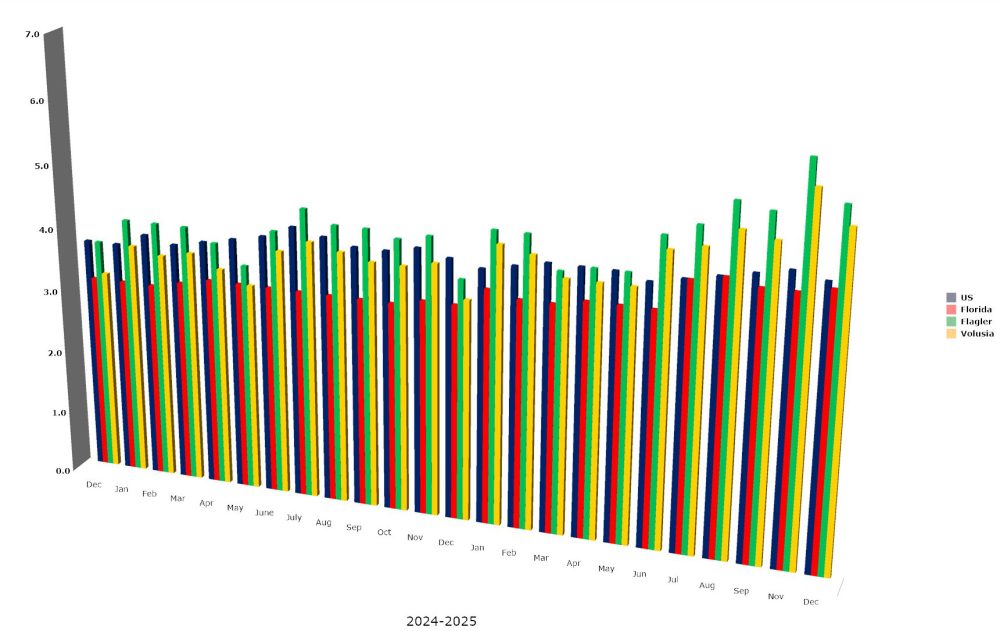

Flagler County’s unemployment fell to 5.5 percent in December, still the highest rate since 2020 but slightly down from the 6.1 percent rate in November, according to the Florida Department of Commerce. Palm Coast’s unemployment rate, which always tracks closely with the county’s, was 5.5 percent, down from 6 percent.

The decline is the result of a decrease of 300 in the number of unemployed, to 3,056 workers, but also due to a small decrease in the size of the labor force (by 162 workers), which remains smaller than it was for most of 2024 and has been relatively flat since. The labor force is an indication of in-migration of working-age people and families, as opposed to retirees, who have accounted for a disproportionate share of the county’s population increase since 2018. The proportion of school-age residents has fallen by several percentage points in the last 15 years.

The labor force, at 55,347, is down from a record-high of 55,852 set in September 2025, and slightly down from a year ago. Flagler County ended 2025 with an average unemployment rate of 4.9 percent, compared with an average rate of 4.3 percent in 2024. The county is now in the tier of Florida counties with the highest unemployment rates, led by Taylor County (9.1 percent), Sumter (7.9) and Citrus (6.9). Volusia County was at 5.2 percent in December. St. Johns was at 4.5 percent. Miami-Dade County recorded the lowest unemployment rate, at 2.5 percent. None of the figures are seasonally adjusted.

Florida’s seasonally adjusted unemployment rate was 4.3 percent in December 2025, up 0.1 percentage point (the unadjusted rate is 4.4 percent), and up 0.9 percentage points from a year ago. There were officially 486,000 Floridians out of work, but the figure is not a complete reflection of the unemployed as it includes only those who are collecting unemployment and following the state’s rigorous demands to qualify for benefits. The benefit typically stretches just 12 weeks (with a maximum of 23 weeks in some cases, depending on prior employment and the unemployment rate), and is among the lowest in the nation. Once the benefits run out, the recipient is no longer counted among the unemployed, nor are discouraged workers who have stopped looking for work.

The average weekly benefit was $265 in the third quarter of 2025, with an average unemployment benefit duration of eight and a half weeks. By way of comparison, the average unemployment benefit in Delaware was $366 a week, lasting 18 weeks on average in the third quarter.

The federal government calculates the alternative measure of unemployment, which includes discouraged workers and the underemployed—those working part-time because they could not find full-time work, or because their hours were cut back. By that measure, Florida’s unemployment and underemployment rate was 6.6 percent on average in 2024. The federal government since the election has not updated the numbers. It was previously updated quarterly.

Even though Florida already has among the strictest rules, the stingiest benefits and the shortest benefit window for the unemployed, a Florida Senate committee last week advanced a bill (SB 216) on a 9-5 vote that would tighten those rules further. The proposed bill would disqualify claimants who fail to contact the required number of employers, appear for scheduled job interviews, and fail to return to employment when recalled, impose new claimant-identification requirements, and institute new fraud-detection mechanisms, all of which could add hurdles for claimants.

In another indication of a slight economic slowdown, Florida had 515,000 job openings in October 2025, compared to 480,000 openings in September, the U.S. Bureau of Labor Statistics reported in mid-January. Over the year, the construction sector lost 7,700 jobs (trade contractors lost 14,500 jobs, but the hiring of building construction workers and engineers made up some of the loss), retail lost 3,700, trade and transportation lost 4,000, manufacturing lost 4,000. Services added nearly 47,000 jobs, for a net gain over the year in all sectors of 35,200–an anemic year for Florida job growth.

The Flagler County Association of Realtors has not publicized a new housing activity report since October, when it reported the sales of 225 single-family homes for the month, 43 more than the same month a year ago, and a median sale price of $375,200, up slightly from $370,000 a year before. Selling a house is taking much longer though–three months for the average listing to get to a contract, compared to 10 days for most of 2022 and 2021–and four months to close a sale. There is a little over five months’ supply of single-family houses in the county, up from around a month in 2021.

There will be no state unemployment report in February. The state ordinarily releases January numbers in mid-March, and February numbers in late March as it revises the previous year’s numbers.

![]()

Leave a Reply