Marian Wang

ProPublica

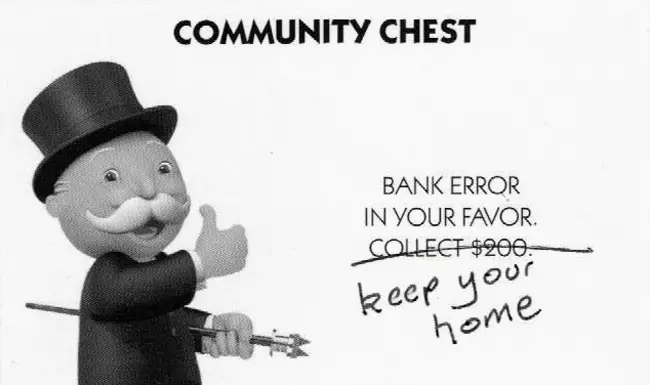

Three of the nation’s largest mortgage servicers have halted foreclosures as scrutiny increases over whether they verify the required paperwork. Several other servicers have also been faulted for foreclosure affidavits that were signed without much authentication, but they have not yet halted foreclosures.

Last week, we noted that the discovery of “robo-signers” — employees who signed off on thousands of foreclosure documents without much, if any, knowledge of their accuracy — had caused Ally Financial’s GMAC mortgage unit to freeze foreclosures in 23 states where foreclosures require a court order.

Since then, Bank of America and JPMorgan Chase have joined GMAC in halting foreclosures in those states. Together with Wells Fargo and Citigroup, these make up the nation’s top five mortgage servicers, with a 71 percent market share, as Bloomberg has noted. (Wells Fargo and Citi both have faced questions about their foreclosure affidavits.)

Since then, Bank of America and JPMorgan Chase have joined GMAC in halting foreclosures in those states. Together with Wells Fargo and Citigroup, these make up the nation’s top five mortgage servicers, with a 71 percent market share, as Bloomberg has noted. (Wells Fargo and Citi both have faced questions about their foreclosure affidavits.)

The Associated Press reported late Sunday that a Wells Fargo executive acknowledged in a May deposition that he had signed hundreds of foreclosure documents each week without verifying any information aside from the date. The company, nonetheless, told AP it had no plans to halt foreclosures and was confident of the documents’ accuracy. (As we’ve noted, other banks — including those that have chosen to halt foreclosures — have also expressed confidence in the accuracy of their documents and played down the likelihood of mistaken foreclosures, despite the flawed paperwork.)

Click On:

- The End of Foreclosure (For Now)

- Don’t Expect Florida’s Next Governor to Solve Foreclosure Crisis

- Mandatory Mediation on Home Mortgage Foreclosures To Start in Flagler

- Taxable Property Values Plummet a Record 20%; Dire Numbers for Local Governments

The Wall Street Journal reported today on a homeowner who was engaged in a foreclosure proceeding with IndyMac, which is now called OneWest Bank. A judge threw out the case after ruling that the servicer’s use of a robo-signer meant the affidavit — which establishes basic facts such as the bank’s ownership of a mortgage — had not been properly reviewed. The judge also concluded that the affidavit was incorrect; IndyMac didn’t own the mortgage and therefore did not have standing to foreclose.

The broadening scope of these problems shouldn’t be surprising. Officials at Fitch, a credit rating agency, recently noted that the processing “defects” are industrywide.

The breadth of these problems could initiate a Justice Department investigation or, for public companies like JPMorgan and Bank of America, a civil investigation by the Securities and Exchange Commission over the servicers’ disclosures to investors, according to Peter Henning, a securities law expert and blogger for The New York Times’ White Collar Watch.

More homeowners will likely challenge servicers’ foreclosure cases in court, which may ultimately prolong the housing slump, as Bloomberg pointed out.

We’ve noted that the paperwork flaws are only one of the many types of problems experienced by homeowners fighting foreclosure. For example, our reporting on the mortgage modification process has also uncovered instances in which banks failed to follow the rules and were sloppy with the handling of paperwork. In some cases, homeowners being helped by one part of a bank have been foreclosed on by another part of the bank.

Larry Glinzman says

If you’re in fear of foreclosure, in the foreclosure process or trying to recover from a foreclosure, Community Legal Services of Mid-Florida, a non profit legal aid law firm may be able to help you.

Call our Flagler County Help Line at (800) 405-1417 to see if you qualify for our FREE assistance. We never charge for any services. (Beware of rescue scams that charge you “fees” and “upfront charges”)

Mike says

So, let me see if I have this straight. One may purchase a home that is above and beyond what he or she can afford with borrowed funds, and then not have to pay for it or receive a real consequence? Wish I knew this sooner instead of doing things the honest way. Silly me.

Alex says

Mike, there is another way to look it this.

There was a real estate agent (at one time 1% of PC’s population had real estate licenses) who wanted to earn a commission (6%?) so this person found a person who was renting. This real estate agent had connections with a mortgage originator. The two got together and secured a mortgage for this renter. The initial monthly payment was less than the monthly rent. Deal was made. The renter was paying less for shelter, real estate agent got his commission, the mortgage originator got his commission. The bank’s MBA packaged this mortgage with other mortgages and stamped a AAA rating on it. That bag of AAA mortgages was sold to a company who needed highly secure financial instruments for investment purposes. Something went very wrong in the bank’s packaging department and the legal ownership of some of the mortgages got misplaced. No problem, that is only formality. A few specialized employees were paid to sign legal documents to verify that the mortgage legally belonged to the bank. Some smart lawyer questioned the the legality of the false documents and the real trouble started for big business……..

Mike, which story is more likely?????

Mike says

Alex: Definitely some valid points made. The “finger pointing game” can be won (or shouid I say lost??? no winners here) on both sides. Thank you for your insight and possible oversight on my part.

Barney Smythe says

Mike ask Starfyre! She’s unemployed, collects SSI disablity and unemployment (this is illegal BTW). Her husband is also collecting unemployment, yet they were given a loan to purchase a trailer in Bunnell. She’ll say it’s God’s way of showing her how much she is blessed. BS.

Mike Simmons says

I’m happy that all foreclosures are currently stopped. The process is way too complicated and unpredicatable. With this economy and the hope for homeowners plan, the banks and the homeowners should be able to work something out. However i’m pretty pessimistic based on the actions of these banks to this point.

over it says

Dammit to hell!! I knew i should have voted for McCain. He promised me he was going to make my home value rise. I didn’t believe him then. But NOW i’m sure he would have made it happen and we wouldn’t be in the trouble we are now. Thank god that the republicans forgive me for not voting for them and will accept my support now. We are such a blessed country.

starfyre says

leave my trailer in bunnell alone….

i am blessed to recieve a loan-its gods will

Daniel S says

So let me get this straight, the banks can package and sell your mortgage, several times even, and then some bank you never had any dealing with can take your house?

The people that are being foreclosed here are not all of the people who got loans they could not afford. These are people who lost their jobs and have to work for 7.50 an hour because the economy is in shambles. Wake up people.

lancethepoolguy says

What mess did banks create? Pay the note keep house. Seems simple enough to me