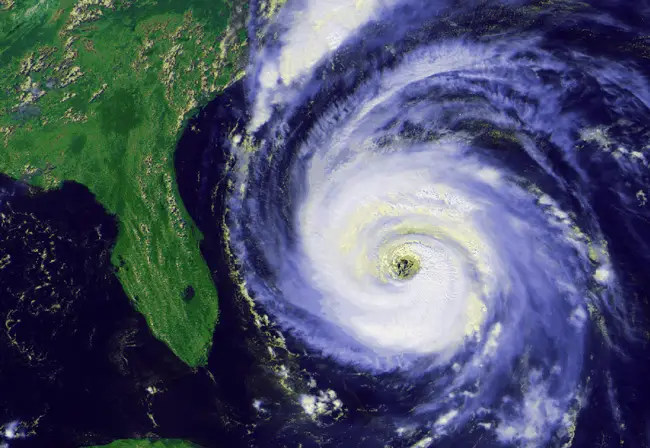

For a ninth consecutive year, the Sunshine State went through the six-month Atlantic storm season hurricane-free.

Eight named storms were recorded in 2014, six reached hurricane strength, and none visited Florida.

Quiet is always good. Still, Florida’s luck won’t last.

Another storm will eventually take aim at the state, hitting somewhere along Florida’s 1,350 miles of coastline and producing results that will be both chaotic and expensive.

But the near-decade respite has allowed the state and property insurers to rebuild from the physically and financially taxing 2004 and 2005 storm seasons.

“I believe we can handle a repeat of ’04 and ’05,” said Sam Miller, executive vice president of the Florida Insurance Council. “Our system is as strong and is better positioned to handle a major hurricane than anybody else.”

Of course, one well-placed storm could change the financial picture.

In 1992, there was only one hurricane, but Andrew, a tightly packed Category 5 storm, left a deadly path of destruction that included about 63,000 homes and $25 billion in damages south of Miami.

“If a major hurricane hitting Miami or Fort Lauderdale does $50 (billion) or $75 billion, the money will be found somehow. But I can’t point to a financial system and say here is how we’d get there,” Miller said.

Steve Burgess, Florida’s insurance consumer advocate, said the years of calm have allowed the state to reduce the potential risk of such catastrophic loss.

“I believe we are heading in the right direction with the current framework,” Burgess wrote in an email. “Every year that we avoid a major storm, we build surplus needed to absorb future losses.”

The state’s Hurricane Catastrophe Fund — insurance for insurers — is already considered financially strong for the 2015 storm season after increasing its available cash and lowering its potential exposure.

Also, policyholders in Florida have benefited as a pair of surcharges to cover damages from the 2004 and 2005 storms will be sunset earlier than planned.

The risk of future assessments has also been lowered as the state-backed Citizens Property Insurance Corp. has moved about a half million of its least risky policies into the hands of private insurers.

“As each year goes by without a hurricane, I think it makes investors and potential investors a little more confident and more willing to take on more Florida property insurance risk,” Burgess wrote. “To the extent we have more capital in the market, the stronger we are. More specifically, additional capital could help further shrink Citizens (through take-out and keep-out offers) and consequently the exposure of potential assessments.”

In September, the Citizens Board of Governors unanimously voted to end a 1 percent surcharge on July 1, 2015. The storm assessment, on the books since 2007, was previously slated to continue until June 30, 2017.

Citizens imposed the storm assessment on insurance policyholders throughout the state —- whether they were Citizens customers or not — to recoup $887 million of the roughly $1.7 billion deficit created by Hurricane Wilma, which hit South Florida in October 2005. The state picked up $623 million of the costs from Wilma, while the remainder was covered by additional assessments imposed on Citizens policyholders.

The September decision followed an order from the Office of Insurance Regulation for insurance companies to end on Jan. 1 a 1.3 percent “emergency assessment” for the Hurricane Catastrophe Fund.

The so-called “Cat Fund” charge, imposed on most home and auto policies, had previously been set to end July 1, 2016.

That assessment has hit policyholders for $2.9 billion, with the money going to reimburse insurance companies for claims from the eight hurricanes that hit Florida in 2004 and 2005, the last time any hurricanes made landfall in Florida.

Heading into 2015, Citizens will continue efforts to shift its least-risky policies into the private market through a number of depopulation efforts that include a new electronic clearinghouse.

The nine-year respite, according to Lori Rodriguez, Citizens legislative and external affairs project manager, has helped to stabilize Florida’s property-insurance market with an increase in available private-market coverage.

“A storm-free 2014 also allows Citizens to continue building its surplus, which, coupled with Citizens’ reduced exposure and enhanced reinsurance program, further reduces assessment risk for all Floridians and makes rate relief possible for many Citizens policyholders,” Rodriguez said in an email.

Miller expects state lawmakers to have a number of insurance issues to deal with in the 2015 legislative session, possibly including a revisiting of the state’s personal-injury protection auto insurance system.

“I like to think that homeowners’ (insurance) is not one of them right now,” he said.

–Jim Turner, News Service of Florida

Eye of the Storm says

I just put a new air condition unit and new wood floors in. This coming year will probably be Category 6 and hit Flagler directly. Karma does not like me !!!