Gov. Rick Scott made much of his initiative to raise per-student funding this year through a $780 million increase in the state education budget. What he didn’t say is that property taxes would go up to pay for the increase.

So they will. In Flagler County, school property taxes are going up around 4 percent, on average. The Flagler County School Board this evening will approve the first step in the usual summer ritual of advertising the new tax rate and, in weeks ahead, holding public hearings before final adoption of the budget.

All local governments will go through the same steps. Most governments are expecting to increase taxes—not by much, though the cumulative effect will be felt by all in the end, including renters: it is a commonly repeated fallacy that renters do not pay property taxes, when in fact those taxes are reflected in their monthly rent dues.

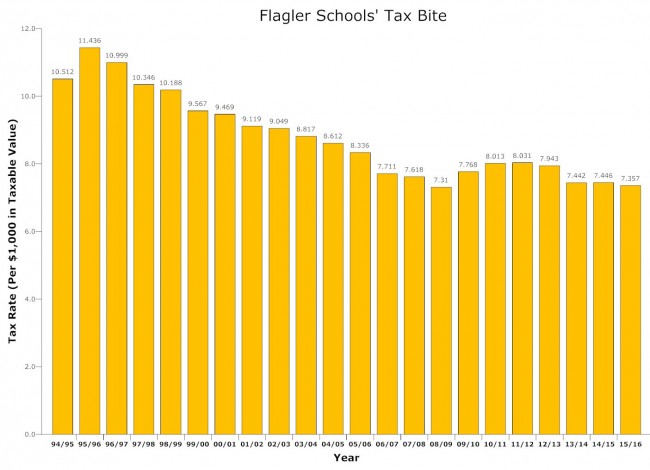

The school property tax rate is actually going down in Flagler, but by a fraction, or the equivalent of 9 cents per $1,000 in taxable value—from $7.446 per $1,000 in taxable value to $7.357. But the tax rate only partially determines what you pay. Property values determine the rest.

If your home’s property value and the tax rate both remain the same, your tax bill will remain flat. If the property value falls, as it did for many years during and after the Great Recession, and the tax rate goes up, you might have ended up paying more. As it was, most property owners in Flagler saw their values fall significantly, and their tax bills fall as well, though not as much.

By law, even if the tax rate falls but property values rise and the local government levying the tax ends up collecting more money than it did the previous year, it’s a tax increase. So it will be this coming year, as the school district projects a 4 percent tax increase. The reason: property values went up 7 percent.

Here’s how the numbers shake out. Assuming you own a home with an assessed value of $150,000, roughly the median price of a home these days in the county. In the current year, you’re paying school taxes on $125,000 of that (only a $25,000 homestead exemption applies. For other government agencies’ taxes, you get the full; $50,000 exemption.) So your school tax bill adds up to $931.

If your home value had stayed flat, you’d have seen a slight decrease to $929, a saving of $2. But if your home’s value increased 7 percent, as it did for properties on average throughout the county, its assessed value would have increased by $10,500, raising the taxable value to $135,500, and your school tax bill to $997, a $68 increase.

Your actual tax bill might not increase as much because the 7 percent increase in values combines the value of new construction with existing properties. Your actual increase as a homeowner is likely to be closer to 4 or 5 percent. Either way, it’s not a large increase (even $68 amounts to less than what most people pay for their monthly cable bill).

Where is the money going?

The district’s combined state, federal and local revenue adds up to close to $94 million, not counting reserves and transfers and other funds, which then push the total to around $135 million. The district’s total expenditures are closer to $133 million. That includes capital spending (the property tax generates $11.5 million for capital projects), transportation, debt service as well as running the district.

Some $75 million is in teacher and support personnel salaries. Administrators, who are assumed to take a large bite out of the pie, actually account for just $5.1 million of the district’s costs. Capital spending is near $10 million, debt service at $6 million.

The public hearing on the proposed tax increase is scheduled for July 28 at 5:15 p.m. at the Government Services Building’s board chambers. These hearings seldom catch public interest and draw only nominal comments. A decision by the board on the tax increase and the budget will be made at that hearing.

Johnny Taxpayer says

“it is a commonly repeated fallacy that renters do not pay property taxes, when in fact those taxes are reflected in their monthly rent dues.”

It’s a commonly repeated fallacy that monthly rent dues cover the entire carrying costs of a rental property… especially in the real estate market Flagler county has experienced for the past 8+ years. Many folks, especially in Palm Coast, are landlords out of necessity rather than choice because a sluggish real estate market made selling impossible. Rents are only just now starting to cover the actual hard expenses. For most of the past 8 years, many landlords rented at a significant monthly and annual loss.

Are you serious? says

Yes sir !! Absolutely…

DwFerg says

Agree w/ Johnny T. Renters do NOT pay the equivalent tax as owners for school taxes especially during past 8 years or so. The real wrinkle is when renters have two, three or more children in the school system. That burden falls right on the backs of the many retired, non school age dependent children households, maybe 33% or more of the homes in Palm Coast. Some new formula for tax burden should be created, imagined or crafted that addresses this inequity.It is a form of redistribution of wealth taxation measures that is commonly accepted in today’s world. Is there not a better, more equitable way to fund our county schools ??? The tax increase that was defeated a little while ago may have been a better idea after all. However, the spending @ School District also demands constant audit/review !

lena Marshal says

Wow, who has been watching that fort?

Bob C says

I find it a stretch that you are blaming the governer for the tax increase even though it is due to property value increase. If property values remined flat and there was no tax increase you would probably be blaming the governor for a poor housing market recovery.