The U.S. economy has been staggering for months and is still millions of jobs away from recovering from the nearly 9 million jobs lost since the start of the recession. Indeed, the official unemployment rate has hovered around 9 percent or 10 percent for more than two years.

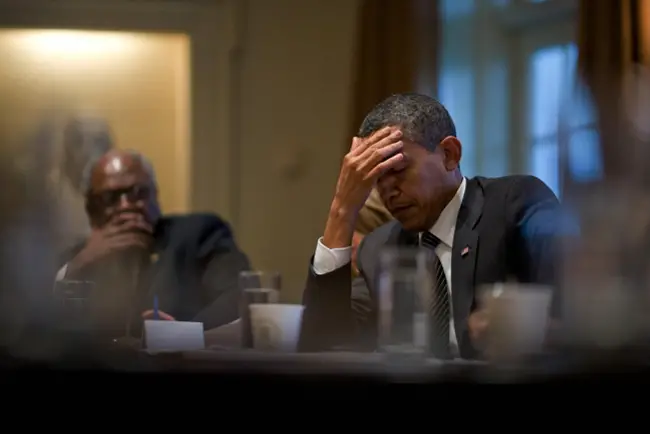

President Obama has promised to focus on jobs, so we decided to look at his actual record: What exactly has the Obama administration done to create jobs so far? Here’s a look at Obama’s jobs initiatives, the hits, the misses, and the ones we’re still waiting for an answer on.

Overall, job creation has been relatively meager during the Obama administration, particularly compared to the massive job losses brought on by the recession. According to the St. Louis Federal Reserve, even if job creation were happening at pre-recession levels, it would take us 11 years to get back to an unemployment rate of 5 percent.

Keep in mind: There is no sure-fire way to count how many jobs a given program added to the economy. Some economists use economic models to gauge how the economy would have progressed in the absence of that program. Others look at raw data. As the Washington Post’s WonkBook has detailed, there are drawbacks to both approaches. But they can still give you an overall picture.

Auto industry bailout, December 2008 to January 2009

In total, the government spent $79.3 billion assisting General Motors and Chrysler. Though the initial round of aid was approved by the Bush administration as part of the Troubled Asset Relief Program, Obama expanded on it. It has certainly helped save the companies and perhaps many jobs in the process.

Click On:

- Incomes at Their Worst Since 1996, Poverty At a 52-Year High, Inequality Deepening

- September 2011: Stalled: Unemployment Remains at 10.7% in Florida, Ticks Up to 14.9% in Flagler

- Job-Killing Regulations: Busting the Myths

- Obama’s Job Gig: Pin-Up to GOP Voodoo

There is little independent data on how many jobs were saved as a result of the auto industry bailout. But a study from the Center for Automotive Research, which receives some industry funding, says the bailouts of General Motors and Chrysler saved more than 1 million jobs in the car industry, supply chain, and communities where auto workers spend their paychecks [PDF], a figure Obama echoes in his speeches on the bailout. According to the Bureau of Labor Statistics, the industry added 45,000 jobs in the nine months after GM exited bankruptcy. [PDF; see fourth page]

American Recovery and Reinvestment Act, February 2009

The stimulus, with its mixture of tax cuts, grants, loans and infrastructure spending, is likely Obama’s most successful job-creation initiative.

Initially projected to cost $787 billion, the package has actually cost $825 billion, according to the Congressional Budget Office’s latest calculations. The CBO’s latest report estimates that the stimulus raised the number of employed Americans by 1 million to 2.9 million over the last quarter. At its peak in the second quarter of 2010, it increased employment by 1.4 million to 3.3 million.

A report by economists Mark Zandi and Alan Blinder [PDF] found that the stimulus, along with the bank bailout, helped significantly soften the recession. Zandi, who is chief economist at Moody’s Analytics, emphasized that it created the basic conditions for job growth. “If you don’t stabilize the financial system, nothing else matters,” he said.

As we mentioned in our earlier guide to Obama’s economic record, most of the major studies on the stimulus say it had a positive effect on the economy. But not everyone thinks it was such a success. Douglas Holtz-Eakin, former head of the CBO and current head of the conservative American Action Forum think tank, said the stimulus’s achievements were small considering the big price tag. “If you throw nearly a trillion dollars at the economy, it has to have an impact, and it did. … The stimulus basically stopped the fall, but it didn’t have any big multiplier effect.”

As we mentioned in our earlier guide to Obama’s economic record, most of the major studies on the stimulus say it had a positive effect on the economy. But not everyone thinks it was such a success. Douglas Holtz-Eakin, former head of the CBO and current head of the conservative American Action Forum think tank, said the stimulus’s achievements were small considering the big price tag. “If you throw nearly a trillion dollars at the economy, it has to have an impact, and it did. … The stimulus basically stopped the fall, but it didn’t have any big multiplier effect.”

Extensions of unemployment insurance benefits, February 2009 (as part of the stimulus), November 2009, July 2010, December 2010

The repeated extensions of unemployment benefits haven’t received the attention, or level of vitriol, that the stimulus has, but they do appear to have saved millions of jobs by allowing people who are out of work to keep buying goods and supporting other businesses. A study conducted for the Department of Labor by an outside firm found that unemployment insurance has been an important economic stabilizer, reducing the fall in GDP by 18.3 percent and preserving about 1.6 million jobs each quarter during the recession. The CBO estimated that the latest extension of unemployment benefits would add $34 billion to the deficit over the next decade.

HIRE Act, March 2010

The $17 billion Hiring Incentives to Restore Employment Act provided a payroll tax break for businesses that hired unemployed workers, but the impact has been, at best, unclear.

The Treasury estimates that for the first eight months of the yearlong program, 10.6 million unemployed workers [PDF] were hired by businesses eligible for the HIRE Act tax cut. But it’s unclear how many of those workers would have been hired anyway, without the incentives. Zandi and Holtz-Eakin both said that given the modest overall size of the program, the HIRE Act’s impact would be small even under the best of circumstances.

Education Jobs Act and Medicaid Assistance Act, August 2010

This bill gave $10 billion to the states to preserve education jobs during the 2010-11 school year. It’s still too early to tell how many jobs were created; not all of the money has been spent yet, because districts also have the option to use it for 2011-12. The program estimates that it has created or saved 114,407 teaching jobs so far.

Small Business Jobs Act, September 2010

The Small Business Jobs Act extended Small Business Administration loan programs and created a $30 billion fund that provided capital to small banks in order to increase lending to small businesses. The results are far from clear.

According to the Treasury Department, $4 billion has gone to 332 banks across the country, though again there’s little research on how this has translated into jobs. Jared Bernstein, a senior fellow at the Center on Budget and Policy Priorities and former Obama administration economic adviser, cautioned that it’s more difficult to gauge how many jobs a program created if it’s not a direct job-creation measure—you’d have to see whether businesses that got access to credit through this program expanded and hired more than business that didn’t.

Holtz-Eakin and Zandi were both skeptical about the program’s results. “The banks that would take the capital probably were the weakest banks, and the banks that were in good shape wouldn’t take the capital,” Zandi said. “There was a great disincentive for participating in that program.” A Wall Street Journal investigation found that more than half of the Small Business Lending Fund money given to small banks this year was used to repay TARP loans, rather than going to small business.

–Braden Goyette, ProPublica

Bill McGuire says

Poor Mr. Obama. He appears to be the incarnation of Enterprise Flagler. We’re not really sure what he(or they), did, nor do we know to what degree, if any, improvement was actually realized, but we think he (and they) meant well and really tried hard to do it

Mary says

I wonder if the Bureau of Labor and Statistics also reported the immediate outsourcing of GMAC jobs after the takeover of GM by the US government? The industry added the jobs, but not in the United States.

GM is now busy increasing its business in the overseas market., a good thing if you are a stock holder.

On November 16 and 17, 2009, many errors were found in the $747 billion plan that showed the plan set aside money for districts that do not exist. According to Recovery.gov, the plan shows its funds will go to 884 Congressional Districts, though there are only 435.[5][6]

http://sunshinereview.org/index.php/American_Recovery_and_Reinvestment_Act

The administrators at Recovery.gov eventually consolidated the fictitious Congressional Districts into “unassigned congressional districts.”

Robert says

I continue to ask the question and have not gotten any type of answer. A sufficient one or otherwise.

Where are all of the jobs that should have been or are projected to be created from the tax cuts that the wealthy have received????

Someone please craft or spin an answer.

Frank says

Here is a another viewpoint on whether or not the American Recovery and Reinvestment Act of 2009 was the administration’s finest achievement. It certainly appears not to be so for the taxpayer.

http://www.nationalreview.com/corner/242731/did-tarp-money-really-get-paid-back-kevin-d-williamson

Below is the text from that article:

Did the TARP Money Really Get Paid Back?

August 8, 2010 1:03 P.M. By Kevin D. Williamson, National Review Online.

I didn’t see the show, but apparently Jackie Calmes of the New York Times was on Candy Crowley’s program on CNN this morning and claimed that the bank and automobile bailouts have been repaid with interest. A friend asks: Is that true?

No, not really. The part of TARP that deals with banks — the big banks, anyway — has largely been repaid: Goldman Sachs, Morgan, Wells Fargo, BONY, and the other bigfoot banks have paid back their loans.

But . . .

Citigroup paid back less than half of its bailout and the government took equity for the rest. We own a fifth of the company (and I wonder if that fact has anything to do with this.)

We still have billions of dollars’ worth of warrants on equity in 280 companies, almost all of them banks and insurance firms. Those warrants represent the option to buy stock at a pre-set price, and Treasury has made a few billion dollars exercising them as bank shares have recovered. It will come as no surprise to you that the American Bankers Association has asked the government to cancel the warrants, representing another multibillion-dollar giveaway to the banks. The administration is leaning toward accommodating that request by converting the taxpayers’ interest into a special small-business lending scheme, which we can safely assume will be handled with all the transparency and deftness that we have come to expect from similar programs run by the Small Business Administration.

The warrants business doesn’t represent all that much money in the grand scheme of TARP, but it is kind of interesting. Here’s a bit from finance professor Linus Wilson’s testimony before the House:

We meet today on almost the one year anniversary of the first warrant transaction, with Old National Bancorp. That transaction demonstrated that the U.S. Treasury without oversight will squander the taxpayers’ profits from their very risky investments in the banking sector. The auctions of several banks’ warrants make me hopeful that the taxpayers will get close to fair market value for their warrants in over 280 publically traded banks. Yet, by my estimates, the U.S. Treasury and the administration today plan to squander a fair market value of warrants and preferred stock of approximately $3.0 billion by allowing existing Capital Purchase Program recipients to cancel their warrants and convert their preferred stock into the proposed Small Business Lending Fund. Thus, vigilance and oversight is essential to ensure that taxpayers hold onto the returns they have earned from the TARP warrants because the U.S. Treasury left to its own devices has often been a poor steward of the $700 billion of taxpayer funds.

. . . The proposed $30 billion Small Business Lending Fund would allow over 580 of the smaller Capital Purchase Program recipient banks to wipe out the warrants worth $457 million, according to my estimates.

As Professor Wilson notes elsewhere, the big banks have been better about paying off their TARP obligations, mostly because the stigma of the program hurts their bottom lines. But the smaller banks are another story: In March, Professor Wilson identified 82 banks that had missed interest payments or dividends owed to the government: “Even as more firms try to feed at the trough of subsidized government capital, it seems clear that a lot of the banks that have received government capital were not worth the risk,” he writes, noting that “one-eighth of the banks remaining in the ‘healthy bank’ program are behind in their payments.”

Back to the major institutions: AIG and GMAC are the stuff of nightmares. In the case of AIG, we put up $40 billion for a company whose entire market capitalization, if I’m reading Yahoo right, is $5 billion. And the automakers have not paid back the capital we put into them, because the government took equity instead, which is why we own a tenth of Chrysler and three-fifths of GM. GM proudly advertised that it has repaid its government loan, which it did — out of a taxpayer-funded escrow account, i.e., it “repaid” its government money with government money. Senator Grassley blew a righteous head gasket over that shenanigan, the Competitive Enterprise Institute filed a false-advertising complaint in response to GM’s dishonest PR campaign, and the stink rose so high that even the New York Times caught a whiff.

So there’s that.

Oh, yeah: Fannie Mae and Freddie Mac have an infinite line of credit at Treasury and portfolios bursting with the worst kind of junk. Plus, we’re going to lose a bundle on the mortgage-assistance programs tacked on to TARP.

Short version: If TARP had only done what TARP was supposed to do — prop up the banking system — it still would have been a mess, but a mess for which the banks, not the taxpayers, ultimately would have picked up the tab. With everything that’s rolled up into TARP, we’re going to take a bath. And it could get really bad if we don’t do something about Fannie and Freddie – and by doing something I don’t mean getting behind a whole new passel of weak mortgages made to people who cannot even raise the money for a down payment.

I hope that answers the question.

some guy says

Jobs created OK sure saved how do you count them?? and at what cost for each fictitious job saved as we Know NO jobs where added to the economy as we have more people out of work after this sham!!

beachcomberT says

Let’s face it, for all the thousands of economists we have collecting salaries at Labor & Commerce, plus the think tanks, we have very little hard data on the employment situation. All we know for sure is how many people are collecting unemployment, and how many workers are listed on unemployment-tax returns. Even those numbers are sketchy. Millions have exhausted their unemployment benefits but remain jobless. Millions of self-employed people are in a nebulous state that no one counts (except the IRS). Probably millions of undocumented immigrants are totally outside the system, either unemployed or working under the table. Recovery.gov was a joke from Day 1, so forget about getting any reliable stats from that propaganda machine. Obama had better shred his “Hope & Change” posters from 2008.

Layla says

The proof will be in the pudding, when all Americans are back to work. And we will all know when it has happened.

Don’t count on that happening for a long, long time.

palmcoaster says

American Corporate elite do not want to invest to create jobs to play the Reps game to make this president one term only? Well…Mr. Obama invite the foreing wealthy business investor under our E5 visas and come here invest 500,000 to a millon hire 10 American workers and stay! They can buy those foreclosed restaurants, hotels, factories then hire workers and help our economy and themselves to enjoy their residence in our beautiful country. While the local rich and corporated barons keep their bank accounts fat.

Outsider says

How about this: GM and Chrysler go under. Ford, which seems to have the vehicles everyone wants picks up the market that GM and Chrysler lost. They then need to hire thousands of workers to meet the new demand. Let’s see, where could they find experienced people to build their cars and trucks?

palcoaster says

Yes Mr. President hold your head on this debacle, as you missed the opportunity to really materialize the promised Change in your first term with the House and Senate majority in your side then. Big waste of time yours trying to pass legislation with some collaboration from the conservatives when you could have done it with that majority..Honestly you goofed as these extreme conservatives just care to put you down only by opposing all you present then and now.

Today we are immerse in this high unemployment, never ending inflation (look at the price of groceries)and gouging at the pump while the wealthy and corporations get richer. Tax them and imports. Stop these wars and hire our workers to repair our failing infraestructure. Remember that Franklin Delano did it and worked!

palmcoaster says

Yes Mr. President hold your head on this debacle as you missed the opportunity to really materialize the promised Change in your first term, with the House and Senate majority in your side then. Big waste of time yours trying to pass legislation with some collaboration from the conservatives when you could have done it with that majority..these extreme consrvatives will oppose anything you propose as their only goal is to make Obama one term President only. Meanwhile the unemployment grows as much as inflation does( price of groceries) and the gouging at the pump while the wealthy and corporations get richer.Tax them and tax imports. Stop the wars and use those funds to repair our failing infrastructure hiring our workers. Do it now!

The Wall Street sacrificed demonstrators are asking you for that.

Doug Chozianin says

My wife and I just finished a road-trip to virtually all the National Parks in the upper mid-Weat. We drove over 8,000 miles and saw many impoverished towns and some prosperous towns along the way.

All the prosperous towns had one thing in common: ALL WERE DRILLING FOR GAS AND OIL OR MINING COAL!!!

The impoverished towns were living on unemployment checks. I was amazed and heartbroken by all the empty stores and office buildings i saw. (Obamanomics is not working and never will. You, me and the government can’t live on credit card cash advances.)

The solutions to our economic problems are simple: Replace Obama; Kill Obamacare; Eliminate job killing regulations; and drill and mine throughout the U.S.to bring back low-cost energy.

Unemployment will be under 5% in no-time.

Layla says

You are not the first person to come back from a trip like this one with this viewpoint. Thank you for sharing it. This is the first place I have lived where so many are unemployed and doing nothing about it, other than coming up with taxpayer financed schemes to bring business in.

We must pay our bills and we must pay our own way. The people know this, at least working people know this. The administration and Congress do not.

It is not the bills the President is proposing, it is paying for them. I agree with you, Doug.

Visit the gulf and ask local governments there how many are out of work as a result of decades of not drilling for our own oil. Every country in the world is drilling off our coast and we cannot. In the meantime, many can no longer to heat their own homes. Disgraceful.