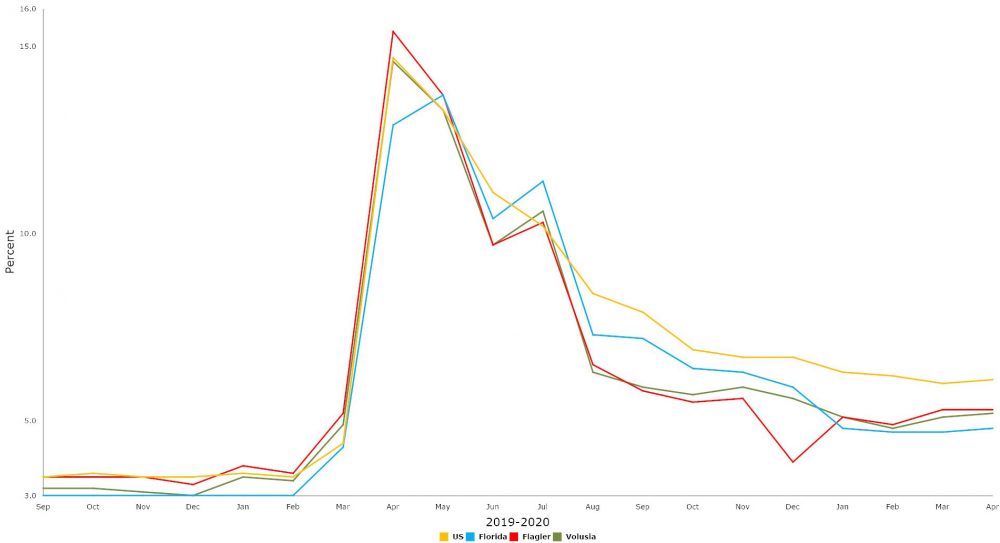

Flatness was the order of the month in April in Flagler County: The unemployment rate didn’t budget from 5.3 percent-a zone where it’s hovered, with bare ticks up and down, for eight months. The number of people on the unemployment rolls barely changed (2,519), so did the number of people with jobs (45,194).

Flagler County’s overall workforce, usually an indication of new influx of workers or a return to the workforce of people who’d been on the sidelines, was also unusually flat, at 47,713. The number is almost 3,000 higher than a year ago, when the pandemic’s lockdowns struck in full force. But it’s still below the pre-pandemic record, set in March 2020, when Flagler County’s labor force stood at 49,165. The employment record was set in February 2020, with 46,560 people holding jobs. The county is just 1,366 jobs away from matching that record again.

An unemployment rate of 5.3 percent would be considered “full employment” in most years, but the rate had fallen to around 3.5 percent in Flagler before the pandemic struck.

Florida’s April unemployment rate ticked up by a decimal point, to 4.8 percent, a disappointing result that mirrors the national unemployment rate in April, which saw an unexpected slowdown in new job creation and also a decimal-point increase in the unemployment rate (to 6.1 percent). Nevertheless Florida added 16,900 jobs in April. The state lost 1.27 million jobs from February to April 2020 and has since gained back 766,000.

There were no significant job gains or losses across sectors in April except for leisure and hospitality, the sector hardest hit by the pandemic. It gained 8,100 jobs in April, just under 1 percent, with most of those jobs returning to restaurants and hotels. Education and health services were the second-largest job-gainers, with 7,600. The steepest loss last month was in retail, a sector that shed 4,000 jobs. Miami-Dade County and Hamilton County now have the highest unemployment rate (6.9 percent) in the state, followed by Osceola (6.7) and Putnam (6.5).

Consumer confidence is improving, but slowly, and remains well below where it was before the pandemic. It ticked up 1.7 points in April to 83 from March’s revised figure of 81.3, mirroring a national rise, according to the University of Florida’s Bureau of Economic and Business Research

Floridians’ opinions about current economic conditions were mixed. On one hand, perceptions of personal financial situations now compared with a year ago increased 4.2 points from 68.4 to 72.6, the greatest increase of any reading this month, according to the bureau. Opinions varied by demographics with men and people older than 60 reporting less-favorable opinions. Opinions as to whether now is a good time to buy a big-ticket item, such as refrigerators, cars, or furniture dropped 1.1 points from 77.8 to 76.7. Similarly, opinions were split by demographics, but in this case men and people age 60 and younger expressed more pessimistic views.

Expectations of personal finances a year from now, however, increased 1.7 points from 90.6 to 92.3. The one-year outlook of U.S. economic conditions remained unchanged at 85.7 points while expectations of U.S. economic conditions over the next five years increased 3.8 points from 83.7 to 87.5. Women and people with an annual income under $50,000 report less favorable opinions.

“Overall, Floridians are more optimistic in April. The increase in consumer confidence is fueled by improvements in Floridians’ personal financial situations now compared with a year ago, which largely reflects the impact of the federal stimulus payments,” said Hector H. Sandoval, director of the Economic Analysis Program at the bureau. “While Florida’s labor market recovery is stalling, the increase in consumer confidence over the last month suggests increased consumer spending and a potential boost to the state economy.”

![]()

Leave a Reply