By Sam Pizzigati

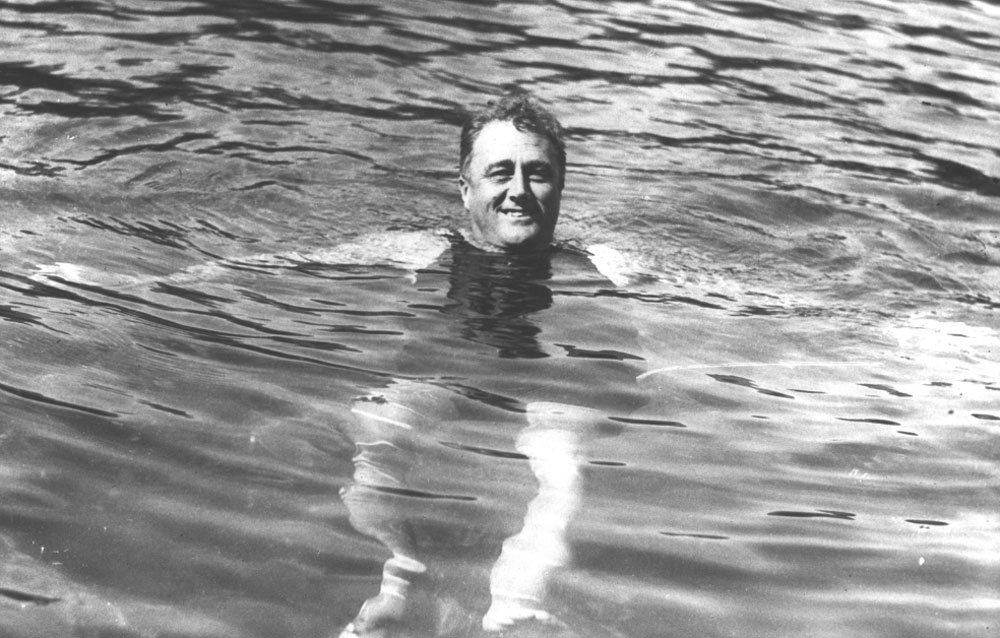

President Joe Biden has made no secret of his admiration for Franklin D. Roosevelt. The president proudly displays a portrait of FDR in the Oval Office.

More significantly, he’s announced the most ambitious plan since FDR’s New Deal for enhancing the well-being of working Americans while trimming the fortunes of America’s super rich. The president has promised to fund his big plans for infrastructure, jobs, and education entirely with taxes on the top.

In fact, Biden’s new tax-the-rich plan is a good deal more Rooseveltian than the numbers, at first glance, might suggest.

In 1945, FDR’s last year in office, the nation’s most affluent faced a 94 percent tax on income over $200,000, a little more than $2.9 million in today’s dollars. The rates Biden has proposed come nowhere near those — they’d top out at just 39.6 percent of ordinary income over $400,000. That’s up only slightly from the current 37 percent.

But the gap between Biden’s plan and FDR shrinks big-time when we toss capital gains — the dollars the rich make buying and selling stocks and bonds, property, and other assets — into the picture.

But the gap between Biden’s plan and FDR shrinks big-time when we toss capital gains — the dollars the rich make buying and selling stocks and bonds, property, and other assets — into the picture.

In 1945, the nation’s deepest pockets paid a 25 percent tax on their capital gain windfalls. Today’s rate tops off at 20 percent. For households making over $1 million in annual income, the Biden plan would raise the top capital gains tax rate to 39.6 percent, the same top rate that applies to earnings from employment.

In other words, the Biden tax plan ends the most basic tax break for the ultra rich: the preferential treatment they get on the income from their wheeling and dealing. This would be a big deal. In 2019, 75 percent of the benefits from the capital gains tax break went to America’s top 1 percent.

Dividends currently get the same preferential treatment. Americans making over $10 million in 2018 took in over half of their total incomes — 54 percent — via capital gains and dividends. If Congress adopts the Biden tax plan, the basic federal tax on that 54 percent would just about double, from 20 to 39.6 percent.

The Biden plan also totally eliminates the federal tax code’s open invitation to dynastic family wealth: the “step up” loophole. Under this notorious giveaway, any fabulously wealthy American sitting on unrealized capital gains can pass those gains onto heirs tax-free. The Biden plan short-circuits the simplest route to dynastic fortune.

Under Biden’s tax plan, new dynastic fortunes would have a much harder time taking root. Already existing dynastic fortunes, on the other hand, would still be with us. Biden — like FDR in his day — has not yet warmed to the idea of a wealth tax.

Senator Elizabeth Warren led a recent hearing highlighting the enormous contribution that even a 2 percent annual tax on grand fortunes could make. Among the insightful witnesses at the hearing: the 61-year-old Abigail Disney, the granddaughter of Roy Disney, the co-founder of the Disney empire with his brother Walt.

“I can tell you from personal experience,” Abigail Disney told senators, “that too much money is a morally corrosive thing — it gnaws away at your character… It warps your idea of how much you matter, and rather than make you free, it turns you fearful of losing what you have.”

Franklin Roosevelt understood that debilitating dynamic well enough to propose, in 1942, a 100 percent tax on annual income over what today would be about $400,000. Biden hasn’t ventured anywhere close to that level of daring. But he’s certainly come much further than anyone could reasonably have expected.

Sam Pizzigati is the co-editor of Inequality.org and author of The Case for a Maximum Wage and The Rich Don’t Always Win. This op-ed was adapted from Inequality.org.

Shelly says

Why don’t you report the truth? Those taxes will be passed down to us as usual.

Steve says

Ahhh Did you read the Article. It’s all proposed at this point but If you fall into those categories you might want to figure it out.

Jim says

gas up ONE THIRD since January… Mortgage rates going up… cost of living on the rise food home goods etc UP… so WHO’S going to pay FOR THIS???? and don’t tell me the …rich….how do u think they got that way? they invest OVERSEAS!!!

Steve says

OH Really then why are Asset Prices in the USA at ATHs. Not because the Rich invest soley Overseas. We still live in a Keynsian Supply/Demand World and after the lull of a Pandemic Prices will rise due to demand. Oil and Cryptocurrencies all with a lot of other Asset classes due to speculation at ATHs which soon will lead to a blowoff Top capitulation and a reversion to the mean. Death and Taxes and the latter never going down IMO.

Dennis C Rathsam says

TAX & SPEND….With no money left, Obiden, will print more! While free speech is under attack, our country is losing its mojoe. The Revolutionary war was fought for our freedom, The Cival War, was fought for equality…We are on the cusp, to losing everything that our great country was founded on.

Ray W. says

In a famous editorial at the time Social Security first passed in the 1930’s, the Chicago Tribune asserted that the Act was a communist plot to undermine American values. To some, America has been just around the corner from national disaster for a long time. Just name a current political debate and we can easily find someone to say we are about to implode as a nation.

I am old enough to remember when the News-Journal published Tax Freedom Day every year, which was the date the average American stopped working for the government.

Tax Freedom Day was and is based on the sum of all federal, state, county and municipal taxes, which is then compared to the nation’s total income. When people are doing well financially, people pay more in taxes. The latest Tax Freedom Day occurred on May 1, 2000, back when we actually experienced a tax surplus. President H. W. Bush famously raised taxes and we promptly entered a long economic expansion during the two Clinton administrations. When the economy falters, people make less money and pay less in taxes. Therefore, Tax Freedom Day ordinarily falls on an earlier date when we enter into a recession or other type of economic downturn, but there are other factors in the equation that can affect the date.

In 2019, Tax Freedom Day fell on April 16th, a fairly ordinary date, as Tax Freedom Days go.

Since around 1970, Tax Freedom Day has been at some point in April, except in 2000. This may surprise some of the doomsayers, but since around 1970, Tax Freedom Day has remained relatively stable. During those decades, we have enjoyed years of tremendous growth and suffered other years of anemic growth.

While Dennis C Rathsame doesn’t mention what is causing him to fear that Free Speech is under attack, I suspect he blames social media platforms that have banned certain politicians from posting on their sites, but I cannot be sure. Since social media platforms did not exist in 1970, or 1990, for that matter, one can argue that social media platforms broadly expanded 1st Amendment rights when they came into existence. Transformed might even be a better term. However, any social structure that can be conceived by humans can be abused by other humans. If privately owned social media platforms now perceive the necessity to curtail certain forms of previously expanded right to free speech in order to protect the country from insurrection by banning those who engage in broad forms of lying for the purpose of individual political and financial gain at the expense of national democracy, one of many arguments available to us is that we still have broader 1st Amendment rights than we had 30 years ago.

Steve says

The Orange Blowhard spent 160 million on GOLF So what’s your point. His Administration increased the National Debt more than any in recent History with nothing to show for it IMO..So what’s your point. PS The printing of money in excess was in fashion long before the Biden Administration. What rock do you live under and again what’s your point

James M. Mejuto says

Great article and insight, Sam Pizzigati but I wonder about a few statements you make: Do those who make

$400,000 plus actually pay 37% and do the wealthy actually pay 20% on capital gains ?

I think creative accounting plays an important part!

Harry says

Being gleeful over a guaranteed failure doesn’t make sense to me.

Pogo says

@FDR is a long time dead, long live FDR

and the usual suspects still don’t know shit from shinola.

https://en.wiktionary.org/wiki/know_shit_from_Shinola

A reminder of how, in large part, retirement in the United (no thanks to Republicans) States of America is even possible:

history of social security

https://www.google.com/search?d&q=history+of+social+security

history of nlrb

https://www.google.com/search?d&q=history+of+nlrb

history of medicare

https://www.google.com/search?d&q=history+of+medicare

medicare history timeline

https://www.google.com/search?d&q=medicare+history+timeline

“What you have made me see,’ answered the Lady, ‘is as plain as the sky, but I never saw it before. Yet is has happened every day. One goes into the forest to pick food and already the thought of one fruit rather than another has grown up in one’s mind. Then, may it be, one finds a different fruit and not the fruit one thought of. One joy was expected and another is given. But this I had never noticed before–that the very moment of the finding there is in the mind a kind of thrusting back, or setting aside. The picture of the fruit you have not found is still, for a moment, before you. And if you wished–if it were possible to wish–you could keep it there. You could send your soul after the good you had expected, instead of turning it to the good you had got. You could refuse the real good; you could make the real fruit taste insipid by thinking of the other.”

― C.S. Lewis