The Palm Coast City Council will get its first look at next year’s budget the same day it holds a meeting on the matter–next Tuesday morning, July 27. The city administration has been working frantically on the budget and won’t have it completed until late Monday, with details not yet filled in even by the time the budget meeting takes place.

But the outlines of the budget are already in place. They’re either bright or grim, depending on how you look at the numbers. And they point to the city’s steadily increasing reliance on fees, fines and water and sewer billing to compensate for diminishing property tax revenue. And plans for a new, $10 million city hall in Town Center are as good as a sacred cow: still on course.

City Manager Jim Landon is working toward a budget that keeps the tax rate as close to where it is today as possible–at $3.5 per $1,000 in taxable value (or 3.5 mils). Doing so would mean a loss in tax revenue of $2.7 million in a budget of $30 million. The reason: taxable values in Palm Coast, as elsewhere in the county (and the country) have collapsed. Values in Palm Coast are 15 percent lower this year than they were last year. Lower values means lower property tax revenue–unless the tax rate is increased.

To bring in the same revenue next year as it did this year–which is to say, to maintain services at the same level–Palm Coast would have to increase the property tax rate from 3.5 to 4.1756 mils, a 19 percent increase. That would translate to a $68 increase for a house valued at $150,000 with a $50,000 homestead exemption. That house is currently paying $350 for Palm Coast’s share of property taxes. It would have to pay $418 if the tax rate was raised to keep in line with last year’s revenue.

The city council is not interested in increasing taxes. It may end up deciding to do so at Tuesday’s meeting, when it must at least decide what the maximum tax rate it would impose will be, so that the rate may be advertised ahead of public hearings. Opting for a higher rate on Tuesday doesn’t mean that the higher rate will, in fact, be adopted: the council won’t make that decision until September. But opting for a higher rate does give the council room to maneuver. It can always vote to adopt a lower rate. But it may not vote to adopt a higher rate than the one it will agree to advertise after Tuesday’s meeting. So Tuesday’s decision will at least set the ceiling on next year’s tax rate.

That said, the city administration is going on the assumption that the council will want to keep within this year’s tax rate and opt for budget cuts instead. Those cuts would amount to roughly $2.7 million in a $30 million budget. To achieve them, the city would scale back construction budgets and eliminate some around 15 positions. That doesn’t necessarily mean that 15 people will lose their job: the city has between 10 and 15 vacant positions at the moment. Many of those positions would be eliminated. Others would be filled internally, causing yet other, vacated positions to be eliminated. But a few people may yet end up jobless.

Two areas will see job increases: code enforcement and the swales rehabilitation program. The city is stepping up code enforcement across the board, and raising fines to generate more revenue. Residents and council members have asked for more rapid repairs to the city’s extensive swale system. Last year the city borrowed $2.3 million for drainage work and swales rehabilitation from RBC Bank–a loan agreement that enables the city to borrow up to $9 million. That loan is underwriting expansions in that department, as are higher stormwater fees the city approved this month. (The loan has to be repaid by 2023. It’s in addition to a different low-interest $4.4 million loan, secured earlier at lower interest through the state, to improve the stormwater system).

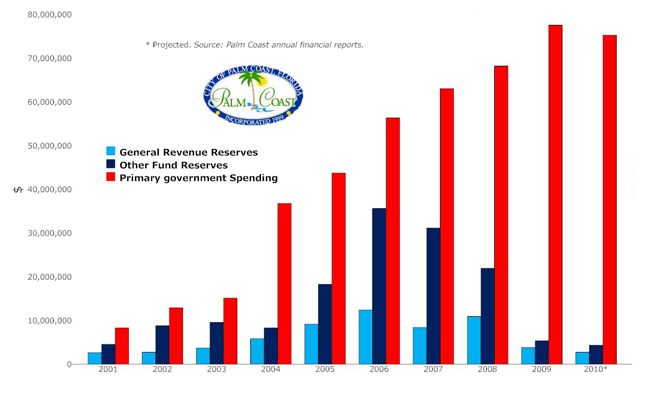

The city budget relied heavily on building fees, property taxes and construction and transportation impact fees generated by new development. While the city’s housing industry was booming, so was the budget. That ended after 2006. At the time, the city’s reserves stood at $12.4 million just in the general fund, which accounts for day-to-day operations of the city. But reserves in all city coffers, including, for example, the city’s construction and utilities funds, added up to a staggering $48 million. Palm Coast has managed to weather the housing collapse and subsequent revenue drops by tapping into those reserves.

Reserves have since been nearly wiped out. The projected reserves for the general fund this year was $2.7 million, when the administration presented its mid-year review, and $7.1 million for all funds. That’s a dangerous situation for the city to be in, in case emergencies strike. Nevertheless, the city continues to push through its plans for a $10 million city hall, which would involve dipping into some of those reserve funds and other pots, including about half the amount coming from borrowed money.

City Manager Jim Landon and City Council member Mary DiStefano, both big champions of the new city hall, sell the project by saying that it would involve neither new taxes nor new borrowing. They may be right about taxes this year, if the city holds to its current goal. (There’s no telling how, in future years, tax increases might be necessary to compensate for lacking revenue or absent reserves.) They’re wrong about borrowing: In order to get about half the $10 million for the new city hall, the city would call in a loan it made to the Town Center taxing district, what’s called a “community redevelopment agency,” or CRA, and cause the CRA in turn to borrow the money to make good on that repayment. It’s a shell game.

The CRA is its own taxing district, but in reality is no different than the city: the CRA board is the city council, and the city council is the CRA board. CRAs are clever, sometimes useful creations of taxable entities that allow local governments to accelerate development in some areas by preventing taxes generated from those districts from being spent elsewhere. But the end result is the same: CRAs are part of the city or county that administers them. In this case, the Town Center CRA is basically a taxing subset of Palm Coast. The city’s general fund “lent” money to the CRA to enable faster development. Businesses in that CRA, such as Target, the mall around it and the hospital, are generating tax revenue. But the CRA doesn’t have the $5 million or so Palm Coast lent it. By calling in that loan to build the city hall, Palm Coast will force the CRA to borrow the money. Unlike municipalities, CRAs may not borrow money at preferential rates. The CRA will borrow that money at prevailing rates. And taxes generated within the CRA will be used to pay back the loan. Landon’s shrewd accounting maneuvers aside, borrowing will account for half the costs of the new city hall while enabling the city council to keep saying that no new taxes nor new borrowing is involved.

Charlie says

Any increase in utilities, would just add “umph” to the “The Cash Cow Account ” that it presently is. The City has consistantly used this category to fund just about everything from , the project to curve Old Kings Way, to satisfy Wal Mart, to loaning money to build out Town Center , and finally to add to the ready money to build, a City Hall (One thing we do need). As an ex-business executive I do applaud The City and the Manager on having created such a money producing account for projects within a budget, but from a resident’s point of view, don’t like it due to it being an additional tax without representation. I’ve always liked the argument, that we are “cutting jobs, that no one is presently occupying” to save money Well, if no one is occupying the positions, , what type of expenses are associated with no one receiving pay and benefits. I still come up with zero. Maybe we never needed the jobs in the first place. But there is a good thing about reduced revenues. The City must think better, and actually listen to residents. But what happens, when the flood gates open again with increased revenues, and it will? Will we out spend the new revenues. Let’s think long term…

dlf says

Maybe Flagler could learn something from Palm Coast, good job by the Palm Coast reps.

H Peter Stolz says

I keep reading the argument that a new city hall would not involve any new taxes or new borrowing – but we are still looking at TENS of MILLIONS of dollars being spent. Dollars that taxpayers have been and will be contributing. Why? So Langdon and company live in plusher quarters, at a time when all Social Security recipients are trying to figure out how to adjust budgets to cope with at least 2 years of no increase. If we have $10 million laying around, I’m sure there are many in town who can suggest very good uses for that money, besides a new city hall, that – with all respect to the ex-business executive posted above – we DON’T need.

Charlie says

Mr. S, you are correct..most, if not all of this $10 million has already been paid by local residents, thru increased fees, inflated water/utility rates, and has been sitting in loans to others, at quite acceptable rates, ..The point being, that we do have other money sitting around. We pay, over $375,000 ,to have a tennis center, which has 370 annual members, yet everyone pays for their play. The golf course numbers , for the year have yet to be discussed, so we don’t know how much we have lost their this year, to include the monies to put the course in shape. But if we left it to the City, they’d build another pool for the swimmers.. Good thoughts on your part..

John Coffey says

A couple of additional points to keep in mind; a new City Hall will require ongoing maintenace we’re not paying for now, vacating the current location will cerainly add to the owners defuault of his loans. If the city moves out that will cause at least 10 additional business failures in the current complex.

Buy the current location for less than the cosyt of a new building, continue to rent to tennets and produce some income, if needs to expand, there is plent of room avalable. Sell the property in Town Center and put that money towards the purchase of City Walk.

itsMe says

Mr. Coffey, your post does make sense.

Bob K says

I have to wonder if the people who claim 15 non-existent jobs were eliminated are the same people who are counting the jobs “saved or created” by the stimulus bill.

some guy says

John C. Your thoughts on a “new city hall” make sense SO we know the polititions will not go for it. Bob K. yup sounds like the same ones to me

Michelle says

John C. – it would make sense to ‘sell’ the Town Center property if the City ‘owned’ it. PC Holdings ‘gave’ it to the City for a City Hall, with the stipulation that they must build within a certain time frame.

A deadline that Mr. Landon does not know (asked directly). But, since PC Holdings is not ‘holding a gun to their heads’ to build, then why use the deadline as an excuse for building now? (listed in the ‘pros’ for building the Hall) Yes, if the market improves and the unknown deadline passes PCH could sell it to someone else, how long could that be?

I have no dog in this fight – don’t live in PC – but would hope that all the citizens affected ask the hard questions and keep at it until satisfied no matter who is in office.