FlaglerLive Editor Pierre Tristam’s weekly commentaries are broadcast on WNZF on Fridays just after 9 a.m. Here’s this week’s.

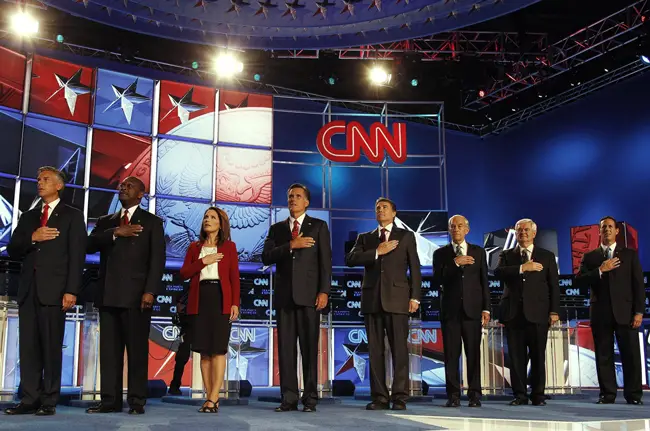

Watching Republican candidates debate on TV—to call them presidential candidates would herniated the meaning of the word—reminds me of original Star Trek episodes featuring those low-tech aliens that nevertheless managed to speak English every time. You could tell the props department at Paramount Television was having a lot of fun experimenting with the meaning of life forms. Monotones inspired by the synthetic intelligence of polyester was the equivalent of stand-up comedy back then. But I doubt anyone expected the props to graduate into templates for America’s Great White Presidential Hopes, plus the token-black pizza guy.

Here we are facing the largest deficits since World War II (thanks in good part to the most concurrent and useless wars since World War II), a crumbling infrastructure, a paralyzed job market and a society more unequal than at any point since the 1920s, yet every Republican candidate in sight wants to plunder the federal treasury, reward the rich and punish the poor by revisiting the exact policy that got us here: lower taxes, the sum total of what passes for Republican policies these days. It’s as if the supply-side psychosis of the Reagan-Bush-Bush years never taught us anything. Lower taxes neither help the economy to grow nor swell tax revenue. The last 100 years are proof to the contrary. The economy grew most in its highest-taxed years from the 1940s through the 1960s, when the highest tax rate was between 90 and 70 percent, and again in the Clinton 90s, after taxes were raised back from their Reagan-era stupor, erasing those years’ deficits. You could also measure job growth in direct proportion to tax rates: the higher the rate, the greater the job growth, culminating in the Clinton years’ 22 million new jobs, still best on the books. It’s no secret why. Tax policies that spread the wealth (those words that give reactionaries the shingles) rather than concentrate it foster a broader base of purchasing power while narrowing inequalities that are murder on a society’s cohesiveness and economic power.

But here are the candidates out-brawling their way to the lowest-common fiscal denominator.

Rick Perry launched a flat tax proposal that really isn’t a flat tax, since it would preserve all sorts of deductions, including the middle and upper classes’ fat annual welfare checks known as the mortgage interest deduction and the state and local tax deduction. He’d also increase the individual deduction to $12,500. His income tax scheme, also eliminating taxes in dividends and capital gains, would ensure that the richest would make out even more like bandits, even though that’s what they’ve been doing for the last 30 years. Steve Forbes went the way of flat taxes in 1996 and 2000 and burned before he crashed when it became immediately clear that the rich would get prosperity’s kickbacks at the expense of everyone else, particularly the working and middle classes, who’d be slammed the most by the elimination of progressive tax rates. That’s what led Mitt Romney to call Forbes’s scheme “a tax cut for fat cats.”

Romney’s verdict this year? “I love the flat tax.” Let’s not get lost in Romney’s biography of a whip-lasher.

Then there’s Herman Cain’s zany 9-9-9 plan, which reminds me of the flathead shark for its ability to look at once menacing and utterly ridiculous. The nines stand for the tax rate Cain would apply to corporate taxes, income taxes and a national sales tax (so Flagler County’s sales tax would be 16.5 percent). The plan, the brainchild of a Cain aide who never studied economics but could match Cain’s short-attention span to the nines, would never raise the money necessary to keep up with federal responsibilities. It’s also dishonest in a Trojan horse sort of way. It’s only the first of two steps toward Cain’s real goal, a 30 percent sales tax replacing all taxes, which he likes to call, even more insanely but with brilliant marketing savvy, the “fair tax.”

You know you’re in a zany world when the only Republican making any kind of sense on taxes, and not by much, is Rick Santorum.

Every one of the candidates seems to take special relish in punishing the poor for allegedly not paying taxes, as if the payroll tax, sales taxes, franchise taxes, utility taxes, communications taxes (all that invisible fine print on your utility bills, for example), are just illusions. As if the biggest and most regressive tax of the last 30 years—health insurance premiums—hasn’t smacked the middle class and priced the working class out of the insurance market altogether. Of course about half the people don’t pay income taxes, but that’s because half the people barely make enough money to live on.

And, of course, every Republican candidate wants to repeal Obama’s health reforms, because that would smack too much of true tax relief to the only classes that truly need it. No wonder the candidates don’t believe in evolution. They’re stuck in 4004 BC morality.

As if on cue, the non-partisan Congressional Budget Office this week released a study that confirms what we already knew but pretended not to admit: the top 1 percent of households have literally doubled their after-tax income over the last 30 years while everyone else bumbled along, with median wages barely budging for that half of America that supposedly doesn’t pay taxes, while insurance costs, the most regressive tax of all, skyrocketed.

Maybe it’s time for a tax on nonsense. The way things are going, it promises to be an endless source of revenue from Republican candidates and their fan base. Now that’s what I call a fair tax.

JR says

I don’t need to respond to this, someone already has. From her final day on the floor of the House of Commons as Prime Minister, Lady Margaret Thatcher:

http://www.youtube.com/watch?feature=player_embedded&v=rv5t6rC6yvg

palmcoaster says

Excellent Pierre!!

William says

The entire field of GOp hopefuls reminds me of an out of control kindergarten class, where everyone is trying to out-crazy the next. They are a clown car of political hacks and poseurs who offer nothing other than the repeat of failed policy. Failed for the average citizen anyway, for the elite the policies worked like a charm.

As the entire game has descended into an overt money grab for the exclusive benefit of the 1%, I am reminded of Louis Brandais’ warning – that we can have a vibrant democracy, or we can have the great accumulation of wealth in the hands of the very few, but we can’t have both.

Lin says

JR – that Margaret Thatcher video is a hoot — the British system shows true debate. She handled herself well. The remarks about the European Union, remarkable considering how things are playing out with the bailouts of greece, etc. Looked up some other quotes regarding socialism and running out of other people’s money. Interesting. Would love to see our head of state in our “house” fielding questions in this manner.

Iris says

Our head of state could never do it without his teleprompter.

William says

“We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America.”

Powerful words. Socialist too, when one considers the phrase “promote the general welfare.” You know, look out for your family, your neighbor, your community. This is the classical definition of socialism, and I believe it’s high time we retire that word. It has been too co-opted to be relevant. During the cold war years the term was used to vilify the USSR in the American mind at the same time that the USSR was using it to bullshit its own people.

Here’s another term that has outlived its usefulness: “Marxist”

“Labor is prior to, and independent of, capital. Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration.” Abraham Lincoln, 3 December, 1861.

Got that? That’s Karl Marx’s argument for the significance of the Proletariat. As uttered by a Republican President.

Seems the Party of Lincoln, and its vacuous adherents have an identity crisis.

Wake up! It’s the system, not the party.

Iris says

Yes, well lucky for you there are many socialist countries in which you can choose to reside, if you wish. This is NOT one of them.

And the Party of Lincoln is not the only one with vacuous adherents. I believe the current head of state is giving us a living definition of this.

some guy says

I think William needs to look into the meaning of provide and promote. The government is not their to provide the general welfare but promote it a BIG difference

Amerigo M. Cimino says

Constructive criticism is always good. In rthe matter of taxes; no one seems to come up with a good alternative. I have read the books on the Fair Tax,and they make a lot of sense. the most simple way to fund the government, and the easiest way to comply! It is so simple, even a lawyer cannot understand it!

Everything we “buy”, has a bundle of taxes already embedded in the purchase price. These embedded taxes are all Federal, and in research, it has been calculated at bout 22%. which means, any item you buy at retail, that costs $1.00, twenty two cents of that dollar is taxes;(Federal!)! If the product did NOT have those embedded taxes, it would cost $0.78! We are paying a tax on taxes! The Fair Tax has been calculated at 23%, and if all goes well; (we hope), with the Fair Tax, there would only be a 1% change in the final cost in that $1.00 item! You would pay $1.01! How good is that?

Just think of the simplicity! Regarding the “poor”, any one living below the poverty level, would be getting a prebate! All of the taxes paid on essentials would be re-imbursed. ONLY the poor would have to keep records of purchases.

The Fair Tax sounds like a winner!

Government could go back to Governing,and leave the private sector alone!

Maybe we won’t have to press “1′ for English!

Do more research.