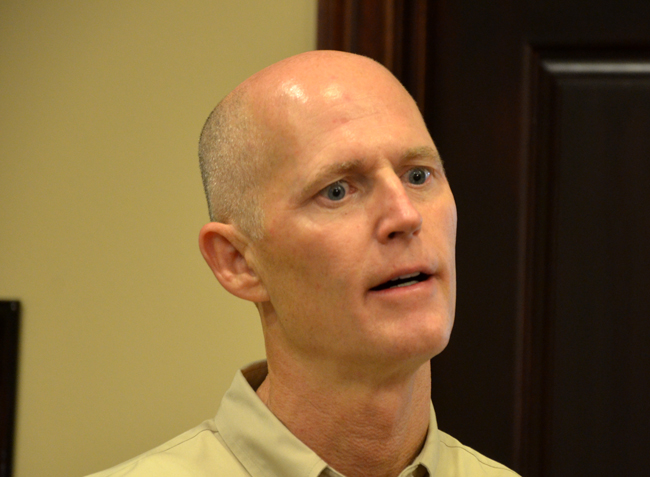

A new drive to reduce the number of businesses paying the corporate income tax and tangible property taxes–part of his push to eliminate all corporate taxes in seven years–will headline Gov. Rick Scott’s legislative agenda, even as state lawmakers face a budget shortfall pegged at $1.3 billion and growing.

In a visit to Central Florida to unveil his economic agenda, Scott said he would ask lawmakers to double the corporate income tax exemption to $50,000, dropping 25 percent of the companies that now pay it from the tax roles. After Scott’s original plan to cut the tax rate got nowhere last year, the Legislature instead approved a measure increasing the exemption to $25,000.

Under that change, about half of Florida businesses already pay no taxes.

Alan Stonecipher, research analyst and communications director for the Florida Center for Fiscal and Economic Policy, tells the Florida Independent that eliminating the corporate income tax would cost the state $2 billion in general revenue, or about 9 percent of that revenue.

Scott also proposed a $50,000 exemption from the tangible personal property tax on businesses, allowing 150,000 of the 300,000 companies that now pay the levy to avoid it. That would require a constitutional amendment that would go before voters in 2012.

“One of the most important things Florida can do to attract businesses, and in turn jobs, is to create a tax environment that welcomes business growth and encourages investment in our state,” Scott said, according to a copy of his prepared remarks.

“Last year,” Scott said, “by passing an exemption for businesses that owe up to $25,000 in corporate income taxes, we were able to eliminate nearly half of all the companies obligated to pay the tax. To continue to fulfill my promise to eliminate the corporate income tax in seven years, I am further proposing to reduce the number of remaining companies required to pay this tax by twenty-five percent. We’ll do it by increasing the corporate income tax exemption from $25,000 to $50,000. The eventual elimination of the corporate income tax will eliminate a major barrier preventing Florida from attracting future Fortune 100, Fortune 500 and other growing companies that can get our residents back to work.”

Scott also said he would push to turn Florida’s unemployment system into a “reemployment system” by requiring some workers to undergo job training while receiving benefits. He also touted proposals to tighten oversight of the state’s workforce boards; improvements in the state’s deepwater ports and transportation system; and pushing universities to focus more on degrees in science, technology, engineering and mathematics.

The last goal has already drawn criticism from educators and others concerned by Scott’s questioning the value of some degrees, but the tax plan could run into resistance as lawmakers try to tackle a budget shortfall in the coming fiscal year that could top $2 billion.

House Speaker Dean Cannon, R-Winter Park, embraced the plan.

“I look forward to working alongside Governor Scott and my colleagues in the Florida Legislature during the upcoming session as we strive to meet our shared goal of reducing the tax burden on Florida families and businesses, eliminating burdensome regulations, and implementing thoughtful public policy reforms that will foster both a business climate ripe for private sector job creation and a skilled workforce ready to meet the needs of a global economy,” Cannon said in a statement following the announcement.

Calling Scott’s plans “ambitious,” Senate President Mike Haridopolos, R-Merritt Island, was more measured in his response. Haridopolos, who was at times openly skeptical of Scott’s plan to reduce the corporate tax rate last year, made no specific reference to the new tax-cut plan in his reaction to Scott’s plans.

“In the coming months and throughout the 2012 Legislative Session, we will work closely with the Governor in order to implement measures that will continue to provide stability and predictability to our state’s business owners and entrepreneurs, as well as pursue an agenda that is focused on job creation and economic development,” he said.

–Brandon Larrabee, News Service of Florida, and FlaglerLive

The Truth says

Why does this guy look like a zombie in every picture that is taken of him?

NortonSmitty says

Deficits bad…Tax cuts good…. My head hurts.

JL says

I think he’s a fool to think the voters will believe this is a trick to entice more businesses. Businesses already know it’s cheaper to do business in Florida than most other states. This is a proposal to help his buddies in business already in Florida. If you look at most other states, particularly the northern states, companies already know it’s cheaper to have a business in the South, including Florida. Florida cannot afford to cut corporate taxes at this time. Don’t fall for it. Who voted for this guy in the first place? It’s going to be a long 4 years. I’m not sure if Florida can withstand it.

palmcoaster says

@ Truth. Rick Scott is Karma for Florida that is why!

More cuts for the rich…already those cuise lines out of our ports pay no tax and the sports stadiums given away for free use to these billionaires while maintenance and replacement cost is on us, are a freebie to them.

Mike G says

This guy is the ultimate troll.

Yogi says

Poor people don’t pay taxes now so it is kinda tuff to give them a break isn’t it? Ole Rick must be ready to cut some fat and the pigs will squeal. So if I pay more in taxes, then how does that help create jobs? Oh yeah, the jobs in the public sector. Right. That’s just what I want to do, create more government to intervene in my life, make more regulations which cost me more to manage, and most of all, give more profits to the poor people that refuse to work, or even take help to re educate. Yes. I can see clearly now. I pay more, so I get more government……yes……that’s it…that will do it.

then there is always bankruptcy

http://nationaljournal.com/economy/harrisburg-pa-votes-to-file-for-bankruptcy-20111012

Anita says

I was under the impression that a thriving and successful community was one with a mix of business and residence, and that business taxes subsidized a percentage of residential taxes, leaving residents enough discretionary cash to support the businesses. A win-win situation.

That being the case, why this notion that a community must ‘give away the store’ in order to help business make a profit? If they’re not paying their fair share of taxes (or any taxes at all), who will? Of course! It’s us, the people they hire and retirees. Sounds like those of us who are NOT corporations, will bear most if not the entire burden of supporting state government, social programs and maintaining infrastructure (and since our governor disdains any help from the Federal government, we can’t look for help there, can we?) Have I got this right? If so, my only other question is, how soon can we begin a recall of Rick Scott?

BW says

Yogi,

That line of thought might have been interesting when people first began blurting it out over the last 2 years, but let’s look at reality:

1. There are over 46 Million people living in poverty today (http://www.census.gov/hhes/www/poverty/data/incpovhlth/2010/figure4.pdf) which is higher than any other year since 1959. Any 2nd grader could tell you if you increase the number of people not being able to contribute then those contributing are going to end up picking up the burden of loss.

2. Taxes were lowered for every working American 2 years ago when the Social Security and Medicare Tax was reduced to 4% (from 6%). That’s going to expire. So will Republicans stand behind their promise to not increase taxes as that expiration draws near? It doesn’t look like it does it.

3. You say we don’t need regulation, isn’t it true that the lack of regulation (and eliminating regulation previously in 2000 with the Financial Modernization Act written by 3 Republicans) was the major contributor to “too big to fail” and the banking collapse?

The truth is that these same blanket hollow bullet points might have sounded good at one time, but they lack truth and more importantly any real solution to real issues. I think it’s easy to blame the victim and that’s what we’ve seen a lot of over the last 2.5 years. Do I want to see taxes decreased? Absolutely. I’ve written the several thousand tax payment checks in my household over the last several years. In fact, the President’s recent Jobs Act would have cut that in half for us and many many many others. But Republicans again say “no” because President Obama suggested it. Sure those over $1 million in income would incur a 5% surtax. So we have a Tea Party and a Republican Party that says that 3% to 4% of the population is far more important than the other 96% to 97% not making over $1 million per year. So you and those people are the ones I should be listening to and taking seriously? I’m neither party, by the way. And the GOP has a long way to go to winning me over at this point.

NortonSmitty says

Yogi, the gambler in me would be willing to bet that if you do not live in a single wide trailer today, your support for the GOP and so called Conservative agenda will guarantee you will before you die. Once you are gone,your children will look back on being protected by the elements by particle board and aluminum siding the good old days. Back before the corporationgovernment said they had to beat out the Indonesians and Africans and Haitians and Chinese in the Great Global Holy Capitalistic Competition in the Race to the Bottom for the right to make money for the High Priest Stockholders.

Citizen says

I’ll just leave this here… I think it pretty much sums up Rick Scott’s plan… nothing new here. But as some commenters are so quick to point out, it’s working PERFECTLY.

In reference to the GOP strategy “Starve the Beast”…

Economist Paul Krugman summarized the strategy in February 2010: “Rather than proposing unpopular spending cuts, Republicans would push through popular tax cuts, with the deliberate intention of worsening the government’s fiscal position. Spending cuts could then be sold as a necessity rather than a choice, the only way to eliminate an unsustainable budget deficit.” He wrote that the “…beast is starving, as planned…” and that “Republicans insist that the deficit must be eliminated, but they’re not willing either to raise taxes or to support cuts in any major government programs. And they’re not willing to participate in serious bipartisan discussions, either, because that might force them to explain their plan — and there isn’t any plan, except to regain power.”

Yet people still somehow identify with the idea that any type of welfare is SOCIALISM ( like the interstate highway system… what a stupid SOCIALIST program that was ). Funny thing though is that WELFARE is fine to these same “capitalists” as long as it’s CORPORATE WELFARE. Big company about to fail because they made extremely risky and stupid CHOICES in an attempt to profit? If they win the bet they profit, if not “we’re too big to fail… save us America”. So regulations are put in place to prevent the same crap from happening again at the public’s expense and then all of a sudden that is the problem… if we can’t run free you won’t have jobs. However if a teacher or firefighter making $30K per year wants a nice public park to visit or grants for an education it’s being a Lazy Socialist or Communist. Wake up people… we should be in the middle and we’re headed towards FASCISM.

palmcoaster says

What Fascist Rick Scott wants when proposing to cut taxes is not for the small businesses the real employer of our workers and the one’s that do not as for a free ride. This crook means tax cuts for the big corporations like the one his wife owns now and like the one (Columbia HCA that stole billions from Medicare and Medicaid while he was their CEO). Further tax cuts for the cruise lines out of our ports as already they pay next to zero and to the same billionaire owners of these Florida sports teams that pay zero tax on their billionaire earnings using for no fee, those sports stadiums built and maintained by us, the 99%. http://www.cruiselawnews.com/2011/02/articles/taxes/no-taxes-the-cruise-lines-dirty-little-secret/

http://blogs.miaminewtimes.com/riptide/2010/12/tricky_micky_arisons_heat_does.php

For the oil companies polluting our Gulf to extract “our non renewable resource” oil for export. Now they even want to further pollute our farmlands pushing for the Keystone pipeline to bring the dirties oil sands from Canada to the Texas ports also for export! http://thehill.com/blogs/e2-wire/677-e2-wire/186969-clinton-keystone-pipeline-review-is-fair. I am so disappointed at Hillary Clinton.

We endure the pollution here while they fatten their wallets and the gullible believe that the oil is for us and to create jobs here….at what cost? If we want our real jobs back, we need to start buying made in the USA and carefully researching where all this shit is made and if they don’t have it, demand that is made here and then buy it!. The shit sold in Walmart? for sure the Waltons have enough money to open factories and employ Americans so is made in the USA and the technology is here as was stolen form us.Better be aware that if we don’t do this, no administration will do it for us. We the 99% have the power to create jobs NOT BUYING ANYMORE IMPORTED STUFF! Or otherwise the unemployment will be like in some 3rd world countries 90%. Always they bring the excuse that our exports will get hurt if we do that?…Well stop the greed and demand that Asia countries, China, Japan, Malaysia, Korea, Vietnam,etc etc…Buy from us as much as we buy from them…as now is done with Canada and Mexico they buy from us as much as we buy from them…they even buy more as Canada is our first buyer of American Made goods and yes….bashed Mexico, is the second one. While China has trade barriers for our exports while all we consume is made by Chinese. How more stupid can we be? http://useconomy.about.com/od/tradepolicy/p/Trade_Deficit.htm

The Primary Trading Partners: The primary trading partners with the U.S. are Canada, Mexico, China and Japan. About one-third of U.S. exports go to Canada and Mexico, with another 15% going to Japan, China and the UK. The U.S. received one-third of its imports from Canada and China, with Mexico, Japan and Germany contributing an additional 20%

Doug says

Thank you Flagler County for voting for this Governor. Isn’t he also backpeddling on his commitment to create jobs since its not government’s responsibility to create jobs?

“Let’s Get to Work” & “We’ll create 700,000 jobs in 7 years” is translated into, piss off I’ll keep the rich richer.