Note: This is the first of two articles on Thursday evening’s hearing before the County Commission on next year’s property tax rate, budget and special taxing district. See the second article: “Overflow Crowd Tells County Commission: No to Taxing District on Barrier Island, Yes to Sales Tax for Beach.”

![]()

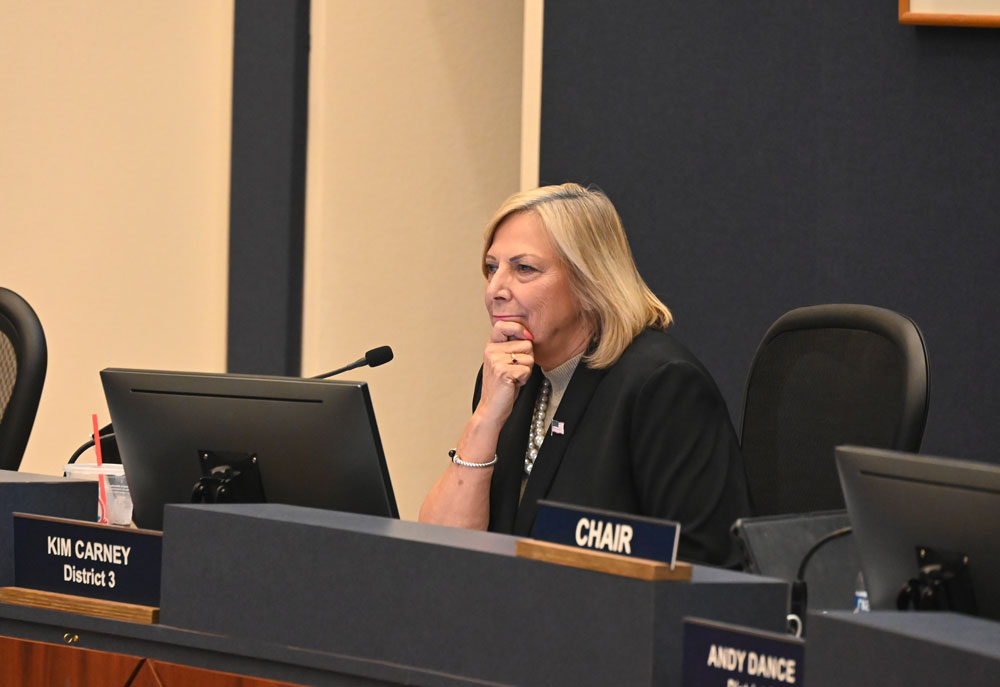

Speaking to a capacity crowd at a budget hearing Thursday evening, Flagler County Commissioner Kim Carney, who has complained of misinformation getting peddled around about county business, dispensed false and misleading information of her own on a central issue dividing the commission: the imposition of an additional sales surtax to help pay for a long-term beach-protection plan.

Carney was speaking at the first of two hearings setting next year’s property tax rate and approving the county budget, as well as a special taxing district for the barrier island. (The taxing district is a placeholder: no actual tax was proposed.) Carney claimed Flagler County could not impose the new sales tax without the cities’ agreement. Under state law, it very much can and has. She also claimed misleadingly that she could not vote for a sales tax increase that would dictate to future commissions how revenue would be spent.

Carney’s misinformation was consequential because she appeared to be using it at least in part to defend her decision not to support the half-cent sales tax increase proposed earlier this year. That increase was to be a key part of the funding mechanism for the county’s long-term beach-management program.

Commissioners Pam Richardson, Leann Pennington and Carney oppose the sales tax approach. Their opposition means the county’s long-term beach-management plan is comatose for now, barely surviving on a cobble of disparate sources of money and fortuitous federal and state grants that, in the longer run, fall far short of needed revenue if the beaches are to be rebuilt and protected.

Carney has opposed the sales tax increase on other grounds as well, namely, by suggesting that there are other ways to pay for the program. She has not come up with any. She wanted the county administration to do so. The administration believes the sales tax is the least painful way to get the most revenue. All other sources provide nowhere near the amounts necessary to make up for sales tax revenue. (Carney was correct when she said the county cannot impose a special taxing district, such as a Municipal Benefit Taxing District, or MSBU, without the cities’ approval. But conflating that with the sales tax, as she did, was inaccurate.)

Thursday evening’s misinformation further muddied the commission’s effort to find a solution, making a correction to Carney’s claims necessary.

There were two specific claims from Carney, one false, one misleading.

“We cannot set laws, even on the half-cent sales tax. We cannot act on behalf of any other municipality. They either come to us as the county and ask us to help, or we enter into an interlocal agreement with them,” Carney said. “We can’t go to their citizens and ask them these questions or present these things. They have to do that on their own. It’s the law.”

That is false. (On Friday afternoon, several hours after this article appeared, Carney said that she may not have been clear about what she meant. She said she is aware that the county commission may impose a sales tax unilaterally, but it may not unilaterally dictate the terms of joint agreements.)

“When I chose not to vote for the half cent, it was a lot of the same reasons,” Carney said. “I could not see it being an infrastructure tax, I could not see where we could say to future boards, you have to put $4 million a year in the beach based on the half-cent sales tax. I can’t do that. Not that I don’t want to do it. I can’t do it.”

That is misleading.

Regarding that second claim: local boards routinely and by necessity appropriate money from recurring sources, including the sales tax, to designated projects. It does not enjoin future boards from changing the allocation. But it can be difficult for future boards to do so. The 2012 County Commission approved a sales tax increase to pay for the expansion of the new jail. It would have been unthinkable for a subsequent commission to change course. None did. At the same time, revenue from the same sales tax has been allocated to projects the 2012 commission had not imagined–such as the beach.

Carney’s claim that “I can’t do it”–meaning she can’t approve a new sales tax and dictate its revenue spending in her capacity as a commissioner today–is not only misleading. It is disingenuous. The budget she voted to approve Thursday evening includes sales tax allocations, along with other allocations from other tax revenue. She had no problem lending her vote to those. A vote for a sales tax dedicated to the beach would be no different. It won’t stop future commissions from changing course.

Carney’s claim that “I can’t” in essence absurdly grants those future boards a veto on her vote today. It is more pretext than logic–a contorted and misleading way for Carney to justify her opposition to the sales tax.

As for her false claim that the commission cannot impose the sales tax:

The County Commission has the authority under state law unilaterally to raise the sales tax, with or without the cities’ agreement. The Flagler County Commission did exactly that in 2002. That halfpenny is still on the books, and will be at least through 2032.

The county has two options to impose a sales surtax. It may do so by referendum. The advantage of that approach is that the money may be bonded, and the revenue may be used to finance the bonds. The disadvantage is that voters’ will is unpredictable.

The commission may also impose the sales surtax by an extraordinary, or super-majority, vote, with at least four of its five members approving.

With either approach, the commission and the cities could enter into joint agreements defining how the revenue would be split, and how it would be used. If the commission were to choose the unilateral, super-majority vote approach, however, joint agreements are optional beyond formal ratification documents required by law. The county could decide to move ahead without worrying about such agreements, the terms of which may be imposed on the cities by the county, according to state law.

In 2002, the county and the cities agreed to go to a referendum for a half-cent surtax. On Sept. 10, 2002, at that year’s primary election, 62 percent of voters countywide approved a 10-year sales surtax to “fund infrastructure improvements.” Palm Coast would get 64 percent of the revenue. Flagler County would get 29 percent. The smaller cities would get the remaining 7 percent.

The sales tax was due for renewal in 2012. The County Commission wanted to change the split to 50 percent for Palm Coast and 45 percent for the county. That would have been the split set out in state law, absent joint agreements dictating otherwise.

Palm Coast and Flagler Beach said hell no. Both cities pulled their support for a referendum on those terms. Without their support, the referendum was certain to fail.

The county was desperate for a funding mechanism to pay for an expansion of the county jail–just as it is, or ought to be, desperate for a funding mechanism to protect the county’s beaches today.

So the county Commission in 2012 did what the law authorizes it to do: impose the sales tax on its terms, not through a referendum, but through a super-majority vote of the County Commission. Then-Commissioners Barbara Revels, Alan Peterson, Nate McLaughlin and George Hanns voted for it, Milissa Holland voted against (she was not happy with the split).

The money would be split according to the formula set out in state law, the formula the county had originally proposed to Palm Coast. That worked out to roughly 45 percent of the revenue going to the county.

There were no joint agreements with the cities once the county imposed the sales tax unilaterally. There were no consultations with the cities, permission requests to raise the tax, or any other interactions between the county and the cities. There was not even an education campaign or a gradual imposition of the new sales tax formula over five years, as Revels had originally wanted. The county imposed the tax, applied the revenue formula, and that was the end of it.

The County Commission set the term of that sales tax at 20 years. It expires in 2032. It was originally intended to finance the construction of the expansion of the Flagler County jail. It has been used for many other infrastructure projects since. A portion is now being used for beach management.

The County Commission has the authority to repeat the very same process for an additional half-cent sales tax. It may place the proposal on the ballot for a referendum. It may also, by a super majority vote of at least four commissioners, unilaterally enact the sales tax whenever it chooses to do so, without asking for cities’ permission, without entering into joining (or interlocal) agreements.

In the event, the county was preparing such interlocal agreements with Palm Coast, Bunnell and Flagler Beach regarding the new half-cent sales tax, if the commission were to enact it. In this case, the county needed the cities’ agreements on the proposed split, and in that sense, of course, the cities would have to sign off. The cities were prepared to do just that. Flagler Beach announced it would unequivocally. So did Beverly Beach. Palm Coast was less sure, but had the three votes to do so. Bunnell was leaning that way.

The agreements called for Flagler Beach and Beverly Beach to turn over all their revenue from the new tax for beach management. The agreements also called for Palm Coast and Bunnell to turn over half their revenue to the county. But after the first year, any increase in revenue would accrue to Palm Coast and Bunnell rather than continue to be split 50-50, giving the two cities further incentive to sign on.

The agreements were ready to go.

The ratification of those agreements was halted when its majority continued to oppose moving toward a sales tax increase. But those agreements may be revived at will, and the sales tax proposal revived, any time two of the three opponents change their mind. For now, none of them appear willing to do so.

![]()

john stove says

Do you want to know why citizens of Flagler County and the City of Palm Coast pretty much will shoot any new tax or fund gathering initiative down?…..

Its because we cant trust any of our elected officials or staff. The lying, the back stabbing among officials and the non-effective mis-management of our tax dollars cannot be believed. I have been involved in City. County and State government for 30 years and the level of moronic buffooneries cannot be believed!!!

Ed P says

Thanks for exposing the truth and shining the spot light on the double talk that we all listened to last night.

Ron says

I spoke at the commission meeting last night. Very respectful.

Was this commissioner aware that the county can implement the 1/2 cent sales tax without consent of the other municipalities? Why did the staff not correct the improper statement or at least the chair?

I say stop kicking the can down the street. Put the sales tax vote back on the agenda and get it done ASAP! Enough is enough. Stop worrying about votes and start making sound decisions based on facts provided by your staff.

After reading this article it’s a common sense approach. Why put it to a vote which will not happen until November 26? Besides all the time and money that will be wasted with no guarantees .

Increase the sales tax now!!!

Duncan says

County Commissioner who is ignorant of the basic laws that govern her conduct is, by that very fact, unfit to hold office.

Moreover, a Commissioner who lies directly to the faces of her constituents has betrayed the public trust and should be subject to impeachment.

It’s not like other coastal counties have not figured it out. Flagler County is the only coastal counties without an approved & funded beach management plan.

Joe D says

Congratulations FlaglerLive for the comprehensive summary of the Beach maintenance plan situation.

Clear documentation shows the beach is NOT just used by FlaglerLive Beach owners (cell tower data shows 4 out of 5 beach users are from Palm Coast). Parking and other pieced together fees, are not going to solve the full problem. Foisting the cost on the sole shoulders of Flagler Beach owners is outrageously unfair!

The Reality is if there is no beach funding for our maintenance “match,” the Army Corps of Engineers won’t do THEIR part of the beach replenishment.

As one Flagler Beach City Commissioner already commented on this site: that the BEACH generates $900 million annually for Flagler County ( hotel and rental taxes, fees, and jobs for local residents).

If you don’t want a minimal 1/2 % added sales tax ( not even on EVERYTHING)…how would you like to come up with the $900 million FLAGLER COUNTY BUDGET GAP, if we lose the tourist money due to our beach!?! You think the County roads and emergency services are difficult to afford now…wait until there is no beach to help FUND IT FOR YOU!!!

Bo Peep says

Nothing new there

marvin clegg says

I also sat through the meeting and was struck by two things concerning this beach preservation funding: 1. Everyone seemed to assume that throwing more money at Mother Nature will be a good investment of public funds. This is a terrible assumption, given the weather extremes we are witnessing, which is why some of us sold our beachside homes some time back. No one wants to discuss things like “managed retreat” as the Univ. of Calif. SB describes it, while many authorities call “nourishment” programs a short-term band-aid, given the possibilities of rising oceans, icebergs calving, more frequent hurricane strikes, etc.

2. One public commenter was candid enough to urge the county commissioners to just force the half-penny sales tax on all county residents and avoid a voter referendum of taxpayers “because we all know it will fail to pass.” Wow. That sure sounds like taxation without representation, urging our commissioners to do something they believe the voters they represent would oppose. Meanwhile, other speakers, nearly all of whom seemed to live near the coast, urged commissioners to “listen to their voters.”

So, in reading this article and some of the comments above, we shouldn’t be so quick to judge our commissioners. It is clearly not decided what voters want here. But the larger question is whether this is the best use of a limited pool of money, to fight Mother Nature. Fifteen years ago, before an earlier administration decided to disband Flagler County’s Long Range Planning Board because it frequently questioned staff opinions, that citizen board heard FDOT suggest we will need to take at least one lane of Highway A1A and move it inland one block as the coast erodes. We also heard conflicting recommendations for whether offshore buried obstacles, or seawalls, or wavebreaks, or dumping sand were the best methods for trying to combat erosion. There were no clear solutions by the experts. Meanwhile, we’ve seen unprecedented (in our puny record-keeping years) flooding of areas like Lambert Ave. along the Intracoastal Waterway, repeated cuts through the barrier island near Washington Oaks, or Summer Haven, and record high-water marks in west Flagler lakes connected to the St. Johns River. Farmers have known for centuries that the weather will nearly always win.

So when a commissioner says that a half-cent sales tax initiated today by the commissioners without referendum might have its targeted benefit changed by future commissioners once weather research or renourishment studies or political pressures, or something else changes drastically, this is believable. After all, we’ve seen our past county commissions reverse their predecessor votes easily, and we just saw the paving priority of one westside county dirt road bump down from 18th ranking to 30th on the totem pole, so priorities definitely change, but we would all be stuck with a higher tax meanwhile, at a time when the vast majority of voters seem to want tax cuts, not increases.

Let’s give the new commission, which didn’t create this problem and which was not the first commission to have a chance to deal with this tough question, a little slack here. We’ve all seen the aftermath of nasty rhetoric and name-calling and many of these people would not last a week in a public position. The position pay has improved, but money’s not everything, and likewise, money won’t necessarily beat the forces of nature.

Maddening Non-Actioin says

What is maddening is that Flagler is the only one of 30 counties which has not used its full allotment of the surtax. This revenue source was for smaller counties which do not have the financial wherewithal to handle their unmet needs.

With commissioners repeating that seeking state appropriations require Flagler to put some skin in the game, how will they react if they learn Flagler has not used all of the authority granted to small counties.

It is not outside the realm of possibility for the Legislature to repeal this tax authorization for small counties with our not using it for some 20 years. It’s insane not to use it given all of our needs, whether the beach or paving dirt roads. At least visitors contribute to the surtax revenue so it is not 100% our burden as ad valorem taxpayers.

Richard Hamilton says

Thank you for a very insightful article Pierre. I have often wished you were on the Commission, but realize you are much more valuable to us with your thorough analysis, facts and history.

Until now I have been prepared to give Comm. Carney some slack while she looked for areas in the Budget that could save us all money without raising taxes. No longer. She has failed TOTALLY, except for some ludicrous proposals like cutting Lifeguards and Library staff.

My comments on the other Commissioners may follow part 2 of your article.

FedUp says

Just another day in the life of a corrupt county. Can’t sell and get out of here fast enough.

Sherry says

No surprise here. Generally, people don’t fundamentally change. You were warned about Kim “before” the election.

Marty Reed says

Carney, Richardson & Pennington need to be voted out of office!

Deborah Coffey says

If it’s that important to try to save the beach, put the half-cent sale tax into effect and raise the property taxes on those with homes on the barrier island. They want to live near a rising ocean? Then, they pay more for that privilege (and, in my estimation…bad choice.) We all participate whether we believe that Mother Nature will win in the end or not.

Evelyn says

@Marty Reed,

Carney and Richardson will both be one term commissioners. I am wondering why Pennington is running again. She is not on her game. Great time for new candidates to be running. Your issues have already been laid out for you.

E.T. says

The difference between the beach and the jail is that the beach renourishment has no project competition date. It may be hard to believe, but future boards may say I am tired of spending $$$$ on sand for dunes, having to refurbish the sand every year. That would make the MSBU vulnerable for any board to raise the amount to cover the costs of the project for any particular year.

“The 2012 County Commission approved a sales tax increase to pay for the expansion of the new jail. It would have been unthinkable for a subsequent commission to change course. None did.” At the same time, revenue from the same sales tax has been allocated to projects the 2012 commission had not imagined–such as the beach.”

Jane Gentile-Youd says

Kim Carney is a disgrace as a commissioner. She asked staffwhich company county has contract for solid waste and trash. It has been Waste Pro for about 20 years and SHE is a commissioner for unincorporated county – she is not a Flagler Beach Commissioner! She lectured my neighbors in Plantation Bay how Mori Hossein has the right to build whatever he wants and they ( we) should accept the fact that he can do whatever he wants with HIS land. She is an idiot because zoning can be rescinded for non use the same as it is legally done in Miami-Dade County

She told me a few weeks ago to STOP e-mailing her as commissioner to clean up the 7 acres of ( possible contaminated with asbestos) of concrete debris and rubble after the ILLEGAL demolition of the 13 year trash laden Old Dixie Hotel ( Harriet Castle and I got it torn down by turning to the State Health Department ( who always helps when the county doesn’t) and FDEP for the illegal dumping without an asbestos survey and report.

The proposed budget has no breakdown of individual salaries in the various departments; has no accounting for the over $100,000 last year or this year spent on ‘outside attorneys’ and has more ‘miscellaneous’ crap than I have ever seen in my life. we need a forensic audit in my opinion of all county funds for the past few years. The Sheriff getting over $50 million to protect just 20,000 people in unincorporated county in addition to the money his department gets from drugs, traffic fines, etc etc and we pay for the building maintenance and his vehicles maintenance from our general fund in addition to costing each person $250 per year is another budget disgrace to the citizens.

Then, she shows her total ignorance by okaying a final budget hearing just 2 hours before the start of the Jewish New Year Rosh Hashanah. Incredibly none of the other commissioners nor staff apparently have any respect for the Jewish population in Flagler County.

Kim Carney is ignorant; her nastiness combined with her stupidity shows she needs to be removed from office in my opiniom; the rest of the commission needs to wake up and do their job or resign. Leann Pennington, whose seat I also ran for, is the only commissioner in my opinion who does her homework.

I too was warned not to vote for her but I never make decisions on hearsay; this is one time I should have…

Jack Flaggler says

As some stated in a previous comment “ Moreover, a Commissioner who lies directly to the faces of her constituents has betrayed the public trust and should be subject to impeachment.” this is the reason governments lost the trust of the people. Kim is unfit to hold office due her flip flop tendencies and lies to just to “protect” her job and perceived power in the country (which is derived from us the people). She doesn’t not listen to us the people of Flagler Beach or anyone besides the her puppet master Perry.

Leanne has unfortunately sealed her destiny in this coming election in November 2026. The people on the west are not your only constituents, we the people of the barrier island should also be represented by you or so we thought, and this coming election we will vote you out to remind you and kim that we have the power not you. Your reason for not voting for the 1/2 cent is absurd, commissions before voted on taxes knowing that you can change them. Are you just worried about your cushy job as commissioner with a healthy pension?

Have some backbone and represent the people from the barrier island and Flagler County that voted for you. You not are just representing the west!

Leanne and Kim – vote for the 1/2 cent sale tax, it is a large portion of the blended funding. We are watching this very closely. No more excuses, we are not buying them. This is the time for real leadership not political grandstanding! It not too late for you…

Larry says

@ Deborah Coffee: Correct, the plan IS to have to 1/2 cent beach tax AND also charge an brand new annual beach renourishment property tax line time only to barrier island property owners in unincorporated Flagler County. So yes, barrier island owners in unincorporated areas (aka Hammock) will be double taxed because they will also get a new line item on their property tax bill for beach renourishment.

Ed P says

Deborah Coffey,

The county can not raise just Islanders’ real estate taxes call ad valorem. However, they can and did put in a mechanism called an MSBU (municipal service benefit unit program) that all unincorporated home owners will pay that incorporated homeowner will not. It is open ended and maybe as small as $160 annually or as large as $2000 annually. It was approved Sept 11 2025 and assessed at zero this year until a study and the balance of the ongoing funding source occurs.

In addition to the MSBU all islanders will also be participating and sharing the cost of all other revenue funding used for the beach. The same beach that does benefit everyone including tourists who generate nearly $900 million in revenue at our restaurants, rentals, hotels, and retail outlets. The tourist tax alone nets 4.3 million dollars. Can you imagine if the beach disappeared?

Finally, islanders’ ad valorem tax ( real estate taxes) easily average 3-10 times and in many instances more than the 10 times amount of what most inland home owners pay. We have been paying higher taxes for years while under utilizing most county resources. One could say we haven’t been getting our moneys worth. We also contend with a daily bridge toll (a tax) that you do not.

Finally, beach nourishment is not exclusively to “protect” our homes from flooding. Of course it is a possible benefit but there are many homes on the island that have never flooded and possibly will never experience flooding. This isn’t just piling up sand on a dune which is a temporary fix, but rather extending the beach seaward. The average nourishment project lasts 3 to 10 years in Florida. Beach nourishment is not new and is effective. Miami started a program back in 1976.

Islanders are paying more than the “fair” share, helping all county residents.

Evelyn says

@Jane Gentile Youd, expert on all things county…

The county pays for services for ALL and not just the unincorporated areas except for trash pickup. For one who prides herself on accuracy, please get your facts straight. The Sheriff protects US ALL and not just the unincorporated areas here.

How many don’t know this? Lots, I would guess. Just accuse them all of being crooks and be done with it.

Toired of it says

Richardson and Pennington can’t think for themselves. They get their marching orders from Carney. This issue of beach protection is a complicated and I doubt that the three amigas have the intelligence to fully understand what is at stake. Carney wants to make a name for herself by being the the no tax champion. Once again, the Republicans knew what these three were like but they voted for them anyway.

Laurel says

Ed P.: On this topic, I agree with you 95%! Good to know you are a neighbor. :)

The way I see it is that this whole beach re-nourishment project is barely thought out. It is clearly for the tourism and the homes and businesses on the ocean. Those of us on the west side of the island will not be protected from the ocean rising, as apparent with the King tide rising in the river, yet will we be paying a grossly disproportionate amount for those whom it will protect: the beach homes, businesses, clubhouses and tourist attractions on the beach..

I see commenters, including Deborah, who believe those of us who simply live east of the river should pay more as we are close to the beach. They, too, moved to Palm Coast to be living coastal, as Palm Coast, Coast, Coast advertises. Otherwise, they would be living in Winter Haven (Orlando advertises as being close to both the west coast and east coast beaches). These commenters do not realize that this boom started fairly recently with the development of the Hammock Dunes properties. Many people lived here less lavish lives before that development. Should they be penalized further? They are not being represented.

Other aspects that have been ignored are: 1.) what happens to the sandfleas that live on the beach, in the rust colored sand, that the fishermen love to use to catch pompano as the fish migrate by? 2.) what of all the little, live coquinas that this area is famous for? The grey sand pumped up is not the same texture and quality as the lovely rust sand they live and thrive in. But we know the answer to that: tourism. Money is much more important. Frankly, I prefer the sandfleas. What of the disturbance, maybe annually, of the staging and dredging on the beaches? What is the effect on beach usage, and what is the effect on the sea life?

I think the county is going about this in a very wrong way. They are, all of a sudden, in a desperate hurry to do what they have ignored all along. Now trying to push a disproportionate tax on a small group of people. Why? Because a small group of people are less powerful. and a smaller voting group, than a large group of people, who want the beach access for free. The tourist industry wants it, and those on the ocean wants to preserve their clubhouses.

We need new representatives, here in the Hammock, and new county staff to advise them much more wisely, and fairly. It astounds me that the current administration has the nerve to blatantly ignore the wishes of the people who live here.

Jane Gentile-Youd says

To Eyelyn: When did you get your degree? Palm Coast does not use WASTE PRO for solid waste, garbage or recycling. The Sheriff sends separate bills to Palm Coast for his services to the city.

Unlike you Ms. Evelyn I do my homework before opening my big mouth. You might consider doing the same.