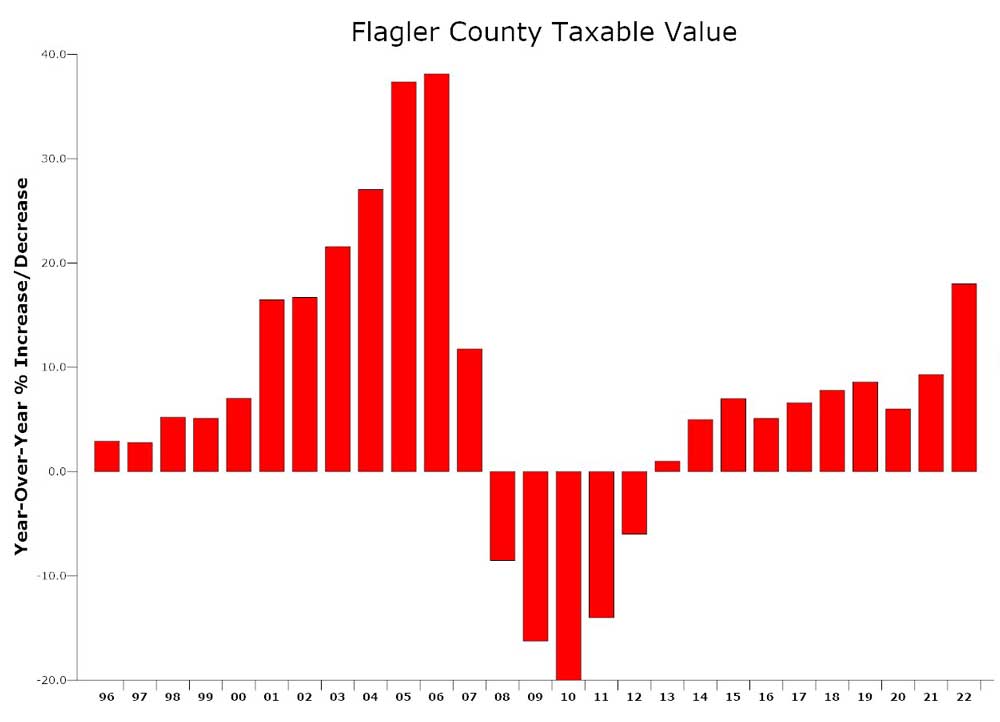

Taxable values in Flagler County rose 18 percent in 2021, higher than initially estimated two months ago. Values rose nearly 20 percent in Palm Coast, 14.5 percent in Flagler Beach and 22 percent in Bunnell. The school board’s taxable values increased by 25 percent.

Those are the steepest taxable-value increases in 16 years, dating back to the peak year of the housing bubble in 2006, when values surged by 38 percent. The difference this time, says Property Appraiser Jay Gardner, is that people are moving into the homes they’re buying, not buying them as investments or to flip them, and demand for housing remains extremely strong.

For local governments, the surging values can translate to surging revenue–if the governments do not hold the line on tax rates.

For example, Palm Coast’s revenue in 2022 from its current property tax rate of $4.61 per $1,000 in taxable value was $28 million. That’s based on total taxable values of $6.4 billion in the city. Values have now surged to $7.7 billion. If the City Council were to keep the same tax rate, that would translate to revenue of $35.5 million, or a staggering $7.5 million increase–a 27 percent budget increase in the general revenue alone.

But if Palm Coast were to keep the same tax rate, or any tax rate that doesn’t adopt the so-called rolled-back rate or less, it will be imposing a tax increase under state law, and must portray it as such to its taxpayers. The rolled-back rate is the tax rate at which the city takes in the same revenue next year as it did this year. That would not be a tax increase, but the tax rate would have to be reduced proportionately.

One caveat: Included in that new taxable value for Palm Coast is $315 million in new construction in the city. That alone represents almost $1.5 million in new revenue. It’s not part of the rolled-back consideration. Value drawn from new construction is considered “free money,” or revenue that the city can take in without affecting its tax rate.

The same applies to county revenue: the county is benefiting from $457 million in new construction. It gets more than Palm Coast because every new structure in the county, including in the municipalities, owes a share of taxes to the county. Palm Coast gets to draw revenue only from its own municipal taxes, while Palm Coast residents must pay their city and county taxes (plus a series of other taxes).

For the county, Gardner says, “$3.6 million they would have because of new construction, that’s free money to spend, you don’t count that against the rollback rate, but the increase they have, the 18 percent, does include that number. But they’re definitely going to end up with more money if they keep the millage rate flat. In other words: a tax increase.”

When County Administrator Heidi Petito presented preliminary budget figures to the County Commission in mid-May, her numbers were based on a taxable value increase of 15 percent (it was 9.2 percent last year). Even then, she was projecting an increase of $12.3 million if the property tax rate did not change. The new numbers will swell that figure. Local governments are in the midst of drawing up their budgets for next year. At the county, the sheriff in mid-May was requesting a 20 percent budget increase. Despite the revenue windfall, Petito was projecting shortfalls between the county’s wish list and what money will be available. Local governments’ wish lists always exceed actual revenue. That’s where elected boards ordinarily step in to decide what to make a priority.

The school board’s taxable values are much higher than for other governments because many exemptions don’t apply to school calculations: only the first $25,000 homestead exemption applies. The senior exemption does not apply. The 10 percent cap on commercial properties does not apply. That’s how the district ends up with a 25 percent increase in taxable values, a boon to the district’s budget, but not nearly as much as you’d think.

The bulk of the district’s revenue is siphoned up to the state. The district’s tax rate is set by the state. Local school board members have no say. The revenue is then redistributed across the state according to a funding formula, again denying local boards a say. The Flagler board does have direct revenue from its local taxes, through the capital outlay portion of its property tax, and through its discretionary portion. Those aren’t small sums: the capital outlay rate alone will generate $22.5 million next year, and the discretionary rate, if it remains the same, will generate $11.2 million in addition to state and federal funding.

The long list of exemptions and the big difference between actual and taxable value underscores to what extent the non-homesteaded properties and people living in them, including renters and businessowners, carry a disproportionate share of the tax bill. (It is a common misconception among homesteaded property owners that renters do not pay property taxes. That is simply not the case.)

Conversely, the exemptions in place ensure that for homesteaded property owners, rising values will not mean rising taxable values, since the 3 percent cap puts a lid on that. That’s why even when local governments increase taxes, the effect is blunted for homesteaded property owners as it is not for the non-homesteaded.

Still, the local property landscape remains out of balance, Gardner said, with just 10 percent of values drawn from commercial properties. He sees that changing somewhat, with commercial construction increasing. “This commercial growth hopefully will help us with stabilization of our residential tax base, because we really don’t have enough offsetting things,” he said.

A better balance would have commercial properties representing 20 percent of the tax base, especially with the skewing effect of exemptions, which keep homesteaded properties from paying their fair share. “Residential does not carry its own weight,” Gardner said. “How much does it cost to put a kid through school right now? Six, seven grand. How many people do you know pay more than $7,000 in taxes?”

Gardner sees more value increases next year, based on what he’s seen in the first six months of the year. (The taxable value rates he just sent to the Department of Revenue are based on figures as of Jan. 1, 2022.) It’s not new construction that’s driving the trend, but the increase in residents, and the demand on housing–and the difference between the 2006 housing boom and today’s dynamics.

“You’ve got five people standing in front of a house, trying to buy a house, you think the house is negotiated down any?” Gardner said. Some people are buying above asking price just to get the house. They’re selling their properties at the north end of the county and retiring here, buying in cash. “They’re all coming here with money and if you have 10 people trying to but one thing, it costs more.”

The trend is reflected in the Flagler County Association of Realtors’ monthly numbers. The median sale price for a home in Flagler-Palm Coast was $400,000 in May, up 36 percent from a year ago and double what it was in January 2018. This isn’t local people affording these prices. No negotiating necessary. The median price of a home was bought at 100 percent of the original list price, with a median time from bid to contract of just 10 days, compared to 60 days two years ago.

Inventory has picked up a bit in may, rising to just over 400 single family homes, but the supply of homes remain at just over a month, and has hovered around the one-month mark for over a year. In 2018 and 2019, the supply was hovering at just below five months’ worth. As Gardner noted, cash sales are again high, with 101 such sales in May, out of 283 total sales–35 percent.

Flamingo Gary says

Message to Flagler County and Palm Coast government. Adjust the millage rate down accordingly to match what the budget would have been with no property value increases. If you do not do that you will mostly be hurting renters in this county because I can promise you in my rentals I will be passing your greed onto them entirely.

A.j says

A windfall the Gov. what about the little man on the street?

Jimbo99 says

We’re not hearing anything about lower millage rates for higher assessed property values, but we’re having million dollar food bank drives so that people can afford their rent/mortgage. Maybe the Homestead Exemption needs to be increased to provide a real world solution to moving the goal posts to gouge people for a roof over their heads. You would think the nation wasn’t facing a recession under the Biden ?

Rob says

Perhaps the trump supporting commissions could not raise their salaries?