As the state legislature again lowers school taxes and makes increasing, unfunded demands on local school boards, the Flagler County school district, unlike any other local government, is again staggering from sharp and little noticed financial crunch outside the Government Services Building. This is happening despite the best property value improvements in 16 years and a lean operation documented by budget figures that show a district operating with far less to do far more.

Here’s a startling fact few Flagler County residents are aware of: the Flagler County school district this year will be operating on $1.5 million less in revenue than it it 10 years ago, without accounting for the cost of inflation.

Ten years ago, it took in $118.5 million in federal, state and local dollars. This year, it’ll take in $117 million.

In inflation-adjusted dollars, the district is far behind: had its revenue kept up with inflation, it would have had to take in $155 million, just to be even with what it took in in 2011-12. It is, instead, operating at a $38 million, inflation-adjusted deficit.

Ten years ago the district was starting the year on a $148 million budget, including all appropriated expenditures, reserves and transfers. This year, it’s starting the year on a $127 million budget, a $21 million decrease, not accounting for the cost of inflation. Had the district’s budget kept up just with inflation, it would have had to be at $195 million. It is instead effectively operating at a $68 million deficit, compared with the inflation-adjusted budget of 10 years ago. (See the district’s proposed budget of 2011-12 here, and its current proposed budget here.)

No other local government agency comes close to experiencing the same decreases. To the contrary. Flagler County’s overall budget has grown from $137 million in 2011-12 to $228 million in the proposed 2022-23 budget, a $91 million increase, or 66 percent, and $48 million ahead of the 2012 budget’s inflation-adjusted dollars.

The sheriff’s budget, not including Palm Coast policing, has gone from $19.3 million in 2012 to $34.4 million, a $14.7 million increase, or 78 percent, and $9 million ahead of inflation-adjusted dollars.

Palm Coast’s overall budget has gone from $106 million to $249 million, an astounding $143 million increase, or 143 percent, and $110 million ahead of inflation-adjusted dollars. Utility and stormwater loans account for a lot of that increase.

The school district, in comparison, is a budgetary crater.

Enrollment has been flat during the period, but it has not decreased, and this year it increased by a few hundred. Salaries and benefits, which account for 80 percent of the budget, have increased substantially, which means other services have had to be cut back. The district is now required to offer a minimum wage of $15 an hour, which also means taking dollars from non-existent revenue.

The state is not only not funding the district adequately. It is, in essence, penalizing it. The state is doing so in three substantial, documented ways.

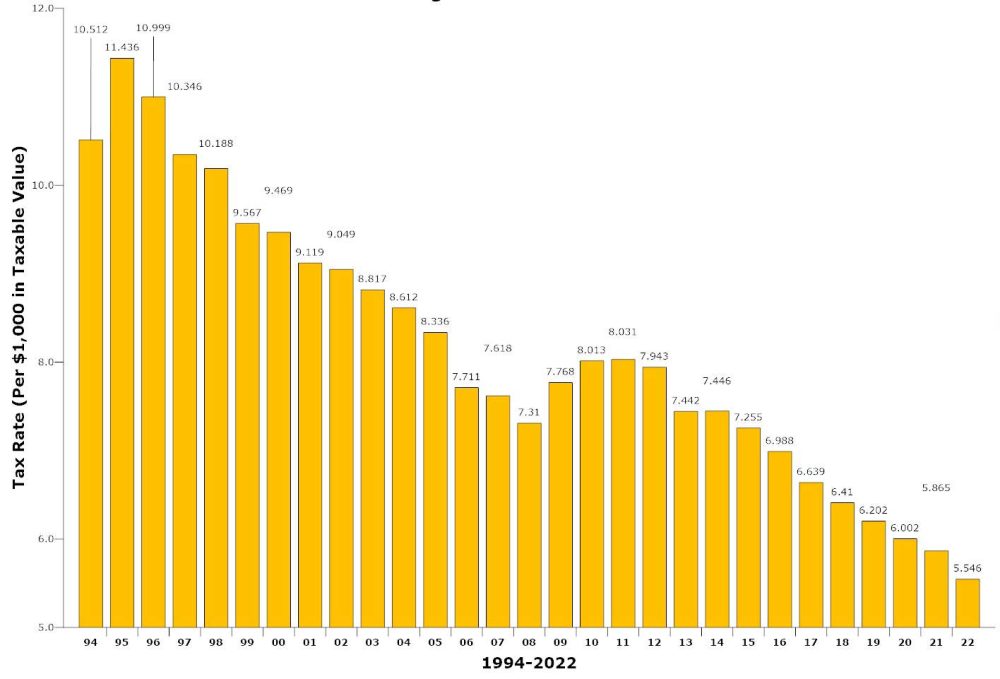

First, the state has lowered school property taxes sharply almost year after year since 1995, and has done so for the last eight years in a row, including this year, despite growing local needs and state mandates on local school districts. Local districts do not set their own property tax rates. Alone among local government boards in Florida, they must submit to rates set by the legislature. “We are the only taxing authority that does not get to set our own millage rates,” District Finance Director Patty Wormeck says.

“Our millage rate in total, including the discretionary and the capital, is 5.546 for 22-23, which again is our lowest millage rates since we peaked in 95-96 at 11.4 mills. So every year for the past several years that we’ve done this presentation, we continue to have to make that same statement: we are at the lowest millage rate again.” (The property tax rate of $5.546 per $1,000 in taxable value going into effect for next year means that a $200,000 house with a $25,000 exemption will pay $970 in school taxes.)

Second, Flagler has continuously received 95 cents back for every dollar it sends to the state treasury. Local officials have pleaded with State Rep. Paul Renner and Sen. Travis Hutson to correct the imbalance. Hutson and Renner have ignored the pleas, and in the last two years the two school board members closest to the legislators, at least politically (Janet McDonald and Jill Woolbright), were more interested in banning books, forbidding demonstrations, attacking minorities and firing personnel than lobbying legislators for budgetary redress. They were unelected from public office last week, though they’ll serve until November. The district is contending with nearly untenable budget math.

That 95 percent differential is still the same this year, Wormeck said. “So even though our property values go up, one would think that we have an influx of property tax revenue, which is not the case,” she said. “When our property values go up, the state funding goes down for us. So as a whole we are not going to be flush with cash because of property values. It’s just adjusted in a different way.”

“So many people relocate here from other places where they hear that we’re flush with property taxes that has increased so dramatically,” School Board member Colleen Conklin said. “The natural inclination is that you have more revenue. In reality that’s just not true in Florida, the way the funding formula works.”

Third, and most consequentially this year in particular, the state is accelerating its shift of public dollars to private- and religious-school education at the expense of locals school districts. The Flagler school district is taking a $6 million hit in that regard this year, an enormous, disproportionate share of the budget, including $3.5 million the state imposed after the district had submitted its annual estimates, forcing the district to raid its own reserves to balance the budget. Even school board members are shocked by the numbers.

“We have a very, very tight budget next year,” Wormeck said. She described the various hits on the budget during a budget hearing in early July. Like almost all budget hearings, it was not attended by the public. But it was among the more revealing meetings of the school board this year, numbing even its two usually more disruptive members.

The district monitors its fund balance, or reserves, very closely. It started the last fiscal year with $9.5 million in its reserves. But the district lost an additional $3.5 million (for a total of close to $6 million) to the state’s private-school scholarships–the ongoing state scheme that funds private and parochial school “vouchers” and so-called “opportunity scholarships” at public expense, drawing on local district’s revenue for the subsidies to parents. The money goes directly to the private schools.

Put another way: the state is syphoning those millions of dollars, year after year, from the district’s own tax revenues to underwrite the private-school education of children outside the system no differently than if, for example, the district was made to cut checks worth thousands of dollars for parents who educate their children at home. (Conklin asked for an accounting of the number of such “scholarship” students in the system.)

The money shifted to private education is going to schools with little to no accountability or oversight in the state’s eyes: the school district has no authority over the schools that syphon off tax dollars, inviting abuses. “The lack of transparency and accountability is is shocking, frankly,” Conklin said.

“So really, our traditional budget that we deal with every single year,” Conklin said, “this is a new cost that is basically being taken out of the budget. It’s basically a cut of $6 million.” The finance director confirmed the figure. This year the cut was “so drastic,” Wormeck said, because the state imposed its “scholarship” payments on local districts after districts had estimated their usual funding formula requirements, provoking the additional budgetary turmoil.

“It’s something that all school districts are dealing with. It has been a very difficult year for many school districts,” Wormeck said. “We are not alone unfortunately. But it’s a big hit.” She hopes there won’t be similar surprises in coming years.

When students get vouchers for private schooling but end up returning to public schools for disciplinary or other reasons, it isn’t a given that the district will get funding for them, at least not for several months: timing ends up penalizing the district, not the private schools, thus adding further pressures on the district.

So the district will have a $6 million reserve instead to start the year, after working “very hard to build this back up,” Wormeck said. It’s not over: the district is raising its lowest wages to $15 an hour. The state, of course, is not funding the district to do that. It will need to dip into reserves for another $1 million for that, and another $500,000 for other requirements to balance the budget, reducing the reserves to a projected, and alarmingly low, $5 million by year’s end.

“I continue to have talks with our superintendent or assistant superintendent about how tight this budget is, how much we need to monitor it,” Wormeck said. “It’s going to be a very tight year as you will see when you look at the budgets for all of our schools. They are tight, I mean there is no fluff.”

“I wish there was a magic wand to make some more money somewhere,” Board member Janet McDonald said. She was missing the point, however: it is not for lack of money that local school districts are being squeezed, but because of the Legislature’s twin strategy of starving the system on one hand with recurring cuts in the tax rate, and robbing it of tax dollars on the other, to benefit private schools. The district is also responsible for funding Imagine School at Town Center, the privately run charter school.

“I would like to see legislators take a little more interest in keeping an eye on those figures because we need to keep public schools strong and yes, we can do it through competition and by what we offer and the value of our education process,” Board member Cheryl Massaro said. “My concern is that it’s actually weakening the public school base, and you can see how it’s affecting us financially. And $5 million left in the fund balance is extremely low. That’s low. And you know, we’ll try to build that back up but if any major issue should develop within that year, we’re wiped out. we’re wiped out, and that’s bothersome.”

But legislators going back to the administration of Jeb Bush have been shifting public dollars to private instruction. The trend is only accelerating, including with champions like Hutson and Renner, the latter now Speaker of the House mirroring Gov. DeSantis’s policies. DeSantis favors more privatization of public schools.

“You’re going to see this trend is going to continue and it’s going to increase,” Conklin said, but you know, the the greatest concerns are about the lack of transparency and accountability for those tax dollars, because they are tax dollars and they are going to private entities, private organizations, for-profit organizations. We’ve seen even here pop up storefront educational schools, schools that you see it happening all over the state. So it’ll be something to watch and track.”

Jimbo99 says

I refuse to support funding any more schools, not with the track record of parents, children/students & the illiteracy for not trying. Not when they had NCLBA (Bush) & ESSA (Obama). These are lies that I don’t empower, not anymore. The schools here have been under capacity, still are, so it’s not classroom size. Some folks need to own their lack of investment to learn for themselves. With the internet having as much information as it does for FREE. I simply don’t want to be set up for the bilk & fleece of education system. Wanna know why Biden is cancelling student debt. Those are kids that were the byproduct of Bush & Obama education acts that failed. And Biden was part of that too as VP. The rest of us funded that, I’m not drinking the Kool Aid any more. Parents need to step up, children students need to step up and the teachers need to go back to the basics of learning and not these experimental methods. If these kids can’t read, that’s not our problem anymore. The books & dictionaries are available hard print or electronic & on line. NO MORE MONEY for sub par performance. Raise the bar, not lower it.

Geno says

Yet the schools in New Jersey, Connecticut and Massachusetts have thrived under the same mandates. I wonder where the problem is?

Skibum says

If you would take the time to do a minimal amount of research, you will quickly discover that studies continue to bear out the fact that it is democrats who are more highly educated than conservatives. Don’t take my word for it… I’ve put links below for your reference if you want to see the truth for yourself. Now it could be because a lot of more liberal minded people live in cities, where more colleges and universities are located when more rural areas seem to be havens for many conservatives. But I did want to reply to your comment since you seem to suggest that Democrat presidents are somehow responsible for negatively impacting our nation’s education system, which I don’t think is fair to imply. I believe it is in the interest of both conservatives as well as liberals to do what is necessary to maintain a very high level of education for K-12 and higher ed.

https://www.washingtontimes.com/news/2018/mar/22/democrats-more-educated-republicans-pew-research-c/

https://www.quora.com/Are-Democrats-more-educated-than-Republicans

https://www.npr.org/2016/04/30/475794063/why-are-highly-educated-americans-getting-more-liberal

Merrill Shapiro says

This is really not a problem in need of much concern at all! Moms for Liberty wants a 100% “say” in determining how our schools are run. Can we not be certain that they will also accept responsibility for 100% of the funds necessary to make and keep our schools excellent?

Momof3 says

I’m guessing all the Moms for Liberty are educators then, correct? Because if not I don’t want you to have any say in how my kids schools are run.

Wow says

Government money for religious (owned) schools is completely unconstitutional. GOP wants to eliminate public schools altogether so they can control who attends, who teaches, and what is taught. It’s a little GOP re-education camp.

Bob J says

The money shifted to private education is going to schools with little to no accountability or oversight in the state’s eyes: the school district has no authority over the schools that syphon off tax dollars, inviting abuses. “The lack of transparency and accountability is is shocking

Celia Pugliese says

I always disagree that my taxes fund private education by undermining the funds for traditional public schools for all students! Further more the schools and board of Flagler County have a loosing battle when it comes to underfunding the school impact fees much lower in comparison with neighboring counties. Schools in Florida need to go back to the very effective PTA’s (Parent Teacher Associations) were we were members to collaborate and monitor the education of our children in a positive way! Nowadays organizations like these moms for Liberty..? what more Liberty they want when nowadays a student at 16 receives an AK47 or 17 whatever from his daddy as bday present or at 18 can go buy his own and then gets back to the school with it to kill fellow students and teachers! Why instead they do not organize a Mothers against Gun Violence in Schools and the sale ban of those high power machine guns and magazines like in other developed countries do, for the safety of their kids in school and everywhere? Don’t they want to secure that when their babies go to school comeback home safe at the end of the day, instead that fighting against literature etc. that do not have a bullet magazine on it? Or also instead of attacking dedicated teacher work together with them for the students safety sake ? When those Liberty moms will star addressing the high power fire arms first?

For all the above I really appreciate the Almighty that I am not a grandma having to worry daily when those babies are to be back home or not from school but I still care if my school tax dollars are used for what intended. Unfortunately our virulent political division undeniably is and will continue affecting the education and development of our children in a very negative way and the results show the reality every day on the reported tragedies. I am all for our taxes helping our young Americans to get a break on their students loans so more of them can get the higher education needed in our industries and not have a loosing hand versus their foreign hired competitors for less in special immigration visas given that instructed USA labor shortage, because allover the world countries have free universities for their people accessed only by the best thru admission test. Thank you President Biden for your signing on student loans was needed…I am always praying for positive change, may God help us all to achieve it!

Jimmy says

This makes sense. More and more kids are NOT going to public schools. After watching the School Board the last few years, is it any wonder? As mentioned, school enrollment at public schools is flat for the past 10 years…

Michael Cocchiola says

This is MAGA DeSantis, “The Education Governor”, starving public schools to feed religious-affiliated schools. Instead of preparing Florida’s students to compete in a world economy, they’re learning to pray. They’ll need it.

A.j says

Let me see. Less money for schools compared to 10 yes. ago. Largest cash surplus in 16 yrs. What is wrong with this picture. One problem I believe is tax $,s going to private schools. Hence the word private I thought they were funded by private donations. Perhaps more People of color can go to private schools since my tax $,s are helping to fund them. Will they keep people of color out and get the people of color tax dollars. Just a thought.

O the Repubs are running the state and county. People continue to vote them in, look what they are doing to our tax $s. Pretty soon the working man and the poor man will have no rights or money under Republican rule, regardless of your color and your vote, they don’t care for us. They WILL NOT GET MY VOTE. I would that other Dems think that way.

Denali says

You have come so close to the truth here. By steadily increasing the numbers of white christian (?) kids in the private schools and then funding those schools by stealing tax dollars from the public schools they will have finally accomplished what 70 years of political skullduggery could not – a ‘legal’ reversal of Brown Vs. Board of Education. Complete and total segregation will be upon us again. But of course they will not call it that – it will be a freedom of choice thing.

Brought to you by those fine MAGA folks and our “pro-education” governor.

Deb says

Without quality education we are doomed to more book-burning, pseudo-flag waving bullies who raise their self-esteem by picking on others and believing FOX b.s. as the American Dream disintegrates. All of us need to step up when it comes to the health, education and well-being of our community’s children. Find something generous to do for someone else and you’ll remember what usefulness feels like.

J. Michael Kelley says

I have an honest question for “Flagler Live”. How do they calculate the amount which goes to Private Schools? Is it by attendance i.e. so much per child? Is it the same amount of money the Public School would receive on a per student basis, or is there another system used to calculate the amount? My kids have already graduated along time back, so my curiosity is simply one of asking for information. Thank you.

FlaglerLive says

We’ll be looking into it.

Trashcollector says

First off it’s mostly a crock .The amount of kids attending private schools k-12 is vastly small in comparison to public school attendees .Furthermore tax credit should and will be used for any btw step up for kids offers transportation scholarships to only Public school kids not private those kids have to pay for their transportation on buses to their be a hoops which are very few and he far between in an thos county .Look up private cc schools around here and u will not not find much of a selection to begin with .my guess is at best 200 students not be attending public and homeschoolers take nothing from public school tax credits .Flagler OC High lost there Finding for their poor performance with Flagship

Ii3 program which was only project based high program for careers ..they also lost a rating grade as did Buddy Taylor middle

Size 9.5 says

I want to point out and explain something: “Salaries and benefits, which account for 80 percent of the budget, have increased substantially,” This is referring to new teacher pay, which is just about what us 15-17 year veterans are making right now. It’s important to remember that DeSantis gave all the new teachers huge starting pay raises – by mandating the districts find a way to fund it (he supplied no money) – and gave us veterans, nothing.

And some, a select few, of the comments on this article are very disheartening. Trust me when I say education is underfunded, underpaid, under-appreciated, and under-supported. I’m in it, I see it, I know it. I just wish others could walk in my shoes.

Laura says

Schools cost a certain amount to operate beyond teacher costs- ac, insurance, janitorial, etc. These are referred to as operational expenses. These costs are disproportionately harder for smaller districts than larger ones (buying in bulk saves money everywhere).

The operational costs are paid for by FTE dollars- each student is allocated a certain amount based on age/race/district and select ESE and like services. There are numerous free public options (like Florida virtual school) that don’t utilize any of the services the local schools provide.

Bottom line is traditional public school enrollment is down in Flagler so the money isn’t coming in & expenses are up–hence the deficit. Bottom line business isn’t good.

Now, if this was operated as a private business the district should be asking critical questions and making important changes to increase revenue. Instead, they are crying foul when property values are at an all-time high and attacking their investors.