If a national recession is looming–by one traditional measure, it is already happening–the signs are mostly not apparent in Flagler County and in Florida. But there are glimmers of warnings.

Unemployment remains at a historic low, according to figures released this morning by the state’s labor department. Construction permits are still being issued at a strong pace–201 in July in Palm Coast. Median housing prices in Flagler are still above $400,000, well above a year ago, according to the Flagler County Association of Realtors. Consumer sentiment improved for the second month in a row in August, according to the University of Florida’s Survey Research Center.

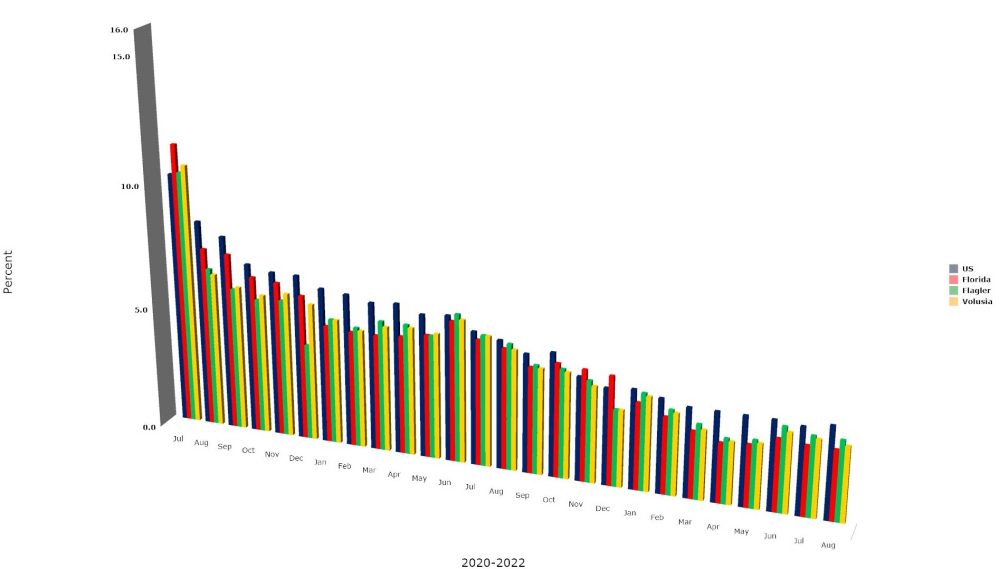

Flagler County’s labor force again climbed to a new record in August, reaching 50,718, pointing to continuing influx of working-age residents at a rapid pace: the labor force has grown by more than 2,000 over the year even as the unemployment rate has declined from 4.7 percent a year ago to 3.2 percent in August, signs that the local economy remains strong as it absorbes newcomers to the workforce.

The Flagler unemployment rate remained at 3.2 percent for the second successive month in August, with just 1,600 people unemployed, down from 2,300 a year ago.

A record 49,111 people living in Flagler County held jobs last month. The figure represents those holding jobs anywhere, including in neighboring counties or through telecommutes, and does not make a distinction between full and part-time work. The number of employed residents has grown by 6 percent over the year, with nearly 2,800 more people holding jobs.

In Florida, the seasonally adjusted unemployment rate was 2.7 percent, unchanged from July and down 1.6 points from a year ago. There were 293,000 Floridians officially out of work in a labor force of 10.7 million. But the figure does not represent the true level of unemployment, since it only counts the unemployed as defined by the state: those workers who are complying with the state’s rigorous demands that they show proof that they’re looking for work, and who are eligible for the state’s stingy unemployment checks, which run out after 12 weeks. In essence, state rules artificially lower the true level of unemployment and underemployment.

The state does not compute a truer level of unemployment. The federal government does, through its “alternative measure of unemployment,” which accounts for discouraged workers (those who have dropped out of the labor force) and those working part-time for economic reasons–because they could not find full-time work, or because their hours have been cut back involuntarily. According to that rate, 6.7 percent of Floridians are unemployed or underemployed. Of those, 1.5 percent have been unemployed longer than 15 weeks (which means their state benefits have run out; there are no longer supplemental federal benefits). The national average for the alternative rate of unemployment is 7.6 percent.

There may be distant warning signs in the local economy. The July report of home sales in Flagler, the latest available, shows a sharp drop of 76 percent of homes selling for cash, an uptick in the median time it takes for homes for sale to go to contract (from eight days to 14 days, still low, but the trend is up), and a doubling of listings as well as a doubling in the supply of housing inventory: the last two years’ housing boom is unquestionably slowing, and may slow even more as interest rates are rising fast.

The average 30-year fixed-rate mortgage crossed the 6 percent mark for the first time in 14 years this week, more than double the level of a year ago. “With a down payment of 10 percent on the median home price listed in the database on Realtor.com,” The New York Times reports, “the typical monthly mortgage payment is now roughly $2,352, up 66 percent from $1,416 a year ago, taking both higher home prices and interest rates into account.”

Consumer sentiment may be lagging behind. According to the University of Florida’s monthly consumer sentiment survey, ” Perceptions of personal financial situations now compared with a year ago increased 2.7 points from 52.5 to 55.2. As a striking coincidence, opinions as to whether now is a good time to buy a major household item like an appliance also increased by 2.7 points from 52.5 to 55.2. Importantly, these positive views were shared by all Floridians across sociodemographic groups except for people with an annual income under $50,000 who reported less-favorable views to the latter component. Outlooks about expected economic conditions were also positive. Expectations of personal finances a year from now increased 4 points from 75.1 to 79.1, though, people with an annual income under $50,000 reported more pessimistic views.”

Inflation remains very high, with the July rate at an annualized 8.3 percent, down only slightly from 8.5 percent the month before (it peaked at 9.1 percent in June). The S&P 500 reached a record high on Jan. 4, and has fallen 20 percent since–and 6.3 percent just in the last five days.

The nation’s Gross Domestic Product (GDP, or the total output of goods and services) fell 1.6 percent in first quarter of 2022 and by 0.9 percent in the second quarter. By the traditional definition, that’s a recession, a judgment disputed by the Federal Reserve. “We find that most indicators—particularly those measuring labor markets—provide strong evidence that the U.S. economy did not fall into a recession in the first quarter,” the Federal Reserve states.

It also disputes the standard measure of a recession: “The two quarters of declining GDP definition is a rule of thumb that does not officially define a recession. The National Bureau of Economic Research (NBER) Business-Cycle Dating Committee, which certifies and dates U.S. business cycles, defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” A range of monthly indicators has been used by the committee to determine the peaks and subsequent troughs in economic activity. The period between the peak and the bottom of a subsequent downturn is called a recession.”

Consumer spending, income, employment, manufacturing and industrial production all remain strong. So do debates over the meaning of recession.

![]()

Caper says

If there is a recession it won’t be because of Joe Biden. The president’s huge spending bills have helped so much. Climate change and equality are what’s most important anyway.

If there is a recession you can blame Ron DeSantis. Why Florida doesn’t have a state income tax is foolish. The state needs that money so if we have a recession the government can support those that can’t or don’t want to work.

A.j says

Will have a recession soon I believe. They do happen regardless to who is in power. People need to be ready for then because they do happen from time to time.