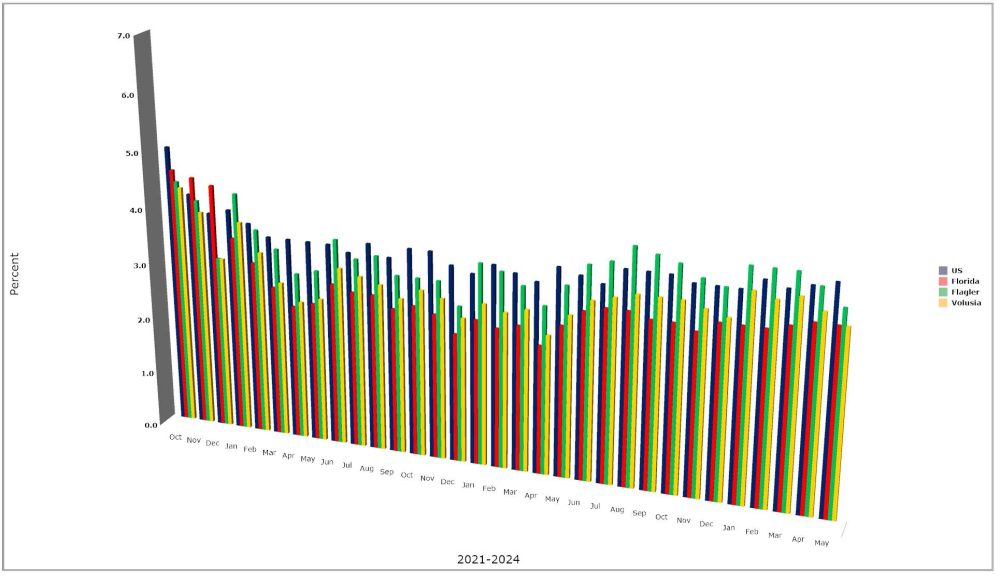

Flagler County’s May unemployment rate was 3.6 percent, down from 3.9 percent in April, as the rate continues to oscillate within the same narrow band it has for a year and a half, never falling below 3 percent, only once reaching 4.2 percent.

Previously steady growth in the labor force, however, has stalled. After rising earlier this year, it declined for the second month in a row, to 51,383, almost exactly where it stood a year ago. The labor force reflects working-age adults with families as opposed to children or retirees, who account for 60 percent of the county’s population.

In-migration continues. Some 1,200 home sales had closed in the 12 months up to May 2023, the same total for the last 12 months, according to figures released today by the Flagler County Association of Realtors. But it is a slower pace than in the first few years of the decade. The median sale price was $380,000, a slight decline from a year ago and a 5 percent decline from two years ago as the local inventory of active listings continues to climb, the nearly 1,150 listings in May are the highest total in more than four years, as is the supply of homes, in months (4.7 months).

Some 40 percent of home sales were in cash, which points to retirees selling homes elsewhere and buying here. The proportion of cash sales has hovered between 30 and 40 percent for the last three years. The in-migration disproportionately weighed toward older new residents is also reflected in Flagler County schools’ enrollment, which has been flat for the 17th straight year.

The number of Flagler County residents who are unemployed fell by 173, but with the number of people in the labor force dropping by 200, the lower number of unemployed could be a reflection of people leaving the labor force–discouraged workers, or people dropping out of the labor force. To remain listed as part of the labor force, an individual must either hold a job, be actively looking for a job, or be receiving unemployment checks. Those checks stop after a mere 12 weeks in Florida, the stingiest state with unemployment benefits. By thus removing people from the labor force when their time is exhausted, the state can show an artificially low unemployment rate.

The federal Department of Labor counters that with its “Alternative Measures of Labor Underutilization,” which counts discouraged workers, including those who have dropped out of the labor force, plus those workers employed part-time because they could not find full-time work or because their hours have been cut back–the so-called involuntary part-time workers. So the rate reflects unemployment and under-employment. By that measure, also known as the U-6 measure, Florida has an unemployment and underemployment rate of 6.1 percent.

The state’s official measure released today by the Department of Commerce, however, is almost half that: 3.3 percent, with 361,000 officially jobless Floridians and just under 10 million Floridians holding jobs. The state has added 222,200 net new jobs over the last 12 months, including 6,000 in the last month. Arts, entertainment and recreation saw the largest proportionate increase in jobs month-over-month, with an addition of 5,400.

Monroe County had the lowest unemployment rate, at 1.9 percent, followed by Miami-Dade (2.2 percent), and St. Johns County not far behind (2.7 percent). Citrus County had the highest unemployment rate, at 4.5 percent. Flagler County is tied for 14th-highest rate with Dixie, Levy and Liberty counties. The national rate is 4 percent.

Consumer sentiment in the state dropped two-tenths of a point in May, according to the University of Florida’s Bureau of Economic and Business Research, to 73.1 from a revised figure of 73.3 in April, contrasting with the national sentiment, which dropped 8.1 points.

“The decline in consumer sentiment was driven by Floridians’ perceptions of current economic conditions. Although inflation is not far above the Fed’s 2% target since peaking at 9.1% in 2022, progress against inflation has slowed down, demanding Floridians to make further adjustments to budgets and spending plans,” Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research, was quoted as saying in a release. “According to the Fed’s preferred measure, inflation remained flat at 2.7% in April. Nonetheless, the unemployment rate has remained below 4% both at the national level and in Florida, suggesting that a soft landing, disinflation without a recession, is still anticipated.”

![]()

FLF says

Well if you look at the types of business’ that are coming to this city… Fast food, service, construction, etc, $20 per hour jobs, what house are you planning on buying here? Rent $1500-$2000 month There’s no manufacturing, no large employers besides Boston Whaler; great jobs and benefits for what, 350 people? Imagine trying to purchase a $380,000 middle of the road house, then taxes and insurance and a newer set of wheels car payment and supporting 1.2 children? Aint happening here.

Jim says

I don’t see any surprise in this data. We just saw that the student population at Flagler is stagnant. It makes sense that the majority of growth in this county is older people who are retired or going to retire and don’t have school age kids.

Nothing new here!

Endangered species says

So the 3.6 percent represents the percent of people claiming benefits for the period. You get kicked off and the system is broken and corrupt so if you believe that number then I have some stuff you’d like to buy.

Ray W. says

You might be right. Mr. Tristam might be right.

All I know is that the unemployment rate is not determined by the “percent of people who are claiming benefits for the period.” People who voluntarily quit their jobs (the quits rate in the JOLTS report) do not qualify for benefits. Therefore, the 3.6% rate is not solely dependent on the claims rate.

don miller says

this means older people om a fixed income can’t make ends meet with inflation. they are back to work at least part time to do so..