Housing prices in the United States rose almost 60 percent between 2012 and 2019, then another 45 percent between 2020 and the middle of this year. Now, with interest rates more than doubling to 7 percent in a year, the longest housing boom since the crash of 2007-08 is ending. The signs are everywhere, across the country, in the Florida and in Flagler County.

House prices are falling. So are the number of sales. Houses for sale are staying on the market longer. The supply of houses is rising. If the downward trend continues, the implications will have a pronounced ripple effect on a local economy still substantially dependent on construction and real estate, on demographic projections, on Palm Coast’s hopes of a westward expansion, and on the timing of school construction planned for later this decade.

There were 329 sales of single-family homes in Flagler in September 2021. Last September: just 200, a 39 percent drop. After peaking at $402,500 in July, the median price of a single-family house in Flagler County fell back to $362,495 in September, a nearly 10 percent drop, according to the latest figures from the Flagler County Association of Realtors. (During the last housing crisis the median price bottomed out at just under $110,000 in early 2011.) The average sale price topped out at $478,000 in July. It has fallen to $417,700 in September, a 13 percent drop.

By volume, total single-family home sales had averaged $131 million a month through August. In September, sales volume fell to $83.5, a 36 percent drop. But for an outlying month of June, when pending sales spiked, the number of pending sales has fallen in six of the last nine months, to 219 in September, the lowest level since April 2020.

For seven of the last 12 months, the median price paid for a house was 100 percent of the list price, pointing to how favorable the market was to sellers. In July buyers pulled back, paying 98.4 percent of list prices on average in July, 97.2 percent in August, and 97.4 percent in September.

But there are also fewer buyers.

Buyers are being rapidly priced out by rising interest rates. It’s simple, cruel math.

Assume Jill and June, a newly married couple moving to Palm Coast, are looking to buy a $350,000 home. Only a year ago, they could have gotten a 30-year fixed mortgage at 3 percent. Putting down 10 percent, their total monthly payment, with taxes and insurance, would have added up to $1,663. If they were looking to buy a house for the same price today, their interest rate would be 7.3 percent. Their monthly payments would be $2,376, or $713 a month ($8,556 a year) more, a 43 percent increase, or more than five times the cost of inflation in the same period. For many people, the jump is unaffordable. The choice is either to look for cheaper housing or to drop out of the home-buying market, further adding pressure on the rental market.

The 10 percent drop in median house prices has not been nearly enough to compensate for the cost of rising interest rate. Of 200 sales of single-family homes that closed in September, only 36 were in the $200,000 to $300,000 range, and only one was below that. The rest were in the $300,000 and up ranges. For those trying to sell the less expensive homes–and those trying to buy them–the growing strains are obvious: for them, the median time to contract has risen much more sharply than for more expensive homes.

The Flagler County school district is projecting building a middle school in two years and a new high school a few years after that./ Those projections are based on rapidly increasing enrollment, much of it also projected in the years ahead. But current trends point in the other direction: if wage-earners and young families are not able to afford local home prices, recent growth in that demographic will not continue as expected.

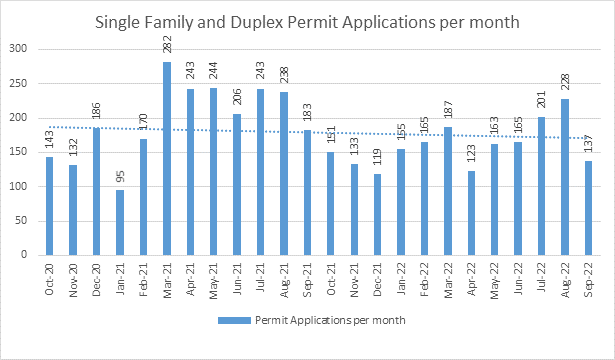

Some home buyers are retreating, but by no means all, especially in Flagler-Palm Coast where, for now, construction of new homes remains strong. But that growth has been powered by older, richer home-buyers, without children in schools. The following graph illustrates monthly permitting activity in Palm Coast for single-family homes and duplexes, through September:

“We are at 100 so far for October,” Jason DeLorenzo, the city’s development director and chief of staff, said. “You can see from the graph that residential permitting is seasonal with declining permits in the fall/winter. This year is following the annual trend.” City and county regulatory pipelines are still busy with permitting new subdivisions, storage facilities and, to a lesser extent, apartment complexes. But the next few months will indicate whether the seasonal drop in permitting will start reflecting the broader slowdown in the housing market.

The same trends are repeated elsewhere. An analysis of Daytona Beach Multiple Listing Service (MLS) data by Wyse Home Team Realty showed that 307 existing single-family homes were sold in the Daytona Beach area with median home sales price of $370,000. That’s a nearly 40 percent decrease in total home sales from September 2021 and it’s 26 percent lower than home sales just one month prior. Total sales volume was down by 31 percent compared to September 2021 and was 31 percent lower than home sales volume in August.

“Home sales dropped sharply in September as the Fed continued it’s efforts to slow inflation,” Realtor Ron Wysocarski, Broker and CEO of Wyse Home Team Realty in Port Orange, said. “Unfortunately for some buyers struggling to find affordable homes, prices haven’t dropped at the same sharp pace. We’re still seeing low inventory levels and steady demand, so home values here have remained strong.”

But for those who don’t have a stake in the housing market, the future is more bleak. The Economist this weak features a freaked-out pumpkin with a jaggedly downward graph for a mouth, beneath the cover headline: “A House-Price Horror Show.” The paper predicts a global housing slump blamed on soaring interest rates. “When combined with a cost-of-living squeeze, that points to a growing number of households in financial distress,” the paper projects. “As an era of low interest rates comes to an end, a home-price crunch is coming—and there is no guarantee of a better housing market at the end of it all.”

Forbes today sees an outright “Housing market Collapse.”

HappensAllTheTime says

This too shall pass. C’mon, all through history this is what happens to economy’s that thrive on real estate and construction. They boom and bust just like the market. Not the first time. Not the last. Perhaps if Palm Coast enticed some white color businesses to move in, we wouldn’t be so reliant on consumerism to stimulate the economy.

Deborah Coffey says

Exactly. I remember our house on the canal in September 2008. One night USAA had its value at $659K (which was ridiculous!) and two days later…$285K. It took all of Obama’s eight years in office to bring it back to $488K and that included major updating.

The dude says

I’ll assume you mean “white collar” there.

And I agree.

This area is unsustainable in the long run. The cush retirements and pensions that drive the entire city’s economy are no more, so the next next generations retiring will not be able to afford this area’s high taxes and overall exorbitant cost of living.

There are no kids here, and if there were, a lifetime of serving cheap, old, cranks isn’t much incentive to put down roots here and stick around.

This area should be a Mecca of manufacturing and technology with it’s proximity to Jacksonville and Orlando.

Instead it’s a Mecca of mow n blow guys, pizza joints, and handy men.

Bill says

Do not forget the other major issue is Palm Coast raised the assessed value to equal market value…..which massively increases the taxes on any newcomer to the palm coast area

The dude says

Mine went up 165% last year.

My escrow adjustment as a result of that and insurance increases caused my house payment to go up almost $800.00 a month. Read that again please… $800.00 a month.

This unsustainable. We’re shopping houses back where we came from, where living is more affordable, even with a state income tax.

James says

Yes exactly.

Gave me sticker shock and the property taxes are higher than eastern MD.

Palm Coast is no deal these days and the 2 year wait to build a house on your lot killed lot sales.

PC is no longer enticing at this point.

michael brown says

No need to entice anyone. Let’s try to make sure the quality of life here remains steady. A city’s job is not to grow itself out of liveability.

Bob says

Did you happen to catch the subtle injection gender in this article? Not why would the writer inject a same sex marriage into an article about the housing market?

This is what is referred to as subliminal messaging. I wonder how many people caught it? “Jill and June, two newly wed home buyers”, is this shit really necessary? What is the objective inverting this crap into an article totally outside of gender equality?

This is totally disgusting and is indicative of the agenda this publication is pushing, in your face or subliminal, can’t they just write an objective article without injecting their personal beliefs.

Kat says

I was interested in reading the article for the stated subject matter, not looking for something to offend me. And guess what, June and Jill don’t offend me but people like you are downright scary. I feel sorry for you, getting your knickers in an uproar, over the mere idea of a same sex couple being used as an example. Oh my, what if Shaneka and Lamont were the imaginary couple? Mohammed and Yanela? Carlos and Maria? I imagine that the names of any couple that didn’t sound as if they were straight and white would be upsetting to you, you need therapy.

The dude says

Nor can you respond to one without injecting yours, being the bigoted old fool that you are…

James says

To be honest, no. I never got past the title… “Housing Market in Flagler and Palm Coast Beginning to Feel Sharp Pain of Rising Interest Rates.”

In considering I just read… https://flaglerlive.com/182445/coquina-shores-palm-coast/.

Just MY observation.

John says

The pain will continue with another 0.75% rate increase next month. Those moving from California and New York will continue to pay cash for houses so interest rates are no concern for them. Country wide, house prices will only fall so far. Overall there is still a shortage of housing.

Jimbo99 says

The fleecing of home owners is a multi-front attack. Homeowners Insurance has tripled, then there was the great supply shortage lie for building materials. Then there’s every home repair gouging for roofing, HVAC, even yard maintenance for the BIDEN INFLATION.

Corporations have been after buying homes for cash since the Census of 2020, nearly 3 years of Biden swamp lies to create financial hardships to steal properties to flip/resell. Look at the permits graph, seems to be plenty of building materials for all those new residential homes (does it even include apartments that are approved ?). And Flagler county getting the Real estate Mayor Alfin ? How predictable was property assessments & property tax increases ? One would seriously have to challenge any property appraisal if this is true about the home prices dropping ?

2020 was the coup of Trump for the Great Biden Reset of Delaware lies & recessional prosperity. Anything record breaking under Biden has been nothing more than gouging & making the middle class bear the cost of Biden smoke & mirrors. Go ahead, look at your bank accounts, anything you hold as investments if you have those. It’s been one big bleed dry/down ever since Biden & the Democrats & rest of the swamp decided they would secure power back to the usual ways of the same Government types that have run the show for decades now.

Covid, that was a man made leak of a virus that anyone making fabulous money to be involved in, won’t ever be held accountable & responsible for that. And it starts with Fauci. How coincidental, Biden is announced the winner in 2020, 2 days later Pfizer & Moderna have the cure of vaccines for Covid. But Biden isn’t done, he needs to force the lies for 2021, so that he can take statistical credit for saving us all from Covid, while he saved America & democracy with those wrapped in a USA flag waving, Star Spangled banner Ponzi scheme lies. That’s not a coincidence. Biden is inaugurated and the rolling average of vaccines administered is already 1 million vaccines per day over a rolling 7 day period, Biden’s goal for the first 100 days was to meet that 1 million/day. That’s no coincidence either.

End of the day, higher property taxes isn’t going away unless we shake up the County & City councils/leadership with a vote. Neither is homeowner’s insurance increases. Hurricane Ian is going to drive up costs too. Because that’s the way insurance works, those with no claims will pay for the losses of the storm(s) in premium increases. But the thing is, the premium hikes will include hidden overcharges like raises to executives. Too many tools to arrive at tripling the cost of homeowner’s insurance. Interest rate hikes were necessary to keep the real estate market from becoming the lies of W Bush house flipping from 2001-2008. The cycle came back, the property flipping followed by the crash of the real estate that were going to see get worse. Biden is only softening the inevitable. Those gouging the rest of us, they’ll be able to afford housing, because the rest of us are paying for that housing. Yet most are never going to live in the unaffordable housing they are indirectly paying for. Directly paying would be paying that mortgage & actually living in the house. The at 2020 Census asked the questions, do you own or rent ? do you have a mortgage or not. From that information the Federal Government can determine who actually has properties of ownership & renting vs ownership as a primary residence. It was intended to be a wealth transfer tool. And by law, you have to respond to the Census & take part in it, answering their questions truthfully & honestly in their entirety. It’s actually the best way to bundle Census & Survey, by law you would provide them with the survey answers, give them the information they need to take your home from you for their own greed & profit.

Joseph Barand says

One big mistake is that so many new homes are being built on postage stamp size lots. In the future this will be a major problem for sellers. Who will buy homes without access to your rear yard, combined with the continual use of PEP Tanks, there is no sound rational for the price of housing. The City has created this problem by hiring incompetent planners, engineers and other staff with bloated salaries and benefits.