How much can a U.S. president committed to greater equality hope to accomplish when lawmakers devoted to helping the rich hold the upper hand?

Advocacy for equality must take a backseat, Obama administration insiders insist, when fanatical friends of the fortunate in Congress recklessly endanger our nation.

Click On:

- Detox for Tax Fact Cheats

- Federal Individual Income Tax Rates By Year: 1913-2011

- Eleanor Roosevelt: If I Were a Republican Today

- My Favorite Republican: A Look Back at Eisenhower’s Otherworldly Farewell Address

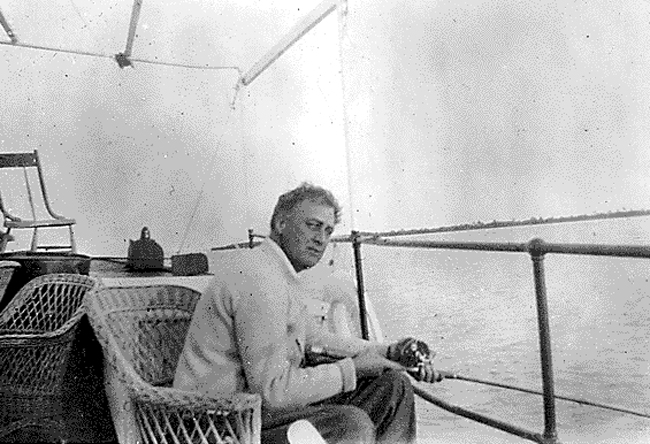

But in 1943, a U.S. president confronted a debt ceiling crisis just like Obama’s — and came up with a different answer. Facing rabid lawmakers every bit as opposed to taxing the rich as ours today, Franklin D. Roosevelt didn’t let up on the struggle for a more equal America. He doubled down.

Roosevelt’s debt ceiling battle actually began right after Pearl Harbor. The nation needed a revenue boost to wage and win the war.

FDR and his New Dealers wanted to finance the war equitably, with stiff tax rates on high incomes. How stiff? FDR proposed a 100 percent top tax rate. At a time of “grave national danger,” Roosevelt told Congress in April 1942, “no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year.” That would be about $350,000 in today’s dollars.

The year before, steel exec Eugene Grace had grabbed $522,537, over $8 million today, in 1941 salary.

But conservative lawmakers would quickly reject FDR’s plan. Four months later, Roosevelt tried again. He repeated his $25,000 “supertax” income cap call in his Labor Day message.

The Live Commentary

Congress shrugged that request off, too. FDR still didn’t back down. In early October, he issued an executive order that limited top corporate salaries to $25,000 after taxes. The move would “provide for greater equality in contributing to the war effort,” Roosevelt declared.

Infuriated conservatives saw red, literally. The “only logical stopping place for this movement,” fumed Princeton economist Harley Lutz, would be “a completely communistic equalization of incomes.”

Rich-people-friendly lawmakers vowed to kill FDR’s executive order by any legislative means necessary. They ended up attaching a rider repealing the order to a bill that would give the wartime debt ceiling a desperately needed lift. FDR tried and failed to get that rider axed, then let the bill with it become law without his signature. He had no choice. Our troops needed financing.

Roosevelt had definitely lost the debt ceiling battle over the salary cap, as he no doubt knew he would. But sometimes a leader can win by “losing.” FDR didn’t prevail on the cap. He did prevail in his far broader struggle to shape the wartime finance debate.

Roosevelt’s relentless campaign to cap top incomes kept that debate focused on taxing the rich. Conservatives didn’t want to do that taxing. They wanted a national sales tax, as do many conservatives today. But FDR’s aggressive advocacy for equity never let that regressive sales tax notion get traction.

The war revenue debate would be fought on Roosevelt’s terms — not on whether to tax the rich, but on how much. And, in the end, that “how much” would turn out to be quite a great deal. By the war’s end, America’s wealthy would be paying taxes on income over $200,000 at a 94 percent statutory rate.

Americans making over $250,000 in 1944 — over $3.2 million today — paid 69 percent of their total incomes in federal income taxes, after exploiting every loophole they could find. In 2007, by contrast, America’s 400 highest earners paid just 18.1 percent of their total incomes, after loopholes, in federal taxes.

The debt ceiling “solution” that White House and congressional leaders bargained does not ask these top 400 — or any other rich Americans — to pay a penny more in taxes than they do now. In the 2011 debt ceiling struggle, inequality has clearly triumphed.

So what does FDR’s debt ceiling battle teach us? Maybe this: We really can have a more equal America. We just need to fight for it.

![]()

Sam Pizzigati edits Too Much, the online weekly on excess and inequality published by the Washington, D.C.-based Institute for Policy Studies.

Layla says

I understand where you are coming from, but resent the blame being placed on the Republicans. Doesn’t matter which party you try to place the blame on, this is why we end up with lousy leaders. Nobody can think for themselves; we are being intentionally reduced to a mob mentality.

Never have I seen such blatant class warfare being stoked by an administration desperate for reelection. When I was growing up, we called this socialism. I still believe that is what it is today.

We have a man in the White House who has been there nearly 3 years, the first two with a complete majority in both the House and the Senate. Personally, I don’t think he could lead his way out of a papersack with a troop of girl scouts. If you call passing healthcare the way he did “leadership” well, then we’ll just have to agree that we have differing views on what leadership constitutes.

And while this BLAME GAME is going on, the NEW JOBS CZAR and Obama confidant Jeff Imelt, CEO of GE is making billions in profit and not paying a dime in taxes. If that isn’t bad enough, he is now busy outsourcing GE jobs to China. Maybe we should change his title to “Chinese Jobs Czar?”

And you want to blame all this on the Republicans? Get serious. Stop the blame game, show up in record numbers to vote them ALL OUT, and let’s get this country back on its feet. The insults are accomplishing nothing.

As for taxes, nobody is opposed to charging the rich more taxes. Nobody. But you won’t stop there. It is the administration’s definition of rich most object to. I AM OUT OF MONEY. Two administrations have taken most of my retirement and now I am unemployed. I don’t think it is taxes you are after, I think it is absolute servitude and dependancy. I think most Americans know this and are fed up with both sides.

The ONLY WAY you get a more equal America is to work hard and EARN it. Maybe THAT is the problem.

See you at the polls in 2012.

Masked Liberal Evangelist says

Why is it class warfare when arguments are made for going back to the 1990s tax rates and closing loopholes? Why aren’t bonuses and golden parachutes for executives that brought on our current economic disaster considered class warfare? Why aren’t offshore sweatshops and tax havens consdered class warfare?

Gram says

I think we deify the rich in our society, and so many people truly believe that the rich deserve to be rich, that that’s the American Dream. The rich are the ones ruining the environment and taking advantage of the country and its populace. I am often reminded of Elton John’s Burn Down the Mission – we need to take the fight to the rich and wrest control away from them. We will not have a candidate in 2012 who represents the people. We need to raise those taxes and raise them high, and we need courage to get that done. I think the courage is all bred out of our political morass.

Prescient33 says

If you were to confiscate the entire wealth of the so called “rich,” at the Government’s present rate of spending we’d burn through it in days, and then what? Do as Greenspan suggests, and print “more money?” Then we’s have inflation like the Wiemar Republic and need wheel barrows to shop.

It is beyond asininity for any sane person to suggest that stifling growth through a confiscatory tax policy choking off an individual’s incentive is a solution. JFK recognized this almost 50 years ago, and Reagan did in the 80’s and real economic growth followed.

The USA is still somewhat of a capitalistic economic system, although the Obama regime is doing its best to destroy it in the hopes that we can live in the Cuban mold festering 90 miles of our shore.

The change coming in November of 2012 will put us back on the correct course, where a person’s efforts will be rewarded, and he or she will be able to enjoy the fruits of their productive labors, as will their employees.

Layla says

The rich are destroying the environment? Have you seen what the illegals have done to it along the border states? I think you would be shocked at the debris being left there and in our national parks…literally TONS of it. People are flowing into the United States at an alarming rate from cultures that have no respect for the environment. And they are coming here because they get BENEFITS. And politicians are allowing it because they get VOTES.

Most people who are well to do put in long hours of work that no ordinary citizen would consider humane. For them, weekends and holidays don’t exist. Being rich is not luck. It takes long hours and very hard work. It is the American dream for us all.

But don’t let politicians tell you it is the other party’s fault when they are all doing it and the President himself is the most guilty of this argument. Not only has he failed to lead this nation, he is not even a good example for it.

I think we’re all on the same page here, people. We need to change our tax laws. EVERYONE needs to be paying taxes and contributing to this country. Too many are taking and not putting anything in. And it is our own government that is doing the enabling. And that is what is dividing this nation, NOT the people who built it.

Gram says

I just cannot believe I’m reading this kind of nonsense. Let’s just let the rich have their way with us then. If we collected taxes from wealthy citizens at a rate of 75%, the country would have enough money to fund programs that put poor citizens to work and fund public works projects that would create strong infrastructure to last the next 100 years.

If you’re not hugely wealthy and you oppose raising tax rates on the super-rich to help the country as a whole, you’re up someone else’s ass and you need a whiff of reality.

NortonSmitty says

Pubescent33, we didn’t have “real economic growth” after the Reagan tax cuts, the growth ALL went to the wealthy. Wages have been perfectly flat or lower since the late 70’s while all of the growth went to the investment class. If you prefer to see this graphically, here are 15 great charts spelling it out. http://www.businessinsider.com/15-charts-about-wealth-and-inequality-in-america-2010-4#

And you are confusing wealth with annual income regarding running through the rich folks money to prop up the government. This is a common misconception of all of the Beck/Limbaugh School of Economics graduates.

And it’s just going to get worse thanks to The Supremes http://www.hightowerlowdown.org/node/2727

Can’t wait!

Layla says

Gram, advise you to look up the stats on this and then maybe sign up for anther math class. YES, THE RICH NEED TO PAY, but so do we ALL. But if you really do think there is enough wealth left in this country to sustain us all through the next 100 years, you could use a good sniff of reality yourself.

This is where I get angry. Charge them whatever you want. 100% if you wish. But if you want their money, put in the time, effort and EARN IT YOURSELF. You are NOT entitled to what others earn.

The 39% of us still paying taxes should not be supporting the rest of the country. That is NOT right and will not be stood for much longer, no matter who is in the White House.

Yogi says

We have a sufficiently free and equal America under the Constitution. We are all equally free to pursue our dreams. These articles debunk the great FDR myth.

http://www.fee.org/articles/great-myths-of-the-great-depression/

http://online.wsj.com/article/SB10001424052702304024604575173632046893848.html

At the end of WW2 Congress denied FDR’s socialist agenda and lower taxes and eased restrictions on business to ensure millions of Americans returning from war and the millions changing from a war time industrial complex to peace time were able to get a job.

JL says

I have to agree with Layla. We all want something but do not want to pay for it. The rich do not get rich by working 9-5, 5 days a week. It hurts when we pay taxes, but we still pay less than most other countries. It is the price we pay for our freedoms. We all owe the debt and all must pay.

I also agree 100% about Obama not being able to lead his way out of a paper sack. He has NO leadership qualities. He made a great televangelist when he was running for President. And people bought what he was selling, just like they bought Jim and Tammy Faye Bakers crap years ago.

We need to vote everyone out. Both sides, start over. The recent debt ceiling fiasco showed America, no one had guts, no one just took the reigns and did what they needed to do. Everyone is so afraid of a few votes. Both sides are to blame. Let’s vote in everyday people. No more politicians, no lawyers. Let’s see some store owners, small business owners, regular people. They can’t do any worse than the jokers we have in there now. I would like to see some younger people run for office. I know quite a few graduates from FPC who are now in the business world and would serve the country well in the Senate and House.

William says

This thread exemplifies what’s wrong with our country. Regurgitated wrong-wing talking points, and the obligatory xenophobic attack on illegals.

NortonSmitty’s comment is the only one with any basis in reality. It’s why I don’t visit here that often anymore. It gets too tedious arguing with a bunch of intellectual crustaceans.

Jack says

@Yogi: I have a hard time believing anything from an organization (FEE) that mirrors the conservative think tank the Heritage Foundation and the second link from a guy who wrote the book New Deal or Raw Deal?: How FDR’s Economic Legacy Has Damaged America, it might as well have been on Michele Bachmann’s list of books right along side Politicking for Dummies. Those are hardly unbiased sources.

Layla says

William: Obligatory xenophobic attack on illegals????? I am a native Californian and worked for two Members of Congress in the Sunshine State. You have NO IDEA the damage of not enforcing our immigration laws has done to states like California, Texas and Arizona.

As long as people can pop across the border, deliver a baby, receive other medical treatment, get an education, all without paying into the system, this country’s economy is headed to the bottom.

That’s reality. The people in these states live it everyday.

William says

Wow Layla,

thanks for setting me straight. Thanks for explaining to me that the powerful “brown people lobby” caused our financial system to crash. Now I finally understand that the brown people shorted the market and forced us to pony up $700 billion to save their sorry asses.

Thanks for letting me know that the “brown people” caused American manufacturing to be sent overseas, because they wanted all those below minimum wage jobs all to themselves.

And now I finally understand that the “brown people” caused the debt-ceiling showdown, because they insisted on the advancement of their ideology.

I can’t even bear to look at them anymore, because those damned “brown people” want to impose Sharia Law on our legal system, and that is damned well not going to happen.

And these bastards keep getting us into these military interventions. How can this be? Is there no decency anymore?

Let’s cure it all. If we deport them, income inequality will become a distant memory. If we get rid of them banks will cease fraudulent forclosures. When they are expunged from our society, businesses will begin hiring again. Our deficit will plunge, because we’ll no longer need to pay ICE agents for their services. Corruption and earmarks will end too, because we’ll no longer have need of fences.

Unfortunately the price of our produce will likely rise significantly, but won’t it swell your heart with pride, seeing that “Picked by an American” label on the head of lettuce you can’t afford? What the hell, it’s a small price to pay to see to it that American jobs are protected.

Only one question remains. Are you a Krill or a Shrimp?

Outsider says

I would sooner pay twice as much for a head of lettuce if I didn’t have to pay for the pickers’ healthcare, babies, kids’ educations and their groceries. The idea that their labor is cheap is an outright fallacy; the REAL cost of their “cheap” labor is simply spread around to the taxpaying society.

Layla says

William: I did not say that at all. Actually, Bill Clinton sent the jobs overseas with NAFTA. And he had plenty of help.

Do you have a problem with all paying taxes instead of less than half of us?

nicole says

The idea that everyone needs to work hard and earn their income…what about people with disabilities? They won’t always have family to take care of them. What about mothers? They don’t get paid to be a mother and certainly, if they have no income though I believe they do hard work, they obvi can’t pay for child care to go out and get a job to earn income. Raising children is an unpaid job, but hard work none the less which occludes a person from having time to pursue some job to “work hard and earn it.”. What about a soldier with PTSD who can’t return to work yet because they still need care to assist them with their trauma and how it affects their daily lives? Unemployment for returning military personnel is higher than the national average…”job creators” aren’t creating jobs with their wealth, they are sitting on it. They don’t give a shit about unemployment except that it drives job demand up and means ppl will settle for lower wages AND cuts to their benefits and pension (which only existed so their bosses could pay them less over their lives with the promise, which can and has been broken many times, that your job loyalty will pay off). Capitalism does not always reward workers and it ignores those unable to earn a traditional income because they are mothers, disabled, unskilled from lack of access to education and jobs…. i believe in hard work, but i don’t believe people without money don’t deserve the security of having a place to live, eat, sleep, clean water. You can be a felon that wants to work hard, but no one will hire you. You can have some bad luck and become homeless, which makes it unbelievable difficult to find work when you have limited or no access to showers, food, sleep, computers. There are many reasons why’work hard and earn it” sounds fair but isn’t upon inspection.

Nudist says

MoronSmitty (sorry, but you took a shot at Prescient33) we did have “real economic growth” through and after the Reagan tax cuts. The charts you refer to are also correct, so, how can this be? What the charts don’t show is:

Chart 1. Wealth Gap. The problem with the chart is that it doesn’t account for all the new industries that have sprung to life especially in the range from 1992 to 2000. That was the internet bubble and the big dip following is the bubble bursting. A lot of millionaires and billionaires were created “overnight” in cellular services, broadband providers, computer hardware and software companies, etc. Think ebay, yahoo, esri, google, etc. etc. The chart shows the rich getting richer because wealth is unbounded at the top end, but zero will always be zero. There are always people entering the work force. There will always be the fruit pickers and waitresses relatively low-skilled jobs. But someone invents a new widget, and voila, he’s a millionaire this year and a billionaire next year. It would be a sad story of American innovative malaise if wealth discrepancy was high in the 1940’s and low now.

Chart 2. 50% of the people make 2.5% of the income. Well, if every family in America was two parents and two kids, and each parent made $60,000 then you’d have 50% of people with no income and 50% with all the income, and $120,000 income disparity between the haves and have nots… but, EVERYTHING WOULD BE NORMAL! :^) So don’t get all worked up over this. Yeah a huge percentage “of America” is kids, retirees, invalids, prisoners, newbies in the work force, etc.

Chart 3. Stock & Bond Ownership. I’m middle class, have nothing to complain about, but never bought a stock or bond. I can afford it, it’s just not something I do. A lot of other people are in this boat with me.

Chart 6. Real Average Earnings Have Not Increased In 50 Years!!! My, gasp!!! Let me ask you this… why should the average schmo doing an average job be making more real dollars now than 50 years ago. What is he doing differently that his employer is going to pay him more? The 0.01% are creating cool new things! Sport professionals used to have second jobs to make ends meet… now they have $20,000,000 contracts. They’re selling more Budweiser and Doritos at half time, and therefore command those sorts of salaries. That wasn’t true in the 50’s.

Chart 9. Republican Tax Cuts have significantly increased the wealth gap. Possibly, but a.) that ain’t a bad thing for reasons already mentioned, and b.) whole entirely new technologies account for much of that. (also already mentioned.)

Chart 10. Meanwhile, income tax is getting lower and lower for the rich. Good. You won’t believe me when I say “trickle down,” so I ought to just shut up. Yet, if the rich don’t spend money to make jobs, and the middle class aren’t doing it, and the poor are to poor to do anything, then where do all the new chain restaurants and shopping malls and condo buildings come from? Anyone?

Chart 11. America spreads its wealth FAR LESS than other developed countries. Good, we’re NOT other countries. We’re not living the Bosnian Dream here.

The charts not mentioned elicited responses similar to those already given.

John says

You people are ridiculous. You act as if the Government not doing something means that it Won’t get done at all. Who took care of the poor, the uneducated, the single mothers, before FDR came along? Family. Friends. Churches. Communities. Charities.

People were not starving to death en masse before FDR came along. They were cared for by those who cared about them the most, and by those who had the biggest interest in their well-being.

And what right does one person have to claim the property of another. If the rich commit crimes- then take their money away. Otherwise, shut up and live your own damn life!

Nathaniel says

I live in Sweden. We have the world’s second highest tax level (after Denmark). I have access to free health care, tuition-free college and university, heavily subsidised public transportation, heavily subsidised dental care, free daycare for my kids, 18 months paid paternal/maternal leave, 5 weeks paid vacation per year – AND I make approximately $400k a year. I can buy gold watches, I can buy nice suits, in fact I can buy shitloads of things that I don’t really need – which is awesome.

But some of the money I make is taxed and converted into free health care etc, quite a lot of my money actually. But who cares. I’m still well off.

Dylan says

You people are arguing if the rich should continue to accumulate wealth or not? It is ridiculous. Anyone recall what happened to Marie-Antoinette? She had her head lopped off for living like a truffle pig, whilst her people suffered. The same is happening in the US right now and even Canada. To tell me that this inequity is okay, is absolutely unjust and unchristian.

TNflash says

We do not have the large families anymore. Now it is not uncommon for seniors to have only one if not no one to take care of them. Yes our taxes are unfair. Why? Because our taxes are based on income and not disposable income or wealth.

Retnan says

2 things you fail to note

1) Democrats had a comfortable majority in both Houses so blaming the GOP is silly. And no most these democrats weren’t “conservatives”, these same people passed the New Deal.

2) Imposing an income cap via Presidential fiat is extremely unconstitutional, whether you’re for it or against it you should recognize that.

Say Something says

It seems you fell asleep during discussion of the Great Depression, The Dust Bowl, etc. Good that you apparently live in a society where every poor , sick, indigent, unemployed person has someone to turn too.

I am not familiar with that life. Count your blessings brother.

Luke says

Dude, my God, you act like taxing the rich is such a brilliant idea. There’s a reason Republicans are against it in highly disproportionate manners, and it sure as heck isn’t political. The rich are a minority. Favoring them doesn’t help any party politically. And raising taxes to 75 percent on them is borderline communism. The definition of communism is the elimination of social classes. That’s exactly what happens when they’re raped with taxes. Who the hell are the Dems to take their money away anyway. It doesn’t matter how jealous you are of it, it’s their money. The Dems are threatened by their power. They want a monarchy with no competition. They feel threatened by the rich in this tyrannical quest. The rich pay over 50 percent of the nation’s taxes, and they can leave, taking their business with them, when they don’t like how they’re being treated here. They’ve done it plenty of times before. The rich make the jobs that fuel the economy. They determine the pay and benefits, which needs to be competitive in light of other jobs available. Hurting the rich therefore hurts everyone. Furthermore, there’s also a lot more of them than there are government officials. So your solution to having the power in the hands of several hundred thousand allegedly corrupt people is to put it in the hands of several hundred instead? Where’s the sense in that?! Republicans know the rich are needed to keep the economy strong, and they know how important they are. The press, most all of whom work for profit, don’t want the public to see it that way. Most of their business comes from drama queen Dems, and most of their viewers are lazy stay at home libs. Everything you’ve said in this article is such a crock. I don’t necessarily blame you though. It’s likely more the media. My advice.

use your own common sense in the future..you’re own thinking. If you’re objective about it I think you’ll discover what a crock all that is as well. I should add also, while off topic, that FDR was a racist, and that’s not a matter of opinion. It’s in black and white in the New Deal he signed and approved. It mandated that minorities were to be segregated into communities that received less benefits. Republicans freed the slaves, and they continue fighting to do that today. Anyway I don’t normally write in public media, but I was looking for the exact percentage FDR hiked taxes on the rich during the depression, and this was one of the first things I stumbled over on Googel. Have a good day.

frontncenter says

Ignorance and gullibility never cease to disappoint in America. What FDR did was a bad thing disguised as a good thing. Social security actually began in 1778, with the Treaty of Paris. In exchange for peace, the British, who had already stolen a great deal of land around the world, agreed to stay out of our affairs. But that didn’t mean King George III totally gave up everything. We made a backroom deal with the King, and the Crown gets its share of tax money ever since.

See the Treaty of Peace (1738), King George III made the “Arch-Treasurer and Prince Elector of the Holy Roman Empire and c, and of the United States of America.” FDR, who is related to Queen Elizabeth (10th cousin), met with Queen Elizabeth I & King George VI to amend the deal, birthing the Social Security Act of 1935. In 1997, Queen Elizabeth II amended it again, under H.R. 1778 (Treaty of Paris date (1778)). That’s why the Queen owns, controls and amends our Social Security.

https://www.legislation.gov.uk/uksi/1997/1778/made

But that should come as no surprise considering America was built on lies, theft, murder, rape, trickery & deceit.

TIMOTHY HAMLIN says

I’m floored by the ignorant comments on this article. Those people need to read Sam Pizzagati’s book; The Rich Don’t Always Win. I have a bunch of favorite parts, stories from the book. One important historical accounting is about how Roosevelt with great persistence and aggressiveness established confiscatory taxes. After the first few hundred thousand income (about 3 million in today’s dollars) their income was taxed at 95% !!! (He also strengthened unions). This led to a huge growth in the middle class due to rising wages, particularly in factories. This tax stuck around until Kennedy started to nibble away at them. Eisenhower (!) said that anyone who would get rid of those taxes would have to be “stupid”. Also, that after a couple years of Hoover not doing anything about the depression huge numbers of working class and rural people switched to the Democratic Party because they realized that the Republicans were just not on their side.

The grossly uninformed commenters need to read up on history. Knowing just a little bit of rudimentary (and accurate) history shows the blatant lies the right likes to tell.

Chris Burleson says

When my grandfather couldn’t pay the taxed, he divided his farm land and gave it away to his neighbors in order to keep the land from being seized by the government and auctioned to the financial elites who were buying land for almost nothing.

After the rich acquired all the land, then FDR put the rich farmers in the farm-welfare program (at tax payer expense). Now the working class will soon have no hope of owning land, and will be imprisoned in suburban plantations while the big farmers and politicians are growing rich in bed with each-0ther.

I pray and pronounce a curse upon all welfare farms, upon the DNC, and upon FDR’s communist policies, in Jesus name, Amen!

Chris Burlington says

When big farming corporations (who are already in bed with the politicians) have gobbled up all the farm land using corporate-welfare money (at your tax dollar’s expense) and your children are enslaved in urban ghettos, then you’ll see how the poor, indigent, and unemployed are treated, but by that time it will be too late for the problem to be fixed without a tidal-wave of bloodshed.

Franklin Beach iii says

I don’t need to be poor