By Scott L. Montgomery

The world is in the grip of an oil price shock. In just a few months, prices have risen from US$65 a barrel to over $130, causing fuel costs to surge, inflationary pressure to rise and consumer tempers to flare. Even before Russia’s invasion of Ukraine, prices were climbing rapidly because of roaring demand and limited supply growth.

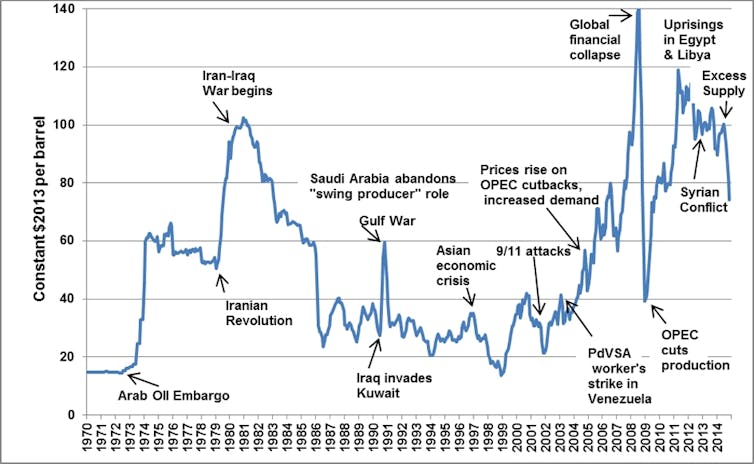

Price shocks aren’t new. Viewed historically, they are an integral part of oil market dynamics, not anomalies. They have occurred since the birth of the industry.

Many factors can trigger oil price shocks. They include large shifts in either demand or supply anywhere in the world, since oil is a global commodity. Shocks can also result from war and revolution; periods of rapid economic growth in major importing nations; and domestic problems in supplier countries, such as political conflict or lack of investment in the oil industry. Overall, the worst spikes have combined two or more of these factors – and that’s the situation today.

U.S. Department of Energy

50 years of ups and downs

Global oil production began in the mid-1800s and grew rapidly in the first half of the 20th century. For much of that time, oil majors – companies like Chevron, Amoco and Mobil that were created after the Supreme Court ordered the breakup of Standard Oil in 1911 – operated effectively as a cartel, maintaining production at levels that kept oil abundant and cheap to encourage its consumption.

This ended when Iran, Iraq, Kuwait, Saudi Arabia and Venezuela formed the Organization of Petroleum Exporting Countries in 1960, nationalizing their oil reserves and gaining real supply power. Over the following decades, other nations in the Middle East, Asia, Africa and Latin America joined – some temporarily, others permanently.

In 1973, Arab members of OPEC cut their oil production when Western countries supported Israel in the Yom Kippur War with Egypt and Syria. World oil prices shot up fourfold, from an average of $2.90 per barrel to $11.65.

In response, government leaders in wealthy countries introduced policies to stabilize oil supplies. These included finding more oil, investing in energy research and development, and creating strategic oil reserves that governments could use to mitigate future price shocks.

But six years later, oil prices more than doubled again when Iran’s revolution halted that country’s output. Between mid-1979 and mid-1980, oil rose from $13 per barrel to $34. Over the next several years, a combination of economic recession, replacing oil with natural gas for heating and industry, and shifting to smaller vehicles helped to mitigate oil demand and prices.

The next major shock came in 1990 when Iraq invaded Kuwait. The United Nations imposed an embargo on trade with Iraq and Kuwait, which raised oil prices from $15 per barrel in July 1990 to $42 in October. U.S. and coalition troops moved into Kuwait and defeated the Iraqi army in just a few months. During the campaign, Saudi Arabia increased oil production by more than 3 million barrels per day, roughly the amount previously supplied by Iraq, to help dampen the increase and shorten the period of higher prices.

CORBIS via Getty Images

More disruptive price shocks occurred in 2005-2008 and 2010-2014. The first resulted from increased demand generated by economic growth in China and India. At that time, OPEC was unable to expand production due to long-term lack of investment.

The second shock reflected the impacts of Arab Spring pro-democracy protests in the Middle East and North Africa, combined with conflict in Iraq and international sanctions that Western nations placed on Iran to slow its nuclear weapons program. Together, these events pushed oil prices above $100 per barrel for a four-year stretch – the longest such period on record. Relief finally came via a flood of new oil from shale production in the U.S..

A pefect storm in 2022

Today, multiple factors are raising oil prices. There are three key elements:

- Oil demand has grown more rapidly than expected in recent months as countries emerged from pandemic lockdowns.

- OPEC+, a loose partnership between OPEC and Russia, has not raised production at a commensurate level, and neither have U.S. shale oil companies.

- Countries have drawn on stocks of oil and fuel to fill the supply gap, reducing this emergency cushion to low levels.

These developments have made oil traders worry about looming scarcity. In response, they have bid oil prices up. It’s worth noting that while consumers often blame oil companies (and politicians) for high oil prices, these prices are set by commodity traders in venues such as the New York, London and Singapore stock exchanges.

Against this backdrop, Russia attacked Ukraine on Feb. 24, 2022. Traders saw the potential for sanctions on Russian oil and gas exports and bid energy prices even higher.

Unexpected factors also have emerged. Major oil companies including Shell, BP and ExxonMobil are ending their operations in Russia. Spot market buyers have rejected seaborne Russian crude, probably for fear of sanctions.

And on March 8, the U.S. and U.K. governments announced bans on imports of Russian oil. Neither country is a major Russian buyer, but their actions set a precedent that some analysts and traders fear could lead to escalation, with Russia reducing or eliminating exports to U.S. allies.

In my view, this set of conditions is unprecedented. It reflects not just increased complexity in the global market, but also an imperative for energy firms – which already are under pressure from shareholder climate activists – to avoid further reputational damage and leave one of the most oil-rich countries in the world. Some companies, such as BP, are abandoning assets worth tens of billions of dollars.

What could ease this shock?

As I see it, the key players that can help curtail this price shock are OPEC – mainly, Saudi Arabia – and the U.S. For these entities, holding back oil supply is a choice. However, there’s no evidence yet that they are likely to change their positions.

Restoring the Iran nuclear deal and lifting sanctions on Iranian oil would add oil to the market, though not enough to greatly reduce prices. More output from smaller producers, such as Guyana, Norway, Brazil and Venezuela, would also help. But even combined, these countries can’t match what the Saudis or the U.S. could do to increase supply.

All of these uncertainties make history only a partial guide to this oil shock. Currently there is no way to know how long the factors driving it will last, or whether prices will go higher. This isn’t much comfort to consumers facing higher fuel costs around the world.

![]()

Scott L. Montgomery is Lecturer at the Jackson School of International Studies, University of Washington.

Mark says

And who is holding back U.S. oil?

DK says

Do you even have to ask??? The “adults” running the White House show led by Bumbiling Biden

Denali says

Please enlighten us as to exactly how the fed is restraining the flow of US oil.

Denali says

As there are no federally mandated ‘caps’ on oil production in this country, one must assume that it is the oil companies who are controlling the flow of crude to the refineries. And then there is the bottleneck at the refineries as they switch from ‘winter gas’ to ‘summer gas’; a process which always seems to increase prices no matter which way they go.

It’s all about greed. Shell reported profits of $19.29 billion last year (with $6.4 billion in the last quarter), profits for 2020 were $4.85 billion. Paying off stock holders and buying back stock are more important to them than what you and I pay at the pump. They know they have us over a barrel, so to speak.

As always, follow the money – ask who stands to gain the most from limiting the supply and you will find out who controls the flow . . .

Mark says

Unless of course you mean the oil companies sitting on 20,000+ drilling permits for the United States. Don’t even mention XL, that would not even be fully functional until late next year even if construction was never halted. wait and see quarterly statements when they come out, don’t be surprised. This is part of the problem too, “oil traders worry about looming scarcity. In response, they have bid oil prices up. It’s worth noting that while consumers often blame oil companies (and politicians) for high oil prices, these prices are set by commodity traders in venues such as the New York, London and Singapore stock exchanges.”

The dude says

No no no…

Ask any conservative rube out there, they’ll tell you the real reason has nothing to with global geo-political issues, supply, demand, or market forces.

It’s all completely because of an unconstructed pipeline that wouldn’t be operational for years. THIS is 1000% why gas prices have risen.

Mark says

It’s not about a single pipeline. It’s about our anti fossil fuel policies and putting enormous amounts of new money into the economy. Of course there are other factors. But, we were energy independent just a year ago. What’s changed? The price of everything started when? When the Ukraine started? No. Take a guess.

The dude says

We’ve never been “energy independent”, turn off Faux Nooz.

And if we were… then why do we need a pipeline from Canada?

Mark says

https://www.eia.gov/energyexplained/us-energy-facts/imports-and-exports.php

Not related to FOX News. maybe you should read or listen to something other than CNN, or MSDNC and get out of the sheeple pen once in a while.

FlaglerLive says

Mark, who has been cautioned several times to comply with the site’s policy on spreading disinformation and is on the verge of getting banned, is here merely misinterpreting the numbers. Forbes’s Robert Rapier provides a less shrill interpretation here: “Surprise! The U.S. Is Still Energy Independent.”

TR says

From what I understand the US was self dependent a few years ago on oil. I believe we have the largest reserve of oil in the world, so why are getting the oil from other countries? It sounds stupid at first. But then thinking about it, it’s a about greed from the congress members that have stock in oil. Greed to the top and the American middle class and lower suffer. BASTARDS EVERY ONE OF THEM. Just goes to show they don’t care about the American people and just themselves.

Common Sense says

Blah, blah, blah, from the article to the responses. We all get it, commodity pricing is extremely complex. The economic principle or model of supply and demand price determination has become a license for the fleecing of the consumer. A consumer that has no ability or resources to push back against this principle.

The dude says

Funny how during times of shocking consumer energy prices, the companies foisting those prices on the consumers manage to always earn record profits.

Also funny, but surely unrelated, is how the cons always ignore those record profits and blame everyone but themselves and the energy companies.

Cons put the “con” in conned. They prove this daily.

Common sensed says

When Santa Claus has to pay inflated prices for deer feed, it’s gone too far.

Everyone has their expert opinion. All based on fictitious realities forced down their throat by whom ever they think aligns with their own false perception of reality. Whether it’s a commodity crop, metals, or energy, the economic principles that govern how these prices go up and down are flawed. Flawed in such a way that rarely in this day in age do you see these large companies take big hits.