Consumer optimism among Floridians rose to a post-recession high in June to 82, a one point increase from May, according to the University of Florida’s Bureau of Economic and Business Research, which conducts the monthly survey.

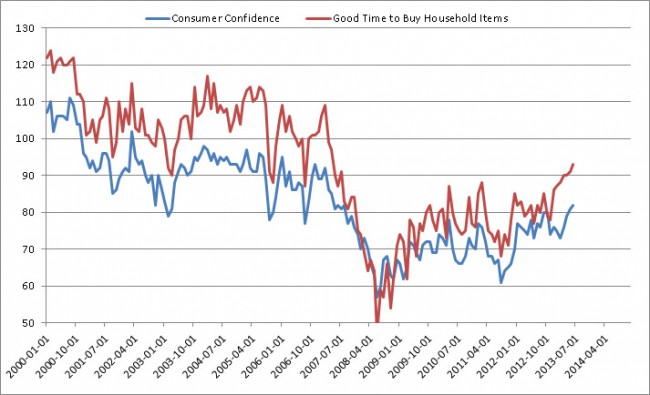

Four of the five components that make up the index rose while one stayed the same. Perceptions of personal finances now compared to a year ago rose three points to 70 while expectations of personal finances a year from now stayed flat at 82. Expectations of U.S. economic conditions over the next year rose two points to 83 while expectations of U.S. economic conditions over the next five years rose a point to 83. Perceptions as to whether it is a good time to buy big-ticket items such as a car or large appliance rose two points to 93.

The index is rising as unemployment has been falling steadily in the state (and in Flagler County), the latest figures in May notwithstanding.

“The increase in our index for June is so far led by a relatively large increase in perceptions of personal finances,” Chris McCarty, the survey director, said. “There are several reasons for this increase, but the stock market gains for the first part of June certainly played a role in that. As we continue to collect interviews through the rest of the month the index will almost certainly be lower when it is revised. It’s worth noting that perceptions of current buying conditions are at a post-recession high of 93. The last time it reached this level was April of 2007 when it was 97. This was the beginning of the collapse in the housing market.”

As of this writing economic conditions in Florida were still improving. The unemployment rate for May was 7.1 percent compared to 7.6 percent for the U.S. The labor force also increased meaning the decline was due to an increase in jobs rather than a decline in the denominator. Housing prices continued to rise in Florida, reaching a median price of $171,000 for an existing single family home. The last time housing prices were that high in Florida was September 2008. The stock market had been maintaining near record highs for much of June before falling in the past week.

“For now consumers are still not registering any fears about the effects of sequestration,” said McCarty. “Most are concerned by the possibility of a rise in interest rates as the Federal Reserve signaled it may reduce its intervention, specifically by reducing the amount of Treasury bonds and mortgage backed securities it purchases totaling $85 billion each month. Concern over this move is likely over-stated for two reasons. First, the Fed is unlikely to reduce the purchases to zero but will likely gradually reduce the effort. If the economy shows signs of weakness the Fed will resume the intervention. It is also worth noting that conditions are not the same as they were in 2008 when quantitative easing began. While the housing market is certainly helped by lower interest rates, there had been a low rate of building and an increase in population, leading to pent up demand. Housing prices may decline from their recent highs, but the underlying quality of loans is now very different from 2008. Recent buyers have good credit scores and typically put 20 percent down on their homes. This means that we will not see the massive foreclosures that led to the last recession. The Fed has seen the economy through dangerous economic times, but the economy is now operating normally. There was nothing normal about 2008.”

Leave a Reply