The headline in this morning’s News-Journal looked catastrophic: “Flagler school district takes $3.8M budget hit.” That’s $3.8 million in a $95 million budget, what would have amounted to a 4 percent cut less than a month before school resumes, and on top of a $1.8 million cut the district had already enacted in spring. An ashen-faced Tom Tant, the district’s finance director, had given the dire numbers to the Flagler County School Board at a meeting Tuesday evening, sending board members reeling.

But the numbers weren’t right. There won’t be a $3.8 million cut. Only a $400,000 cut, and that amount has already been absorbed following a plan Superintendent Janet Valentine worked out this morning. So it’s nothing that will significantly impact students at this point, or existing staff,” Valentine said in late afternoon.

What happened?

Tant was right regarding a dollar reduction the state was forcing on Flagler under the so-called “required local effort” side of the ledger—a complicated formula that taps various sources to arrive at the money each district may generate from its own property taxes. That amount was, indeed, dropping severely, because the state is reducing the property tax school boards may levy—in some ways a plus for property owners (but in other ways a continuing diminution of districts’ financial authority and stability, which may not benefit property owners in the long run.)

Tant reported that drop to the school board Tuesday evening—a combination of lost discretionary and capital dollars. He had gone over the figures, provided to him that day by the state Department of Education, repeatedly, though he’d focused on the “required local effort” portion of the ledger, which had generally driven the district’s funding formula. There was another component to the figures: the state was making up most of the lost dollars.

“Oh gosh, we’re so relieved. We did not quite have the whole picture,” Valentine said. “The local effort usually goes up. When it went down, we didn’t anticipate that the state portion would go up significantly enough to offset that, but it really did. We’re probably looking at a $400,000 change, which we can deal with.”

Valentine is freezing the positions of a few in-school suspension monitors, who will not be hired. She has also asked principals to hold their faculty’s supply purchases at 50 percent of budgeted needs for now. And she’ll be meeting with her top staff again next Wednesday to make sure those measures are enough. That means no need to affect services, no need to go into reserves, though there’s enough there to provide a cushion.

“It seemed so outrageous last night, something did not seem right,” board member Colleen Conklin said this afternoon. “It’s still a cut, and the tax rate is still significantly different, and this has never happened that way. Usually we’ve gotten this information way in advance.”

For all that, Sue Dickinson, who chairs the school board, is still cautious about another shoe dropping.

“We all know it’s election time,” Dickinson said, “and throughout my years on the school board, we’ve had years when we’ve had cuts throughout the entire school year. If the state is going to make up $3.2 million right here in Flagler County, where are they getting it from? That’s my question, because obviously that’s statewide. So I’m very cautious that something isn’t going to come out before the end of this calendar year.”

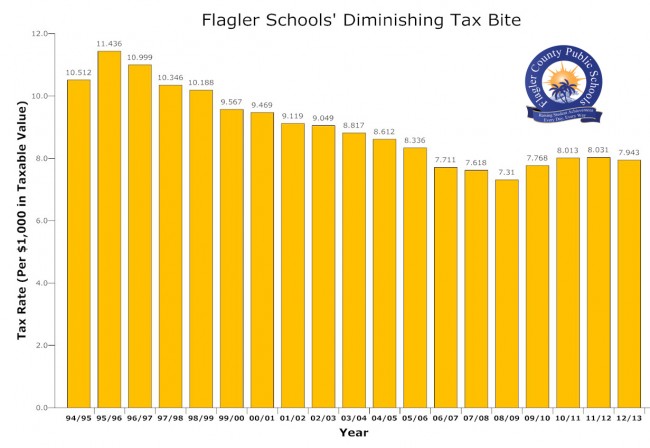

One set of numbers that Tant provided the board Tuesday evening will not change: the new school property tax rates for the coming year, which will be significantly lower, providing property tax payers a cut not only in their school taxes, but—because those taxes dominate any local property bill—essentially erasing the effects of any property tax increases being considered by the county or Palm Coast. That was also the case last year, when school taxes dropped, more than offsetting increases by Palm Coast and the county, and resulting in a net tax cut for local property owners.

The current school property tax rate is $8.031 per $1,000 in taxable value. In other words, a house valued at the median price of $125,000 in Flagler County, with a homestead exemption of $50,000, is paying $602 in school taxes.

The new tax rate will be $7.943 per $1,000 in taxable value, resulting in a tax bill of $596.

But most tax bills will actually realize a greater saving, because property values dropped 7 percent. That typical $125,000 has likely been devalued to $116,000, resulting in a school tax bill of just $524, a net $78 saving over last year. (Had the school board set its tax rate at the level required to bring in the same amount of money next year as it did this year, in order to offset the loss in property values, it would have had to set that rate at $8.579 per $1,000 in taxable value.)

Hmmmm says

Thank goodness they will be wasting less of my money

Shady says

How embarrassing!!! The first five words in the second paragraph say it all, “But the numbers weren’t right.” Its always about the numbers and ours never seem right!!! Nothing like a little 3.4 million dollar accounting error to put some excitement into your day.!!! LOL

Out of curiosity says

Thank you for clarifying this issue!!