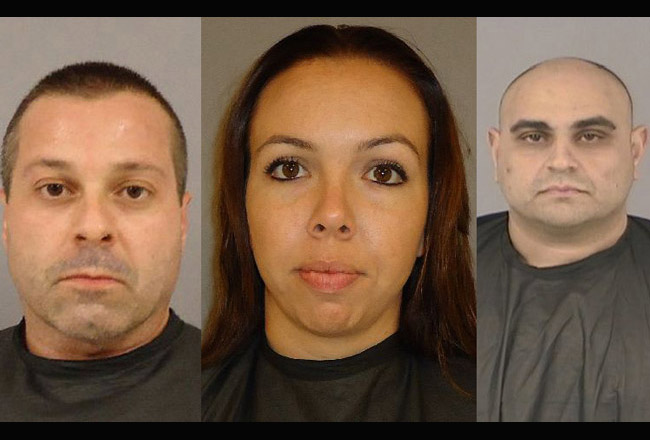

First it was Anthony Fregenti. The 41-year-old Palm Coast resident of Bulow Woods Circle was arrested two years ago on fraud and grand theft charges stemming from a Ponzi and money laundering scheme he allegedly ran through a set of real and fictitious companies, each with Dark Hawk in its name. His bond was set at $450,000, which he posted.

Then it was Michael Stevens, 45, of Calusa Court. He was arrested in mid-October and held on $1 million on a related money laundering scheme.

On Nov. 14, it was Devin Nicole Kolb’s turn. The 31-year-old resident of Collier Court in Palm Coast was arrested and charged with three counts of money laundering, again in connection with the same alleged scheme involving Fregenti and Stevens. On Tuesday, the State Attorney’s office formally charged Kolb with one count of money laundering over $100,000, consolidating the three former counts. The total amount she’s accused of laundering: $3.22 million.

It’s a first-degree felony. Kolb has already posted $300,000 bond.

Fregenti’s case, coincidentally, was in court Wednesday, but his attorney, Harry Shorstein, told Circuit Judge David Walsh that he wasn’t ready for trial, because the people related to the case were themselves getting arrested, and depositions hadn’t been taken. Fregenti’s trial was scheduled for March 25.

The Kolb arrest is based on an affidavit filed by State Attorney investigator Michael Taylor on Nov. 9. The affidavit outlines detailed financial transactions involving Kolb, Fregenti and Stevens, and several companies they created, including one, KCF International LLC, whose initials stood for “keep cash flowing.”

In December 2010, Kolb told investigators in a sworn statement that she and her husband had been working in the time share industry. They’d met Fregenti through a mutual friend. Fregenti proposed a business opportunity, giving them 20 percent ownership in a time share liquidation company. So they started KCF International, while Kolb simultaneously started a company called ITL Marketing in hopes of tax write-offs, according to the investigative report, and to see if she could get more accounts.

ITL was a listing company: consumers paid to have their time shares listed for rent or for sale. Independent contractors solicited timeshare owners. “Kolb spent her time securing merchant accounts while Fregenti floated in and out of the office,” the investigative report found. “The entire venture became a fiasco as Fregenti knew nothing of the time share business. They continued to lose money with merchant accounts that were closed due to chargebacks.” A chargeback is essentially a refund.

The trio’s relationship became so problematic that Kolb and her husband left Fregenti and opened a new company called Vale Professionals. Nevertheless, Fregenti put up $20,000 in start-up costs for that company, the investigation found. The money was wiped out, since there were still $30,000 in chargebacks that carried over from the previous company.

ITL Marketing, meanwhile, had never been an active company. But its bank account was used: In one instance, Fregenti asked Kolb to deposit a check from Darkhawk Enterprises or Darkhawk Cycles into the ITL Marketing bank account. The check was for about $270,000. He then asked Kolb to get a money order for him in that amount the next day. On another occasion, Fregenti gave Kolb a check to deposit in the ITL Marketing checking account, with orders to get a certified check written out of it, to him, immediately afterward—which Kolb did, the report states.

He also asked her on two occasions to write checks—one for $579,000, one for $400,000—to Todd Mitchell and Dale LNU, respectively, and deposit the checks into their accounts, even though Kolb knew there was no money to cover the amounts. But she did as she was told, and “did not ask questions,” according to the investigation. “Fregenti claimed he had money coming from the Federal Reserve from a car deal involving cars he shipped to Saudi Arabia and there was a large wire that sat with the Federal Reserve,” the investigative report states.

The report then outlines a list of 16 instances of deposits, counter-deposits, checks written and withdrawals, between Sept. 15, 2009 and Jan. 25, 2010, that are the substance of the three charges of money-laundering against Kolb.

The transactions add up to $3,216,639, which Kolb is accused of unlawfully and knowingly laundering with Fregenti, “knowing the proceeds were the result of an illegal transaction, with the intent to promote the carrying on of the unlawful activity knowing the transaction was designed in whole or in part to conceal the nature, location, source, ownership and control of the proceeds of the unlawful activity.”

“Because all of the defendant’s transactions occurred within a 12 month period, state law requires the charges to be consolidated into one count,” Klare Ly, a spokeswoman for the state attorney’s office, explained today. So the other two counts were dropped.

downinthelab says

Who says there is no business in Palm Coast?

NortonSmitty says

With all of the lying, deception, betrayals of friends and clients, bullying of employees and shameless over-riding dedication to greed, I can’t understand how the local Chamber of Commerce never recruited them to run for office! Sounds like they’d be right at home in the Republican House caucus, and they wouldn’t have to worry about those pesky prosecutions.

Dadgum says

Tell me – Would you buy a used car from this trio. Only in Palm Coast. Oh, sorry – America.

Sea dog says

It seems odd, I cant get money out of my bank account that fast, even its only a few hundred dollars.

Concerned says

Does anyone else read all the stories that have been written?

Give me a break with all the bs, look I don’t know this fregenti guy but I have met this mike aka Slim

On several occasions and looks to me like if he was the owner and the registered

Account holder why would he listen to someone else? Come on people. Sounds to me like this Slim guy was

Taking money to fatten his own pockets!

What grown man says I stold money and screwed people cause someone told me too?

Wake up