Shauniqua Epps was the sort of student that so many colleges say they want. She was a high achiever, graduating from high school with a 3.8 GPA and ranking among the top students in her class. She served as secretary, then president, of the student government. She played varsity basketball and softball. Her high-school guidance counselor, in a letter of recommendation, wrote that Epps was “an unusual young lady” with “both drive and determination.”

Epps, 19, was also needy.

Her family lives in subsidized housing in South Philadelphia, and her father died when she was in third grade. Her mother is on Social Security disability, which provides the family $698 a month, records show. Neither of her parents finished high school.

Epps, who is African-American, made it her goal to be the first in her family to attend college.

“I did volunteering. I did internships. I did great in school. I was always good with people,” said Epps, who has a broad smile and a cheerful manner. “I thought everything was going to go my way.”

At first, it looked that way.

Epps was admitted to three colleges, all public institutions in Pennsylvania. She was awarded the maximum Pell grant, federal funds intended for needy students. She also qualified for the maximum state grant for needy Pennsylvania students.

None of the three schools Epps was admitted to gave her a single dollar of aid.

To attend her dream school, Lincoln University, Epps would have had to come up with about $4,000 per year, after maxing out on federal loans — close to half of what her mother receives from Social Security. It was money her family didn’t have, she said.

Public colleges and universities were generally founded and funded to give students in their states access to an affordable college education. They have long served as a vital pathway for students from modest means and those who are the first in their families to attend college.

But many public universities, faced with their own financial shortfalls, are increasingly leaving low-income students behind — including strivers like Epps.

It’s not just that colleges are continuously pushing up sticker prices. Public universities have also been shifting their aid, giving less to the poorest students and more to the wealthiest.

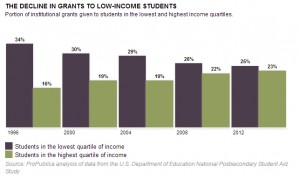

A ProPublica analysis of new data from the U.S. Department of Education shows that from 1996 through 2012, public colleges and universities gave a declining portion of grants — as measured by both the number of grants and the dollar amounts — to students in the lowest quartile of family income. That trend has continued even though the recession hit those in lower income brackets the hardest.

Attention has long been focused on the lack of economic diversity at private colleges, especially at the most elite schools. What has been little discussed, by contrast, is how public universities, which enroll far more students, have gradually shifted their priorities — and a growing portion of their aid dollars — away from low-income students.

State schools are typically considered to offer the most affordable, accessible four-year education students can get. When those schools raise tuition and don’t offer more aid, low-income students are often forced to decide not just which college to attend but whether they can afford to attend college at all.

“The most needy students are getting squeezed out,” said Charles Reed, a former chancellor of the California State University system and of the State University System of Florida. “Need-based aid is extremely important to these students and their parents.”

There’s no data on the number of needy but qualified students who are “squeezed out” and don’t make it onto four-year college campuses. But what is clear is that while the number of needy students has been growing, state schools have not kept up.

Over roughly two decades, four-year state schools have been educating a shrinking portion of the nation’s lowest-income students, according to an analysis of Pell-grant data by Tom Mortenson, a senior scholar at the nonprofit Pell Institute. The task of educating low-income students has increasingly fallen to community colleges and for-profit schools.

Epps’ top choice, officially known as The Lincoln University, is about an hour’s drive from Philadelphia, and was one of the nation’s first historically black colleges. Founded in 1854 to serve African-Americans excluded from other colleges, the school became a public institution in the early 1970s, when the state legislature deemed its mission to be “completely compatible with the needs of the Commonwealth.”

All of the school’s own aid typically goes toward athletic or merit-based scholarships, regardless of students’ needs. In the 2009-10 budget, for instance, most of the roughly $3 million in institutional aid went to four specific “merit-based” scholarships — and the rest to athletics, international students, and study abroad, according to data supplied by Lincoln. The only need-based aid available to students is through separate donor-supported scholarships, some of which are earmarked for needy students, said university spokesman Eric Webb.

Aid given based on merit or other factors could still go to needy students, but that doesn’t appear to be happening much at Lincoln.

Data made available by the nonprofit Institute for College Access & Success show that 84 percent of the school’s grant dollars in the 2009-10 school year did not go to meeting students’ needs. (The data does not include athletic scholarships and certain other forms of aid.)

At Epps’ second choice, Millersville University of Pennsylvania, two-thirds of aid dollars in 2010-11 went to students who had no documented need for it, according to the latest data available. (East Stroudsburg University of Pennsylvania, the third school that accepted Epps, did not provide a breakdown of institutional grant aid.)

Why have public universities across the nation shifted their aid?

“For some schools, they’re trying to climb to the top of the rankings. For other schools, it’s more about revenue generation,” said Don Hossler, a professor of educational leadership and policy studies at Indiana University at Bloomington.

To achieve these goals, schools use their aid to draw wealthier students — especially those from out of state, who will pay more in tuition — or higher-achieving students, whose scores will give the colleges a boost in the rankings.

Private colleges have been using such tactics aggressively for some time. But in recent years, many public colleges have sought to catch up, doing what the industry calls “financial-aid leveraging.”

The math can work like this: Instead of offering, say, $12,000 to an especially needy student, a school might choose to leverage its aid by giving $3,000 discounts to four students with less need, each of whom scored high on the SAT, who together will bring in more tuition dollars than the needier student.

Those discounts are often offered to prospective students as “merit aid.”

Despite its name, “merit aid isn’t always going to the very best students,” Hossler said. “It’s an intentional strategy to help offset the loss of state support.”

Hossler knows this world firsthand. For years, he carried out such strategies as vice chancellor for enrollment services at Indiana University.

“One of my charges was to go after what I would call pretty good out-of-state students,” he said. “Not valedictorians, not the top of the class. Students who you didn’t have to give thousands and thousands of dollars to in order to get them to enroll.”

Indiana University is not alone in thinking about financial aid this way. Consultants who work with schools on financial-aid strategies said they’ve seen an uptick in interest from public universities in recent years, with many focused on generating more revenue.

Indiana University is not alone in thinking about financial aid this way. Consultants who work with schools on financial-aid strategies said they’ve seen an uptick in interest from public universities in recent years, with many focused on generating more revenue.

“When public [universities] come to us individually now, they won’t admit it, but they’re all looking for the same thing — smart students who can pay,” said an industry consultant who asked not to be named.

Another industry consultant, Mary Piccioli of Scannell & Kurz, said many of her firm’s public-school clients are looking to use financial aid “to positively impact the bottom line.”

College officials often argue that attracting students with more resources means they’ll have more aid to redistribute to those in need.

“There’s certainly some truth to that,” said Donald Heller, dean of Michigan State University’s College of Education, who has researched institutional-aid patterns extensively. “But I don’t think that’s really the motivating behavior for many institutions. The more dominant motivating behavior is interest in high-achieving students, which will help them with institutional prestige.”

Epps, apparently, didn’t generate that sort of interest.

She was in her high school’s computer lab, checking her email, when she saw the message from Lincoln University laying out her financial aid package: a mix of state and federal money but nothing from Lincoln.

“Once I saw it, I knew it wasn’t the amount that I needed,” Epps said. “Right away I knew it.”

Epps had been getting guidance from Philadelphia Futures, an organization that helps low-income high-school students get into and complete college. When she went through the cost calculations with a coordinator there, it became clear: The money simply didn’t add up.

At first, Epps said, she blamed herself for not qualifying for aid. She felt like a failure.

“I was kind of upset because I felt as though I worked so hard,” she said. “I kept thinking how I’m not a good test taker.”

Epps had scored a combined SAT score of 820 on math and critical reading. In fact, that’s solidly in the middle of Lincoln’s score distributions for many years, according to data reported to the U.S. Department of Education.

But what Epps didn’t know is that the school had committed to “continuously improving its SAT and GPA averages for incoming cohorts” — as language found in a strategic planning document put it. She also didn’t know that the school had been spending the majority of its financial aid on students who would help bring up those averages — regardless of whether they needed the money.

“To attract top students to your institution, you have to be able to offer them a competitive scholarship package,” said Lincoln University President Robert Jennings. “That’s usually a full-tuition scholarship, that’s a private room sometimes or laptop computer, or a whole bunch of other perks. That’s what schools do. All schools do it.”

Rather than giving small discounts to many students, as many colleges do, Lincoln focuses on giving free rides to top scorers – as a Lincoln admissions flyer lays out.

The strategy seems to have worked. Lincoln University has raised its scores in recent years. In 2002, half of Lincoln’s incoming freshmen scored between a 360 and 460 on the math section of the SAT. In 2012, half of students scored between 410 and 490.

The boost in scores has been no accident, according to Jennings. He said it was a mandate from the Board of Trustees.

“They wanted to increase the SAT averages of students coming to Lincoln,” Jennings said.

And what about students who may have once been a natural fit but aren’t hitting the higher scores? The school still wants to serve some of them — “because of our historical mission,” explained Jennings. But Lincoln has also increasingly been “trying to steer that lower tier of students — students who need much more help — into community colleges,” he said.

Jennings doesn’t see this as a departure from the school’s mission to provide public access. “Absolutely not,” he said. “That’s why you have community colleges. They, too, are public institutions, and we have built collaborative relationships with them.” He added that the school recently launched a campaign to raise more money for scholarships, some of which will go to providing more need-based aid.

Like Lincoln, both Millersville University and East Stroudsburg University — the two other colleges that accepted Epps — have created strategic planning documents that include language reflecting a desire to move up academically.

In a 2010-15 strategic planning document, East Stroudsburg University outlined the goals of becoming “more selective in each new year” as well as fostering “strategic alignment of financial aid” to better attract top students.

“High-achieving and access are not mutually exclusive,” said spokeswoman Brenda Friday. “As such, we look for and recruit students who present both. We also recruit these groups separately. There are funding possibilities available for both groups of students.”

East Stroudsburg and other regional public colleges are in a tough spot. Many don’t have very much aid to give, and most serve a higher percentage of needy students than more prestigious public flagship universities, which have more money from endowments, research and fundraising. It’s a common phenomenon in higher education – students with less money relegated to institutions with less money.

In Pennsylvania, as in most states, public higher education has faced steep cuts, especially since the most recent recession. Over the last five years, the state has cut funds for higher education by 18 percent. At public institutions, that’s worked out to about $2,000 less in state and local support per student — a 32 percentage-point drop, according to data from the State Higher Education Executive Officers.

“All the arrows point in a direction that shows what we are out doing now is raising revenue. The old business model has sort of broken down,” said Patrick Callan, president of the Higher Education Policy Institute and formerly the head of state higher-education boards and commissions in Montana, Washington and California.

“There have probably been no winners from all of this,” Callan said. “But the biggest losers were those who were disadvantaged on the front end.”

In high school, Epps went by the nickname “Neeks” with most of her friends. They were a mixed group. Some, like her, fostered hopes of attending college. Others just wanted to finish school and get a job.

Though she loved high school, Epps said that looking back she realizes that despite her own efforts, she didn’t get the best education.

About a third of the students at her high school didn’t graduate. After she left, the school was among roughly two dozen shuttered by the chronically underfunded School District of Philadelphia.

“On a couple of levels, systems are failing these students,” said Ann-Therese Ortiz, who worked with Epps as director of pre-college programs at Philadelphia Futures. Low-income high-school students could put in the same effort as their better-resourced counterparts, but “even with the same effort, it simply doesn’t yield the same fruit. And then there’s limited access to the same opportunities, because they’re not receiving the same educational foundation that really opens those doors.”

Those disadvantages can also show up in test scores. A substantial body of research shows that SAT scores are strongly correlated with family income.

“How do you separate merit from privilege?” asked Jerome Lucido, a professor and executive director of the University of Southern California’s Center for Enrollment Research, Policy, and Practice. “Merit needs to be tied to mission, not just who got a higher test score. We already know that has a direct correlation with family income.”

But the SAT and other tests are still crucial to how publications such as U.S. News & World Report and Barron’s formulate college rankings, which are widely regarded as measures of prestige.

Not surprisingly, colleges are constantly working to move up the lists. A prospective student flipping through Barron’s 1995 college-rankings guide would have found about 90 public institutions in the top three tiers of competitiveness and more than 170 in the less competitive or non-competitive tiers. In the 2013 guide, that top tier has grown by more than 40 colleges — about 46 percent — and the bottom tier has shrunk by 60.

“The whole system is constantly moving up, going upstream to get better and better students, and get students who can pay,” said Anthony Carnevale, director of Georgetown University’s Center on Education and the Workforce. “It all looks great for the press release. But you’re systematically leaving people behind.”

Carnevale, who has authored many studies analyzing this shift, likens the state of higher education to “hospitals for healthy people,” competing for the easiest to treat, most lucrative patients, rather than taking on the cases of those who stand to benefit the most. “The question is, are you trying to reach down or not?”

Schools might argue they are — in a way.

Many state schools have in recent years struck what are called “articulation agreements” — partnerships with community colleges that make it easier for community-college students to transfer to a four-year school. In the last two years, Lincoln University has established such agreements with 11 community colleges.

But even with improved transfer pathways, there’s still an inherent risk for students like Epps who “undermatch,” or don’t attend the most selective school they can get into. Low-income, minority and first-generation students frequently undermatch, research shows, and in doing so, they often end up at institutions with less support and far lower graduation rates.

Without any aid from Lincoln or the other colleges that accepted her, Epps weighed her options and chose a different route. She recently completed her first year at the Community College of Philadelphia — a school where about half of full-time freshmen don’t return for a second year.

“In a way, four-year colleges are asking two-year colleges to do the dirty work of selecting who’s worthy of a four-year college,” the Pell Institute’s Tom Mortenson said. In doing so, four-year colleges are not “taking on the responsibility from the beginning when they’re freshmen and making a real commitment to these students.”

But colleges — even those with an explicit public mission — have mounting incentives to avoid students like Epps. Carnevale points to the dawning of what’s known as the “accountability movement” — an effort by states to reform higher education by tying funding for public colleges to student outcomes and graduation rates. Last month, President Barack Obama announced that the federal government would also be moving in a similar direction — and hopes to eventually tie federal aid to certain performance measures.

Unless policymakers build in some incentives to take on more students at the margins, the accountability movement could drive schools further away from low-income and minority populations, which have lower graduation rates overall, Carnevale said. “The whole logic of this industry — and the reform of it as well — excludes low-income and minority students.”

While colleges strive to enroll wealthier and better-performing students, the demographics of the nation’s high-school graduates are moving in a different direction: As a group, tomorrow’s high-school graduates will be more racially diverse and more low-income than today’s.

“There is a significant misalignment. And I think the misalignment’s going to continue to grow,” said David Tandberg, an assistant professor of higher education at Florida State University who previously worked in the Pennsylvania Department of Education.

“The public really, really benefits from a first-generation student going to college. All sorts of wonderful outcomes come from that,” Tandberg said.

A more educated workforce has widespread benefits: It leads to more earning power for those who graduate, a stronger tax base for the state, and greater potential for economic growth in the future.

Public universities have the task of “balancing institutional striving with the public’s needs,” Tandberg said, which “are often two very different things.”

Epps still remembers going out and buying a new button-down shirt, slacks and dress shoes the night before her high-school graduation. She remembers the nervousness she felt the next morning, and the tinge of sadness.

“I was going to miss my friends. We had been together for four years, and we were all going in different directions,” she said. “I didn’t know how life was going to turn out.”

At graduation, in her white cap and gown, she was the mistress of ceremonies, introducing each of the speakers and making sure the ceremony flowed. She read out the theme of the year’s graduation, a rephrasing of a Thoreau quote: “Go confidently in the direction of your dreams. Live the life you have imagined.”

She’s certainly trying. Community college started up again last week. Epps has already signed up for a full schedule of six classes.

A year from now, she hopes to transfer, finally, to a four-year state school and eventually to get a bachelor’s degree. She’s thinking she might want to study accounting.

–Marian Wang, ProPublica, with Jonathan Lin

Reaganomicon says

Excellent article, and I also recommend Matt Taibbi’s college loan scandal article. That said, here are a few things that parents and future/current college attendees absolutely need to know about attending college.

1. If you don’t know what you want to do when you go to college, take classes that just about every major out there “requires” so you don’t waste your money. English 101/102, College Algebra, some sort of lab science, etc. This will help you pick your degree because it will expose you to a smattering of different subjects. As a sidenote, it’s interesting to note that the ONLY REASON you are required to take many of these classes is because as majors, many of them have very few students and as such would get almost no funding from the college without some sort of core requirement to spread the money around.

2. Never, ever borrow beyond what you absolutely need to attend college. Student loans, even from private lenders like Sallie Mae, fall under a different category than pretty much any other loan in existence. You can’t default away from them and even if you are living on foodstamps and WIC you’ll still see your IRS refund garnished if you don’t bother to pay them back.

3. Get and keep your student handbook for the year you begin attending, and once you have declared your major look in it at what’s required and plan your classwork yourself. Never, ever listen to an advisor about “what you need” because they are idiots and you’ll end up taking more classes than what’s required. That’s why UCF has the nickname “you can’t finish” and 9/10 students attending DSC are in more debt than they need to be – they listened to advisors and didn’t research the actual course requirements for their major.

4. Use the community college/state college system to do half of your degree, with the following caveat: know where you want to go, and ask them about transferring from one. Some classes don’t transfer even though they are supposed to. State colleges are marginally less about your money than the university system is, I say marginally because (as an example) some local state colleges have drifted away from community mission statements and lend less to students because they are worried about their bottom line.

Tator says

Why go to college ? There’s NO JOBS !!! 13 million college grads are collecting welfare or un-employment. How about stopping ALL aid to foreign countries and invest in America !!!

John Adams says

Predjudicial leftist article that is deliberately written to mistate, misdirect and cloud the issue.

The progressive left obamma administration President obama considers single people making over $200,000 to be rich. In addition to his past tax increases on income earners, obama has specifically called for raising taxes on singles making over $200,000 and couples making $250,000 every year he’s been office.

Children of both ‘wealthy’ and ‘poor’ families have equal opportunity to obtain loans. Obama has just DOUBLED the student loan rate to a whopping 7.9% burdening students with massive debt load. College costs have far outpaced inflation (which obama says does not exist!). Therefore, loan amounts of necessity have dramatically increased putting students even further into the loan debt hole.

The left is never happy no matter how much money is spent (tax payer money given away) as long as they are in control of it and can increaseingly spend, spend, spend without care of the national debt ballooning. Obama has spent more money and achieved less than any other president. obama in almost 5 years has spend more and increased national debt more than all other U.S. presidents combined. It is tragic how he and the democrats are obsessed with mindless spending. After paying off the unions, colluding with politicans, where has all the TRILLIONS of dollars gone? See any repaired or new roads or bridges that obama promised were “shovel ready?” Of course not. Where the democrats and obama is concerned, sweet talk and promises is their stock and trade. Power and control is their currency.

If the democrat liberals had any serious ambition to help ANY Americans with rapidly rising education costs, why haven’t they provided low cost loans instead of WASTING TRILLIONS of dollars from TARP and the Stimulus programs? Where has all those many TRILLIONS of dollars gone. As always, obama says nothing and blocks inquiry in his “most transparent” administration. The left proves itself dishonest, unethical and worst of all, hurtful to Americans of all colors and of all income levels.

Sherry Epley says

Excellent article! Again, those who need it most are second in line. The leaders in our universities should be ashamed, but I imagine this disparity is in not even on their radar. . . BUT, it most certainly should be!

Great advice from Reaganomican as well!

Sherry Epley says

If your “TAXABLE” income is over 200,000 a year, you are wealthy. . . by anyone’s definition! Less than 5% of the people in the USA make over 200K a year.

Many of the wealthy in the USA pay no taxes at all. . . take a look at the charts in this article:

http://www.theatlantic.com/business/archive/2012/06/35-000-rich-people-arent-paying-any-income-tax-how-is-that-possible/258183/

Anonymous says

Yes, Obama is EVIL, EVIL, EVIL! Nothing was ever wrong, crooked, unjust or just plain stupid before he came into office! We were living in a paradise before he came into power (illegally, because, of course, he faked his birth certificate) and installed his Muslim Brotherhood! My Lord, to listen to some of the people on this forum, you would think that everything was peaches and cream before Obama came along and flushed the US into the toilet. What REALLY happened is that a whole lot of people got sick and tired of the trickle-down cynical bulls**t that characterised previous administrations and decided to exercise their right to demand change. That REALLY pisses off some people…But, you know what? Too bad! To the ones who are now being forced to face the notion of sharing opportunities and resources with those less fortunate–Try to at least pretend to be the good Christians and caring citizens you like to think you are. To those less fortunate, who continue to hang onto the belief that they will be in the money someday if they subscribe to the Rush Limbaugh/FOX news journal, WISE UP! The people who have made their fortunes hand over fist at your expense aren’t interested in anyone getting ahead besides themselves and their own. They’ll lie to you and continue to use you if they can, for as long as you let them.

Johnny Taxpayer says

“I did volunteering. I did internships. I did great in school. I was always good with people,” all great things, but what I don’t see in the article is any mention of actual, paid, work. Now maybe she worked every summer and after school and socked away as much cash as she could, but I don’t see that mentioned anywhere in the article, which leads me to believe it probably didn’t happen. The article says she needed $4k per year after maxing out student loans, surely she could have earned that over the summer and during the school year? The entire years tuition does not have to be paid up front, and every college out there has a monthly payment plan.

And please don’t mistake me, I’m not someone who says “back in my day you could work your way through college”, I fully realize those days are long gone, but if you look at the math $4k per year is not much of a stretch to earn, part-time, even in this economy. But unfortunately that seems to be overlooked.

Rocky Mac says

FYI: Congress failure to agree on college loan rates caused the rates to double. Not sure why right wing fear mongrels and liers have to place the problems of the world on Obama, but if you get your kicks from doing that then go right ahead and have fun. Your whole tirade is a joke. Oh, by the way, the thunderstorm we had the other night that knocked out your electricity was Obama’s fault too.

Richard Moore says

The loan rate reset to 6.8%, not 7.9%.

It was at 3.4% but congress decided to throw us students under the bus. Had nothing to do with the President.

A.S.F. says

@Johnny Taxpayer says–I think you may be missing the point. The point is that financial aid seems to be going to people who can more easily afford coming up with the money for college tuition without outside help. What about the money that is financing the educations of students from families that are better off? I wonder if you would be so quick to make the same value-based judgements about those kids (especially if they are White.)

Reaganomicon says

Not that I disagree with the sentiment, but some majors in college explicitly forbid you from working while in school. When my wife was looking into medical school, it was made clear to her that if she was caught working she would be kicked out of school. You’re also wrong about monthly payment plans, with the exception of awards like tuition wavers or in-house grants, universities and colleges want their money up front for the semester and rely upon FAFSA via students to get their money.

Sherry Epley says

The people who need to invest in the USA are the greedy CEOs of huge PRIVATE companies that would rather sell the US worker down the river to poverty than to take one penny from their record breaking profits. The monsterous 1% would rather give jobs to sweat shops in Asia and hide their personal billions in off shore accounts. . . and then run for President of the USA (Romney= RUINME). . . the country they are helping to destroy!

Johnny Taxpayer says

Value based judgment? I’ve made no judgment. I’m simply pointing out that the young lady in the story seems to be doing a lot of great things towards getting to college, but there is no mention of any employment. This was a very in-depth article, covering her life in fair amount of detail,but yet there was no mention of any employment. She could have worked during highschool, and she can work during college to save and come up with the $4k per year she needs. That’s not an unrealistic statement. There has been a big shift away from work + aide to cover the costs of a college degree to just relying on aide.

All colleges and universities have tuition payment plans, and I’m quite certain the young lady in the article is not entering medical school at 19 after being unable to attend undergraduate school for want of $4,000 per year. Absent the military academies, the overwhelming majority of undergraduate students can and work at least part-time while attending school. I, like many of my colleagues, worked full time, while going to school full time, and was able to graduate in 4 years. It can be done, it’s just not anymore.

Genie says

@ Richard Moore: Excuse me, but you are incorrect. The President had EVERYTHING to do with taking the student loan program over from the banks. See below, please.

http://www.sfgate.com/business/networth/article/Feds-take-over-student-loan-program-from-banks-3193888.php

Genie says

@ Sherry: Only 47% of Americans even have full time jobs anymore. Did you know that?

Genie says

@ Sherry: Excuse me, but it is not Romney who is in charge now. Romney at least has created more jobs in his lifetime than Obama has.

Many see the current President doing a pretty good job at destruction.

[Factcheck: Genie, your comment is demonstrably incorrect, as far as job creation is concerned. As Factcheck.org reported in April, “By the time of Obama’s second inaugural in January, the economy had added a net total of 1,208,000 jobs since he was first sworn in four years earlier, according to current figures from the Bureau of Labor Statistics. That beats George W. Bush’s eight-year total of 1,083,000. And so far, Obama is extending his lead over Bush. Counting jobs added in February, his total now stands at a net gain of over 1.5 million jobs. […] The economy lost 8.7 million jobs as a result of the 2007-2009 recession, the worst since the Great Depression of the 1930s. Those losses included 4.4 million jobs lost during Bush’s final year, and another 4.3 million during Obama’s first 13 months in office. But since then, all the jobs initially lost under Obama have been regained, plus another 1,564,000.” Needless to say, Romney’s job creation was not in the same league.–FL]