthur Burns to make monetary policies that were deleterious to the national economy but favorable to Nixon’s political prospects. The Federal Reserve’s loss of independence during this period contributed significantly to the economic period now known as the Great Inflation.

“Like Trump, Nixon dressed up his distaste for democratic norms in humor. At Burns’ swearing-in ceremony, Nixon joked, ‘I respect his independence — however, I hope that, independently, he will consider that my views are the ones that should be followed.’

“Similar to President Trump’s recent remarks pressuring Fed Chairman Jerome Powell, Nixon waged an unabashed pressure campaign to manipulate the Federal Reserve and expressed open frustration with Burns’ refusal to acquiesce. Transcripts from one particularly heated meeting in the Oval Office between the president and the Fed Chair reveal an exasperated Nixon shouting, ‘The whole point is, get it [the money supply] up. You know, fair enough? Kick it!’

“When that didn’t work, the Nixon administration retaliated against Burns by strategically leaking stories to the press that disparaged Burns’ character and exploited his fear that the U.S. Treasury would attempt to take over the Federal Reserve. With striking similarity to Trump’s own pressure against Powell and Cook, Nixon organized his allies on Wall Street to write letters to Burns to ‘urge a more expansive monetary policy’ and ‘predict[ed] disaster’ if the Federal Reserve did not increase the supply of money. The administration even planted a false story that Burns was requesting a pay raise when, in truth, he had asked for a pay cut. What the president could not squeeze from the Fed Chair in private, he would attempt to coerce from him in public.

“These tactics deeply annoyed Burns, and they also created a no-win situation for him. In a private diary entry in November 1971, Burns wrote, ‘The President’s preoccupation with the election frightens me. Is there anything that he would not do to further his reelection?’

So, according to the author, despite evidence that inflation was rampant, the Federal Reserve expanded the money supply by printing more money and it anchored the lending rate below 5%. “Inflation ballooned, business investment stalled, and unemployment reached its highest levels since the Great Depression.” Nixon was reelected, but America eventually paid a great price.

In 1976, during a Bryant College commencement speech, Fed Chair Burns said:

“The founders of the Federal Reserve System were well aware of the dangers that would inhere in the creation of a monetary authority subservient to the executive branch of government — and thus subject to political manipulation.”

The author concludes:

“Since Trump took office, job growth and GDP have stalled, while inflation is back on the rise. Desperate for the economic sugar high of lowered interest rates, Trump is attempting to bend the Fed to his will — most recently by taking the unprecedented move of firing Fed governor Cook and threatening her with criminal action. In a speech at the Economic Club of Chicago on April 17, Powell said the Fed would hold a very high bar for interest rate cuts in light of Trump’s new tariffs. In response, Trump told reporters, ‘Powell’s termination cannot come fast enough.'”

As an aside, according to the reporter, when Turkey’s Erdogan tried to strong-arm his nation’s central bank, the value of its currency plunged by 400%. When Chavez took over Venezuela’s central bank, inflation soared by 2 million percent.

Make of this what you will.

Ray W. says

I see that after President Trump claimed to have brought peace to the Middle East, in the estimation of at least one FlaglerLive commenter, the IDF earlier today launched an operation called “Summit of Fire”, which operation struck a building in Qatar’s capital city, Doha with rocket fire.

According to the CNN story, Hamas leaders had gathered in the building that was struck. Five Hamas members are dead.

Make of this what you will.

Me?

Only the gullibly stupid among us would post a comment to the FlaglerLive site that Trump brought peace to the Middle East.

The IDF continues to destroy Gaza. Saudi Arabia recently attacked once again Houthi rebels in Yemen. An unnamed group recently blew up a Kurdish crude oil pipeline. Israeli citizens remain under constant threat of attack. Palestinians in the West Bank continue to be murdered by religious extremist Jewish settlers, who want all of the land of Palestine from the river to the sea.

Ray W. says

According to a story published by The Independent, John Deere told investors via its third quarter earning report that tariffs had cost the company $200 million, up from the $100 million that tariffs had cost the company before the third quarter. Deere economists believe that tariffs will cost the company $300 million more dollars in the fourth quarter.

Make of this what you will.

Ray W. says

Early this year, according to a CNBC story, the U.S. Travel Association projected foreign travel spending in the United States would rise to $200.8 billion for the year.

Noting a “sharp and widespread” downturn in arrivals, the World Travel & Tourism Council now projects that foreign traveler spending in the United States would be $169 billion for the year.

Make of this what you will.

Ray W. says

More on my John Deere comment in this thread.

John Deere said what it said about tariffs and their impact on John Deere’s bottom line because the company knows that it can be sued if it lies to investors, current and potential, on its earnings statements. And investors, historically, have never been afraid to sue over false or misleading statements in company earnings reports.

This, arguably, why is why GM told investors, current and potential, in its most recent earnings statement that it anticipates a $5 billion hit for the 2025 year due directly to tariffs. And this is why Ford told investors, current and potential, in an earnings statement that it anticipates a $2 billion hit for the 2025 year due directly to tariffs.

Who knows how many other publicly owned companies are telling their investors that tariffs are directly and negatively impacting their bottom lines?

And it has to be considered, too, that some company bottom lines are benefiting from tariffs. Some companies have to be reporting to their investors that their bottom lines are healthy due to tariff impacts.

I accept I might be wrong about this, but to me if Ford takes a $2 billion hit from tariffs during 2025, that means that Ford is not passing all of its tariff costs to its customers. Ford, it appears, would rather take a profit loss than risk losing market share by raising vehicle prices.

And I might be wrong on this, too, but to me if Ford takes a $2 billion hit to its profits this year, that might also mean that those union workers who have a profit-sharing agreement built into their union’s contract with Ford will bring home less money than they would have brought home had the tariffs never happened.

The reason I comment on this is that the complexity of our economy boggles my mind. Some FlaglerLive commenters don’t seem to be bothered at all by the complexity. They read about or hear something they like, whether it is true or not, and they suddenly become convinced that they fully understand the economy. I do not do this. I know that I am not an economist. At best, I am a curious student.

To me, tariff strategy is greater than simply saying that money paid by importers due to tariffs will go to the Treasury to offset our deficit. I do not take at face value the claims by the administration that collected tariff revenue is the only thing we should look at. The issue is much more than that. If a hypothetical 10,000 Ford union employees receive smaller profit sharing checks from Ford, they directly lose from the tariff hit to Ford’s bottom line. Their tax payments will not reflect what they would have received sans tariffs, meaning their tax payments that go into the Treasury will be smaller, offsetting some of the tariff revenue the administration is crowing about.

Ever since the onset of tariffs early in 2025, I have been cautioning FlaglerLive readers that a wait and see approach is the most reasonable to adopt among other reasonable options. Don’t jump to conclusions based on short-term economic data, I argue. Yes, we are more than eight months into the tariff experiment. I still wonder whether enough time has passed to begin to draw conclusions about the true impact of tariffs.

I continue to assert that no economist alive today has ever seen an average effective tariff rate as high as it is today. If that is true, then perhaps it is also reasonable to argue that no economist has developed a predictive economic model that accurately explains what such high average effective tariff rates will do to our economy, and to economies all over the world?

And is it reasonable to argue that no one knows whether the tariffs will be effective as a positive economic tool to bring about world change, as a few FlaglerLive commenters argue, or whether tariffs will be nothing other than a destructive force, no matter whether world change occurs or not?

I think that the Fed economists have resisted significant political pressure to cut lending rates for as long as they have because they, too, do not believe that they have a competent predictive economic model either. “Let’s wait and see” seems to be their approach. If what I argue is accurate, can it be inferred that Fed economists simply do not know with any measure of certainty what actually is coming down the pike?

Meeting after meeting this year, a majority of the FOMC voting members vote to wait for more data before cutting the lending rate. At last month’s meeting, only two of the 12 voting members voted to cut the lending rate, one by a quarter of a percent and the other by a half of a percent.

The next FOMC meeting is set for later this month.

Ray W. says

CNBC reports that today’s Bureau of Labor Statistic’s “producer price index [PPI]” report “unexpectedly” revealed a 0.1% drop in wholesale prices “across a broad array of goods and services.”

And, July’s PPI report on wholesale prices was revised downward to a 0.7% increase for the month.

To me, both of the August figures are economic positives, though the July figure that was revised downwards to 0.7% is definitely not a positive economic number.

Twelve straight months of that type of inflation would yield 8.4% inflation for the year. This is why I caution against placing too much emphasis on short-term economic reports. If you average July’s 0.7% figure with August’s -0.1% figure, you get 0.3% for the two-month period. Extrapolated out over a year and you get 3.6% inflation, which is definitely not good.

Year-over-year, wholesale prices rose 2.6%, a figure above the Fed’s adopted target number of 2.0%, meaning that inflation in wholesale prices for goods and services remains above what the Fed is attempting to accomplish by keeping lending rates higher than what the administration desires.

“Core” PPI, year-over-year, is up 2.8%. For August, “core” PPI dropped 0.1%, too.

“Core” means that the more volatile trade, energy and food categories are stripped away from the normal figure contained in the report.

According to numerous economists, year-over-year “core” PPI is one of the most important figures the Fed considers when its Fed Open Market Committee meets to decide the lending rate.

Another figure in the August wholesale PPI report on which the Fed relies is “services” prices, as opposed to “goods” prices. Services wholesale prices dropped 0.2% for the month, also a good monthly figure.

Chris Rupkey, Fwdbonds chief economist, told the CNBC reporter:

“Net, net, the inflation shock that was not is rocketing markets higher as inflation barely has a heartbeat at the producer level which shows the tariff effect is not boosting across-the-board price pressures yet. … There is almost nothing to stop an interest rate cut from coming now.”

Make of this what you will.

Me?

Mr. Rupkey presents as an economist who can become enamored by a single month’s report. And why not? It is a positive figure!

Like him, I welcome the report as good news, but it is news possibly too volatile on which to base an opinion.

For example he argues that there is no inflation shock. My argument is that the average effective tariff rate across all goods and services was under 3% at the beginning of the year. Yes, high tariffs were imposed early in the year, but almost all of the early high tariffs were almost immediately delayed. Some of the high tariffs were delayed second time. It wasn’t until early August when today’s average effective tariff rate finally took effect.

Different stories show different average effective rates right now, but almost all of the stories have the average rate at just under 20%. I remain unconvinced that there has yet to have been any true “shock” from the tariffs. The lag time for a true tariff shock to occur likely remains far in the future.

To me, a few more months of this type of deflationary yet positive figure and the year-over-year wholesale “core” inflation rate will drop much closer to the desired goal of 2% inflation from the 2.8% at which it sits right now. I argue wait and see. Relying on short-term reports might not be the wisest choice. But you can’t ignore such a report, either.

Ray W. says

According to a CNBC story, last Thursday, before the August BLS jobs report was released, President Trump as asked about the upcoming release of the report. He answered that Americans could expect to see “the real numbers” in about a year.

He followed up by saying:

“The real numbers that I’m talking about are going to be whatever it is, but will be in a year from now on. … You’re gonna see job numbers like out country has never seen before.”

The next day, Commerce Secretary Howard Lutnick was asked whether the figures in the report were accurate. Secretary Lutnick talked of his expectation that the removal of people from the Bureau of Labor Statistics would improve the data:

“I think they’ll get better because he’ll take out the people who are just trying to create noise against the president”, adding that “people would see ‘the greatest growth economy … starting six months from today to a year from today.'”

Make of this what you will.

Me?

Secretary Lutnick is lying to the American people. The jobs figures coming out of the BLS reports are accurate for what they are and what they were designed to be. He knows that to be true.

The narrative is that BLS employees are working against the president. However, all raw data collected by surveyors and interpreted by economists is retained and available for study. All methodology and statistical algorithms are tested and reliable. The system is set up for revisions and always has been, dating back to 1979, when the agency was created.

What the current administration is setting out to do is to change the methodology by which BLS creates the jobs reports. Once a new algorithm is claimed to be adopted, any new data obtained by meeting with individuals and surveying businesses will not be compatible with any of the older BLS findings. The Trump administration is attempting to transform transparent data collection methods utilized by an independent statistical body into a dependent agency tasked to produce politically bendable figures.

Right now, the BLS jobs data is considered the most reliable in the world, according to President Trump’s commissioner of the BLS during his first administration. There is zero evidence that BLS employees are “trying to create noise against the president.” Removing people will not improve the data.

For years, all efforts to properly staff the BLS have been thwarted. Yes, the agency’s breadth and rapidity of data collection could be improved by hiring more people. That that is a different issue.

Ray W. says

Here is CNN’s take on Wednesday’s preliminary annual revision to the BLS monthly jobs figures dating from April 2024 to March 2025, a statistical revision that has been taking place each and every year for the past 90 years. The process is known as the annual benchmark review of jobs data.

As foundation, each month of every year the BLS releases a monthly jobs report, based on preliminary returns of both business surveys and individual contacts. The results are known to be nothing more than estimates at the time of publication. Each month’s jobs estimate is revised for the first time in the following month’s jobs report. The initial estimate is revised once again in the second following month’s jobs report.

By definition, the monthly jobs report “is meant to provide a higher-frequency look at employment trends, but that timeliness comes with a cost to accuracy.”

At the same time, data that is being gathered from entirely different sources is to be used for an annual report, not in the monthly reports. The annual report is called the Quarterly Census of Employment and Wages (QCEW) report.

This QCEW report is more comprehensive and more accurate than the monthly jobs report, because its data comes from quarterly tax records submitted by businesses to the state government in which the businesses resides. The problem inhering in the annual report is that the tax data comes with a significant lag time. Unlike the monthly jobs report, which sacrifices accuracy for speed, the annual QCEW report is designed to be more accurate but at a cost to immediacy.

A preliminary edition of the annual QCEW-based report is released each September. It’s focus is on data gathered between April 1 of the previous year to March 31 of the current year. Every jobs statistician ought to know that the preliminary QCEW-based report is not the final annual QCEW-based report. The final annual QCEW-based report is released each February of the following year.

For purposes of the CNN story, this year’s preliminary annual QCEW-based report came out yesterday, Tuesday, complete with a downward revision to the collective job totals from the twelve monthly BLS estimates, dating from April 2024 to March 2025. This year the September QCEW-based downward revision is 911,000 fewer jobs than those collective job figures reflected in the twelve monthly jobs estimates.

Last year, when the preliminary annual QCEW-based report came out in September 2024, the downward revision to the twelve collective monthly jobs reports was 818,000 jobs. In the February 2025, final annual QCEW-based revision to that September preliminary 818,000 fewer jobs figure corrected it down to 589,000 fewer jobs.

According to the reporter, statisticians say that ever since the pandemic and the economic environment that followed the pandemic, there have been unusually large revisions to the monthly jobs figures. The problem at issue is identified by the statisticians as the “birth-death model”, which is not a mortality event, but a business event. The model tracks the birth of new businesses and the death of businesses, old and new. It is somewhat easy to track the creation of a new business, but more difficult to track the death of businesses, old and new.

Based on pandemic-derived issues arising from the birth-death model, economists already were predicting a large downward revision to the jobs data from the 12 monthly reports issued between April 2024 and March 2025, just as they had predicted a large downward revision to last year’s jobs data, for three reasons:

1. Weaker-than-inferred job creation at new firms. More specifically, there is a “seasonal residuality problem” involving an “overestimation of new firms versus those that have gone out of business “that bedevils “data-based estimates”, estimates that have yet to be “properly adjusted following pandemic era shocks.” That “seasonal residuality problem” is similar to that which occurred in the years after The Great Recession. “The BLS birth-death model has well-know[n] issues in capturing declines in business formation and bankruptcies especially around mid-cycle corrections and end of business cycle dynamics.”

2. Sampling errors resulting from declining survey response rates, an error problem that can be reduced by hiring more BLS surveyors.

3. Adjustments for asylum-seekers and other undocumented workers.

According to the reporter, “[t]he recent years’ massive increase in immigration helped to ease substantial labor shortages that occurred as the US economy quickly ramped up following the pandemic. However that very dynamic wasn’t the easiest to measure and estimate.

“Since the QCEW data is drawn from tax filings for unemployment insurance, it’s likely to exclude undocumented workers who are not eligible for benefits. Whereas the monthly jobs reports are drawn from surveys of businesses who relay back the number of people on their payroll.”

Make of this what you will.

Me?

Many decades ago, the federal legislature created and funded the Bureau of Labor Statistics. The goal was a politically independent agency that could produce both speedy but inaccurate monthly jobs data and slow but more accurate annual jobs data.

Why? Business can’t wait up to two years to get the best available jobs data. Businesses need to compete in an international marketplace. Speed is important. Yes, the jobs data might not be as good as it will be later, but it is needed to help keep American businesses more competitive.

So let’s ask ourselves:

Does it make sense that when BLS surveyors contact business owners each month for their total employment rate that the employers will accurately and honestly tell the surveyors the total number of employees on the payroll, regardless of whether the employees are undocumented, documented, or native-born?

And does it make sense that undocumented workers cannot by law apply for unemployment insurance if they are fired or laid off?

And does it make sense that when BLS statisticians gather, in part, tax filings for those fired or laid off workers who can apply for unemployment insurance, that that figure might exclude undocumented workers from consideration in the data?

Finally, does it make sense that, without the presence of the undocumented in the unemployed data collected by the BLS for the annual report, but the undocumented are included in the monthly jobs data, then the jobs figures obtained for the monthly reports might be higher than that derived from the jobs figures gathered for the annual reports?

So, yes, I argue that the jobs data from those 12 monthly reports issued between April 2023 to March 2024 should have been ultimately revised downward by 589,000 jobs, though not by the preliminary 818,000 jobs. But, I argue that it needs to be considered for context that the jobs data obtained from the 12 monthly reports between April 2019 and March 2020 was also revised downward by the annual report, this time by 514,000 jobs.

And it needs to be considered that the biggest downward final annual revision to the 12 monthly jobs reports occurred in February 2009, when the figures from April 2007 to March 2008 were revised downward by 902,000 jobs, a period that took place just after The Great Recession.

But there can be no doubt that revisions to all jobs reports are built into the process.

I have not forgotten the comments posted by two of our more gullibly ignorant FlaglerLive commenters who repeatedly complained that former President Biden had been manipulating the monthly jobs figures. Over and over again, the bitter duo commented not knowing they were laundering lies. Perhaps they still don’t realize that they were laundering lies.

I await apologies to all FlaglerLive readers from those two gullibly ignorant commenters.

To sum this up, the BLS has done nothing procedurally wrong. I suppose that the understaffed BLS surveyors and economists and statisticians could make innocent errors, but there is no evidence of malice in the reports. But that flaw can be corrected by Congress funding more positions so that more individuals and businesses can be contacted and surveyed, so that better initial monthly jobs data can be collected.

Sherry says

An analysis published by The Budget Lab at Yale on Tuesday finds Trump’s tariff hikes will likely increase the number of Americans living in poverty by 875,000 in 2026. This increase includes an additional 375,000 children in poverty.

The figures are based on the Official Poverty Measure, a long-standing poverty metric based on pre-tax income.

Tariffs and related price hikes tend to hit low-income families the hardest. Less affluent households typically spend a bigger chunk of their paychecks than high-income families on living expenses, meaning they’re more vulnerable to shifts in prices.

Not only that, but economists say lower-income households often buy more imported products — which are most exposed to tariff-driven price hikes — than higher-income households.

“Tariffs are a tax on American families,” John Ricco, associate director of policy analysis at The Budget Lab, told CNN. “Because tariffs are a tax on goods and services, instead of income, they hit harder on people who spend a higher percentage of income than they save.”

The Budget Lab also estimates the poverty rate would increase to 10.7% after accounting for Trump’s tariffs, up from 10.4% without tariffs.

Ray W. says

Mediaite is reporting that for the first time since Russia invaded the Ukraine, Russian drones penetrated deeply into Poland. Unlike prior Russian drone penetrations over Polish territory that paralleled the Polish border, nineteen drone flew into Polish airspace, prompting a defense response and an emergency shutdown of four Polish airports.

Apparently, all nineteen drones were shot down, after aircraft from the Netherlands, Italy, and NATO joined the Polish aircraft response.

Poland invoked Article 4 of the NATO treaty, a step short of the collective defense obligations set out in Article 5.

Poland’s Prime Minister, Donald Tusk, advised that he considers the situation the “closest to armed conflict since the Second World War.”

Russia’s Dmitry Medvedev, the former puppet president of Russia between Putin’s two stints as president, posted to social media after the incident that Finland was building a new “Mannerheim Line”, a reference to a WWII defensive fortification between Finland and Russia. With specificity, Medvedev posted:

“While building a new ‘Mannerheim Line’ in a fit of revanchism against Russia, the Finnish establishment must not forget that confrontation with us can lead to the collapse of Finnish statehood, this time forever.”

Medvedev ended his post:

“”… Unlike in 1944, no one will go soft on them this time. … As the saying goes, you get what you ask for.”

Make of this what you will.

Me?

It is true that two people can look out of a building from two different windows see completely different things.

There are some in the current administration who look out a window in the building and see Russia as a benevolent political entity that just wants to secure its borders from Nazi influences and to prevent the intrusion of NATO into the Ukraine. To these people, the Ukraine started the war and Russia is simply defending itself, as it should.

Then there are others across the world who look out a different window of the same building and see an aggressive, violent, insatiable Russia that seeks the Ukraine first in order to increase Russia’s native-born workforce, steal the Ukraine’s children, occupy its rich farmlands and gain access both to the Ukraine’s port facilities on the Black Sea and gain access to the Ukraine’s ample mineral and energy deposits. Finland might be next, followed by Poland, Romania and on and on in a piecemeal fashion.