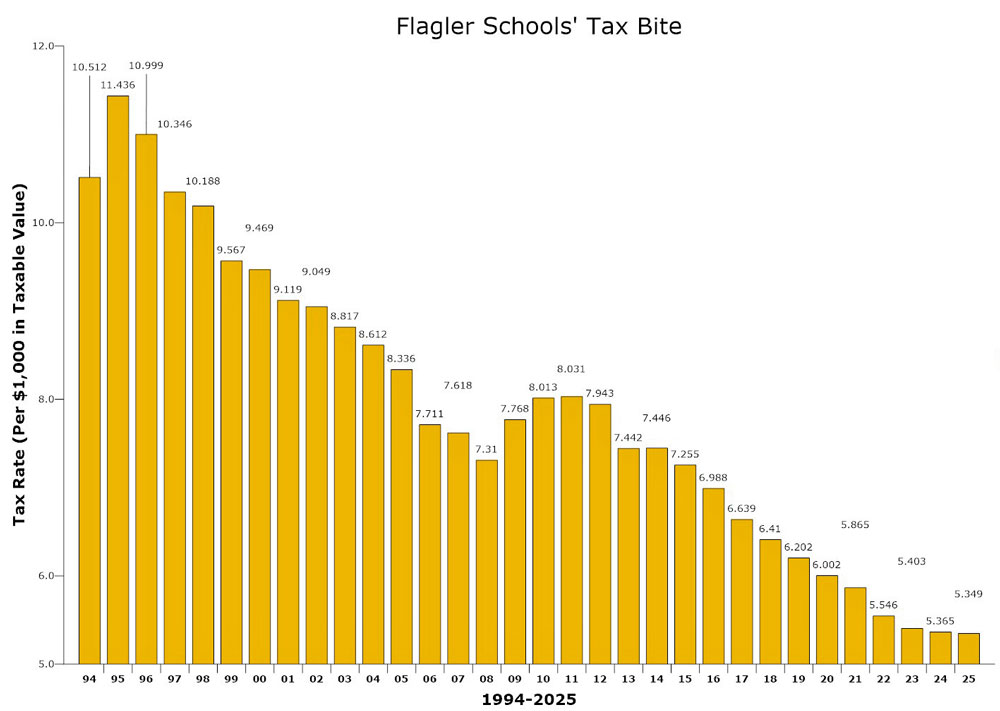

The Flagler County School Board in a 15-minute meeting this evening approved the tentative school property tax for the next fiscal year, a small decline from last year that continues a 20-year trend of cutting the school tax rate every year but in the three years of the Great Recession.

The local school board has no authority in setting the tax rate. It is set by state lawmakers. The local school board has no choice but to ratify it, and may not alter it. “We are the only taxing authority that does not set our own millage,” Patty Wormeck, who heads the district’s Finance Department, said, referring to the property tax. “That millage is given to us by the state, and we are told what it is every year.”

The meeting drew no public comment: the chamber was empty but for a few staffers. But Board member Janie Ruddy pointedly noted the discordance between falling tax rates and local needs, and between the expansion of vouchers–public funding for private education–at the public schools’ expense. Will Furry, who chairs the board, countered with a defense of vouchers.

“As public school enrollments decline due to the shift, we lose funding and economies of scale while still being required to maintain staffing facilities and programs for the children who remain,” Ruddy said. “This is not more efficient. It’s actually more expensive for the taxpayer over time. This program marketed as parental choice, expends massive amounts of taxpayer money to support a choice that was never at risk. Parents have always had the choice for private school, and in recent decades, the choice to home-school.”

Furry said vouchers’ expansion shows that “the school choice program is working for parents,” and that “public schools are no longer the monopoly, and the onus is on us as an organization, to present to parents that we are the best choice, right?” (Public schools, of course, have never been the “monopoly” as charter and private schools thrived well before vouchers.) “I believe that we are the best choice in Flagler, and I think parents are going to see that as time goes on,” he said.

Ruddy’s concern was about how the district could compete on an uneven playing field, especially as the district is required by law to meet certain standards, meet accountability benchmarks and offer a wide array of services and programs, none of which are required of schools subsidized by vouchers. Furry did not address that discrepancy.

The tentative rate is $5.349 per $1,000 in a property’s taxable value, or the equivalent of $936 for a $200,000 house with a $25,000 exemption. (You have a $50,000 exemption for all other local government taxes, but the school tax exempts only the first $25,000.) It is a saving of $3 when compared to the current rate of $5.365.

“So even though our values are going up, we are not benefiting from that. It is balanced out by the state,” Wormeck said.

The lion’s share of the tax rate is the state’s share. About 14 percent of the tax rate draws discretionary revenue for the district–the money is not sent to Tallahassee for redistribution–and another 28 percent draws revenue for the district’s capital needs (almost $29 million in the coming year).

Wormeck presented the $163 million budget at this evening’s hearing. The figure is deceptive. It includes $17.1 million that the state is channeling through the district, only for it to be distributed to nearly 2,000 students in “vouchers” subsidizing private or parochial school tuition, or home-schooling families. The district will not see any of that money except for a few dollars here and there as “voucher” families opt to enroll in a-la-carte programs in the district.

“You can see how those numbers have drastically increased since 2021,” Wormeck said. “This is definitely impacting all the school districts in Florida.”

There were just 136 such students in 2020-21. The number rose to 798 in 2023-24, then doubled to 1,600 last year as the program, called “family empowerment scholarship,” was expanded without previous restrictions such as income. Even millionaire families are now eligible for individual vouchers of $8,000 per student, more for students with special needs.

In the coming school year, 1,926 students are expected to participate, eroding the district’s enrollment.

A deceptive enrollment graph included in Wormeck;’s presentation shows district enrollment rising in the last three years, but only because the graph includes voucher students. The district has attempted various ways to mask its declining enrollment, but never so blatantly, though as Wormeck explained it, when the state calculates a district’s total number of students–to calculate the voucher share–it lumps them all together.

Last week the board was preparing contingencies in a budget that could have been denied federal funds as the Trump Administration had frozen those funds. The administration released them late last week, saving several local programs that benefit mostly underprivileged students.

![]()

Merrill Shapiro says

You’ll rarely go wrong following the lead of Janie Ruddy! She is a more than worthy spokesperson for Florida’s Constitution, Article IX.Section 1: Section 1

Public Education

(a) The education of children is a fundamental value of the people of the State of Florida. It is, therefore, a paramount duty of the state to make adequate provision for the education of all children residing within its borders. Adequate provision shall be made by law for a uniform, efficient, safe, secure, and high quality system of free public schools that allows students to obtain a high quality education.

That’s “a” uniform, efficient, safe, secure, and high quality system of free public education, not a bunch of private systems that we, the taxpayers must now fund.

Robin says

Thank Ms.Ruddy. Vouchers are another form of defacto segregation. Private and charter schools can be understaffed with special education teachers. Students who are not performing to a school’s standard can be dropped and sent back to public schools.

I know as I have taught in charter and public schools.

Concerned Citizen of Flagler Ciunty says

Kudos to Ms Ruddy! FCSD needs to come up with something to get these students back into the public schools Mr Fury why are you on the school board if you are in favor of choice? I’m sure glad Ms Ruddy is protecting and supporting PUBLIC Schools. That is what each school board should be doing instead of getting political. These are our students and I support PUBLIC svhools. My grandson will be entering kindergarten this coming school year with FCSD. I’m a product of PUBLIC schools and my children were too. In fact there is so much more to offer our students then there was years ago. This is a positive thing. I would hate to see programs go away and not benefit our children.

Dennis C Rathsam says

FOLKS YOUR MISSING THE PROBLEM!!!!! TAKE YOUR HEAD OUT OF YESTERYEAR. Look in the mirror & blame your self. You all caused this, everyone of you is to blame! Parents want the best for thier kids, so when they see all the all the hate & name calling, backroom deals, & confusion, what would you do? Stay with the same mess your in now, or try something different. Obviously Ladies & Gentlemen, look deep in side your soul. If this is a political stepping stone for you, don’t let the door hit you on the way out! This is a job for people that care. Care about our kids, that’s the bottom line, if this is just another job for you, its time to back your bag too! Parents, get involved! Speak out, These folks need all the help they cant get, & they need it now!

Laurel says

The far right is trying to implode everything public. Just like the National Park system. Keep taking funding away from it and it becomes a place no one wants to go to. Then, bring in that private hotel and pickleball courts, and see how much better it is?

The distribution of school taxes should be, at the very least, voted on by the public. Then, if decided that vouchers should remain, these schools, and home schools, should have the same scrutiny as public schools. Religious schools should not be funded by state, or federal money.

JC says

Dennis C Rathsam can you stop streaming like a boomer on your keyboard? I wonder if you have any hobbies besides bashing your keyboard all day/night.

Timm says

Of course the republican furry defends them. Kids outside the pubic schools are much more likely to be abused. We see how they protect one of the largest abusers in the world. I said this when they announced their plan to defund schools that’s all it ever was! They use words like school choice as their followers lack critical thinking skills to realize the choice was simply to defund schools. wheres the lottery or private schools to help with the ymca or the beach? Corruption runs rampant here ! The gop is very well funded well organized terrorist organization.

Corrupt much says

Ron’s representing the big donors that got him there and ensuring they get a return of your tax dollars! Your individual representation was sold to the highest bidder thanks to citizens united! “We the people” get hosed by corporate oligarchs ! Greed is powerful

Susan says

Stop the gop grift! Cutting public education to make a few people richer. That’s sick, sad, and pathetic ! But that’s republican leadership! Oh and people including children are being captured by others in masks and is totally normal now……

Reality says

Another comment section filled with people displaying open and utter disdain and contempt for families BEING ALLOWED THE FREEDOM TO CHOOSE.

Folks, they don’t care about you. They think school choice families are stupid. They think we are racists. They have 0 curiosity about why are making the choices we’re making: it’s on full display in these hateful, vile comments.

They want to control your kids. They want power. You need to really internalize this and call it out whenever you see it. The people you see crying every day about the rise of fascism, totalitarianism, or whatever – they are the ones who are openly mocking the idea you should be allowed to educate your kids the best way they learn. They want to stop that from happening at all costs. They want the power to hurt you and hurt your kids.

There’s literally no other explanation for this despicable behavior. Do these people seem smart to you? Does it sound like they have a strong grasp on policy, on how your kids learn, or on anything whatsoever?

They don’t. They’re radicalized to hate you for having choice. Get away from these people as fast as you can. The state of Florida knows this is the truth about these people and is trying to help.

Begging everyone with their minds still attached to this reality to see this obvious truth and protect your children. Get together with your friends and families and teach your kids to your shared values. Make them strong and thoughtful and curious – the exact opposite of the people in these comments. The further you get away from them, the less chance they have to amass power to control you.

Private school graduate says

Parents who choose not to use the public school system do it with reason.

They are still paying the public school tax PLUS contributing to thier school of choice.. a more costly option BUT with good reason, citing the lack of discipline and watered down education public schools provide.

If the public school system provided the better option it could be a more popular and less costly option for parents.

The way I see public schools would have a financial advantage for families IF they could just straighten out and become the better option

Nothings going to change says

The state of Florida has been hollowing out public schools for decades. The voters have done nothing to stop it. Perhaps they hate schools. If you only have good schools for the wealthy, who were already going to private schools, then families will leave. The lack of workers is going to break Florida. If you’re looking for fraud ,waste and abuse, it’s coming from the state legislature and the governors office. Killing schools is just another get rich quick scheme from all those elected attorneys who represent the special interests.