By Scott W. Spradley

Last Friday, Florida Governor Ron DeSantis betrayed the neediest of Florida’s needy by vetoing CS/HB 265, even though the measure came to his desk after being unanimously approved by the Florida House and the Florida Senate.

The bill would have afforded a measure of relief for Floridians already beset by bankruptcy, by giving them a little credit for equity in their primary vehicle. Instead, the Governor voted “no.” In a statement accompanying the veto, DeSantis proclaimed that the measure, if enacted into law, would have “incentivized” Floridians to file bankruptcy.

I believe the governor’s stated justification is ridiculous. My opinion is not grounded in politics. I am a lifelong Republican and I voted for Ron DeSantis in the last election. He just got this one horribly wrong.

First of all, let’s be clear: No one wants to file personal bankruptcy. No one. In fact, personal bankruptcy is, for most, a last resort. It is a necessity, brought about by unforeseen medical bills, by reduction of or elimination of income, or loss of a small business, or is a financial by-product of divorce. Individuals file personal bankruptcy to stop wage garnishment, or to save their house.

On a daily basis, my staff and I meet with those who are lost and uncomfortable, due to embarrassment but usually due to hopelessness about their financial affairs. Our goal during this initial meeting is to help lift the client’s spirits, to explain options, and to have them leave my office in a better state of mind than when they arrived. This is the hard truth about bankruptcy. Individuals most certainly do not jump into personal bankruptcy due to imagined “financial incentives,” which is what the governor inferred. That is nonsense. Personal bankruptcy is a means to get out of financial quick sand. It is not a luxury or an investment strategy.

Some background is in order: Chapter 7 Bankruptcy was implemented by Congress in the early 1970s in order to provide “honest but unfortunate debtors, a fresh financial start.” The Chapter 7 process takes about 90 days, and when successful, results in a discharge of debt, which means the debt is extinguished. The type of debt typically discharged includes credit card bills, medical bills, and mortgage deficiency bills.

The type of debt that survives Chapter 7 bankruptcy includes mortgage debt on houses being retained, car loans on cars being kept, student loan debt, certain tax debt, and debt resulting from divorce, such as child support and alimony. Far and away, the largest benefit for most clients I represent in Chapter 7 cases is the elimination of credit card debt, usually incurred to make ends meet when wages were lost due to medical situations, or loss of job or some other financial calamity.

But there is a tradeoff: If you file for Chapter 7 relief, the government imposes certain limits on how much personal property you can own and retain, without paying, essentially, a bankruptcy tax.

For example, if you seek to discharge $40,000 in credit card debt that was incurred while you were in the hospital and unable to work, the government allows you to retain a couple of thousand dollars’ worth of personal property, including such items as clothing, furnishings and money in the bank, free of charge. That’s not much. If you are over the government’s limits, you may have to pay an equivalent amount of money to a Bankruptcy Trustee, who takes a fee and distributes the remainder (if any) to your creditors. So there is the tradeoff: you get a discharge of debt, but you pay a bankruptcy tax to retain property not covered in the government’s exemptions.

Getting to the point here, the government currently allows you to keep $1,000 in equity in your vehicle, assuming you are one of the lucky ones who actually has equity in your vehicle. That amount obviously doesn’t go very far, especially if you own your car outright. For example, if you own your 2012 Ford Explorer, with a current fair market value of $6,000, you are over the $1,000 exemption by $5,000. Consequently, your bankruptcy trustee could demand that you pay the sum of $5,000 to the government in order to keep your vehicle, and thereby pay for it twice. That’s quite a hardship for a family already in bankruptcy.

The situation is made worse by recent events sparked by the pandemic, which has seen car values skyrocket and thus increase the amount of money a family would be required to pay the government, in order to retain their vehicle after bankruptcy. So to the rescue came Chad Van Horn, a South Florida Bankruptcy attorney, who was able to successfully lobby Rep. Mike Gottlieb, the Sunrise Democrat, to sponsor a bill increasing the vehicle equity protection from $1,000 to $5,000. Noteworthy is that the Florida vehicle equity protection amount has been stalled at $1,000 since 1993, despite nearly thirty years of increased vehicle prices.

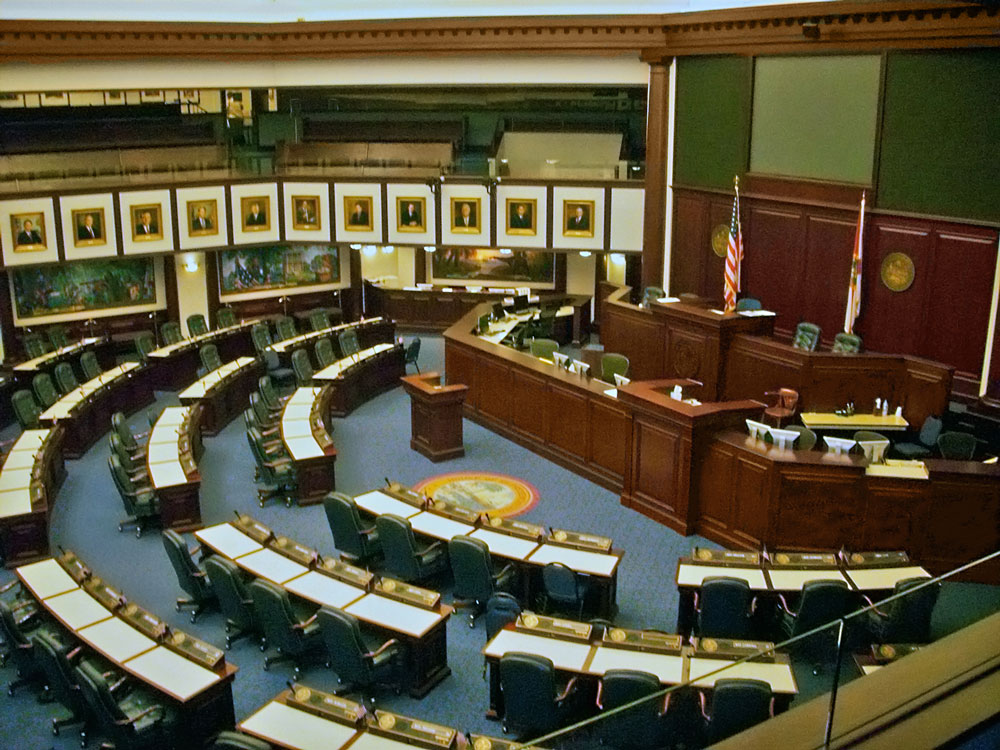

Not surprisingly, Gottlieb’s bill sailed through the Florida legislature, with a 117-0 favorable vote in the Florida House followed by a 37-0 vote in the Florida Senate. This makes sense, because after all, this modest proposal would go a long way in allowing financially distressed Florida families with a small amount of equity in their vehicle to perhaps retain their car after a bankruptcy. And for those with more than $5,000 equity in their vehicle, they would still have to pay that value to the government. Who could possibly object?

Well, the answer is: Gov. Ron DeSantis.

By vetoing CS/HB 265, Governor DeSantis ensured that the Florida vehicle exemption in bankruptcy remains at its 1993 rate of $1,000. For Florida families that own even a clunker with a $3,000 value, they will have to pony up the non-exempt amount of $2,000 to the government to keep the car.

Had DeSantis signed the bill into law—as the Florida Legislature would have had him do—that same family could keep their car and could focus on their fresh financial start, rather than worry about whether and how they could pay the government an extra $2,000 to keep it. Moreover, since the money that a family would pay the government would for the most part be allocated to the government’s fees, with any remaining funds paid to unsecured creditors, primarily credit card issuers, the bill would overwhelmingly benefit Floridians at no real cost to anyone.

By claiming that Floridians would be “incentivized to file for bankruptcy” if the new law was enacted I believe DeSantis is in the best case either uninformed or is completely disconnected from Floridians in financial straits. Or in the worst case, he is intentionally placing the interests of large financial institutions that issue credit cards ahead of the interests of Florida families in significant financial difficulties.

The fact is that with 34 years of experience as a bankruptcy attorney, I will say that I don’t believe for a minute that passage of this bill would increase the number of bankruptcies filed in Florida. If a Florida family needs to file bankruptcy due to significant financial difficulties, then they will file bankruptcy, regardless of whether there is an extra benefit of a modest increase in vehicle equity protection. If that same family decides that the financial situation, while difficult, can be managed outside of bankruptcy, the family will not say: “You know Diane, with the $4,000 increase in vehicle equity protection in place, let’s go ahead and pay attorneys’ fees to file a bankruptcy case and go through that process….” It’s not happening.

Instead, by vetoing this bill, I submit that Governor Ron DeSantis has not prevented an increase in bankruptcy filings, but he has instead needlessly made it more difficult for Floridians in bankruptcy to emerge and fully obtain their fresh financial start. And by doing so, he has betrayed the very Floridians who need his support most.

Scott W. Spradley is a Flagler Beach resident and a member of the Florida Bar since 1988.. His Flagler Beach law firm focuses on representing individuals and small businesses in bankruptcy proceedings.

Rick G says

Wow, big surprise that our Republican Governor sides with large financial institutions instead of people with financial problems caused mostly by huge medical bills. Then there’s the fact that no Republican supports a Medicare for all legislation that would greatly help those who get ripped off by the medical industry.

Denali says

And once again DeSaddist governor in the country shows his lack of concern for Florida residents facing hard times. This latest uneducated action coupled with his inaction on reforming the insurance industry and lack of action during the pandemic just reinforce the fact that he caress not for the people of Florida unless they can serve his needs. He would rather pick a loosing fight with a mouse, censor school books, whitewash history and continue to sign legislation which even Trump appointed judges have rejected. This poor excuse of a human being needs to be shown the door.

And now as we watch the latest school shooting unfold in Texas I remain fearful that we will see yet another Sandy Hook, Columbine, Parkland, Uvalde occur in Florida. DeSaddist has the power to prevent such a tragedy, will he?

Steve says

But it’s AOK For the orange bloated gloat to file 6 or more times thats fine and acceptable . DUHSantis could care less about Florida or it’s People period

coyote says

“Instead, by vetoing this bill, I submit that Governor Ron DeSantis has not prevented an increase in bankruptcy filings, but he has instead needlessly made it more difficult for Floridians in bankruptcy to emerge and fully obtain their fresh financial start. And by doing so, he has betrayed the very Floridians who need his support most.”

the ‘very Floridians’ who need his support most aren’t the ‘very Floridians’ whose support DeSantis needs most. Therefore, they are unimportant to him.

To quote Peter, Paul, and Mary .. “When will they ever learn?”

Susan says

Once again DeathSantis votes something that helps him personally and not the people of Florida. Stop voting in people that are only in politics to benefit themselves and he is one of them for sure.

Ira S. says

Excellent analysis and article. I am a Canadian bankruptcy practitioner. I was especially moved by your description of the potential client’s state of mind and emotions and what we really do in the initial n0-cost consultation. The technical information we disperse learned over many years of experience is of course important, but if the potential client does not leave our office feeling both educated and made to feel better emotionally, then we have not properly done our job.

Scott W. spradley says

Thank you Ira.

Anne-Marie Bowen says

Thank you, Mr. Spradly, for a very well written article. As a long time debtor’s attorney in Orlando, I can tell you that what Mr. Spradley says is true about the reasons why people file bankruptcy. Bad things do happen to good people, and/or people make bad/hard choices which can become insurmountable. People need relief from financial burdens, and our Bankruptcy Laws help.

While I am extremely disappointed Governor DeSantis vetoed this bill, he did articulate a bigger reason why than what was mentioned in this article. He said, “Although it may be time to consider increasing the outdated exemption amount, this increase should apply to all persons who can claim Florida exemptions, whether in or out of bankruptcy…” Then, he went on to say what Mr. Spradley’s article is about, “so that people are not incentivized to file for bankruptcy, which has long-lasting, negative consequences for a person’s credit history.”

Thus, while I remain extremely disappointed the Governor would not sign this bill into law, I can see that maybe he wants the legislature to send him a bill which protects more Floridians. This bill only helped people who actually file bankruptcy. It did not help protect cars and trucks of people who are sued in state court for the collection of a debt. The bill only helped debtors who make the hard but necessary decision to file a bankruptcy case. It seems like the Governor wants to help all Floridians. I think this was a misguided attempt to do that. I wish he had signed this into law to provide debtors relief now, and then come back next year to protect the rest of Floridians. I am confident that if enough of us reach out to our local Representatives and Senators they will bring up a new bill in the next session to protect all Floridians by providing the modest increased exemption of $5,000 in one vehicle no matter whether the person claiming the exemption is in bankruptcy.

Scott W. Spradley says

Thanks Anne-Marie. Good thoughts.

A.j says

We complain about DeSantis, people will vote for him. The people he is hurting will be the ones to keep him in power. Not me I will not vote for him or any of the Repubs. I will vote for the Dems.

KommonCents says

You’ve got your shorts in a bind because Gov. DeSantis is trying to de-incentivise declaring bankruptcy??? How about getting riled-up about the REAL WORLD, DAILY INFLATED COSTS (rising daily) that our wage-earning citizens are dealing with? Oh, that’s right… we can’t blame the dufus who’s in office right now. How about directing your complaints at the White House??

Denali says

Please show us ‘real world’ examples how the current administration created the world-wide inflation we are seeing as a result of the pandemic. While at it, please explain why the oil companies who had record profits last year have not reduced their prices accordingly but rather bought back stock and paid huge dividends. Or perhaps you could explain how GM sold half a million cars less last year than 2020 yet their revenues increased by $5 billion. Or maybe you could discuss the fact that the dismantling of NAFTA (by TFG) compounded the baby formula shortages we are experiencing. I am sure you will find a way to blame the current administration, just cannot wait to see how.

Sherry says

Right On Denali!!! Too bad the mindless “cult” members care nothing for actual “Facts” beyond what FOX has programmed them to say!