In its first comprehensive recommendation to the Palm Coast City Council for the coming year’s budget, the city administration is proposing a 7 percent budget increase that includes money for five new sheriff’s deputies, two new firefighters and a fire inspector, and nine additional administrative positions.

The budget proposal rests on a request to keep the city’s property tax rate flat, which would result in an increase in revenue of over $5 million from property taxes alone, but would also equate to a tax increase of around 14 percent, though homesteaded property owners would not see an increase anywhere near that.

The budget also includes over $150,000 more for city council members’ salaries, the cost of one and a half deputies, as a result of the council’s self-voted 151 percent salary increase last spring, the largest in the city’s history and one of the largest on record in any city in the state. Finally, the budget would also result in a deep cuts in the city’s reserves despite the vast increase in revenue.

“You’ve heard a lot of increase in cost resource issues that this budget also is looking at mitigating the risk of that future recession period,” City Manager Denise Bevan said, noting the city’s premium on retaining talent and ensuring a steady succession within the ranks. But neither Bevan nor Helena Alves, the city’s finance director, mentioned the tax increase explicitly as they presented the budget in a workshop Tuesday.

Bevan confirmed that in Mayor David Alfin’s words, “staff has been directed to review their budget asks and to trim them to the lowest level that they feel they can operate their department.” Still, some council members are uncomfortable wit the budget as presented, and are looking to find a few cuts, either in services or in the tax rate. Their salaries, of course, are not on the table.

The fiscal year begins Oct. 1. It’ll be the first year when the new council salaries, reflecting a 151 percent raise plus benefits the council voted itself, will be impacting the budget. The new salaries don’t kick in until after the November 8 election. When they do, the cost will add $157,000 to the budget, for a total of $291,000, up from $133,000 this year. That cost increase, of course, has nothing to do with inflation.

Palm Coast is benefiting from a 19.7 percent increase in taxable values, a huge increase over the previous year and the largest such increase in 16 years. Some 5 percent of that is attributable to new construction. Once the new construction is deducted from existing values, it results in a 14 to 15 percent net increase in existing taxable values which, if not offset by an equal reduction in the property tax, would equate to a 14 percent tax increase. But since homesteaded properties’ year-over-year taxable values are capped at 3 percent, homesteaded property owners would not see that increase.

Businesses and renters will.

The city is still seeing 150 to 160 single-family home building permits filed every month, according to Ray Tyner, the deputy development director, powering yet more revenue from new construction and continuing to push property values up of next year’s calculations.

Palm Coast government runs on a $229 million budget. But there really are two governments within the government: the part that’s directly financed by your taxes, and the part that’s financed by your fees. It comes down to the same thing in the end: you’re still paying for it. But the method of payment is not the same.

The $229 million figure includes $91 million for the water and sewer utility, which operates separately, as do other large semi-autonomous funds that generate their own fees: the stormwater management fund ($24.4 million), the garbage fund ($9.4 million), building permits, and information technology (combined $4.1 million). You pay for most of those those services monthly, and steeply, through your utility bill (building permits and IT excluded).

The city’s general fund (“can’t spell general fund without fun,” in the words of City Council member Nick Klufas), where property tax and other revenue flows, is $46.7 million this year.

The general revenue is made up of property taxes, sales taxes, some permitting fees, some charges for services, and the city’s reserves. Property taxes alone generated $28 million this year. That revenue is expected to ramp up to $33.4 million next year, a $5.3 million increase, assuming the council adopts the same tax rate in effect today. That’s what the administration is requesting.

The general fund accounts for many of the most visible city services: fire, police, parks and recreation services, the city administration, code enforcement, street maintenance, and communications. All those operations employ the equivalent of 244 full time employees.

The city is proposing a $52.7 million general fund budget for next year, and requesting an increase of 12 employees, to 256. That would include two new firefighter-EMTs and a fire inspector, but not the five additional sheriff’s deputies, who would be in addition to the 12. They are counted separately since they would be on the sheriff’s payroll, paid by contract by the city.

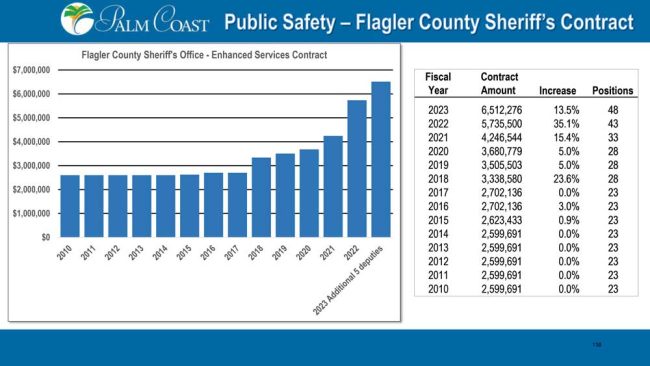

Flagler County Sheriff Rick Staly is requesting the additional deputies for the policing contract for Palm Coast, swelling that budget to $6.5 million and 48 positions, up from $3.7 million and 28 positions in 2020. the city administration’s submission of that request was accompanied by a graphic illustrating the steep budget increases of the last five years, in comparison with relatively flat budgets the right years prior, along with a chart outlining the year by year increases. The increase includes an annual, built-in 5 percent increase, Helena Alves, the city’s budget director, said, though “overall, the law enforcement budget is increasing by 13.5 percent.”

The subtext to those illustrations is the divide between city staff and the city council: if city staffers are eager to show the sharp increases, which eat at other city priorities, most city council members have been quick to support the sheriff.

The fire department’s increases have been more in line with those early years of policing budgets, increasing mosestly from year to year.

“The personnel services increase reflects a burden of the new firefighters for the ladder truck which you did partially last year,” incoming Fire Chief Kyle Berryhill said, “two new firefighter positions to control overtime associated with minimum staffing and a new inspector position designed to provide additional capacity and succession in the Prevention Division.” There are also additional operating expenses, including a one-time increase of $640,000 to the city’s fleet-replacement fund, in preparation for replacing two engines and an attack truck.

For the past decade, Palm Coast has relied on solid reserves. Reserves stand at $3 million today, down from $3.7 million when the budget was adopted–and falling sharply: the city is taking out another $2.5 million from those reserves to pay for upgrades to its public works facility, leaving a paltry $900,000 as reserves for the year starting on Oct. 1–not the safest position to be in ahead of a possible recession.

Some of the figures listing the number of employees in each department don’t corelate with budget figures. For example, on paper, the city attorney line item reflects only a part-time position of 0.5 employees. In Fact, the city attorney’s budget is $574,000 this year, rising to $624,000 next year. The city employs an outside firm for its legal services.

The current property tax rate is $4.61 per $1,000 in assessed value. A $200,000 house with a $50,000 homestead exemption would pay $691 in city taxes. (County, school and other agencies’ taxes are on top of that.) Let’s assume your house value increased by 20 percent, gaining $40,000 in value. Its total value would be $240,000. But that would not be its assessed value, which would be limited to a 3 percent increase–so $6,000, or a total of $206,000 in taxable value. If the council kept its rate flat, your city tax bill next year would come out to $719, or a $28 increase for the year–about six gallons’ worth of gas at today’s prices, or a few uselessly calorific coffees at Starbucks. That’s why tax increases of the sort never jam council chambers, which are notoriously cavernous during those public hearings.

Council member Ed Danko, citing “an uncertain future,” wants to see a decline in the property tax rate, because no one can tell how long the sharp increases in property values will last. “I think we may have to go cut a little bit deeper. That’s my initial reaction to this,” he said.

“We’re in a tough spot here because of our growing population,” Klufas said. “With this rate of growth, it’s hard to scale that level of service in a linear fashion with some of the different services that we provide.”

Alfin suggested that each council member could speak with the city manager individually to propose budget decreases or increases. “That millage rate is the end of obviously a very long and involved process,” he said. “So we really need to go backwards and identify those items that maybe perhaps can be pushed forward, phased or whatever it might be.”

The maximum property tax rate will be set at a council meeting on July 19. Beyond that, council members can set a lower tax rate, but not a higher one than that set on the 19th. The first public hearing to adopt the budget and final tax rate is scheduled for Sept. 8, and the second on Sept. 21.

![]()

Richard Smith says

Instead of wasting money up dating the tennis facility just us that money on the help tax payers with our property taxes. Just a thought…

Jimmy says

You aren’t even paying attention. None of the tennis center money is coming from general fund. Watch a meeting…

Jimbo99 says

Tax millage rate needs to be reduced for the new growth to pay for the additional resources & infrastructure. We all knew this would be the case/line for the last year plus, as Palm Coast & Flagler county continues to approve & build more residential & commercial. The council(s) can do better for a lower tax rate, rather than award raises & approve new construction communities. Like gasoline, the gouge on citizens as the victims is on.

David Schaefer says

HELL NO…….

Tjmelton says

Of course, with $5 gasoline, food prices outrageous, & prescription prices a burden, then add home owners property insurance to the load, Palm coast decides they need to raise property taxes and balance their greed on their constituents, then it’s time to vote the bastards out. Come November, we’ll remember.

PB says

OMG PLEASE DON’T RAISE MY TAXES!!!!!!!!!!!!!!!!!!!

I am almost 70 and cannot afford an increase. You say my house has gone up in value? What good does that do for me? Unless I take out a loan I cannot pay back.

The glass only holds so much water. When it is empty no more water!!

Do you consider many will have to access more programs like food stamps etc. The middle class is going away one of us at a time.

Please at least consider a larger senior exemption so I can keep the glass a little wet. I need to eat to stay alive. My SSA increase this year was gone before I got it. Do you politicians have parents?

How do you sleep at night?

JustBeNice says

I understand and support the need for an increase in first responders what with population growth. But what are the 9 administrative positions and what are the salaries for these positions? And who determines the need for these positions?

No!!! says

No. Nope. I do not approve. People should have a say on these matters. I’ve always felt that way. The citizens should have a say on everything, not a handful of people huddled in a room making the decision on behalf of thousands.

Laura H says

Property taxes in this season create a windfall for local governments. Now is the time to increase reserves and prepare for the recession that is coming to maintain status quo for next decade vs spending unscrupulously . History repeats itself…

Montecristo says

Because we have an inexperienced City Manager and Assistant City Manager we are all paying more. Learning on our dime. This place is a mess.

Palm Coast resident 30 years says

Listen growing Palm Coast government! We are your taxpayers and we are hurting. Stop this madness! Inflation is above 9%. Please give us a break or we will be forced to react.

Bruce Draganjac says

The residents had their chance to “react” at the last election. But sadly, they voted in their sleep and this is what we have. A bunch of tax-and-spend liberals.

Kat says

Just who are these “tax and spend liberals” among this overwhelmingly republican local, regional and state representation? You got what you voted for, a bunch of Palm Coast and Flagler County good old boys that look out for themselves and their donors- not their constituents. You sleep in the bed you made so take some ownership.

Flaglerlocal says

I take great offense to that. As multigenerational Flagler county resident, those aren’t good ole boys.

Shawn says

Wouldn’t higher impact fees on developers help pay for some of these services? Isn’t that what they are for? If developers think impact fees are too high, perhaps they may not build so fast and we won’t have to add so much to our operations budgets. Just saying…

Jimmy says

No. Impact fees must be legally justified by a study. You can’t just raise impact fees. Palm Coast is already charging max amount. The impact fee money also can only be used for expansion. All this is audited to ensure the city follows state law.

The other guy commented about inflation earlier. That impacts Gov’t, too. So this isn’t surprising. But hey…you and me both know of they took a hard look at the budget, they could reduce the taxes…so…

Timothy says

Hey Alfin give up your salary that no one wanted you to get in the first place. A property tax increase because it is obvious the Officials of Palm Coast did very poor future planning and now they want the property owners to bail them out. It’s time we start elected people that know how to run a town because what we have now has no clue.

Dennis C Rathsam says

Spot on Tim, Stuff EM in Alvin is no prize to Palm Coast! He will ok any housing program, the bigger the better!We all have seen our garbage go up, our taxes have gone up, now they want more….SHOW THESE BAFFOONS THE DOOR!!!!!

cgm says

Stop turning Palm Coast into NJ!

Tim says

How about no new cops and we keep things where they are . My pay hasn’t gone up

Cindy says

Yep. No surprise here. Gotta pay fir the city council’s self appointed 151 percent raises.

Tjmelton says

Apparently the thieves that ran Pennsylvania by embezzlement & corruption have followed me down here & are running the same taxpayer scam here.

ULTRA MAGA says

Any Palm Coast/Flagler County Leader who does NOT support 40% Up Front Fees from developers should. RESIGN-NOW!

Nicole says

A Fire Inspector? They must be kidding. Not enough work for that & that costs big bucks. Someone has a friend who wants a job? Also big raises for the Mayor & Council.. taxpayers it appears have no say in that! An expensive splash park & pickle ball court.. really? Sure would be smarter to put that stuff on the back burner,need a lot of maintenance. Maybe 2-3 cops to start.

Deborah Coffey says

What part of “NO” don’t you understand? You kiss up to any building contractor that catches your eye and let them off the hook for everything, you give yourselves over 100% raises, you refuse to fix the roads and you won’t give schools the money they need. We’re not your sugar daddies! We’re your voters. We put you in and we will take you out!

December says

How about no salaries for mayor and city council those are elected positions the parties involved chose to run for they were well aware these were not paid positions and should not be turned into such. We’ve lived in three different states and in none did the city officials get paid to serve, in all fairness they did get a small payment if they were required to travel for city business.

A.j says

I know cities need money. There is always sticker fingers in the pot, tax payers always foot the bill. I guess higher taxes are o.k. if they are used properly. Ysll know that is seldom the case. 9 more administrators what for, there goes part of the reason for a tax increase. Who will they be, lazy lying white Republican males taking everything from the little man especially men of color. The political parties especially the Repubs don’t give a hoot about the working people of color. Nov is coming, how will we vote, we complain but will we vote the greedy, lazy people out of office. Will we remember come November?

ULTRA MAGA says

The RINOS Support a Tax Increase Yet VOTE against 40% Up Front Fees and increase in Up Front Fees from Developers! Palm Coast and Flagler County has the WRONG Leadership! The Master Plan is a JOKE because Developers keep getting Zoning Changes for their benefit! Return to 80ft Wide House Lots for Common Sense Fire Protection!

PB says

Just filled out my mail in ballot. It was simple. If you are in, you are now out. More than ever it shows voting is the only voice we have!!!!!

jeffery c. seib says

I had planned to go to the city council meeting today and speak on behalf of No tax increase this year for Palm Coast residents but whenever I have spoken during the three-minute public comments time all I get from up there is a blank stare and the words ‘next speaker ‘when I am finished. In our city today we have a diversity of residents that either own or rent their dwellings. Single family homes, apartments, condominiums, and duplexes make up our living arrangements. In each one of these instances right now people are having a challenging time meeting their financial obligations. Palm Coast, the country, and the entire world is gripped by the potential ravages of out-of-control inflation. Many retirees on fixed-incomes and young families with children here are struggling to make ends meet.

Costs of food, fuel, housing, vehicles, everything that has a price tag has gone up and has caused problems among a segment of our city’s populations. The shutdowns of the pandemic and now this is a real hardship for many here and everywhere. People need a little help. I am asking for a little help. Help for Palm Coast from Palm Coast.

I am requesting the city council at this time send the upcoming city budget back to the drawing board to be redone with no tax increases for 2023 and no cuts to all the programs that benefit people already here such as sidewalks, streetlights, and other infrastructure instead of the new developments that maybe coming here in the future. Help us first.

PB says

Well said!

Sara Voight says

Check the salaries of our “leaders”! I almost vomited when I saw what the County HR Director made per year.