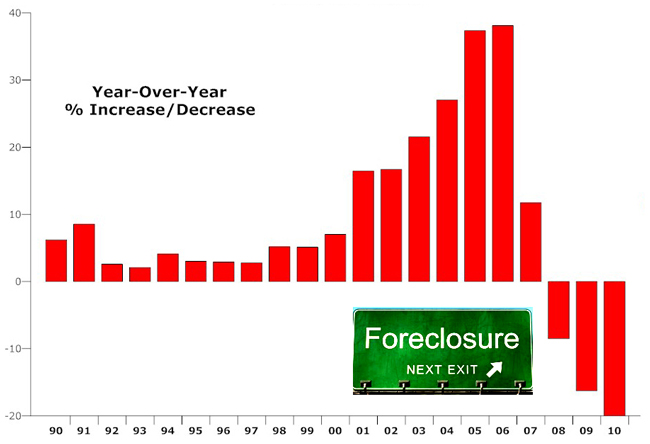

Flagler County’s taxable values are still crashing to record year-over-year losses. When Property Appraiser Jay Gardner announces preliminary figures later today, taxable values will show a staggering decrease “in the ballpark of 20 percent” over last year, Gardner said, when values lost more than 16 percent. In 2008, taxable values lost 8.5 percent.

“Obviously the values are falling in reaction to what the market is, this horrible real estate market we’re in, a market of short sales and foreclosures and people losing their jobs. That’s all that’s affecting us,” Gardner said.

Flagler County had never experienced a drop in taxable values in any year between 1973 and 2007. This year’s loss is the worst in the county’s history. It will have far-reaching consequences for every local government and every property owner. Local governments will spend the next few weeks setting next year’s budget. They must set their tax rate according to the amount of services they intend to provide—and the tax revenue they expect to take in.

“The only thing that can happen when the values fall is two choices,” Gardner said. “Cut services or raise the millage rate.”

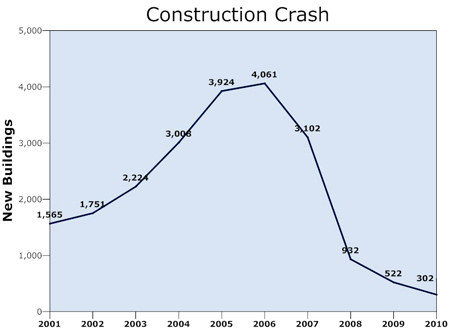

The millage rate is the property tax rate. The county and Palm Coast raised property taxes slightly last year. Only slightly, because they’ve been using up their reserves fast. Those reserves are dwindling, forcing elected officials to make the sort of choices they don’t want to make. And economic activity is still nowhere near the productive levels it recorded earlier last decade or in more normal times before the housing bubble, especially in construction. In the taxable year that ended in 2010, just 302 buildings were raised in Flagler County, by far the lowest level in more than a decade. Construction peaked at 4,061 units in 2006 and has been plummeting since.

The millage rate is the property tax rate. The county and Palm Coast raised property taxes slightly last year. Only slightly, because they’ve been using up their reserves fast. Those reserves are dwindling, forcing elected officials to make the sort of choices they don’t want to make. And economic activity is still nowhere near the productive levels it recorded earlier last decade or in more normal times before the housing bubble, especially in construction. In the taxable year that ended in 2010, just 302 buildings were raised in Flagler County, by far the lowest level in more than a decade. Construction peaked at 4,061 units in 2006 and has been plummeting since.

Lower property values doesn’t necessarily mean lower tax bills. When property values fall, local governments offset the loss in revenue by setting their tax rates either at the level that would command the same revenue they took in the previous year, or higher. Either way, the result is higher tax bills for property owners.

When the housing bubble burst, Flagler County and Palm Coast were left with an inflated inventory of properties, and a slew of property owners who could not afford what they bought. This year’s foreclosure rate is higher than last year, thus accelerating values’ downward spiral.

Lower values don’t mean lower taxes. Lower values don’t mean fewer services demanded by residents, either, or fewer teachers in classrooms, or fewer cops on the streets.

“You expect an ambulance to your house when you need it. We all do,” Gardner said. “So our choices as citizens, if you think money should be spent in a different way you should come to a budget hearing. But when you go in there make sure you’ve looked at the budget and you understand what the heck their options are. They can’t just cut, they can’t just leave the millage rate. They have to pay our bills. I hear people say, no matter what they can’t raise the millage rate. Why?”

![]()

Taxable Values, in Millions

| County | School | Palm Coast | Flagler Beach | Bunnell | Marineland | Beverly Beach | |

|---|---|---|---|---|---|---|---|

| 2000 | 2,725 | 2,757 | 1,594 | 265 | 61 | 2.3 | 18 |

| 2001 | 3,174 | 3,210 | 1,773 | 323 | 72 | 2.5 | 22 |

| 2002 | 3,706 | 3,746 | 1,984 | 385 | 76 | 5.9 | 29 |

| 2003 | 4,511 | 4,554 | 2,404 | 463 | 88 | 7 | 33 |

| 2004 | 5,738 | 5,785 | 3,108 | 549 | 100 | 8.52 | 39 |

| 2005 | 7,882 | 7,933 | 4,445 | 728 | 129 | 14 | 63 |

| 2006 | 10,903 | 10,958 | 6,240 | 917 | 195 | 19 | 80 |

| 2007 | 12,185 | 12,297 | 7,010 | 932 | 251 | 21 | 85 |

| 2008 | 11,147 | 11,898 | 6,132 | 820 | 264 | 22 | 97 |

| 2009 | 9,336 | 10,108 | 5,247 | 712 | 234 | 19 | 84 |

| 2010 | 7,658 | 8,452 | 4,467 | 581 | 180 | 11.7 | 64 |

beachcomberT says

Well, actually there is a third choice. Give govt workers and teachers the option of taking lower pay and benefits if they want to stay employed. Not a great alternative, I realize. But maybe it’s better than adding more people to the unemployment rolls.