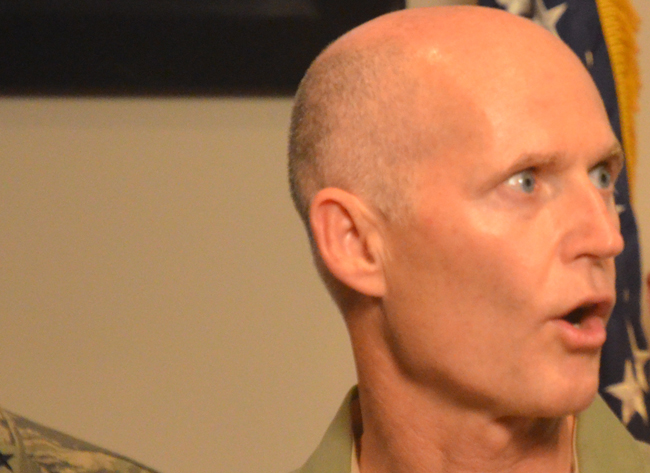

Gov. Rick Scott this week said Florida is ready to weather a potential federal shutdown and if he were put in congressional shoes he’d oppose efforts to raise the federal debt ceiling.

Scott conceded that the nation, which has never failed to pay its bills, is entering new territory if Republican lawmakers and President Barack Obama cannot reach an agreement, but he added that financial markets have likely already figured in such a scenario and would not overreact if it comes to pass.

Click On:

- Scott Administration Analysis of Shut-Down

- Boehner-Obama Debt-Ceiling Follies: Your Hair-Pulling Guide on Stats and What Ifs

- Debt Ceiling Fallacies: How to Pay Down The Deficit Without Really Trying

- Enough Nickel and Diming: How to Cut $1.5 Trillion From the Budget Without Really Trying

- Rick Scott Archives

“I don’t think anybody knows because it’s never happened, but I believe the markets understand where the federal government is,” Scott said. “They understand where the spending is so I think the market has already priced it in.”

Scott’s assessment may be overly optimistic. He spoke on Monday. On Tuesday, the Dow Jones average lost 0.73 percent, or 91.50 points. Today (Wednesday, July 27), it had lost another 161 point an hour from the closing beel, or an additional 1.29 percent, one of its steepest one-day drops of the year.

More than markets would be affected, of course: if the federal government cannot pay its bills, Social Security checks, soldiers’ pay and ammunition, traffic controllers’ pay and innumerable other responsibilities would be jeopardized. The original date of the Treasury running out of money was Aug. 2. The Treasury says it may have a little more room–a few days’ room, that is, not weeks. On Aug. 2, The Times reports, “the United States will owe about $307 billion during the rest of August, but is expecting to take in about $172 billion in revenues, according to an analysis by the Bipartisan Policy Center. Without enough money to pay all of its bills, the government will have to decide what to do. The possibilities range from “prioritizing” some payments and paying them first to paying bills in the order in which they were received.”

Alex Sink, Florida’s former Chief Financial Officer and the loser in a closely contested race for governor against Scott last November, called Scott’s assessment “clueless.”

“Heck yes our credit rating will be impacted. That’s Florida budgeting 101,” Sink told the Times/Herald. “Suggesting the debt ceiling should not be addressed is outrageous and irresponsible,” Sink said in an e-mail. “A default by the federal government would have immediate impact on the state of Florida, our budget, and our credit ratings. The people of Florida know better, and we need our governor to know better.”

Scott said his office did an analysis in April when federal shutdown talks first began and determined the impact to Florida “would be minimal.” The governor said Monday that view has not changed, but the extent to which a shutdown would affect the state will depend on a host of unknowns that the state has minimal control over.

“We’ll have to see what they pay and what they don’t pay,” Scott said.

Scott’s analysis misses a crucial element relevant to Florida homeowners, who already have one of the highest rate of properties in foreclosure or under water: if the United States defaults, investors, abroad and at home, will likely demand higher interest rates on their loans. That will translate to steeper costs on credit cards and mortgages, especially adjustable-rate mortgages.

Others aren’t so optimistic as Scott, either. With 2.9 million Medicaid recipients and thousands more on food stamps and other federal assistance in Florida, the potential of a government shutdown could prompt the loss of critical services at a time when Floridians have already been subject to the most severe recession since the Great Depression.

Carol Weissert, political scientist and director of the LeRoy Collins Institute at Florida State University, said bedrock federal programs like Social Security and Medicare will likely not be affected (an assertion contradicted by federal officials), but Medicaid may not be so lucky if lawmakers have to choose what programs to fund. Other vulnerable areas are grants to states for education and transportation programs.

“I would say we are entering into new territory,” Weissert said. “And I do not believe that it is fertile ground.”

In April, more than 3 million Floridians receive food stamps through the U.S. Department of Agriculture. The figure represents an 18.3 percent increase in the number of food stamp recipients from April 2010.

Meanwhile, Florida’s Medicaid program costs $20 billion a year, with more than half of that coming from the federal government. The program is run through the Agency for Health Care Administration.

“AHCA is monitoring the situation in Washington,” said agency spokeswoman Shelisha Coleman. “It is too early to comment on how the federal government’s budget negotiations may affect services provided by AHCA.”

–Michael Peltier, News Service of Florida, and FlaglerLive

Attila says

Two sets of stuck on dumb, and politicin idiots in DC. It has been said by reps and dems that if we were to tax the wealthy at 100% it would not balance the budget. So how can we expect that the middle class will not pay more in taxes, either by higher rates or less deductions? It was also reported last year by the Presidents commission on the debt that all of the waste and fraud would only be a small percent of the deficit even if we could eliminate it. So if we can not raise tax revenues, and increase prosperity to pay the governments bills and debts, don’t we have to stop spending somewhere?

beachbum says

Come on, get real! There is plenty of money in the coffers. There will not be a shut down that affects anything important. Worst case is a few hundred thousand lazy and unnecessary federal workers will be on vacation for a week or two.

This is all just political posturing and game-playing. Proof that our Congress is more interested in protecting their parties and their re-election than the good of the people they (LOL) represent.

Federal revenues are (shockingly) about $200 billion a month, and debt interest is (only!) $20 billion.

Don’t be scared by the B.S. — it’s all in the plan. Errr, what plan? I say, put a lid on it now and forever.

Kyle Russell says

“Lazy and unnecessary federal workers.” Because the federal government doesn’t provide any vital services, right?

Charles Ericksen, Jr says

Help me understand.. Is what is happening now in Wash,DC, Democracy at its Best or Worst?? I would add the 536 and Presidential staff to the Governor above, as those who don’t know, don’t care about the average citizen..

Sam says

“Debt interest is (only!) $20 billion”………Interest only !!!!! So we will just continue paying only ” interest payments”, but NO principle payment. Our children and grandchildren will become slaves to China in 15 years. There is NO WAY of every paying off this debt in 10 generations. I think we need a better plan and FAST .

palmcoaster says

Mr.Ericksen yes what is happening in W DC now is much closer to democracy than what was with Bush. Now a president trying to engage the conservatives to no avail to have America not to loose credit rating credibility, as they have a destructive agenda while they approved Bush 7 debt ceiling increases out of his 8 years! Shameless GOP.

You just lost my vote!

The better plan and fast is…stop our useless 3 wars we can’t no longer afford bring our soldiers home and put them to work under the the Army Corps of Engineers to repair our decaying infrastructure using the billions given to Cheney’s/Bush Halliburton and the like, to keep these wars alive for their profits. Have the oil companies and other mighty big corporations pay the taxes they don’t and cut all their tax deductions and incentives. Cut all the BS foreign aid to our “so called allies” , billions there to be saved. Have millionaires and billionaires pay the same tax rate as middle class and workers do, no less as now. Tax all imports and bring back our outsource jobs. I have no problem driving my Fords, Chevy’s and Jeeps. Steve Jobs and his investors can shove their Apple gadgets made by slaves in China.

Create the jobs that realistically 20 million unemployed Americans need to be able to generate the income and payroll taxes that sustain our federal and states budgets! And our night,mares will be over.

Anyone out there willing to risk their lives for the passage of sustaining legislation, to the above?

John Smith says

Did you see the interview on CNN Scott could not come across with a straight answer and they put the pressure on him to do it and he could not, showed just his same political self like he is still running for gov. What a joke this jerk is. Made Florida proud.

cindy says

You have to really look back in history, where this debt was incurred, if we all could look at history books they would surely tell you that in 1996, the Republican shut down the federal government and caused Chaos. This seems to be a pattern of theirs. Any idiot can see we need to stop spending however, is now the time to stop when we are just making headway and a slight recovery, they will just send everything into a Great Depression and there will be no coming back. During that time the American people revolted againist this party, if they are trying to stop this President they are doing it the wrong way, they will fall on their faces flat, a depression or recession will not help the rich put any more jobs out there and no one will be buying anything anyway, so much for helping the economy. This is a two edged sword they are playing with fire again.

Pat says

Rick Scott is an ignoramus!!!!!! Need I say more.

richard says

One thing i dont understand? I i were President and I thought i would run out out of money in a week or so I would already have shut of lots of payments to contractors, suppliers and others. Especially i would have shut of any payments to keep Washington running. Makes me realize that Washington has no sense of how to manage a budget.

palmcoaster says

Correct Cindy. These fake faces reps in DC approved Bush 7 times in 8 years to raise the debt ceiling and now oppose it because Obama ask for it. Donkeys! Raise the darn debt ceiling and afterwards address cut spending and tax corporations and the wealthy for more revenue. This budget is down, not only for spending but also for lack of revenue. We have 20 million unemployed that do not contribute income and payroll taxes that sustains most of our federal budget. Meanwhile this idiotic Tea Party GOP elected in 2010, keep on laying off workers. How any dumber they could be?

elaygee says

The entire deficit is due to cutting taxes on the wealthy and fake wars. Period.

Return the tax rates to what they were under your dear departed saint, Ronald Reagan, and the deficit goes away comletely.

Kyle Russell says

Richard: actually, the Treasury did stop investing the Federal Pension system’s income in Treasury bonds back in May.

Lucine says

People: You lose credibility when you are incapable of typing a coherent thought.

No wonder we’re all in trouble.

Nancy N. says

See, what Rick Scott meant was that it won’t affect his richie-rich Floridian friends because they’ve all moved their assets into safe financial harbors like gold. The rest of us little people….meh. That’s minimal effect to him.

palmcoaster says

Lucine, you are one more blaming the crime on the victimsthat are posting their astonishment and perplexity of what is currently being done, anyway they can here?

palmcoaster says

Which is the party that opposes the end for oil companies, tax incentives, breaks and refunds…you got it right the GOP. Who get gouged at the pump when the oil tycoons hare ripping all time high earnings?

http://finance.yahoo.com/news/Big-Oil-reaps-big-profit-in-apf-3778164863.html?x=0&sec=topStories&pos=9&asset=&ccode=

Lucine is the above enough coherent for you.This news fresh from the presses? Too bad too, that our current Prez exempted the oil futures as well as the pharmaceuticals from limit tradings just enacted, promoting this way green flag for more gouging.

William says

This entire Kabuki theater has one purpose, and one purpose only: the unimpeded upward flow of wealth.

In the event of a default, payment #1 is interest on debt (translation: the financial sector gets paid no matter what). If actual human beings die due to a lack of services, well, that’s the way the ball bounces.

The Greedy Ol’ Party and its extremist TeaBircher segment are the owner’s hatchet men. Unless they are stopped they WILL destroy the village in order to “save” it.

The dims are either complicit, or too chickenshit to punch this irrational schoolyard bully right in the face.

We need another Eugene Debs.