By Deniz Torcu

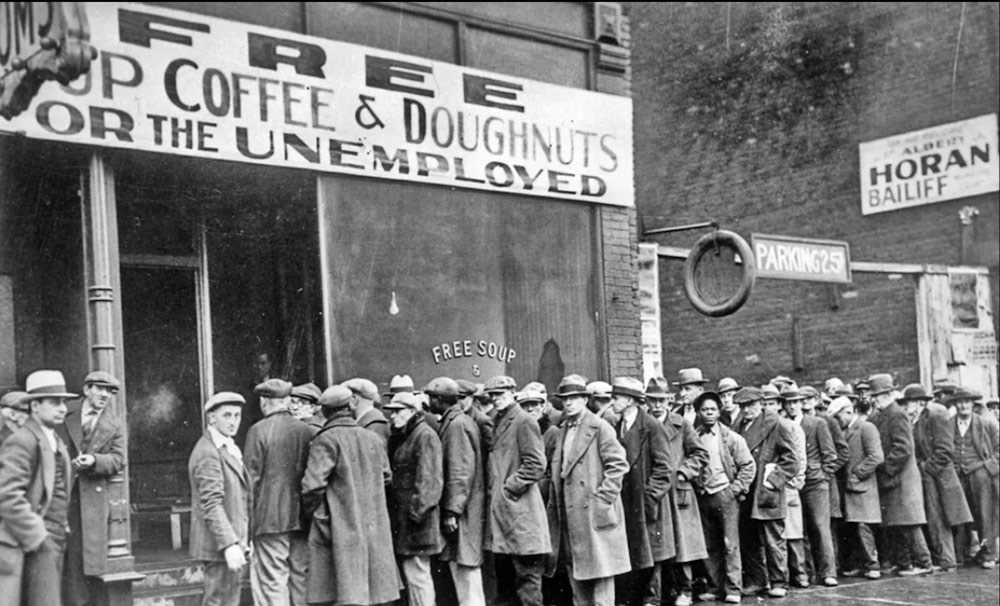

Imagine waking up in 1932, in any US city. Upon ordering your morning coffee, you realise that its price has doubled since last year. This isn’t because of a coffee shortage, but rather because new trade barriers have caused the price of importing Colombian coffee beans to shoot up. The same thing has happened to sugar, tea and cocoa. Everyday items have suddenly become a luxury.

This dramatic change stemmed from one of the most harmful decisions in modern economic history: the Smoot-Hawley Act, enacted in June 1930. This law, championed by senator Reed Smoot and congressman Willis C. Hawley, aimed to safeguard US agricultural interests in the wake of the 1929 stock market crash.

However, pressure from industry lobbies meant it quickly expanded to cover over 20,000 products, including manufactured goods. Tariffs averaged around 40%, but in some cases were as high as 100%.

Far from helping the economy, this measure contributed to the collapse of international trade, as countries like Canada, France, Italy, Germany and the UK imposed harsh retaliatory tariffs on on US products. This set off a chain reaction: international cooperation weakened, US exports fell by 61% between 1929 and 1933, and global trade shrunk by over 60%.

This further aggravated the Great Depression. It hit economies who depended on international trade especially hard, and exacerbated geopolitical tensions throughout the 1930s.

Skyrocketing inflation, mass job destruction and falling living standards became stark testaments to protectionism’s failure. The contraction of global trade not only crippled key industries, but also destabilised entire economies that depended on exports to sustain growth. Currencies were devalued, deficits soared, and financial systems collapsed one after the other.

The 1930s therefore witnessed not only an economic crisis, but also a transformation of the international system fuelled, in part, by misguided political and trade decisions. This historical lesson, as the current case of Trump’s tariffs demonstrates, continues to be ignored by leaders who prioritise short-term populist measures over global economic stability.

Why do tariffs fail?

After decades of progress in trade liberalisation – driven by multilateral organisations like the World Trade Organization, the United Nations and the OECD – it seemed that lessons had been learned. However, Donald Trump’s second presidential term has revived disturbing parallels with Smoot-Hawley.

Historical and contemporary evidence clearly shows that tariffs rarely function as an effective tool of economic protection. In an interdependent global system, supply chains cross multiple borders before reaching the final consumer. Higher tariffs raise production costs, hurting both consumers and businesses, even in the countries that implement them.

In addition to the US, other countries have also felt the adverse effects of protectionism. Argentina, for instance, implemented an import substitution policy with high tariffs and trade restrictions for decades. Although it initially stimulated industrial development, in the long run it led to a loss of competitiveness, high inflation and dependence on the state to prop up inefficient sectors.

Brazil had a similar experience in the 1980s and 1990s. Its tariff barriers temporarily protected certain industries, but also reduced product quality and stifled technological innovation.

Until its 1991 economic reforms, India had one of the world’s most protectionist tariff regimes, which limited its integration into global trade and slowed its economic growth.

From these examples we can see that protectionism often causes a chain reaction of negative, escalating impacts:

- Rising prices for consumers

- Loss of economic competitiveness and job destruction

- Reduction of global economic growth due to uncertainty and diminished international trade.

Making economies more cooperative and resilient

From the Smoot-Hawley Act to Trump’s current trade war, economic history clearly demonstrates that protectionism is not only ineffective, but counterproductive. In a world where value chains are global and innovation depends on transnational cooperation, closing economic borders weakens collective resilience.

Protectionism may seem like an immediate solution to economic crises and domestic pressures, but its long-term consequences are almost always more costly than its apparent benefits. Instead of strengthening domestic industries, it isolates them. Instead of protecting jobs, it destroys future opportunities.

The aforementioned cup of coffee in 1932 became a symbol of an economy locked in on itself. In 2025, it could be electric car batteries, medicines or basic foodstuffs that remind us of the high cost of negatively interfering in global trade.

Now more than ever before, international cooperation, market diversification and investment in sustainable competitiveness are the only smart way forward.

![]()

Deniz Torcu is Adjunct Professor of Globalization, Business and Media at IE University.

JimboXYZ says

Economic crisis comes in two forms. The 1928 Stock Market crash & Depression is one form. Took WW2 to turn that around to the prosperity of the 1950’s. The other form, faux prosperities of W Bush & Biden. Here’s the 3-headed monster from the article ?

“From these examples we can see that protectionism often causes a chain reaction of negative, escalating impacts:

Rising prices for consumers

Loss of economic competitiveness and job destruction

Reduction of global economic growth due to uncertainty and diminished international trade.”

What of those 3 did we not see with Biden-Harris ? Rising prices for consumers ? Inflation that was astronomocal for US History. Loss of economic competitiveness ? That’s the whine of corporate America every day for the last quarter century for global trade, specifically with China. The last quarter century, and I’m going to say it, China is producer to the world, it’s the middlemen selling te Chinese products at marked up prices to create a higher cost of living in the USA. Take Amazon, 99% of the items sold on Amazon are Made in China, the one’s marking those products up for inflation to consumers are quite & more often Americans. The AliBaba & Temu’s of the online marketplace are the Chinese counterparts. Just me but I’m not pro tariffs, but I’m also not pro whatever anyone wants to call what happened over the last 4-5 years, whether it’s blamed on Covid or whatever else. It’s a gouge of greed, some might even defend & label that as Capitalism ? There’s the extremes, Depression of the 1930’s to Bidenomics of the 2020’s. Imagine a POTUS taking credit for creating 16 million jobs for a national shutdown in 2020. Then the DOL gets caught materially mistating a rolling year of employment/labor reports. The faux prosperity of post Covid Biden-Harris. There has to be something in the middle of that, that actually works & is sustainable.

I’ll be the first to say it, Trump has been disappointing for the first +/-120 days domestically/economically for prices to consumers falling. That’s Main Street, Wall Street contracted to be a disappointing performer too. But prices have dropped. And that reflects Corporate America to a large extent. They aren’t giving up their bread & butter for revenues from products & services. The valuation of 401-K’s/403-B’s and what the payouts to investors, which obviously are the labor of working class getting screwed as usual. If there was such a thing as a prosperous recession, that’s what the last 5 years has been. How does one reverse the fact that labor’s incomes haven’t paced inflation yet again for an era of US History. The scorecard is going to read $ 15/hour min wage wasn’t buying anyone a house before passing that in 2020, it sure as hell isn’t buying a house with higher mortgage principals, interest rates, down payments, property taxes & homeowner insurance costs. All we saw & experienced under Biden-Harris is the domestic dollar just become anemically more worthless than it has anytime in US History under easily the worst POTUS-VPOTUS ever in US History.

Imagine those photos of the Great Depression, only in today’s imagery is a unaffordable groceries with full employment. instead of free coffee, we have $ 5-7 Starbucks coffee. End of the day, nobody is better off for anything trying to pace the rampant Bidenomics of it all.

Ed P says

Todays history lesson ignores the stark differences of the technology gap between 1930 and 2025 as well as the current level of unfair trade practices that since metastasized.

Current Economic data doesn’t indicate depression. Although there isn’t any reliable reference points to gauge whether accepted economic theorems actually apply.

The current tariffs dust up is not rooted in the same protectionism as the Smoot-Hawley act of 1930. It was also launched during the Great Depression.

Deniz Torcu missed the mark.

Pogo says

@A fool and liar

… sit next to each other in a trolley car from hell as it rolls towards its last stop.

And so it goes.

Sherry says

“Come on Baby Let’s Do The Twist. . . Around and Around”. . .

Ed P says

Pogo,

Data, science, facts, common sense, reality, or even the truth be dammed?

Do any of them exist in an ideology of everything from the right has to be wrong?

If the left was on the correct trajectory for our country, what happened?

The smartest people aren’t afraid to admit they were wrong, because they see mistakes as lessons, not failures.

Ps. Name calling is reminiscent of recess during 3 rd grade….

Laurel says

Anyone who believes that Trump is somehow a financial genius, who knows more than all economists, who plays a four (or is it five, or six) dimensional chess with our lives…and will win…and somehow mysteriously knows how to make everything “beautiful” is a fool in my opinion. He fu*ked up vodka.

Trump could have sent a representative, not depending on simple minded, butt kissing loyalists, to the various countries (most economically important countries first) and really negotiated with them. There would have been changes for our benefit. But instead, he started his New York Mafia extortionist, bullying style instead, because that’s all he knows. Strong arming does not require mental acuity. Nothing genius there.

“”Edmund Burke (1729-1797) said “Those who don’t know history are destined to repeat it.”” – Answers.com

Technology has little to do with that knowledge. A change in the times does not wipe that slate clean.

Pogo says

@Liars

… and fools. Answer to your name, when YOU hear it called, all you want; sell crazy to someone else.

Ed P says

I’m not suggesting Trump is a financial genius nor playing a chess match at any level.

However, the global trade reset occurring, (tariff war) probably could not be achieved without the complete disruption of the standard existing trading practices.

The leverage Trump achieved may well be the single most important strategic piece of the puzzle. The world needs the United States’ business. Period.

Call it what you will, continue to call it foolish, predict disaster. It’s going to happen. Rational people can accept that premise. There’s nothing “thuggish” about it.

It is absolutely necessary for the future financial success of the United States. Anyone, and I mean anyone who has dealt with international trade knows that the inequalities that Trump keeps repeating is the absolute truth. Even our foreign allies admit and accept those facts.

Railings against success suggest you want failure for future generations or your distain for Trump is being exposed. Which is it?