A divided Tourist Development Council voted 4-3 today to recommend increasing Flagler County’s bed tax from 3 percent to 4 percent. The recommendation, designed to broaden the county’s marketing efforts beyond its borders, goes to the County Commission, which must approve it for the tax increase to be effective. The council’s vote, and anti-tax sentiment beyond any government agency’s chambers, suggest that the proposal may have a jagged road ahead.

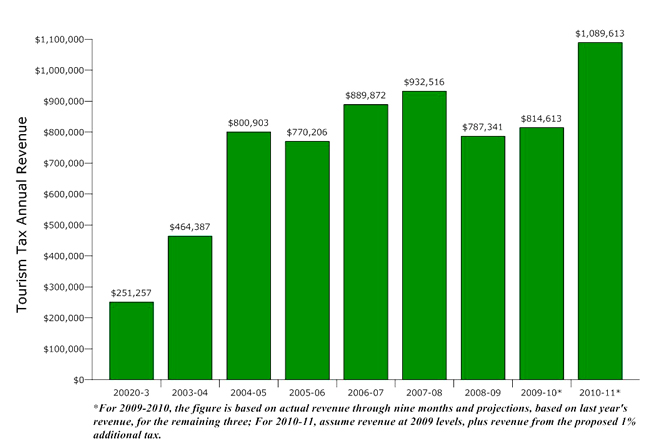

The 3 percent bed tax is levied on all accommodations at hotels, motels, apartment hotels, rooming houses, RV parks/campgrounds, and condominiums where individuals stay six months or less. It’s in addition to a 7 percent sales tax. The bed tax raised $787,000 last year, and $933,000 the year before. It’s administered by the Tourist Development Council, with the approval of the county commission. The money is split three ways: 55 percent goes toward marketing and promotion, including subsidizing local events that draw tourists who actually book hotel rooms; 30 percent goes toward repairing or building facilities that attract tourists; and 15 percent goes toward beach-related improvements.

Raising it to 4 percent would bring in between $275,000 and $300,000 more. The proposal is to add that money to the marketing and promotion pot. In Volusia the bed tax is 6 percent. It’s 3 percent in St. Johns County.

Milissa Holland, who chairs the tourism council and is a county commissioner, is championing the increase to solidify the county’s long-term strategy of making Flagler a tourist destination, and an eco-tourist destination in particular.

“I go back to how far we’ve come in the last year, and really focusing our energies on destination areas,” Holland said, “whether it be bringing in more tournaments, whether it’s promoting and recognizing that we can have conventions coming here, staying, that have been beneficial to our community as a whole. I can remember first getting on the board of county commissioners and having the Ginn tournament, and at first going, wow, we’re giving $100,000 for this tournament, why are we doing this?” That was a golf tournament sponsored in part by the Ginn Corp., the development company that has since filed for bankruptcy (and walked out on a $2 million investment in local, public dollars on its behalf at the county airport). Looking back, Holland said, the golf tournament investment “made the most sense for us to spend our resources on because it did promote such an exponential growth in visitors to our community by that one tournament.”

The proposal’s shape and timing, however, is problematic for some members of the council, who reflect a chronic aversion to more taxes in economically dire times. “As a representative for Hammock Beach, we contribute a large portion to the fund, we’re not in support of increasing the 1 percent,” Andy Blair said.

“I understand where you’re coming from,” Holland told Blair. “I would ask that this council not look at it from kind of a self-serving perspective from your corporation.”

Blair disagreed. “We spend a lot more targeted marketing dollars, and I think that spending currently $500,000 for county advertising, I think it is an adequate budget based on the number of accommodations that we have here in the county,” he said. “I just don’t think it’s the right time to be raising the taxes and jeopardizing bringing business in or bringing even the existing customer back the following year when we make it even more competitive to the other counties to secure business when we fight for business on a day to day basis. We fight to try and keep our rates, we fight to try and promote the quality of a visit here in Flagler County, but when you start raising the prices, it makes it a lot more hard to be competitive against some of the other properties and some of the other counties.”

The tourist council’s marketing budget devotes some $255,000 to advertising. Salaries take up $148,000 and the balance goes toward developing marketing-related resources such as web design, developing videos or media presentations and the like.

Council member Linda Mitchell opposed raising the tax for a different reason. “I wonder if we’re missing the boat sometimes on speaking to people that generate this tax. Are we going around and calling them together before we make this kind of decision and saying, well, what do you think? I’m not talking tourists. Our lodging community, the people that have the resorts: I think they should at least be asked their opinion of it, since they’re the ones that have to collect this tax.”

“In my history in this business,” council member Pamela Walker countered, “The hotels never want to raise the hotel-motel tax because it’s a benefit to them to have the taxes lower, their overall rate lower so that they can attract tourism. But there comes a point where you have to promote more tourism, in my opinion, and to do that you need more capital coming in, and when you can promote it better, then you have more people coming in, and more tax dollars flowing to the community, and 1 percent is not that much in the great scheme of things.”

“Well,” Mitchell said, “it’s not except right now no one wants to see taxes raised. Do we want that right now? I don’t.”

“I don’t think that the people that are coming here have any knowledge that we’re raising the tax,” Walker said. “They come because they want to go to the Hammock Beach Resort or they want to go to all of our properties. They’re coming here for a reason, and they’re willing to pay.” In sum, Mitchell said, tourists book rooms for the destination. A 1 percent difference in price is not usually a deal-breaker. There’s a precedent, too, regarding hotel and motel owners’ responses to raising the tax. The commission last raised the tax from 2 to 3 percent in 2003. At the time, the county sent a survey to 45 business owners who pay the tax. Nine said they’d be in favor. Nine opposed it. The rest didn’t answer. The increase from 1 percent to 2 percent took place in 1992.

Holland, along with Peggy Heiser, the county’s leading executive on tourism development, are scheduled to hold a town hall meeting at the Palm Coast Community Center on Aug. 23 at 6 p.m., to discuss the council’s strategy—and, for Holland, explain why and how some of the council’s money is awarded. Holland is facing some criticism for having led the effort to spend $150,000 on a projected marina in Marineland. The council had recommended half that sum. The county commission, behind Holland and in a split vote, went for the larger sum. The additional tax proposal is likely to fuel more debates over tourism’s public dollars—whether or not those dollars are generated on the back of local residents. Most of those dollars, in fact, are not, since visitors pay the tax. But as Blair noted, it affects local businesses.

“My thought process has been, I’ve seen us build a foundation, a very strong foundation in the last couple of years,” Holland said in defense of the proposal. “I see everyone kind of collectively moving in a similar direction, and the numbers and the data are showing us that our focus is working. We’re successful. Bed tax collection is down in other areas. Our bed tax collection is up. And that clearly is due to a more strategic focus on our marketing dollars.”

Crediting Heiser’s marketing studies, Holland added: “I think now we have to have the resources in order to back up our focus, in order to move it forward in a way that builds on our destination market, which allows more visitors to come here, which fills our hotel rooms, has our restaurants thriving because we have more people here, our businesses, because people are spending money here, I think there’s a lot more benefit to growing this as a marketing experience. I’m very supportive of it due to the fact that it’s going specifically, restrictively towards marketing dollars.”

The discussion over the additional 1 percent tax over, the council, in an unusual move, approved next year’s marketing budget for the council based on figures that already assumes revenue from the additional 1 percent. This year’s marketing budget was $505,000. Next year’s, according to the council’s vote, will be $650,000. The sum is being borrowed from another tourism fund. Should the county commission turn down the additional 1 percent in bed tax, the council will have to reconfigure its budget, and what proportion of money goes to what fund. The maneuver left Blair uneasy. He voted against the new budget as configured under those parameters. The budget passed, 6-1.

Kip Durocher says

© FlaglerLive

“A divided Tourist Development Council voted 4-3 today to recommend increasing Flagler County’s bed tax from 3 percent to 4 percent. The recommendation, designed to broaden the county’s marketing efforts beyond its borders, goes to the County Commission, which must approve it for the tax increase to be effective.” The TDC, led by Ms. Holland, never met a tax they did not want to increase or a tax dollar they did not want to give away.

“The council, in an unusual move, approved next year’s marketing budget for the council based on figures that already assumes revenue from the additional 1 percent.”

Do the TDC members have some inside information on how the Flagler County Comissioners are going to vote, before they have even discussed the issue? Sunshine what?

The TDC is another non-taxpayer mandated agency that spends tax money willy nilly any way they see fit. It is another group of people who should be cut off from the public trough. Why don’t they all bring their expense reimbursments to the next meeting for the publc, who pay it, to review.